USA

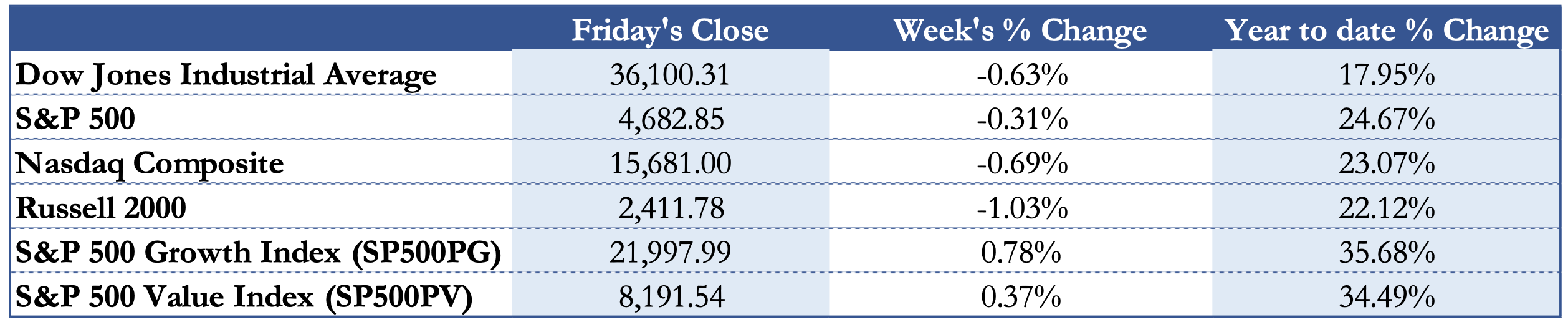

The US stock rally came to an end this week when the S&P 500 registered its first decline after nine sessions, ending the longest positive since 2017. The US index fell 0.31% this week, after some shocking news. Dow Jones and Nasdaq composite followed suit, with losses of -0.63% and -0.69% respectively, as well as the Russell 2000 Index, which has plunged more than -1% this week. The week started with the results of the poll posted on Twitter by Elon Musk, who called on his followers to cast a vote on whether he should sell 10% of his Tesla (NASDAQ:TSLA) shares. The outcome saw a convinced “Yes” winning with around 58% of preferences. This, together with the decision by Musk to respect the outcome, brought shares down 10% this week, also raising a huge debate on the actual reason for the Twitter poll, given the extremely suspicious short position Musk’s brother took just the day before.

On Wednesday, CPI release showed a snapshot of US inflation with a worrying 6.2% YoY figure, the highest since 1990 (0.9% since September, against the forecasted 0.6%). This supports the argument that inflation might not be as transitory as institutions are portraying it, and that stronger action in the form of lower bond buying or even rate hikes might be soon needed. Several observers point out that these unsettling data are to be ascribed to supply bottlenecks, but according to Citibank strategist Scott Chronert, inflation may peak around February 2022 before coming back to more manageable levels. Meanwhile General Electrics (NYSE:GE) announced that it will split into three standalone companies, together with Johnson & Johnson (NYSE:JNJ), which will divide into two companies, one focused on drugs and medical devices, and one on consumer products.

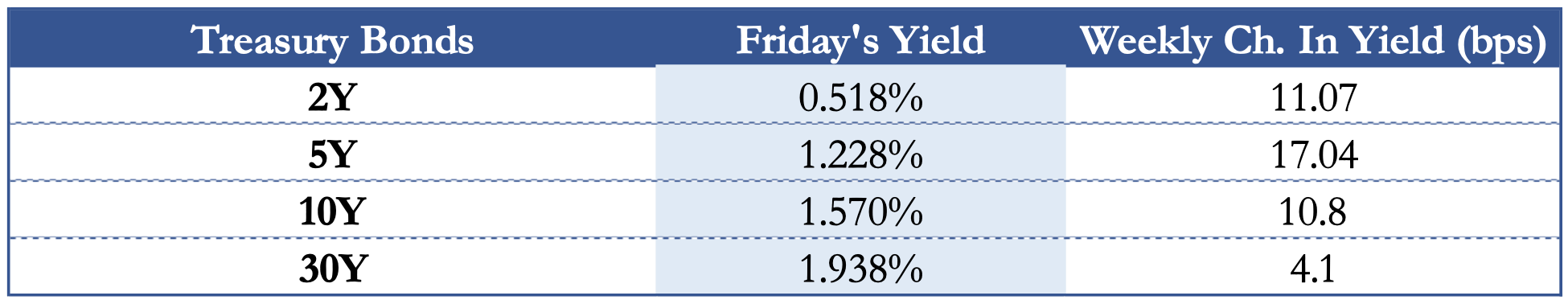

Bond markets have suffered the inflation data release, with yields increasing substantially, especially in short-term debt, and with the highest implied volatility figure since April 2020. This balances out the intraday plunge of 10Y yields to 1.41% amid geopolitical tensions between China and the US and the news of Joe Biden interviewing Federal Reserve Governor Lael Brainard for the role of Fed chair.

Europe and UK

Shares in Europe closed higher, thanks to loose monetary policy by the ECB. The STOXX 600 gained 0.68% this week, and all major indices climbed: Germany’s DAX rose 0.25%, while France’s CAC 40 gained 0.72% and UK’s FTSE 100 advanced 0.6%. The only exception was Italian FTSE MIB, which registered a minor loss (-0.25%). The bullish sentiment on European stocks is also helped by better than forecasted industry outputs (0.2% reduction against the predicted -0.5%), which allowed to adjust economic growth expectations to 5.0% compared to the previous 4.8%. However, supply chain destruction and inflation are a problem in the Eurozone as much as the US, and this may eventually slow growth in the upcoming years. The shortage of goods is strongly impacting the UK, where growth slowed to 1.3%, kept low also by unemployment and a huge rise in Covid cases, a problem being faced by almost the entire continent. Several countries are considering reintroducing mask rules or mandatory proofs of vaccination to access certain services. Tension also rose between the EU and Russia, due to a military buildup by the latter which, according to intelligence data, might be sign of an imminent invasion of Ukraine.

Core Eurozone bond yields rose decisively, this week, most notably with an increase of 7.6 bps in the 10Y Italian BTP and of 7.4 bps for UK 10Y gilts. This defied beginning of the week expectations of a rate increase after dovish comments by the ECB. US inflation data indeed caused a reversal, and yield ended up higher.

Rest Of The World

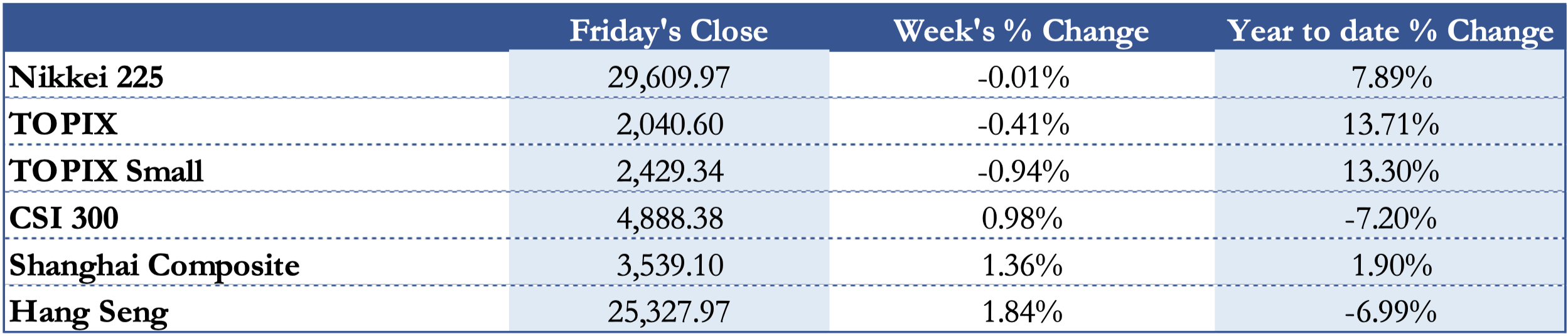

Chinese stock markets advanced amid speculation that Beijing would announce easing measures to help indebted property companies as the specter of defaults continued to loom over the sector. The large-cap CSI 300 Index rose 0.95%, and the Shanghai Composite Index added 1.4%. Real Estate behemoth Evergrande declared once again a last-minute default on its biggest payment so far, and Fed warns in general on the fragility of the whole segment, with corporate junk yields being as high as 25%. Meanwhile, Xi Jinping is set to deliver the first resolution on Communist Party history in 40 years, which could have global ramifications and give him the mandate to potentially rule for life. Moreover, Chinese PPI accelerated to 13.5%, a 26-years high. Yet, fear of stagflation stays high as analysts point to China’s ability to export inflation amid strong external demand.

New details about the government’s upcoming fiscal stimulus package and perceptions that valuations were lagging U.S. peers provided some tailwinds for Japan’s stock markets during the week. The corporate earnings season mostly confirmed positive effects from yen weakness. Due to this, Nikkei and TOPIX generated almost flat returns. Still, producer prices rose at the fastest pace in almost forty years, with a surge of 8% in October.

FX and Commodities

Oil prices fell on Friday, wiping out gains from the previous session, in a third weekly loss chipping away at the nine-week rally that started on August 23rd. West Texas Intermediate, the U.S. crude benchmark, settled down 80 cents, or almost 1%, at $80.79 per barrel. For the week, WTI was down 0.6%, after the back-to-back losses of 2.8% and 0.2% respectively in the previous two weeks. But compared to WTI’s seven-year highs above $85 in October, the deficit was just a drop in the barrel, so to speak. The U.S. crude benchmark also remains up 65% for the year. London-traded Brent crude, the global benchmark for oil, finished down 70 cents, or 1.2%, to $82.17 on the day. For the week, Brent was down 0.8%, after the back-to-back losses of 1.9% and 1.3% respectively in the previous two weeks. Brent scaled a three-year high above $86 last month and remains up 58% for the year.

U.S. gold futures’ most active contract, December, settled Friday’s trade up $4.60, or 0.3%, at $1,868.50 an ounce. It earlier peaked at $1,871.35 — its highest since June 15. The metal sparkled for a second week in a row, notching a win of 2.8% this week after last week’s 1.8%. It also rose for a seventh straight day, its longest stretch in the green since a previous run between the end of June and the first week of July. However, investors are still skeptical of its worth as inflation hedge, stating that to be considered a valuable instrument, it should break once again the ceiling of 1900 dollars per ounce.

Meanwhile, an initial optimism on increase in gas supplies in Europe from Russian Gazprom led to a plunge in prices, but the positive expectations soon vanished later in the week when supplies were remarkably smaller than what hoped. Overall, the increased Russian gas flow isn’t any more than it should have been at this time of year under contractual agreement. This sums to the threat of Belarusian leader Alexander Lukashenko to cut off transit gas supply if the European Union imposes additional sanctions to the country in response to the migrant crisis at the Belarus-Poland border.

Inflation worries have also greatly influenced currencies, with the Yen hit the hardest. The pair USD/JPY has weakened to around 114.05, compared to last week 113.41 due to continued expectations that the Bank of Japan (BoJ) will maintain low interest rates for longer than other developed market central banks. The pair EUR/USD reached an all-time low at 1.1444, while the pair GBP/USD also plunged to 1.3418.

Next week main events

On Tuesday and Wednesday, France, Italy, UK, Canada and the EU will release their Core CPI data. Moreover, on Tuesday UK will release Unemployment rates for September. We are also expecting, starting from Sunday evening, the release of 3rd quarter GDP by Japan, Europe, and Russia. Finally, throughout the week, several FOMC members will hold a speech.

Brain Teaser #13

Monty Hall problem

Let us suppose you are a participant in a game show that gives you the chance of winning the prize behind one of three doors. Behind one door, there is a car, while behind the others, goats. As you don’t know what is behind the doors, you pick a random door and announce it to the host, say No. 1. After your choice, the host opens one of the doors he knows contains a goat, say No. 3, and gives you the option to switch between your initial pick and the remaining door (i.e., between door No. 1 and 2). Should you exercise the option, why?

Solution:

First, we acknowledge that the probability of winning in the case of a non-switching strategy amounts to 1/3 (you pick one out of three doors), as your choice is independent of the host’s action. Thus, the probability that the car is behind the other two doors is 2/3. Nonetheless, as you can choose just one of the two doors (behind the other one, you know it is a goat), the winning probability in case of switching becomes 2/3.

Many might argue that as there are only two doors, the winning probability is 1/2, and it doesn’t matter whether you switch or not. The right strategy becomes clear if we look from a different point of view. In the case of switching, you win the car if you initially choose a door with a goat, i.e., one having a probability of 2/3, while you lose if you pick a door with the car, i.e., one having a probability of 1/3. Therefore, switching is the best option in our case.

If you are still not convinced by the proof, you can make a more formal one by applying the Bayes Theorem or proving it with the use of computer simulations.

Brain Teaser #14

Four people want to cross a bridge across a river during the night. Due to the narrowness of the bridge, only two people can pass simultaneously. Besides, they have only one torch and need to use it when crossing the river. The first person can cross the bridge in one minute, the second – in two minutes, the third – in five minutes, and the fourth – in eight minutes. When they cross, they need to go with the pace of the slowest person. What is the fastest time in which they can all cross the river?

0 Comments