USA

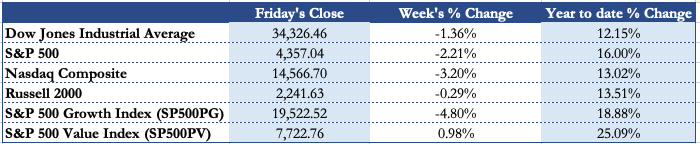

A rough week for the American stock market ended with solid gains Friday. After rising Treasury yields were a headwind for much of the week, Friday’s sharp drop in the 10-year yield help spurs equities. Small caps led the way, with the Russell 2000 up 1.7%. For the week, Russell lost just 0.29%. The Dow Jones industrials jumped 1.4% Friday, the S&P 500 rallied 1.10% and the Nasdaq gained 0.80%. For the week, the S&P 500 lost 2.21%, and the Nasdaq fell 3.20%, their largest drops since the week ended Feb. 26, 2021. The Dow lost 1.36%, its largest drop since the week ended Sept. 10.

Growth stocks had their worst week since the coronavirus crash, the S&P 500 Growth Index lost 4.80%. Energy stocks, financials and travel stocks fared relatively well last week. Energy and bank stocks are subject to shifts in energy prices and Treasury yields, respectively. The energy sector surged 9.30% in September, representing the best monthly return since a 21.5% gain in February, the rally in September, of course, was aided by a surge in crude oil prices. Travel stocks may have a longer-run tailwind. With the Covid delta wave seemingly fading in the U.S. and worldwide, more people will be willing to travel, especially with governments lifting or easing restrictions on cross-border travel. S&P 500 Value Index gained 0.98% for the week, with a 25.09% return YTD. Reflecting more speculative story, ARK Innovation ETF (ARKK) tumbled 5.09% for the week.

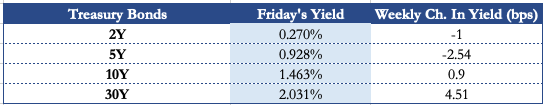

U.S. Treasuries ended a bumpy week on a higher note, sending the 10-yr yield back toward its closing level from last Friday, up to 1.463%. Friday’s buying pressured the 30-yr yield back to 2.031% but it still finished the week with an almost five-basis point increase. The 2 years closed at 0.270% for the week, while the 5-year yield fell back to 0.928%. Yields for government debt fell during the Friday session as traders brushed off Friday’s update on the personal consumption expenditure price index. The personal consumption expenditure index rate of inflation in the 12 months ended in August edged up to 4.3% from 4.2%, the highest level since 1991. The yearly pace of core PCE inflation, which strips out volatile food and energy prices, was unchanged at 3.6%, but also a 30-year peak. The report, coupled with a global energy shortage, unfolding across the U.K., Europe and China, is heightening investors’ concerns that the U.S. may already be embarking on a stagflation-like path that causes higher inflation to linger for far longer than previously thought. Until very recently, Federal Reserve officials had insisted inflation would start to fall back toward pre-pandemic levels of 2% or less by year-end. But over the past week, senior central bank leaders acknowledged that inflation could remain high well into 2022 because of ongoing shortages of crucial business supplies and even labour.

.

.

Many factors prompted investors to anticipate lower gains and more persistent volatility this week. On the economic front, U.S. consumer spending rose 0.8% in August, the Commerce Department said. The pickup signals the U.S. economic recovery is gaining steam heading into autumn, though some analysts warned the gains might be more reflective of inflation than actual consumer activity. Meanwhile, the fate of the $1.2 trillion infrastructure bill remains unclear. House progressives are demanding significant progress, at minimum, on a multi-trillion-dollar reconciliation tax-and-spend packages before voting for the bipartisan infrastructure bill. But Democratic leaders now appear to be trying to get centrist Democrats to agree to a $2 trillion reconciliation package vs. the long-touted $3.5 billion package. Investors are still contending with lingering worries over property giant China Evergrande Group.

Europe and UK

European stocks slumped to their lowest in two months on Friday, as warnings from companies and factory activity data highlighted the economic headwinds from supply-chain constraints and elevated prices. The Europe-wide STOXX 600 ended the week with a decline of 2.24%. in a weak start to October, which has traditionally been a rough month for equities, with technology, miners and banks leading broad declines. A survey showed eurozone manufacturing growth remained strong in September, but activity took a big hit from supply chain bottlenecks that are likely to persist and keep inflationary pressures high. With government bond yields surging to multi-month highs and concerns about inflation coming to the fore, the benchmark STOXX 600 closed September 3.4% lower in its worst month in almost a year. “For equities, this combination of slowing growth – albeit at a high level of demand – rising inflation and higher bond yields has meant slightly higher volatility, lower market returns and a rotation beneath the surface,” Goldman Sachs strategist Sharon Bell said in a note.

Investors also looked ahead to the upcoming meeting of Eurozone finance ministers, who are set to discuss the impact of high energy prices, among other things. FTSE 100 shed about 0.35% in the week, while the CAC 40 and the DAX lost 1.82% and 2.42%, respectively.

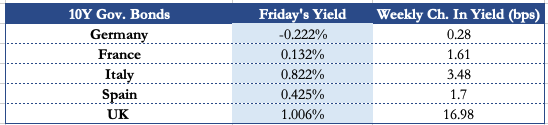

In a speech on Monday evening, BoE governor Andrew Bailey did not attempt to push back against market expectations of a rate rise by February, sparking a fresh wave of selling. Sovereign bond markets across the euro area ended September with the biggest jump in borrowing costs in months. With data on Thursday showing inflation in Germany accelerated at a record pace in September, bond yields edged back up to roughly three-month highs earlier this week. Signs that inflation could prove stickier, combined with a hawkish shift at the U.S. Federal Reserve and the Bank of England, have put markets on alert that central banks could wind back post-COVID stimulus measures sooner rather than later. Moves in the UK have been sharper, with 10-year gilt yields rising above 1 per cent for the first time since March last year, more than doubling from the levels recorded in late August. The 10-year German Bund yield rose on to a high of minus 0.22%

In economic news, Eurozone inflation accelerated for the third straight month and hit the highest level in thirteen years in September, advancing to 3.4% in the month from 3% in August. The rate was also above economists’ forecast of 3.3%. The rise has been driven higher by surging energy prices, deepening concern among policymakers. The front-month gas price at the Dutch TTF hub, a European benchmark, has risen almost 400% since the start of the year. This record run in energy prices is not expected to end any time soon, with energy analysts warning market nervousness is likely to persist throughout winter. Core inflation that excludes energy, food, alcohol, and tobacco, increased to 1.9% from 1.6% in the previous month. Eurozone manufacturing growth weakened in September as producers report a growing toll from supply chain headwinds. The corresponding PMI dropped to 58.6 in September from 61.4 in August, posting the largest drop since April 2020.

The German election was won narrowly by the SPD, as expected, but coalition talks will take some time. The most likely result is the traffic light coalition with the Greens and Free Democrats, but a grand coalition can’t be ruled out. Germany’s retail sales rebounded in August but at a slower-than-expected pace. Retail sales grew 1.1% month-on-month in August, reversing a 4.5% fall in July. Economists had forecast a monthly growth of 1.5%. On a yearly basis, retail sales growth held steady at 0.4% in August. This was much slower than the expected growth of 1.9%.

The U.K.’s manufacturing sector also saw growth slowing last month on the back of surging material and staff shortages.

Rest Of The World

Chinese stocks ended a holiday-shortened week on a mixed note. The CSI 300 Index of large-cap stocks edged slightly higher, while the Shanghai Composite Index declined from the previous Friday’s close. China’s markets were closed Friday for the weeklong National Day holiday starting on Friday. Positive news concerning indebted property developer China Evergrande Group supported investor sentiment. On Wednesday, Evergrande said that one of its units would sell roughly 20% of its stake in Shengjing Bank Co. to a state-owned enterprise for USD 1.5 billion to help reduce its debt load. Separately, the People’s Bank of China (PBOC) pledged to ensure a “healthy property market” and to protect homebuyers’ rights in a statement following the central bank’s quarterly monetary policy committee meeting.

Japanese stocks followed the lead of U.S. markets and declined during the week. The Nikkei 225 Index lost 4.89%, with losses concentrated on Wednesday and Friday, but remained in positive territory for the year-to-date period. The broader TOPIX Index also lost about 5% for the week. BoJ Governor Haruhiko Kuroda said a new prime minister will not cause the central bank to change its policies. Kuroda’s comments at an ECB conference came just a few days after the BoJ’s latest policy meeting, in which it announced it was continuing its asset purchase program at current levels while keeping interest rates very low.

The Index of Prices and Quotations (IPC) registered a weekly loss of 0.09%, adding five weeks of consecutive contractions in which it accumulates a decline of 2.63%. Australian shares have dropped to their lowest level in four months, on persisting worries about rising inflation and the uncertainty surrounding cash-strapped Chinese property developer Evergrande. On its first trading day of October, the ASX 200 index closed 147 points (or 2 per cent) lower at 7,186, following a big drop on Wall Street overnight, wiping out all the gains it made since early June. Overall, the ASX has lost 2.14% during this volatile week. Brazil’s stock market looks weak, too. The lack of investor faith is showing up in the financial markets. The Bovespa index of the country’s leading stocks is down about 12% from June through September. The value of the country’s currency, the real, has taken a beating lately. Investor dissatisfaction likely comes from a few key problems. First, polls indicate the left-leaning presidential candidate Lula de Silva is ahead against incumbent Bolsonaro. Meanwhile, inflation rates have tripled over the past year to an annualized 9.7% in August, up from 3.1% in August 2020. In addition to surging gasoline prices, the country’s hydroelectric sector got hit with some unfortunate weather that hurt the country’s ability to run its hydropower plants. “A severe drought pushed up electricity prices in May, as power companies depend heavily on hydroelectric plants,” says a recent report from the Institute of International Finance.

Fx and Commodities

Oil prices rebounded strongly in September, aided by a stabilizing or declining COVID-19 cases and the effects from Hurricane Ida. In fact, WTI closed the week up 2.38% at $75.72 per barrel, Brent was up 1.45%, closing at $79.14. Adding fuel to the fire, the US will ease air travel in November, and that might push prices up in advance of November. As we around the world slowly acclimatize to the new normal of living with a background level of COVID, I expect economies around the world to continue to strengthen and demand more oil. OPEC+ is having its monthly meeting in a few days. While I expect it will continue with its current planned increase of 400 thousand barrels per day, one can never be too sure. There are rumors that the US is pressuring OPEC+ to open the taps beyond the planned increase.

Gold futures end higher on Friday, tallying a small gain for the week, with prices finding some support from weakness in the dollar and government bond yields even after a reading on the cost of U.S. goods and services revealed a rise for August. Gold closed the week higher 0.61% higher at $1760.65. Silver managed to gain 0.52% for the week, after dropping more than 4% on Wednesday. Looking ahead for the gold market, U.S. economic data releases will be in focus next week, said Chintan Karnani, director of research at Insignia Consultants, with durable goods, ISM non-manufacturing and ADP and nonfarm payrolls jobs numbers set for release. Stronger numbers will “cause another big sell off in gold and vice-versa,” he said. “These numbers will tell us the growth outlook for the fourth quarter,” and the economy will be the key driver for precious metals and currency markets in October.

For the week, the dollar index posted its largest percentage gain since late August, as investors looked to the Federal Reserve’s reduction of asset purchases in November and a possible rate hike late next year. The dollar index gained 0.85% this week, closing at 94.07. China’s currency, the renminbi (RMB), strengthened against the U.S. dollar 0.31% to 6.447 per dollar. The Japanese yen weakened versus a strong U.S. dollar through Thursday but recovered somewhat on Friday, closing the week at 111.07 per dollar. The euro fell about 1.1% for the week, its biggest percentage fall since mid-June closing at 0.8621 per dollar. Sterling was also an underperformer, dropping 0.95%, and posting its worst week in more than a month, amid growing supply chain problems. Bitcoin and other cryptocurrencies jumped suddenly Friday, a day after Federal Reserve Chairman Jerome Powell said the U.S. didn’t have plans to ban cryptocurrencies. Bitcoin rose 10.14% to $48,109.69, its highest level in almost a month.

Next week main events

The main events of next week are the following. On Monday, in addition to the Eurogroup meeting, the Spain Unemployment Change (SEP) will be released with a forecast of -82.6k. On Tuesday, both BoJ Governor Kuroda and ECB President Lagarde will have a speech, the Euro Area Markit Composite PMI Final (SEP) will be published as well. On the 6th of October, in addition to the ECB Non-Monetary Policy Meeting, the Retail Sales YoY (AUG) will be released, forecasted to be 0.4%. The week will close with ECB Monetary Policy Meeting Accounts and the release of the USA Consumer Credit Change on Thursday, followed by the release of the USA Non-Farm Payrolls (SEP) and Unemployment Rate (SEP), forecasted at 460K and 5.1% respectively, on Friday.

Brain Teaser #9

Suppose you have an cube ![]() made up from smaller

made up from smaller ![]() cubes. The outside of the larger cube is completely painted. On how many cubes, is there any paint?

cubes. The outside of the larger cube is completely painted. On how many cubes, is there any paint?

Solution:

We can compute the number of cubes on which there is paint by subtracting from the total number of cubes ![]() the cubes that do not have any paint on them. The latter cubes (not painted) are the ones that are not in the outside layer, i.e., they are part of a smaller cube of

the cubes that do not have any paint on them. The latter cubes (not painted) are the ones that are not in the outside layer, i.e., they are part of a smaller cube of ![]() dimensions. Hence, the number of painted cubes can be counted as

dimensions. Hence, the number of painted cubes can be counted as ![]() .

.

Brain Teaser #10

Let us assume that there is a lotus flower on a lake on the first day. As the number of flowers doubles every day, there will be two lotus flowers on the second day and four on the third day. If it takes thirty days to fill the entire lake with flowers, how many days does it take to fill half of the lake?

0 Comments