United States

The US market certainly retains the main stage of financial attention, after the drop in the past few weeks that could have signalled investors’ fears ahead of the new election. However, this time around the equity markets saw a dramatic bull run, with the S&P 500 and Dow Jones Industrial Average gaining 7.3% and 6.9%, respectively. The tech-heavy Nasdaq advanced 9%, and all three had their best weeks since April when U.S. stocks were rebounding from the COVID-19 plunge.

Some observers thought that the prevailing sentiment will be grim, given that the US topped 100.000 COVID-19 cases in a single day and the election results dragged on. Instead, investors outweighed these numbers by warming to the prospect of a divided government, which made sweeping overhauls of the tax code or regulations less likely. This particularly fostered the hopes of big technology and Internet stocks, which surged while concerns about changes to US antitrust laws eased. Cigna (+13.7%), Anthem (+10.4%), UnitedHealth (+10.3%) led part of the S&P 500 rally in drug-makers and healthcare names, now that Democrats’ arduous path toward Senate control lowered the risks of ACA impact.

On a less bright side, the interest-rate-sensitive communication services and utilities sectors underperformed as bond yields fell. Oil and gas stocks were initially lifted by the International Energy Agency’s report of large drawdowns in crude oil inventories, but later the group fell due to global demand concerns as European countries toughened travel restrictions because of increasing COVID-19 cases.

With a blue wave failing to materialize, investors are adjusting their inflation expectations: the US yield curve is flattening in response to election results. It is noteworthy, though, that the behaviour is not mirrored in the municipal bond market: prices fell relative to Treasuries in the immediate aftermath of the election and then rebounded, but didn’t receive the big bump many analysts had expected would follow in the event of a sweep by Democrats.

As Goldman Sachs noted on Friday, the general surge in asset prices should be greeted as a sign of economic recovery – forecasted of about 5-6% in 2021 by the investment bank – rather than a worrisome ascent into bubbles territory. The US labor market is on stronger footing moving into the final quarter of 2020: the headline unemployment rate dropped to 6.9%, participation ticked up slightly, and 639,000 jobs were created last month. On the downside, many people are working part-time who would otherwise be full-time.

On the corporate side Uber, Lyft and other companies that work in the gig economy won a big victory in California, when voters approved a measure that will avoid them to classify their drivers as employees. The companies will not have to comply with State laws such as providing sick pay benefits to drivers, although some have pledged to offer more protections. Uber (+32%) and Lyft (+29%) surged this week, as they hinted that such a win on their main market and battleground can be translated in other countries if not continents.

The so-called “fear of missing out” (FOMO) ravaged even the bitcoin market this week. The infamous cryptocurrency rose about 16% this week, up to $15,505. The news might have welcomed warmly Robinhood day traders once upon a time, but now it has become of broader interest when the American firm Microstrategy decided to dash $425m into the market. Microstrategy, which sells technology that enables business to analyze internal and external data, had $600m of idle cash to spare after strong revenues, and decided to follow the mantra “cash is trash”.

Europe

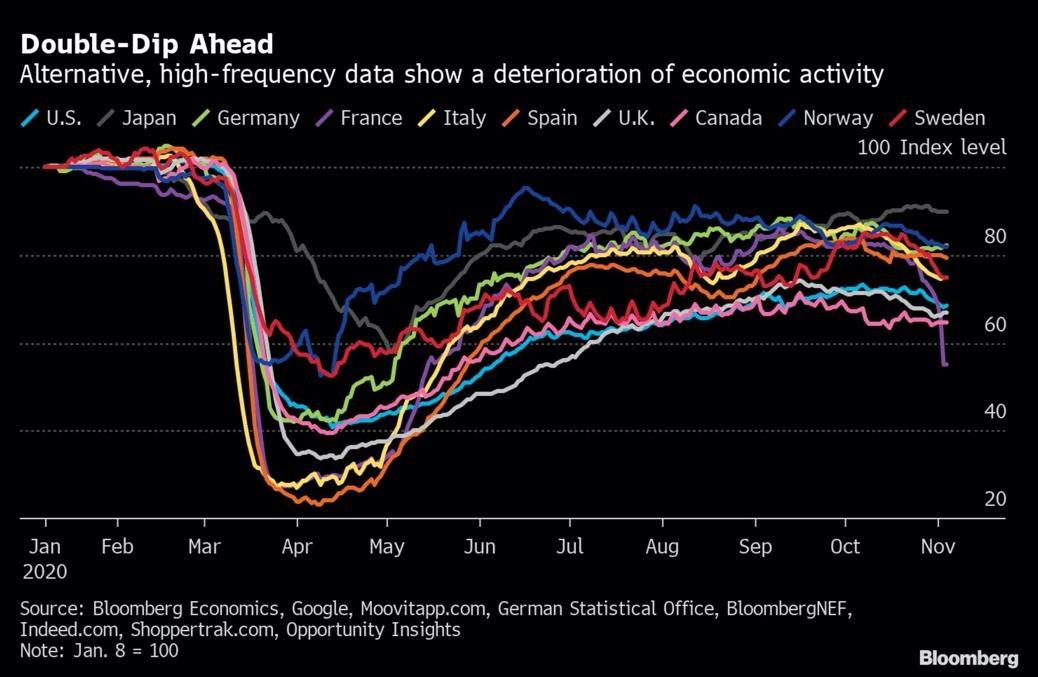

All major equity markets in Europe moved higher, with the EURO STOXX 50 up 7%, greeting a positive reaction to the US election and outweighing concerns about new lockdowns in Europe, hence the risk of a double-dip recession. Investors in Europe had been looking eagerly for a big stimulus to boost inflation and economic growth as a spillover effect from the US. It became clearer by Thursday, however, that the U.S. elections were closer than polls and investors had expected.

The European Central Bank, last week, said it intends to keep its support of the eurozone’s economy in December, with a package that could include new bond purchases, an interest-rate cut and cheaper loans for banks. Four officials said the ECB is deciding whether to extend its pandemic QE (PEPP) or boost its regular QE (APP) that, crucially, ties bond buying to a country’s capital key. This would be particularly damaging for the Italian sovereign bonds, which generously benefited from this divergence in March, and whose 10-year yields fell further Thursday. Italy’s five-year yields went negative for the first time in history, before closing just in positive territory at 0.003%.

On the equity side, insurers got a boost after Germany’s Allianz reported a surprising 6% rise in third-quarter net profit. On the same note, French lender Société Générale jumped 5.7% after it swung back to quarterly profit, as its equity trading business continued to recover from a weak start to the year. Meanwhile, the airline industry is still enduring its nightmare: both Lufthansa and Air France-KLM reported another heavy quarterly loss. The German and French-Dutch airlines have received State bailouts during the pandemic, but Lufthansa said it would restructure its business further. Air France-KLM, likewise, is going to curtail its flight schedule for the rest of the year. Ryanair, which has been vocal against the lockdown measures since the beginning of the pandemic, also made a loss as passenger numbers naturally plummeted.

On the data front, the eurozone economy seems to be limping back to speed: Germany’s industrial output rose less than expected, signaling a possible double-dip recession. Output grew by 1.6%, below a Reuters forecast of 2.7%. Driven by the German manufacturing sector, PMIs in Europe posted decent growth figures, but with lockdowns measures taken widely a decreasing GDP figure for Q4 will be now taken for granted.

Source: Bloomberg

United Kingdom

The UK market was taken by a stark surprise even before the week started, as Prime Minister Boris Johnson announced on Saturday further lockdown measures with immediate effect. UK stocks underperformed as they did since the beginning of the year, with the FTSE 100 gaining 5.9%. Talks with the European Union about post-Brexit trade once again seemed to make little progress, in spite of a feeble light of hope, early in the week, that a compromise over the controversial issue of fishing rights might emerge soon.

Earlier Thursday, the Bank of England officials said they expect the U.K. economy to shrink in the final quarter of 2020. To counteract the struggles of the darkest hour, the BOE exceeded market expectations to boost QE by £150bn (vs £130bn consensus), and “helicopter money” expanded as Chancellor of the Exchequer Sunak extended the furlough program (80% of lost wages paid) to 2Q 2021 with indirect BOE funding.

Towards the middle of the week, a weaker pound boosted the overall equity market as dollar earners like AstraZeneca Plc, Experian Plc and Rentokil Initial Plc paved the way.

Oil

U.S. crude inventories plunged last week by 8 million barrels, against analyst expectations for an increase. Oil glut persists in several key market hubs as Royal Vopak, an independent oil storage outfit, has sold out most of its capacity at its three main hubs in Singapore, Rotterdam, and Fujairah. With oil prices in contango, carry trades remain popular to support tanker leasing rates.

Providing some support, the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, a group known as OPEC+, could delay bringing back 2 million barrels per day of supply in January, given weaker demand after new lockdowns.

ExxonMobil posted its third consecutive quarterly net loss, this time of $680m. It plans to cut 15% of its global workforce next year. Saudi Aramco, the world’s biggest oil company, made a net profit of $11.8bn, but that was 45% less than last year. It still intends to pay out dividends, but most of that will go to the Saudi government which owns the bulk of Aramco’s shares.

Source: Bloomberg

Rest of the world

Asia stocks followed European and American gains this week, with the Hang Seng Index up 5.7%, the Nikkei 4.3% and the Kospi 6.2%. Most importantly, the US dollar index DXY was trading at 92.6 during the election, declining earlier this week from levels above 93. This meant that the Japanese yen, widely regarded as a safe haven, could easily rise up to 103.46 per dollar, having strengthened from levels above 104.4 against the greenback this week.

The biggest news so far, without a shadow of a doubt, entails the highly anticipated initial public offering of the fintech giant Ant Group. Chinese regulators stunned financial markets on Tuesday when they slammed the brakes hard, just days before its shares were scheduled to float in Shanghai and Hong Kong. Ma’s firm was set to raise $37bn and become the biggest share sale in history, but the Shanghai Stock Exchange said in a statement that it had postponed the Ant Group IPO because of “major issues” that might cause the company “not to meet the listing conditions or disclosure requirements.” Shares in Alibaba, the e-commerce giant that Ma co-founded and owns a roughly 33% stake in Ant Group, plummeted 7.54% in Hong Kong.

The Shanghai Stock Exchange’s announcement comes just over a week after Ma said that avoiding systemic risk is important, but publicly criticized Chinese regulators by being too risk averse. In September, delivering a worrying statement for foreign investors flocking to China’s onshore market, the party published an unusually frank set of guidelines that emphasized the need for “politically sensible people” in the private sector who will “firmly listen to the party and follow the party”.

China’s Banking and Insurance Regulatory Commission proposed new rules on Monday for online lenders which means that Ant would have to set aside more cash for the loans it facilitates and would place more credit risk on its balance sheet. Given these considerations, Ant will need to regroup and retry the IPO in about six months.

A private survey also showed China’s service sector activity growing in October, with the Purchasing Managers’ index coming in at 56.8.

The Reserve Bank of Australia released its monetary policy statement, said the pandemic will have long-lasting effects on the Australian economy and GDP will unlikely return to its pre-pandemic level till the end of 2021. On the economic data front, Australia’s retail turnover fell 1.1% in September 2020 on a seasonally adjusted basis, according to the country’s Bureau of Statistics. Following that release, Australian dollar traded at $0.7261, after seeing an earlier high of $0.7284.

The Turkish lira’s momentum weakness directly challenged President Erdogan’s economic thesis that lower rates depress inflation. As the lira made new lows, Erdogan fired TCMB Governor Uysal after just one year on the job. Uysal had led TCMB after Erdogan relieved former Governor Çetinkaya of his duty for not complying with presidential demand to cut interest rates.

0 Comments