USA

This week, the selloff in US equities, especially growth stocks continued. The most decisive event this week was the publication of inflation numbers this Thursday, which swung all indices but the S&P 500 Value Index into red territory after having started out the week with slight gains. To give the most important figures: the annual Consumer Price Index level for January was estimated to rise to 7.2% however reported figures were 7.5%, meaning CPI Inflation is currently at its highest rate since February 1982. This meant that traders are now pricing in even more hawkish interest rate increases and strategists at Goldman Sachs are now predicting seven 25 bps interest rate hikes in 2022.

The Dow Jones closed 1,00% lower this week at 34,738.06 as mounting concerns of an invasion of the Ukraine added to uncertainty caused by inflation which could not be overcome by strong financial results of giants such as Walt Disney Co. The S&P500 dropped 1.82% to 4,418.64 with information technology and communication services stocks being hit the hardest. The tech heavy Nasdaq composite posted the largest loss this week, closing 2.18% lower at 13,791.15 as investors continue to sell off their reserves of tech stocks in light of looming interest rate increases. The Russell 2000 was able to eek out a gain of 1.39% as many companies posted strong earnings results. Similarly to the Nasdaq composite, the S&P 500 Growth Index also lost value this week, closing at 18,177.19, 1.25% lower than at the start of the week. It continued its downward trend, having now lost 14.51% in value since the start of the year, further showing the reluctance of investors to buy growth stocks right now. In contrast, the S&P 500 Value Index gained 1.22%, closing at 8,461.24. In fact, it was the only index to post YTD gains as investors are looking for safer bets in times of uncertainty.

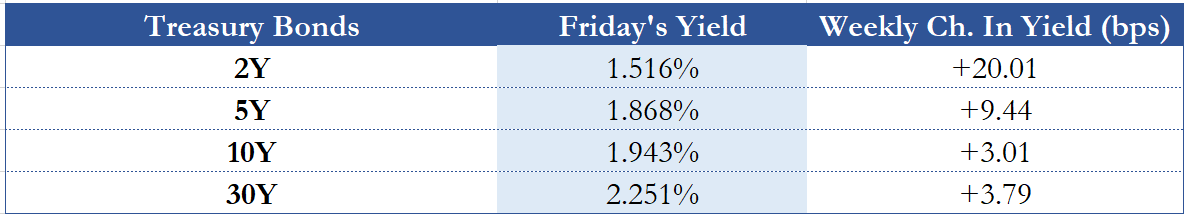

The selloff in the bonds market continued this week in the US as all yields on all bonds rose. However, the selloff is drastically frontloaded with the 2Y bond yields posting gains of just over 20 bps (now sitting at 1.516%) meaning investors are expecting sharp rate hikes soon. Furthermore, this surge in short maturity yields could mean that the yield curve could become inverted over the next year which, in the past, was an indicator for a recession. 5Y bonds posted the second largest gains at 9.44 bps this week, closing at a yield of 1.868%. 10Y and 30Y yields rose more moderately with 3.01 and 3.79 bps gains respectively; more importantly however, the 10Y yield jumped over 2% for the first time since 2019 this week but has since fallen back to 1,943%. The 30Y yield sits at 2.251%. It is noteworthy that currently, the 10-year breakeven inflation rate (the difference of the yield on 10-year Treasury notes and 10-year TIPS) which measures inflation expectations sits relatively unchanged at around 2.5 percentage points, so investors still seem to think that inflation will be of a more transitory nature.

Investors will now be looking towards the Federal Reserve once again, as they seek to gain more information on when, by how much and how often the Fed seeks to hike rates this year.

Europe and UK

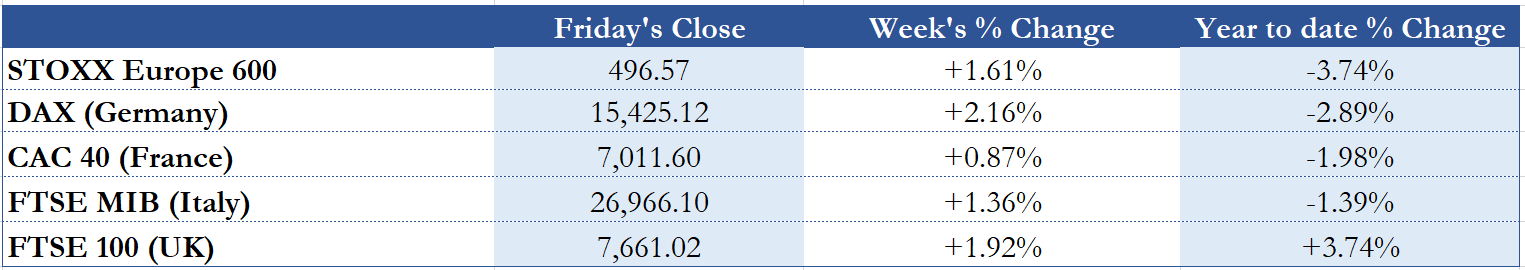

In contrast to the US stock markets, European equity indices all posted gains over the last week after a series of weeks of heavy market corrections. While US inflation numbers weighed on European equities and recent comments from high-ranking officials of the Fed and ECB calling for a more hawkish strategy added to uncertainty, strong earnings and a pause in the selloff of sovereign bonds carried European equities into more positive territory. Investors were also weary of the fact that the conflict in the Ukraine was not able to be resolved, further adding to uncertainty. Altogether, this meant that the STOXX Europe 600 closed at 496.57 with a weekly gain of 1.51%. The German DAX closed at 16,054.36, a plus of 2.16% with the bulk of gains coming from stocks of automobile manufacturers, which reacted positively to strong financial results of Toyota. Just like most other indices, the French CAC 40 jumped on the rally of US equities on Wednesday, which was triggered by strong earnings of banks and tech companies in the US. This meant that it closed the week 0.87% higher at 7,011.60 closing just higher than the 7,000 barrier it had first broken in early November of last year. The Italian FTSE MIB closed 1.36% higher, ending the week at 26,966.10, having profited from the surge in US equities on Wednesday, while investors were also relieved that the presidential elections were successful finally. After the Bank of England voted in favour of increasing interest rates from 0.25 to 0.5 percent last week, UK-stocks started off the week strongly and continued rising just until US inflation numbers were released. Nevertheless, the FTSE 100 posted the second highest gains of the week in Europe, closing 1.92% higher at 7,661.02.

Yields on all European 10 Year Bonds continued their rise with yields of all major European economies posting two-digit basis point increases except for the Bund 10Y. All yields experienced a sharp surge on Thursday in the aftermath of the US inflation rate figures being released. In numbers, German 10Y bonds yields were up by 8.93 bps to 0.299%, while French 10Y bonds gained 11.92 bps closing at a 0.765% yield. Italian bond yields experienced the strongest increase, namely a jump of 21.33 bps to a 1.957% yield. Most notably, this also meant that the BTP-Bund 10Y Spread continued its surge to a level of around 160 bps which could pose concerns for the Italian government as it faces higher costs of debt than its European neighbours. Spanish 10Y bonds increased by 14.51 bps closing the week at 1.193% and UK bond yields rose to 1.548% by 13.25 bps.

Uncertainty remains high in Europe and investors will be looking to Russia’s next moves in the conflict with Ukraine and to ECB-officials to make a clear statement on their position of when and how to start a more contractionary monetary policy.

Rest Of The World

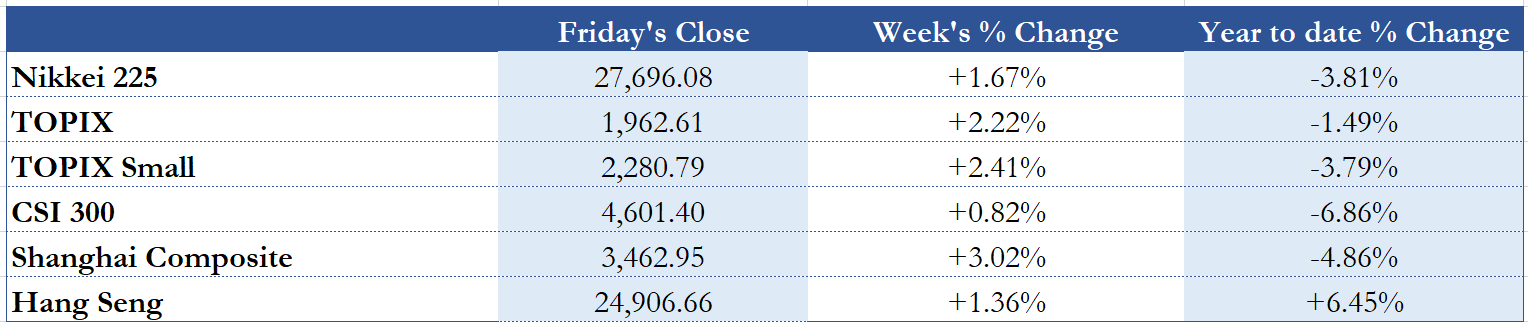

All major Asian indices have gained in value over the past week, however Asian stocks were not immune to a selloff after the release of US inflation figures. Nevertheless, the Japanese Nikkei 225 gained 1.67% on the back of automobile manufacturers raising outlooks for the next year, closing at 27,696,08 and the larger TOPIX index gained 2.22% to 1,962.61 this week while the TOPIX Small gained 2.41% to 2,280.79. Chinese equity markets also closed higher after a government investment fund started buying equities in order to stop the downwards trend of the past weeks, which evidently has worked. The CSI 300 ended the week at 4,601.40 with moderate gains of 0.82% while the shanghai composite also profited from the government intervention, gaining 3.02% to 3,462.95.

The Hang Seng index was able to add 1.36% in value closing at 24,906.66 this Friday which. YTD performance is mixed in Asia with all but the Hang Seng index having earned negative returns. Still, the indices have not dropped as strongly as those in the USA which can be traced back to more moderate valuations.

Turkey, which was recently in the news due to their extremely high inflation numbers, has now vowed to keep the Turkish lira stable and bring inflation back down to single-digit numbers. In a statement, the Turkish finance minister said, that “Inflation is the only problem” for the Turkish economy right now. This meant that the BIST-100 index gained 5.52% this week, closing at 2,051.05; 10,41% higher than just at the start of the year. The Mexican IPC Index gained a 3.85% in the past week as the central bank has increased rates by 50 bps to 6.00% in order to combat inflation. The Brazilian Bovespa gained a moderate 1.18% this week while the Brazilian central bank did not give specific guidance on future monetary policy due to the high level of uncertainty around asset and commodity prices. Still, inflation has reached the highest rates since 2016, however central bankers are forecasting inflation to fall again in the spring. The Korean Kospi stagnated and ended the week at 2,747.71, losing 0.09% in the process even though it had started out the week strongly. Inflation numbers of 3.6% instead of an expected 3.3% for January and inflation in the US pulled down the stock market as monetary tightening seems more and more likely even though the Bank of Korea had already raised interest rates 3 times since last August. Markets in Australia also started the week with gains but some of the gains were wiped out after US inflation numbers were published. The S&P/ASX 200 closed the week 1.36% higher at 7,217.3.

FX and Commodities

Both WTI and Brent futures stayed over $90 this week with WTI futures gaining 2.14%, while Brent futures rose 2.79% with prices closing the week at $93.90 and $95.10 respectively. Oil prices continued their upwards trend as the tensions in the Ukraine were not able to be relieved. In fact, both futures were set to end the week with a loss; however, after U.S. secretary of state Blinken stated on Friday that a Russian invasion of Ukraine could be imminent and might even happen during the Olympics, oil prices spiked. To add to these tensions, OPEC+ members are still reluctant to increase production meaning oil prices could be set to rise even further in the near future.

While natural gas prices in Europe have come back down from their December highs, they are still considerably higher than just half a year ago as the energy crisis continues. Since much of Europe’s gas is transported from Russia through Ukraine, we could see an uptick in prices once more if Russia decides to invade the Ukraine.

Gold futures finished strong this week, posting a 2.86% gain with one ounce of gold now costing $1,860.60 as investors seek gold as a safe haven against inflation and amid mounting concerns of a Russian invasion of the Ukraine. This gain has come as somewhat of a surprise seeing that talks about interest rate hikes have increased which put downward pressure on prices. Near term movements in gold now seem to hinge on the situation in the Ukraine.

The Dollar Index closed 0.61% higher this week at 96.045. After experiencing strong spikes in both directions on Thursday (the day of the inflation rate figures release), the Dollar Index took home gains on Friday when tensions in the Ukraine reached their (current) climax. Euro to Dollar conversion rates dropped this week, ending at $1.1350 while Pounds Sterling to Dollar rates increased to $1.3564. As to be expected, both the Euro and the Pounds Sterling experienced sharp opposite movements in conversion rates on Thursday as opposed to the Dollar index. The Dollar lost 0.24% in value as opposed to the Japanese Yen but was poised to lose even more until the end of trading on Friday. The U.S. Dollar stagnated against the Chinese Renminbi, closing at 6.3546, losing 0.010% in the process.

Next week main events

An important week lies ahead of us with some important inflation figures being presented. Though Monday is somewhat lackluster in terms of economic news, US Core Producer Price Index inflation numbers are published on Tuesday, while the EU presents preliminary GDP figures for Q4 of 2021 and the Reserve Bank of Australia publishes their meeting minutes two weeks after their interest rate decision. More important inflation numbers are published on Wednesday, where G7 members Canada and the UK as well as economic powerhouse China post their Consumer Price Index inflation for January. In the US, retail sales figures will be looked at fervently. Thursday is a more calm day again with Australian employment numbers for January being released while the week ends with the UK and Canada releasing retail sales numbers as well as Japan releasing their CPI inflation for January.

Brain Teaser #16

Calculate the angle between the hour-hand and minute-hand of a clock at 8:15 PM?

What is the probability of drawing two queens from a card deck?

Solution:

Considering that the previous market recap was the last from 2021, we decided to propose two (slightly easier but instructive) brain teasers instead of one. Next, we will show the solutions of both:

Given that the clock has the shape of a circle split into twelve sections, it has a total of 360 degrees and 30 degrees per section. Imagining the time 8.15 in front of us, we can observe the angle between the hour and minute hand, comprised of slightly more than five complete sections (5*30=150 degrees). The mild addition to that specific angle formed itself during the 15 minutes when the hour hand moved forward from 8 o’clock. As in an hour, the hour hand moves by 30 degrees, then in 15 minutes – it moves by 7.5 degrees. Thus, the angle we are looking for is 150+7.5=157.5 degrees.

The probability of drawing two queens from a card deck is 4/52*3/51=1/221, as once the first queen is drawn, there are three queens remaining.

Brain Teaser #17

A four-digit number written on the board can be replaced by another, adding one unit to two neighboring digits, if both are different from 9, or subtracting one unit from two neighboring digits, if both are different from 0. Is it possible with a finite number of such operations to obtain the number 2022 from number 1234?

0 Comments