USA

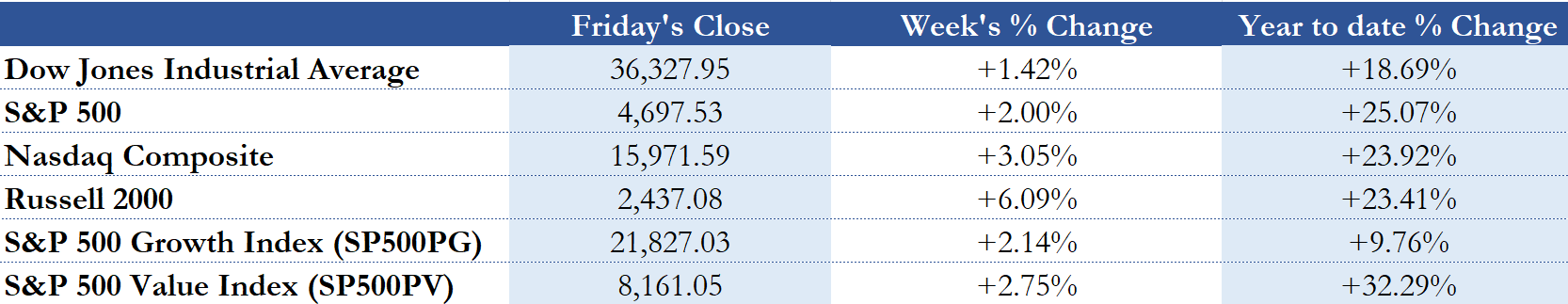

The US stock market ended this week with all indices but the S&P 500 Value Index reaching all-time highs with the latter just barely closing under its all-time high. The main event last week was definitely the publication of the Federal Reserve’s decision to not raise interest rates but taper off its asset purchase program by $15 bn per month starting in November. Adding to this, the number of jobless people in the United States is declining at a strong rate, further leading investors to believe in a favorable economic outlook for the near future, making the end of the year rally that typically starts in November gain even more momentum.

The Dow Jones closed at 36,327.95 with the top gainer being Boeing with a gain of 8.42% due to investors being more optimistic about a recovery from the Pandemic in the heavily hit airline sector. The S&P 500 ended the week just under the 4,700-mark at 4,697.53 with a 2% gain after having breached 4,600 just one week prior. This strong growth was fueled by strong earnings results such as by Qualcomm, which beat the forecast by analysts handily and shot up over 22% last week. The tech-heavy NASDAQ paints a similar picture, closing at 15,971.59 with technology stocks being the hottest stocks in the market right now. Even though the global chip shortage shows signs of coming to the end in the not-too-distant future, chipmakers such as Nvidia and AMD performed exceptionally well last week, both posting dual-digit gains. This strong performance could push the index over the 16,000-mark next week for the first time ever. Small caps did especially well with the Russell 2000 gaining over 6%, closing at 2,437.59. Reversing their pattern from the prior week, value stocks did better than growth stocks with the S&P 500 Value Index gaining 2.75% closing at 8,161.05 and the S&P 500 Growth Index gaining 2.14% closing at 21,827.03. This continues the recovery value stocks, which reached pre-pandemic levels only early this year, somewhat lagging behind the stellar returns of most other indices in the aftermath of the Coronavirus Pandemic. This recovery means that the S&P 500 Value Index also posts the highest YTD return of all covered indices.

Demand is high for US Treasury bonds of all maturities, especially those with maturities of up to 10 years, lowering yields substantially. 2 Year bonds yields are at 0.399% and have gone down by 10.22 bps compared to the prior week. Similarly, yields for 5 Year bonds hover at 1.056%, declining by 13.09 bps and 10Y bonds are at a yield of 1.453%, also declining by 10.69 pbs. Only 30Y yields have not down by as much, sitting at 1.888%, down 4.61 bps. This sharp decline in 2-10Y bond yields is due to the fact that the Fed was adamant about not intending to increase interest rates in the near future, even though it had announced it would be tapering off asset purchases. The strong job market report then put further downwards pressure on yields.

Investors will now be looking towards the Federal Reserve once again, as the surprisingly strong job market numbers could mean that the Fed could increase rates earlier than expected, even if Fed Chief Powell did not make any remarks in this direction.

Europe and UK

The stock market rally in the US is continued in Europe with all major indices posting gains over the last week, regaining some momentum from prior weeks after weaker returns one week ago. This momentum was driven by a variety of factors. First and foremost, the Bank of England’s decision to keep interest rates on hold due to job growth concerns catapulted European stocks to or closer to all-time highs. This decision came to a surprise to many investors, as the market had prices in a 15 bps hike in rates. Similarly to the US stock market, European stocks also reacted positively to the Feds decision on interest rates and asset purchases. Adding to this, ECB President Christine Lagarde emphasized that the ECB does not want to increase rates in 2022. Altogether, this meant that the STOXX Europe 600 index closed at 483.44, 1.67% higher than at the start of the week. Several country-specific indices broke through important barriers: the German DAX was able to breach 16.000 after having experienced several sharp selloffs at this mark in the past, closing at 16,054.36 with a 2,33% gain. Equally, the CAC 40 from France was able to break through the 7,000-barrier, gaining 3.08% to 7,040.79 with an impressive YTD performance of 26.83%. The Italian FTSE MIB gained the most of all major European indices this week, namely 3.42%, closing at 27,795.93. The FTSE 100 stagnated somewhat, only gaining just under 1% to 7,303.96 still inching closer to its all-time high. The Brexit-stricken economy was under pressure recently by a fuel shortage, but seems to be continuing on it’s slow but steady path of recovery from the Coronavirus Pandemic. Still, YTD gains for the FTSE 100 of 13.06% are the lowest of all European indices looked at.

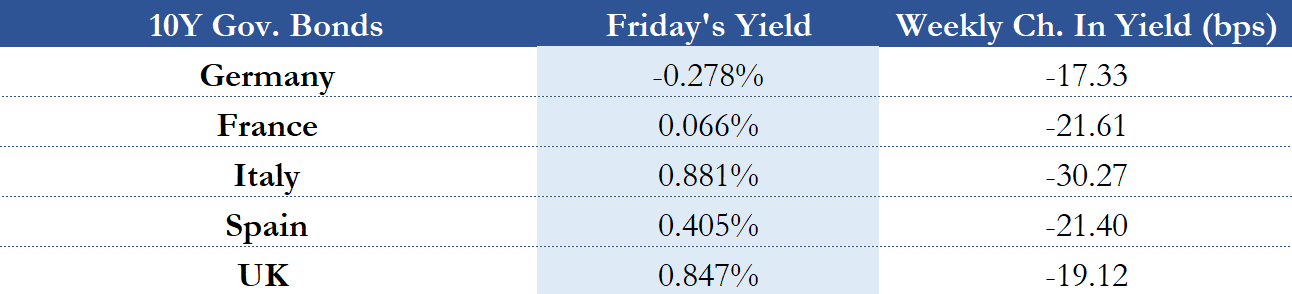

Similarly to the US Bond market, yields on European 10 Year bonds were under heavy downwards pressure from the major Central Bank Decisions by the Fed and Bank of England. When compared to US Treasury bonds with 10 Year maturity, the downwards change in yield was greater for each major European economy. A supporting factor for this sharp decline in yield could also be the fact that industrial production was down surprisingly in September in countries such as Germany (-1.1%) and France (-1.3%) due to the ongoing supply bottlenecks. In numbers, German 10Y bonds yields were down to -0.278% by 17.33 bps, while French 10Y bonds lost 21.61 bps closing at a 0.066% yield. Italian bond yields were hit the hardest with a decrease of 30.27 bps to a 0.881% yield, while yields for Spanish 10Y bonds were down by 21.40 bps to 0.405%. Lastly, UK bond yields declined to 0.847% by 19.42 bps.

The presentation of EU-wide industrial production figures for September will now be a highly anticipated event for investors, while CPI numbers from Germany are also published next week, so an important week both for stocks and bonds lies ahead.

Rest Of The World

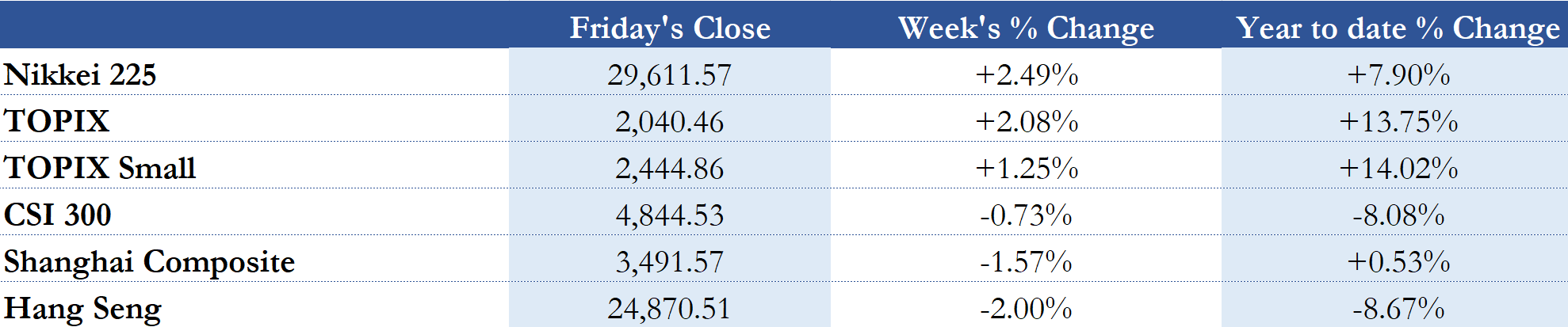

The week has ended after rough trading in some Asian markets, especially China. While Japanese indices gained over the past week, all major Chinese indices suffered losses. This is mainly due to the ongoing property developer crisis in China, as developers frantically tried to sell Billions worth of assets in order to cover their debt payments. This crisis found its pinnacle last week with Hong Kong-listed property developer Kaisa Group being suspended from trading on Friday, after it had announced it had missed payment on a wealth management product. This meant that the CSI 300 fell to 0.73%, while the Shanghai Composite declined by 1.57% to under the 3,500 again. The Hong-Kong based Hang Seng, which accommodates some of the country’s largest property developers, suffered the most and fell by 2% to 24,870.51, even though some companies such as BYD Co. posted high returns of over 8%.

The uptrend in Japanese indices was mainly due to the fact that the Liberal Democratic Party LDP had maintained it’s majority in the Japanese election, which left investors optimistic for new fiscal stimulus. Consequently, the Nikkei and TOPIX indices shot up by about 2% and then stagnated at this level for the rest of the week, meaning that the Nikkei gained 2.49% to 29,611.57, while the TOPIX closed at just over 2,000 with a 2,08% gain and TOPIX small gaining a little less at 1.25%.

As Japanese indices have gained some momentum, after losses due to the ravaging Coronavirus Pandemic in early autumn, it remains to be seen if this upwards trend continues. Meanwhile in China, the stock market is still captivated by the debt crisis of property developers and the next weeks could prove critical for the market as a whole as developers have to try their best to not miss any more debt payments without throwing the sector into even more turmoil.

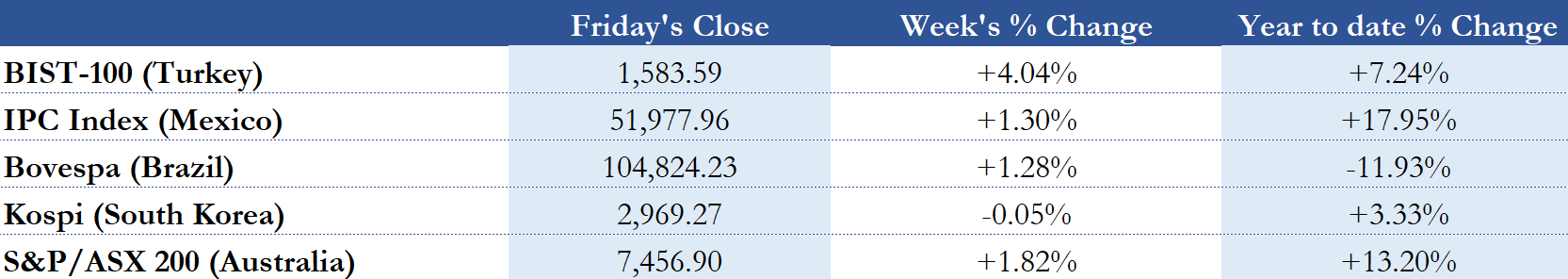

In Turkey, Inflation has gained momentum to 19.89% in October, though the figure was under expectations. Combined with President Erdoğan saying, that “although international institutions estimate a 9% growth, we think that we will reach double-digit growth figures at the end of the year”, Turkish stocks were in high demand, with the BIST-100 gaining 4.04% to 1,583.59. The Mexican IPC Index gained a moderate 1.30% in the past week with the country still experiencing high levels of uncertainty regarding the overall economy, as GDP contracted by 0,2% in Q3 of 2021 combined with rising concerns about high levels of inflation. After having raised benchmark interest rates to 7.75% on 28. Oct. it was calm around the Brazilian Bovespa with it also gaining moderately by 1.28%. The Korean Kospi stagnated and ended the week at 2,969.27, losing 0.05% in the process. This stagnation is mainly due to the fallout of the debt crisis in China, but strong demand for Korean chipmakers might be a ray of hope for the stock market in terms of future growth. In historic news, the Reserve Bank of Australia (RBA) has abandoned it’s yield control approach of monetary policy due to rising inflation and is one of the first large central banks to actively act against inflation while also moving its projection for rate hikes forward from 2024 to 2023. Meanwhile, the RBA also raised its predictions for economic growth for 2022. Altogether, the Australian S&P/ASX 200 ended the week at 7,456.90 with a gain of 1.82%, the highest per-week gain in one month.

FX and Commodities

Another tumultuous week has ended for oil futures, with WTI futures down 3.35% to $81.17 and Brent futures down 3.12% to $82.35. After the US had increased pressure to boost supplies earlier this week, OPEC+ members did not budge and agreed to maintain their agreement of increasing oil production by 400,000 barrels per day in December, rather than ramping up production sooner and faster. This led to speculation about the US possibly tapping its strategic oil reserves, though experts have deemed this unlikely. Still, this meant that WTI futures fell to under $80 on Thursday, though speculation on rising oil prices heaved the price of oil futures higher once more. What the effects of OPEC+ increasing production will be remains to be seen, but until that happens, oil prices could be set to increase even more.

In Europe, the ongoing gas shortage has not yet been fully solved. Russia, which supplies 35% of Europe’s gas, did not agree to increase its gas production, seeing as it had fulfilled its contractual obligations. This meant that benchmark future prices rose up to 15% in a sharp spike but cooled off once again after Russian President Vladimir Putin said the country would start sending more gas through its pipelines once it had filled up its own reserves.

Gold has finished strong this week with gold futures gaining about 1.8% and closing at $1,819.95, the highest in three months. This is due to the lower yields on US Treasury bonds lowering opportunity costs for holding nonyielding assets such as gold. However, as risk aversion is low currently, only few investors seek gold as a safe haven, so one should not expect overly high future growth opportunities at this moment in time.

The Dollar Index gained ever so slightly, closing 0.015% higher at 94.207, though the Index hit a one-year high on Friday after strong employment numbers in the U.S. but then decreased during the rest of the trading day. The peak of the Dollar Index coincided with the lows for this week in Euro to Dollar and Pounds Sterling to Dollar conversion rates. However, while the Euro gained against the Dollar again, strengthening by 0.07% this week, the Pound Sterling weakened by 1.3% in comparison to the Dollar. The decrease in value of the latter is mainly due to the Bank of England not raising interest rates. Even though strong unemployment figures shortly spiked the value of the Dollar against the Japanese Yen, the Dollar weakened against the Japanese Yen, closing the week at 113.4, a decrease of about 0.62%. The U.S. Dollar stagnated against the Chinese Renminbi, closing at 6.399, losing 0.015% in the process.

Next week main events

An important week lies ahead of us with some important inflation figures being presented. First and foremost, 3 of the world’s largest economies, China, the United States and Germany present their consumer price indices for October on Wednesday. Furthermore, the US Producer Price Index excluding Food & Energy will also be a highly anticipated number on Tuesday. Other than that, key events are the presentation of the Japanese Leading Economic Index for September on Monday, which has recently come under pressure from the Delta variant of the Coronavirus. On Thursday investors will look at the presentation of UK GDP figures as well as employment changes in Australia. The week wraps up with the EU presenting industrial production numbers for September, after some of its major economies had already unexpectedly posted declining production figures earlier this week.

Brain Teaser #12

How many traders should there be on a trading floor such that the probability that two traders have the same birthday is more than ½?

Solution:

First, we will assume there are N traders on the floor and 365 days in a year. If we ignored the problem’s restriction and chose the birthdays randomly, there would be achievable ![]() series for the birthdays of the N traders.

series for the birthdays of the N traders.

On the other hand, if we aimed to construct a series of different birthdays, we could choose the birthday of the first trader in 365 ways, while the one of the second, only in 364 ways. Following the same logic, we can deduce that for the n-th trader, there will be 365-n+1 choices. Thus, there are ![]() achievable series such that the N traders have all different birthdays. By solving the following inequality:

achievable series such that the N traders have all different birthdays. By solving the following inequality:

![]()

we can get the minimum number of traders that satisfy the problem’s condition. After computations, we find out that the smallest number of traders satisfying the problem condition is 23.

If you want to have a better understanding of the Birthday problem, you can visit this page.

Brain Teaser #13

Monty Hall problem

Let us suppose you are a participant in a game show that gives you the chance of winning the prize behind one of three doors. Behind one door, there is a car, while behind the others, goats. As you don’t know what is behind the doors, you pick a random door and announce it to the host, say No. 1. After your choice, the host opens one of the doors he knows contains a goat, say No. 3, and gives you the option to switch between your initial pick and the remaining door (i.e., between door No. 1 and 2). Should you exercise the option, why?

0 Comments