USA

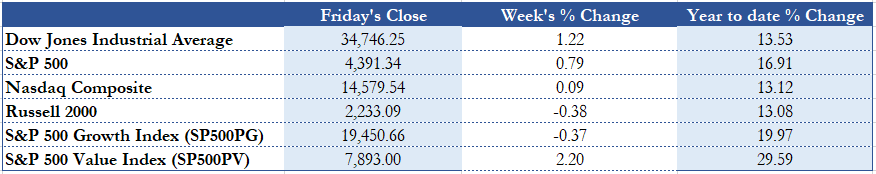

The DJIA, S&P 500, and Nasdaq composite ended the week recording gains, despite weaker than expected U.S. jobs data, which brought about concerns over the recovery for the world’s largest economy. The DJIA and S&P 500 increased by 1.22% and 0.79% respectively, this week, while the Nasdaq Composite gained 0.09% and the Russell 2000 decreased by 0.38%. However, almost all American Stock Indexes lost ground on the last session of the week: The U.S. non-farm payrolls report displayed employers hired 194,000 new workers in September, widely missing expectations for 500,000 new jobs. On Friday, the DJIA and S&P 500 lost 0.03% and 0.19% respectively, while the Nasdaq composite dropped by 0.51% and the Russell 2000 fell by 0.76%. Overall, despite the weak Friday, the DJIA ended a volatile week with its highest gains since June and the S&P 500 had the strongest weekly performance since August. Throughout the week, major concerns have been inflation, surging energy prices, and negotiations on the debt ceiling. Indeed, the main catalysts of this week indexes’ performance after many days of uncertainty were the ease of Delta variant of the coronavirus in the U.S. and the agreement by lawmakers to temporarily extend the debt limit. Bond prices plunged and Friday’s yield of the 10-yr Treasury Note was 1.613%, corresponding to a positive change of 15 bps.

The S&P 500 Value Index gained 2.20%, the best performance among American stock indexes for the week, while Growth stocks lost 0.37%. Energy stocks rallied 5.02% and Financials up 2.27%, whereas Biotech and Real Estate dropped by 2.26% and 0.76% respectively, reporting the worst performance of the week and signaling that the rotation of sectors is about to start. Overall, the energy sector performance has been mainly driven by the surge of crude oil prices, even though the natural gas has been the main character of the week. Indeed, on Oct 6th, natural gas prices rallied 14.79% from last Friday’s close, surging to its highest level on record and, as the Russian President Vladimir Putin declared his willingness on stabilizing the global energy market, it experienced a sudden reversal, closing the week with a slight loss in prices of 0.23%.

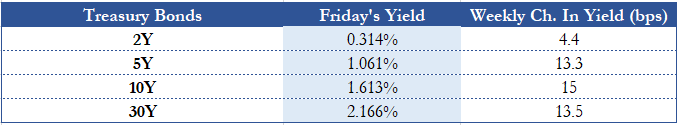

Despite the initial drop occurred immediately after the release of the U.S. non-farm payrolls report, U.S. Treasuries ended the week with a rise in yields, sending the 10-yr yield above 1.6% for the first time since June. In the next month, the Federal Reserve is expected to announce a cut to its $120bn monthly purchase program of bonds and the major concerns of investors are whether the data would be strong enough to continue to pursue its plan. The tapering operation would serve as a primer for the FED to raise short-term interest rates above their current level near zero, causing even a more relevant impact on bond prices.

Indeed, analysts reckon the central bank to stick to its plan, thus the selling in U.S. government bonds pressured the 2-yr yield to 0.314% and the 5-year yield up 1.061%, and caused declines in Tech stocks and a rise in the dollar value. Friday’s yield of the 30-yr was 2.166%, finishing the week with 13.5 bps increase. On Thursday, the U.S. Senate agreed to extend the debt ceiling by increasing the debt limit by $480bn, in order to fund the government until December. Furthermore, President Joe Biden would have also the opportunity to work on agreements for his $1.2tn infrastructure bill and $3.5tn welfare spending package. The risk of default pushed investors to move to riskier opportunities including stocks. In fact, this week, the Cboe’s Skew index plunged to its lowest level in 11 months, showing the demand for protective options has been diminishing steadily and confirming an inclination towards risk appetite. Finally, the Vix index closed at 18.77, perhaps supporting the analyst’s view of the recent sell-off as a buying opportunity.

Europe and UK

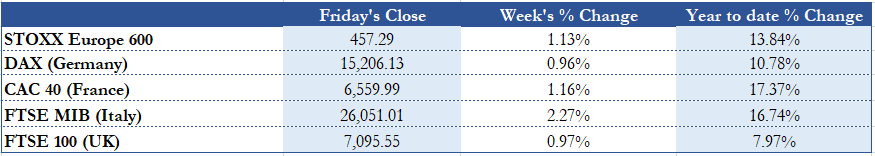

On Friday, the European-wide Stoxx 600 closed at 457.29, ending the week with a gain of 1.13% as energy crunch worries have been mitigated, at least temporarily, by the declaration of the Russian President regarding the natural gas supplies. Along with stagflation fears, the relief over a temporary lifting of the U.S. debt ceiling supported the index weekly movement. Throughout the week, European chemical, cement and steel companies faced with the rise in gas prices that would threaten the economic rebound after the coronavirus pandemic, since sustained increase in prices would lead to higher manufacturing costs. Yet, the speech of Mr. Putin restored confidence in the stabilization of prices and the approval of Nord Stream 2 pipeline might prevent Europe from persistent supply chain bottlenecks and high economic damages over the long-term. However, analysts have been questioning whether Russia’s supplies may not have a lasting impact in mitigating prices as Russian has been already exporting gas to Europe at elevated levels.

The DAX index closed at 15,206.13, increasing by 0.96% and the CAC 40 Friday’s close was 6,559.99, recording a gain of 1.16%. The FTSE 100 ended the week at 7,095.55, up 0.97%, although the collapse in Britain’s energy supply market has left British households facing a dramatic increase in bills. The Italian FTSE MIB reported the best performance of the week, rallying 2.27% with a closing price of 26,051.01.

In the minutes of September meeting published by the central bank on Thursday, some ECB policymakers have raised concerns about inflation forecasts. In last month, given the easier financial conditions and as a countermeasure to rising inflation, the ECB announced its willingness to decelerate the bond-buying program of €1.85tn launched to support the recovery from the coronavirus pandemic, although some member of the governing council argued in favor of “a more substantial reduction in the pace of purchases.”

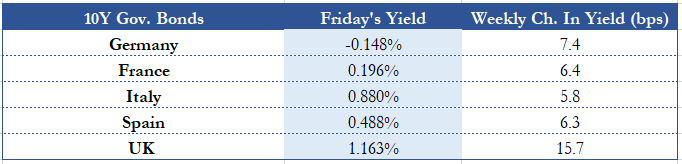

Indeed, the recent rise in euro zone inflation to its highest level for more than a decade has been amplifying the debate between ECB governing council members and raising doubts whether the monetary policy should be adjusted. The more conservative council members expressed doubts about the reliability of ECB forecasts that displayed a hypothetical fall from an annualized rate of 2.2% to 1.7% in 2022 and 1.5% in 2023, as the central bank underestimated the impact of rocketing energy prices and supply bottlenecks on inflation this year. The 10-yr German Bund Friday’s yield was -0.147%, up 7.4 bps with respect to last week, while the U.K. 10-yr Gilt up 1.163%, finishing the week with 13.5 bps increase.

Rest Of The World

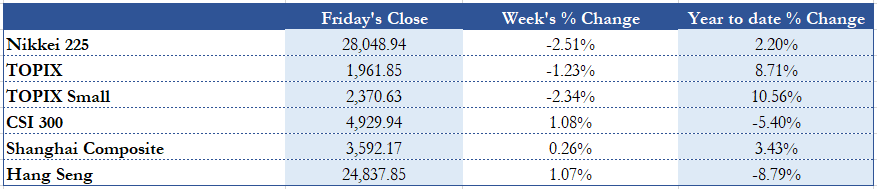

The CSI 300 Index of large-cap stocks increased by 1.08%, while the Shanghai Composite Index shed about 0.26%. Along with the uncertainty due to indebted property developer Evergrande, China’s energy crisis will be under focus throughout the weeks ahead. In fact, China’s electricity crunch caused by shortage in the coal-fired power has already alarmed authorities and forced manufacturers to reduce output, especially in metals and cement sectors. China’s government is about to adopt countermeasures such as expanding coal production and incentivizing financial institutions to mitigate risk for loans to coal plants. Indeed, this policy brings about concerns regarding China’s transition to green energy given that coal-fired power still accounts for about 70% of China’s electricity.

The Nikkei 225 Index plunged by 2.51% and the broader TOPIX Index also lost about 1.23% for the week. The BoJ, in a quarterly report, cut its economic view for five out of the country’s nine regions, showing concerns over the output disruptions and the plunge of consumption from the coronavirus pandemic. Although BOJ’s growth forecast might experience a downgrade this fiscal year, BOJ Governor Haruhiko Kuroda maintained his optimistic view on the economy due to an expected rebound of consumption thanks to a sharp decline in new infections and progress in vaccinations.

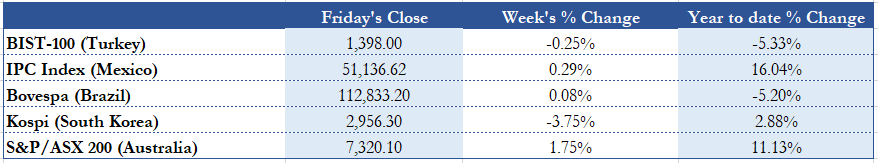

The Index of Prices and Quotations (IPC) registered a weekly gain of 0.29%. The ASX 200 index closed at 7,320.10, gaining 1.75% this week. The Bovespa index slightly up 0.08%, rallying on Friday about 2.03%. Brazil’s real was flat, plunging by 2.7% this week. Stagflation has been affecting also emerging markets with Brazilian data displaying that September consumer prices grew at their fastest pace for the month since 1994 because of higher fuel and electricity prices. The Brazil’s central bank would be probably forced to raise interest rates, even if it would be the sixth time this year.

Fx and Commodities

Energy commodities continue to record the strongest reaction to global recovery driven by supply concerns ahead of the winter, outperforming U.S. equities YTD. The West Texas Intermediate crude oil rallied 4.89% this week, hitting a new multi-year high at $80 a barrel and closing at $79.59 on Friday. Brent Friday’s close was $82.58 a barrel, pushing the international oil benchmark up 4.16%. Prices soared as OPEC+ opposed to pressures to open the taps beyond the planned increase and the rally of Saudi stock market, a representative index for oil demand that is up 33% YTD, signals that the energy crunch is perhaps far from being over. Even though global economies continue to demand more oil in the process of recovering from coronavirus pandemic, OPEC+ refusal to increase output faster widens the deficit between supply and demand. As a countermeasure, U.S. government may release strategic oil reserves in order to mitigate prices.

On Wednesday, Natural Gas futures hit $6.466 surging to new record highs in over a decade, but closed the week at $5.565 losing 0.23%. The reversal took place right after Mr. Vladimir Putin stated that Moscow was a reliable supplier that always fulfils all its obligations aimed at stabilizing the global energy market. However, investors are factoring the stagflation risk of slowing growth and rising prices in their market view. In fact, Gazprom PJSC, a Russian majority state-owned energy corporation, did not increase gas shipments so fast, signalling that supplies might boost once the Nord Stream 2 pipeline to Germany is approved. From a geopolitical perspective, suspicions arise from Ukraine and other eastern European countries that Russia is trying to use higher prices to pressure officials and regulators into approving the pipeline project, as a large share of Russian gas exports to Europe transits through Ukraine.

Gold and Silver futures closed the week at $1,757.20 and $22.685, losing 0.07% and gaining 0.66% respectively. The dollar index recorded a slight gain of 0.08% this week, closing at 94.079. China’s currency, the Renminbi (RMB), lost 0.05% against the U.S. dollar, closing at 6.443 per dollar. The Japanese yen soared versus the U.S. dollar, closing the week at 112.24 per dollar. The euro up 0.15% for the week, closing at 0.8636 per dollar. Sterling plunged by 0.52%, closing at 0.7344 per dollar. Positive week for cryptocurrencies with Bitcoin Friday’s close at $55,997.

Next week main events

The main events of the next week are the following. On Monday, the U.S. bond market is closed in observance of the Columbus Day, while the U.S. stock market is open. On Tuesday, the European ZEW Index and the U.S. JOLTs Job Openings will be closely watched as they evaluate economic sentiment for the euro zone and job vacancies in the U.S. respectively. On Wednesday, in addition to the FOMC Meeting Minutes, both the German CPI YoY and the U.S. Core CPI YoY will be released, respectively forecasted at 4.1% and 4.0%. Furthermore, the U.K. GDP Growth Rate YoY will be released. On Thursday, U.S. Initial Jobless Claims and Producer Price Index (PPI) will be under focus as they are highly relevant for gauging the economic recovery and the fear of stagflation.

Brain Teaser #10

Let us assume that there is a lotus flower on a lake on the first day. As the number of flowers doubles every day, there will be two lotus flowers on the second day and four on the third day. If it takes thirty days to fill the entire lake with flowers, how many days does it take to fill half of the lake?

Solution:

As we know that flowers will cover the whole lake on the thirtieth day, then on the twenty-ninth day, half of the lake will be filled with flowers (consider that the number of flowers doubles every day).

Brain Teaser #11

Player A tosses five coins, whereas player B tosses six coins. What is the probability that player A gets more heads than player B?

0 Comments