US

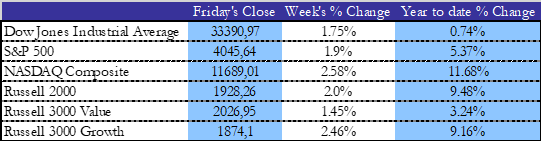

Every major index in the US had a positive week after starting slow and rebounding in Thursday’s and Friday’s sessions. The NASDAQ Composite led the pack with a weekly growth of 2.58%, followed closely by the Russell 3000 Growth Index which enjoyed a WoW climb of 2.46%. The indexes who saw some more modest increases were the Dow Jones, and the Russell 3000 which rose 1.75%, and 1.45% respectively, bringing the Dow Jones’ YoY change, back to positive after a difficult pair of weeks. The strong performance of all indexes this week was propelled by Raphael Bostic’s dovish comments, where he stated that he did not believe it was necessary for rates to increase above the 5-5.25% level in order to achieve the Fed’s goal of price stability. This gave investors a lot of confidence ahead of the next FOMC meeting scheduled in 2 weeks’ time (March 14th and 15th).

This was in sharp contrast with early sentiment in the week, underlined by the WSJ article by Jason Furman, former economic advisor to the Obama Whitehouse, that stressed how rates should go up by 50 bps in the next meeting on the back of negative annualized 3 months core inflation data out earlier in the week.

The best performing sectors this week were Energy, Basic Materials, and Transportation, which rose by 4.50%, 3.83% and 3.11% respectively. On the other hand, the worst performers in the last 7 days were Utilities and Consumer Non-Cyclical, which both took hits of around 1%.

Some worries about Fed’ hikes however were spurred by the continued resilience of the US labour market, which saw weekly jobless claims stay under 200,000 for the 7th consecutive week. An increase in the ISM Manufacturing PMI to from 47.4 to 47.7 also contributed to long term hawkish fear, in great contrast to the short-term positive sentiment that characterized the week. The ISM Non-Manufacturing PMI however, saw a slight dip from 55.2, to 55.1.

This is worrying because a) it gives the Fed room to cut rates without hurting the economy, and b) it shows a still buoyant economy which will continue to put pressure on prices and on wages, risking to make inflation ‘stickier’.

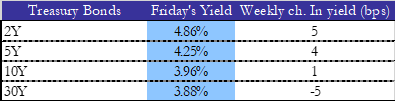

During last week, yields rose modestly across the board, except in the very back end of the yield curve, where the 30Y’s yield dropped 5 basis points to 3.88%. The movement in Treasury prices this week was the complete opposite when compared to the equity market. All major liquidity points in the yield curve saw double digit dives in Thursday’s and Friday’s sessions, offsetting the yield gains they had seen in the first 3 days of the week.

Some signs of economic contraction were seen at the start of the week as US Durable Goods Orders MoM came in 50 basis point lower than the -4% forecasted change. This could have contributed to the very slow start the equity markets had during the week.

Major earnings releases of this week included DELL and ZM .

DELL announced a record full-year revenue of $102.3 billion, up 1% from last year, and a record full-year operating income of $58.8 billion, up a staggering 24% from last year. 4th Quarter revenue was $25 billion, down 11% and EPS were announced at $3.24. Investors did not react positively to this report as shares failed to increase in the session after the announcement.

ZM jumped 8% following better than expected results, but lost all of its gains throughout the week, ending the % day period down almost 6% WoW. EPS was reported at $1.22 demolishing expectations of just 81 cents. Further good news was announced as revenue also came in higher than expected ($1.12 billion).

EU

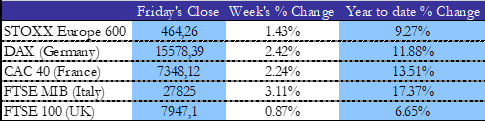

European equities enjoyed a similar week to their counterparts across the pond as all major indexes rose across the continent. Italy’s FTSE MIB saw the biggest jump with a 3.11% WoW increase, spearheaded by AMP’s near 10% gains, while the UK’s FTSE 100 saw the smallest gains with a 0.87% increase in the last week. The DAX and the CAC 40 saw increases of over 2% for the week.

On Monday, the Economic Sentiment Indicator came in slightly lower than the month before (99.7), but this did not hamper equity market performance, which was very aligned with the US, as stocks rebounded after a tough start to the week.

The following day, inflation rate YoY was released for France, which increased for the second consecutive month, to 7.20%. The following day the CAC 40 took a hit of over 150 basis points before rebounding. Furthermore, this piece of news reinforced the fear of future ECB rate hikes.

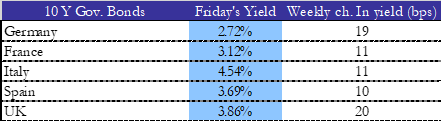

This increase in ECB hike speculation had consequences in the fixed income world as European government bond prices fell on Tuesday and continued to do so across the whole week. Germany’s 10Y bond experienced the highest rise in yield with a staggering 19 basis points, while Spain’s bond had the lowest increase, 10 basis points, nevertheless. Policy sensitive 2Y government bonds also saw increases in yields. The big jumps in yield were clearly a consequence of investor sentiment regarding monetary policy. We can see that investors in Europe had a more hawkish approach than in the US, in the last week.

This increase in ECB hike speculation had consequences in the fixed income world as European government bond prices fell on Tuesday and continued to do so across the whole week. Germany’s 10Y bond experienced the highest rise in yield with a staggering 19 basis points, while Spain’s bond had the lowest increase, 10 basis points, nevertheless. Policy sensitive 2Y government bonds also saw increases in yields. The big jumps in yield were clearly a consequence of investor sentiment regarding monetary policy. We can see that investors in Europe had a more hawkish approach than in the US, in the last week.

Italy’s economy grew firmly last year, as Wednesday it was reported that GDP increased by 3.7%, however the good news was counteracted by a growing budget deficit. On Wednesday German CPI data released. Inflation, both on yearly and monthly came in higher than expected, as YoY inflation stayed at 8.7%, and MoM rose to 9.3%. This also reinforced the idea that further ECB rate hikes are imminent. Inflation in the euro area slightly decreased to 8.5% in February but was still 30 basis points above expectations.

Rest of the World

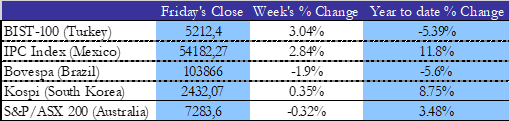

On Tuesday Canada announced that QoQ GDP remained practically unchanged after 5 quarters of consecutive increases. The following day Australia announced the same data, which revealed their economy grew slightly with a QoQ GDP increase of 0.5%. The equity market did not react well to this piece of news as the ASX 200 was one of the only indices to contract in the past week. Brazil’s Bovespa suffered even larger losses, continuing its 2023 woes. South Korea’s Kospi had a relatively flat week finishing the week up 0.35%. The BIST-100 and Mexico’s IPC Index both boasted gains of around 3%.

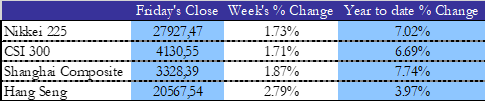

In Asia all major indices were up with the Hang Seng leading the way, with gains of 2.79%. The Nikkei 225, Shanghai Composite and CSI 300 all had a very similar performance for the week with solid gains in the 170-190 basis point range.

On Wednesday China’s NBS Manufacturing PMI skyrocketed to 52.6 from the 50.1 levels of January, which is more evidence that shows their re-opening is in full effect. It will be interesting how this expansion in China’s production sector will affect the supply chain issues which have caused inflation to shoot up in Europe in the last 12 months. Less positive news came from Japan as the Consumer Confidence Index rose just by o.1, and came in at 31.1, lower than the expected 32.

FX & Commodities

This week gold prices rose to a two-week high, and were up 0.8% to $1850 per ounce, but eventually closed slightly lower on Friday. With China reopening, gold consumption should continue to be stable. Stability will also be maintained as investors buy metal to hedge against inflation.

On the other hand, with energy prices trickling down, the Ruble has fallen to a 10-month low, now trading at about 75 Rubles to the dollar. The dollar itself also fell relatively to the euro as EURUSD now trades at 1.063, despite lower-than-expected PMI data for most European countries. GBPUSD continues to trade at either side of the 1.200 level. Retail trader data revealed that 65.11% of traders are net-long, suggesting that GBPUSD prices could fall in coming weeks. This is subject to variations caused by their respective Central Banks’ actions.

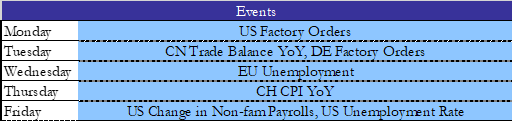

Next Week’s Events

Brain Teaser #36

Four points are chosen at random on the surface of a sphere. What is the probability that the center of the sphere lies inside the tetrahedron whose vertices are at the four points? (It is understood that each point is independently chosen relative to a uniform distribution on the sphere.)

Source: Putnam 1992

Solution: Having placed 3 points ABC, the 4th D will enclose the center in the tetrahedron iff it lies in the spherical triangle A’B’C’, where P’ is directly opposite to P (so that the center lies on PP’). The probability of this is the area of ABC divided by the area of the sphere. So taking the area of the sphere as 1, we want to find the expected area of ABC. But the 8 triangles ABC, A’BC, AB’C, ABC’, A’B’C, AB’C’, A’BC’, A’B’C’ are all equally likely and between them partition the surface of the sphere. So the expected area of ABC, and hence the required probability, is just 1/8.

Brain Teaser #37

There is a tribe of perfectly logical people living on an island when a visitor comes with a strange order: All the blue-eyed people must leave the island as soon as possible. There will be a flight out at 8 PM every evening. Each person can see everyone else’s eye color, but they do not know their own (nor is anyone allowed to tell them). Additionally, they do not know how many people have blue eyes, although they do know that at least one person does. How many days will it take for the blue-eyed people to leave?

0 Comments