USA

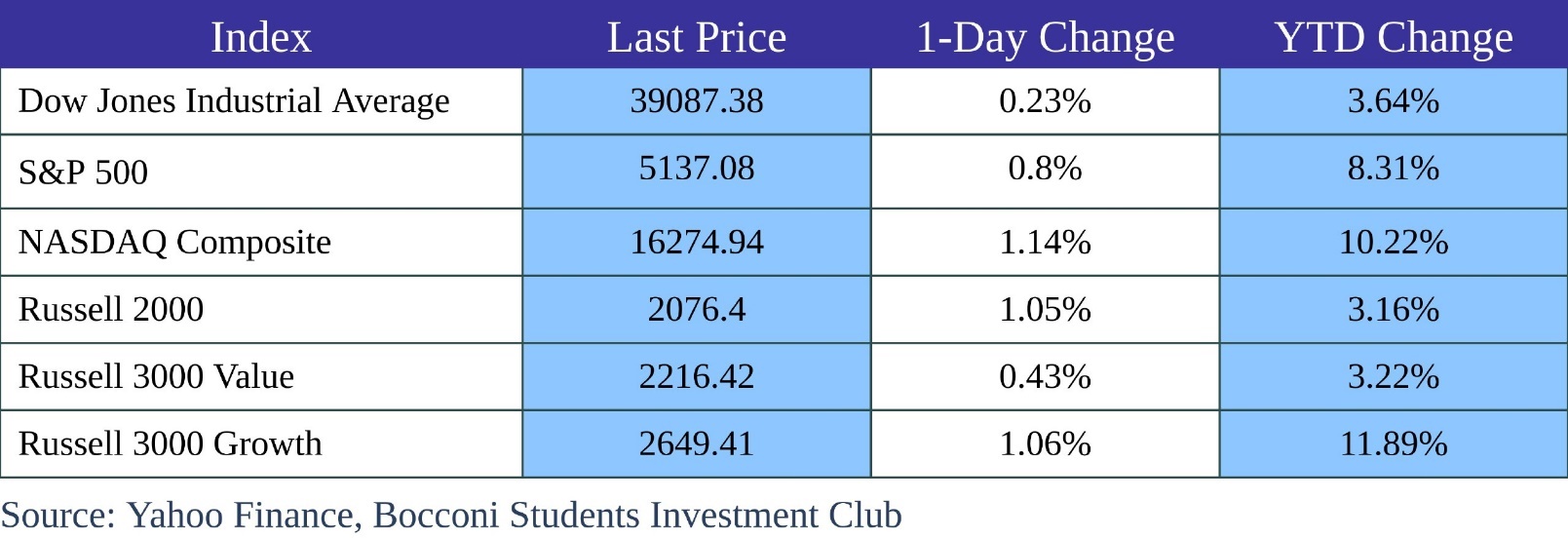

This week started quietly for the US markets, with all major equity indices falling slightly while investors were cautiously looking ahead to Thursday’s PCE print, which came out at 2.4%, the smallest annual increase in nearly three years. On Friday, the ISM data revealed a contraction in manufacturing, given by a lower than expected manufacturing PMI of 47.8, and the University of Michigan surveys of consumers showed all sentiment, current conditions and consumer expectations falling more than expected.

The low PCE inflation, together with weak US economic data on Friday, led the equity market on a rally with both the Nasdaq and S&P 500 reaching new record highs ending the week respectively with a 1.74% and a 0.97% weekly gain. The Dow Jones lagged, down 0.11% weekly.

As in the past weeks, this rally was led by the tech sector, with NVIDIA gaining more than 4% and crossing the $2 trillion market capitalization threshold. On the other hand, Apple shares are down 5% over the past month, experiencing a 0.6% fall this week after being removed from Goldman Sachs’ conviction list. Furthermore, the regional bank New York Community Bancorp shares plummeted 25.89% after a fourth-quarter loss being 10 times what previously stated and identified material weaknesses in loan risk control.

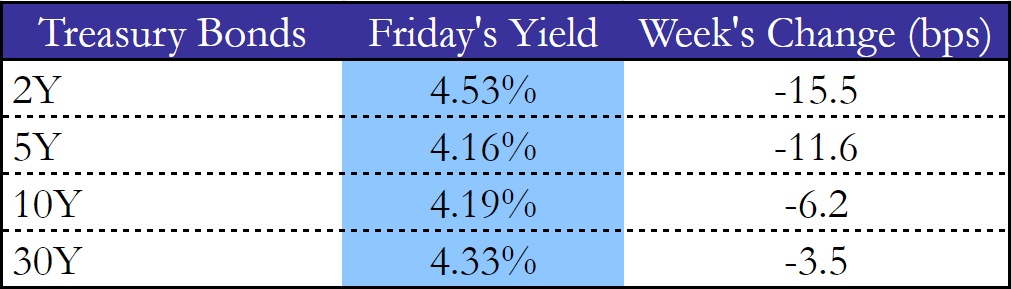

US Treasury yields started the week rising over investors requiring for higher premium in the two government bond auctions on Monday, signaling weak demand ahead of key data later in the week. US economic data over Thursday and Friday, as discussed above, reinforced the expectation that the Fed might initiate rate cuts in June. Also on Friday, Fed Governor Chris Waller raised hopes for a reduction in interest rates by saying that decisions about the ultimate size of the Fed balance sheet do not imply anything about the stance of interest rate policy.

This led Treasury yields to a sharp fall, with the 10-year Note dropping more than 10 bps on Friday and the 2-year yields experiencing the biggest daily decline since the end of January and losing 15.5 bps weekly.

Source: BSIC, worldgovernmentbonds

Europe and UK

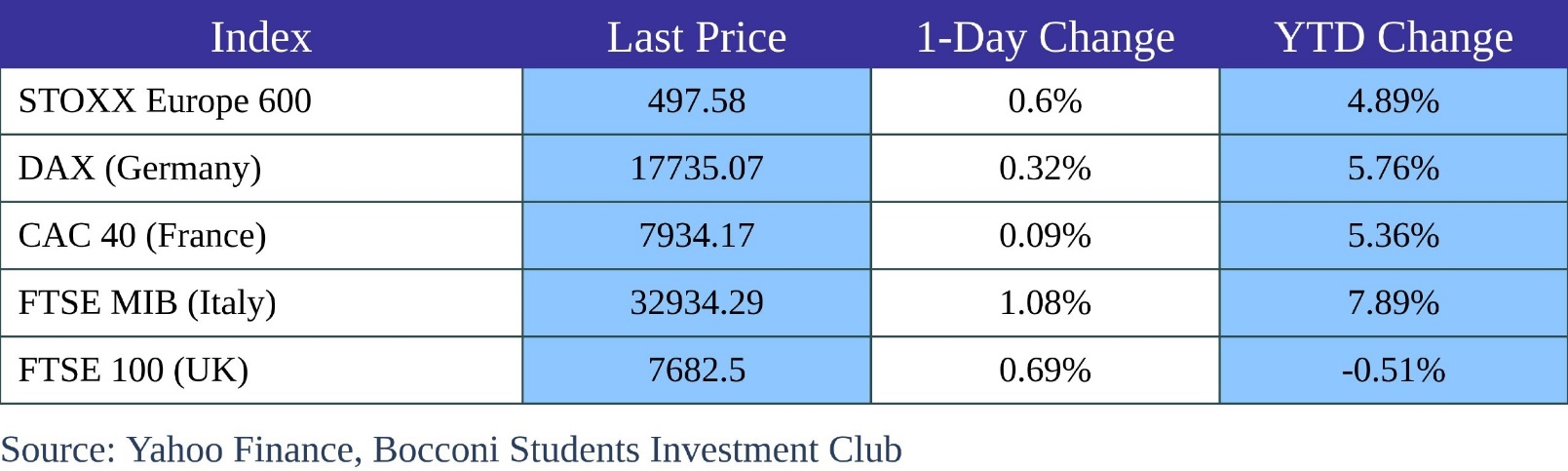

European indexes consolidated the upward trend with the STOXX Europe 600 Index reaching a record high of 498 on Friday. Across the Eurozone, Germany’s DAX saw the best performance, rising 1,83% and reaching a new record high after inflation rate dropped more than expected to 2.5%. Also in Italy, the CPI print was lower than the expectation, remaining steady at 0.8%, while the GDP expanded by 0.9%, overshooting the forecasts and leading the FTSE MIB to a 0.74% weekly rise. On the other hand, France’s CAC 40 Index remained flat, closing the week with a 0.20% drop.

Regarding the Eurozone economic data, the CPI declined to 2.6% in February, down from 2.8%, but remaining above market expectations of 2.5%. The economic sentiment indicator declined to 95.4 as businesses are facing still-high inflation, rising borrowing costs and weak external demand. The unemployment rate showed the lowest record at 6.4%.

In the UK, the stock market faced a slight drop on Wednesday, due to disappointing earnings updates. Nevertheless, a higher than expected rise in house prices and the manufacturing PMI revised higher brought hope in the market, that gained 0.7% on Friday, closing the week down just 0.20%.

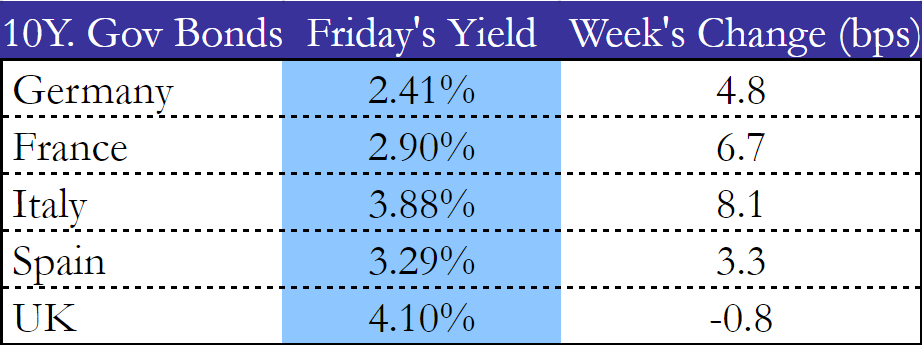

Eurozone 10-year bond yields faced the same pattern during the week. As investors awaited US and European inflation data, and after ECB President Lagarde emphasized the need of further evidence that price growth is moving toward the desired target, yields were rising being close to 3-month highs. Then, after the CPI print, despite it being higher than the expectations, yields fell, following the expectation that current disinflation will continue and that rate cuts will come by the second quarter of the year.

Source: BSIC, worldgovernmentbonds

Rest of the World

The Shanghai Composite traded near 3-months highs, driven by a robust outlook for the AI sector that resulted in a rally, following US artificial intelligence boom. On Friday, PMI data revealed that manufacturing activity contracted for the fifth consecutive month in February, down to 49.1 but in line with expectations, while services sector growth was above expectations with a non-manufacturing PMI of 51.4. On the other hand, China’s 10-year government bond yields dropped to a record low 2.35%, under deflationary pressures and economic uncertainty.

The Japanese Nikkei index experienced a weekly gain of 1.41%, closing on an all time high, pushed by strong corporate earnings. The inflation rate fell to 22-month low in January at 2.2%, while the 10-year yield rose above 0.7%, as investors bet on a potential end to ultra-loose monetary policy.

The Brazil’s Bovespa started the week positively, over optimism given by lower than expected inflation, but then, the Brazilian GDP stalled for the second consecutive quarter, missing the expectations of a 0.1% increase, erasing the positive movement and leading the stock index to a flat week.

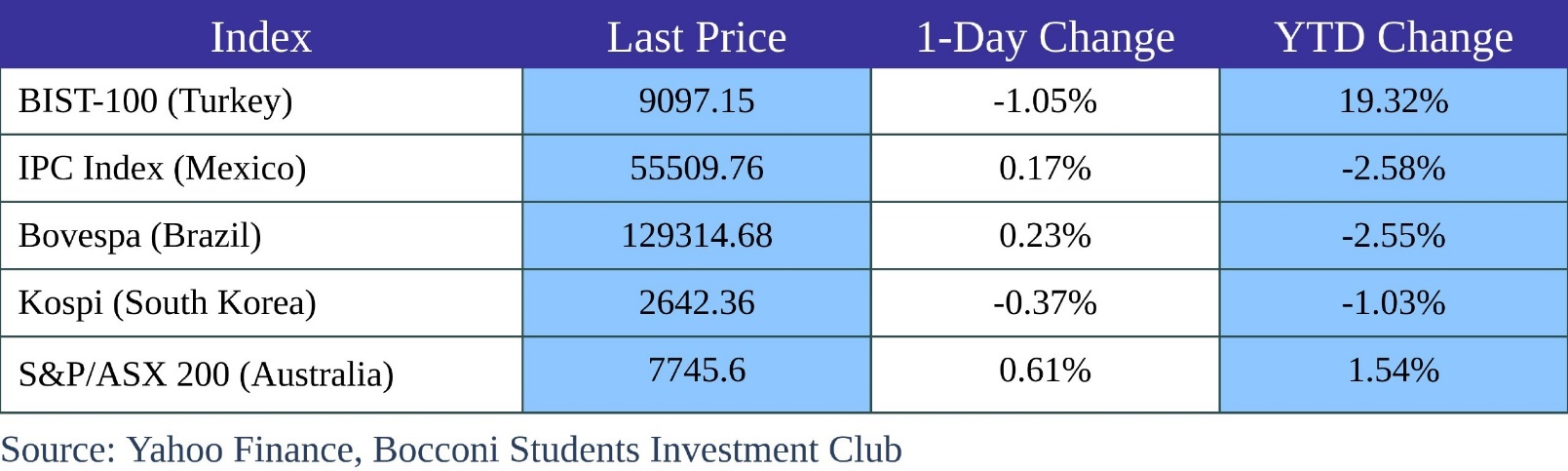

Turkish GDP expanded more than expected, growing 4% year on year in Q4 2023. Despite this and the manufacturing sector returning to grow, with a PMI of 50.2, the Turkish BIST-100 dropped 3% this week and the USD/TRY reached all time high of 31.44.

FX and Commodities

The Dollar index dropped 0.26% on Friday, over US economic data, closing the week flat. Also, both EUR/USD and GBP/USD remained flat over the week swinging respectively around 1.083 and 1.265. The Japanese Yen strengthen on Thursday after BoJ board member Hajime Takata referred to the possibility of the central bank to start ending ultra-loose monetary policy, including an exit from negative interest rates and bond yield control. On Friday, as the BoJ governor Kazuo Ueda said it was too early to conclude that inflation was sustainably meeting the 2% target, the Yen weakened past 150, erasing the previous movement.

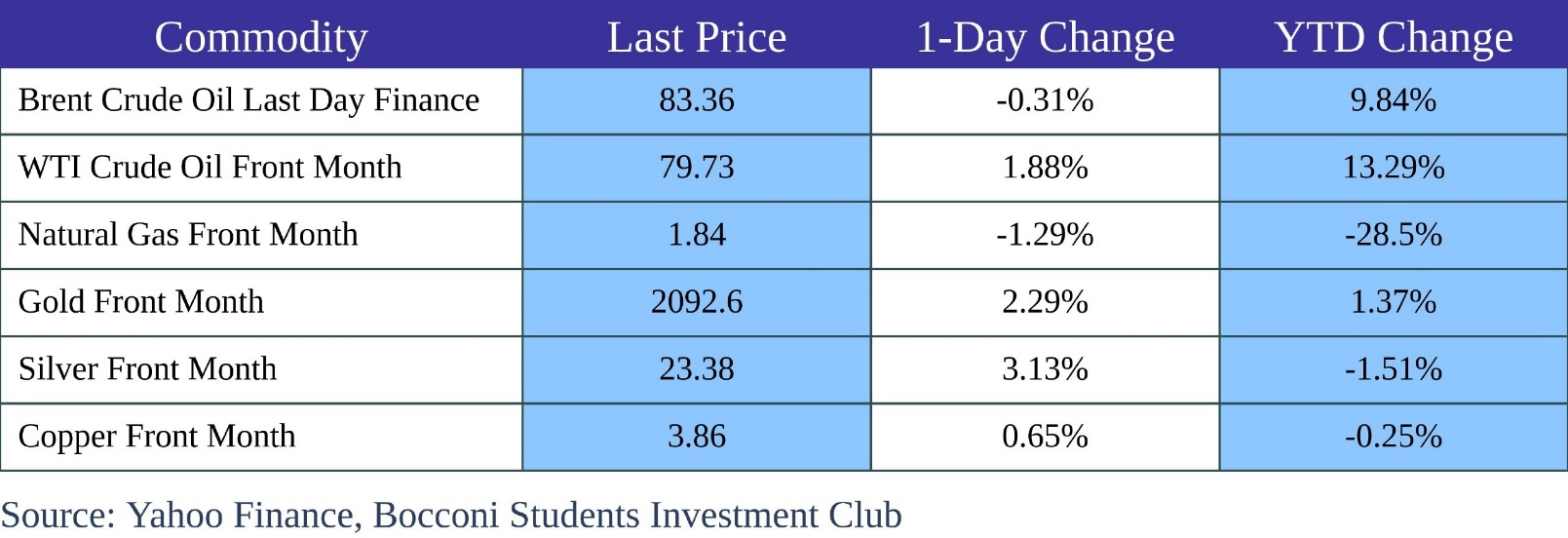

In the energy market, both Brent and Crude prices rose, reaching 4-month highs on Friday. This is driven by speculation that OPEC+ will extend voluntary oil outputs cut in the upcoming March meeting. Shipping disruptions in the Red Sea and uncertainty regarding ceasefire talks between Israel and Hamas, also added a risk premium to oil prices.

Gold marked a new all time high on Friday, rising over $2090 per ounce following US economic data and lower Treasury yields. Silver followed the gold, rising on Friday over news weakening the dollar. Natural Gas recovered 4.20% this week, still being down 27% YTD.

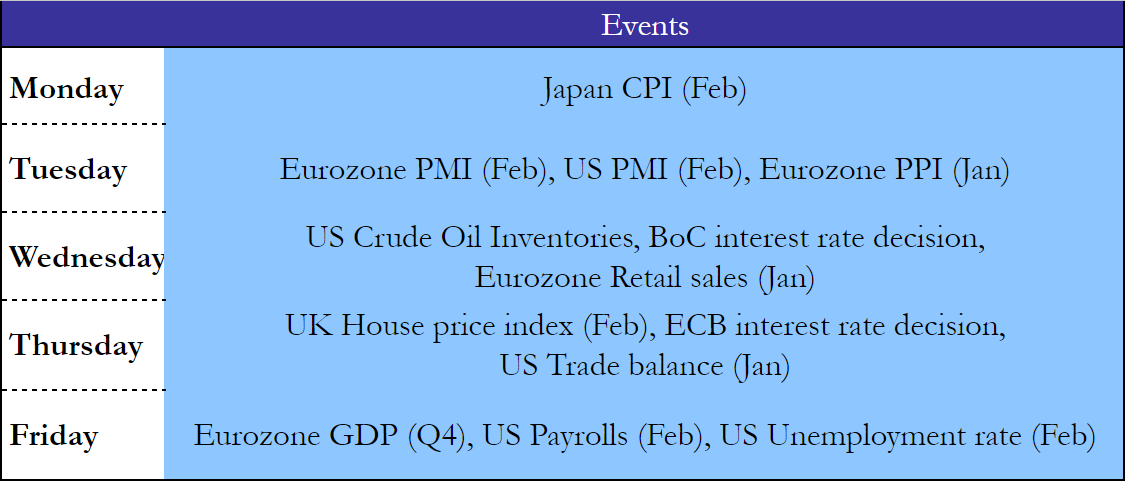

Next Week Main Events

Brain Teaser #11

You have a large jar containing 999 fair pennies and one two-headed penny. Suppose you pick one coin out of the jar and flip it 10 times and get all heads. What is the probability that the coin you chose is the two-headed one?

Source: Heard on the Street: Quantitative Questions from Wall Street Job Interviews

SOLUTION

We can arrive at the answer simply by applying Bayes’ Theorem. Indeed, we can represent the probability of choosing a two-headed coin given that we got heads 10 times as P(HH|10H).

Using Bayes’ theorem:

P(HH|10H) = P(10H|HH)*P(HH)/P(10H) = P(10H|HH)*P(HH)/[P(10H|HH)*P(HH) + P(10H|HT)*P(HT)] = 0.506

The answer is thus 50.6%

Brain Teaser #12

Suppose that you roll a dice. For each roll, you are paid the face value. If a roll gives 4, 5 or 6 you can roll the dice again. Once you get I, 2 or 3, the game stops. What is the expected payoff of this game?

Source: A Practical Guide to Quantitative Finance Interviews

0 Comments