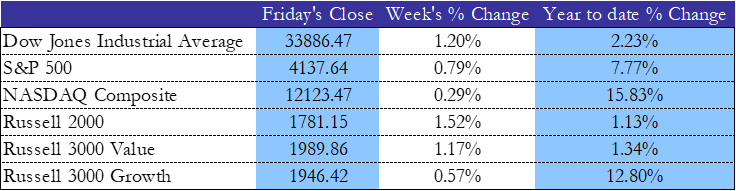

US

The second week of April was again positive for the US stock market, with the main indexes ranging from +0.29% for the Nasdaq, to +1.52% for the Russell. The S&P 500 and the Nasdaq are now 18% and 25% off the October lows respectively, trusting the ability of the Fed to handle the disinflation process without forcing the US economy into a severe recession.

This week also kicked off the first quarter earnings season, with some of the big banks, such as JP Morgan, Wells Fargo, BlackRock, and Citigroup reporting. Results were positive across the board, confirming the potential deposits flight from the small banks to the most solid and regulated banks. All the companies mentioned beat consensus on earnings, but it was JP Morgan to stand out the most. The bank colossus crushed analysts’ expectations both on revenue, $38.3B vs $36.1B, and on earnings per share, $4.10 vs $3.41, also raising the guidance for the FY net interest income to $81B from the prior $73B. The stock was up 7.55% on Friday, driving the financial sector to almost a 3% gain for the week.

Apart from the banks, United Health Group also reported on Friday, topping analysts’ expectations both on sales and EPS. However, the stock fell 2.75%, due to worries over high future costs linked to policy changes for government-backed health insurance plans.

Overall, US stocks were pushed higher throughout the week by the inflation slowdown, confirmed by both CPI and PPI March data, released on Wednesday and Thursday respectively. Core CPI came in at 5.6%, matching expectations, while core PPI printed at 3.4%, down from 4.8% in February and marking the twelfth consecutive decline from the prior month.

On the economic activity side, the first signs of weakness are starting to emerge, but they are still mild. Jobless claims were up to 239K, beating consensus, but remaining at an historically low level, while retail sales came in worse than expected on Friday, at -1%, although the decline was largely due to gasoline and autos.

Finally, yields on treasuries and bonds increased, on the reinforced conviction over the resilience of the economy, that made the bond market almost erase the possibility of a Fed pause in May, now priced in at a 22% probability.

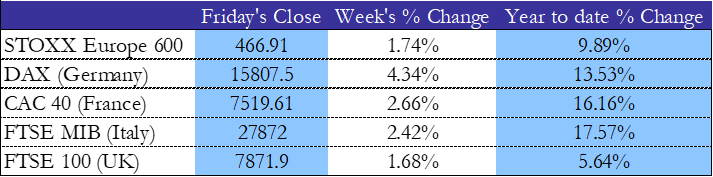

EU

European markets closed another positive week, extending the bullishness of the first week of April, with the European Stoxx 600 up 1.74% for the week. The French CAC 40 was the weekly top performer, posting gains above 2.6%, followed by the Italian FTSE MIB, that added 2.42%.

The positive weekly performance was supported by the reinforced conviction of investors that the Euro Area inflation is finally sharply down-trending, while the European economies are proving to be resilient to the adverse macroeconomic conditions.

In fact, on Tuesday, Euro Area retail sales came in half a percentage point better than expected, at –3% YoY, while industrial production also beat analysts’ consensus on Thursday, +2% YoY vs +1.5% expected.

FTSE 100 was one of the worst performers this week in Europe, although still up 1.6%, due to the mixed economic data that were released on Thursday, denouncing weaker economic conditions in the UK than in the other European countries. GDP and manufacturing production were both unchanged MoM, slightly missing expectations, while industrial production was down 0.2% MoM vs up 0.2% expected.

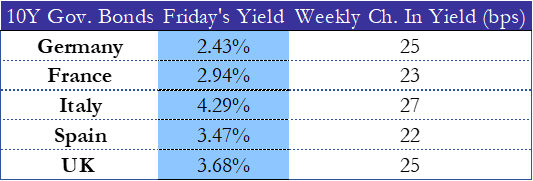

On the inflation side, March data released on Thursday matched forecasts at 7.4%, showing a sharp decline from the February data of 8.7%. Despite the downtrend in inflation is now clear also in Europe, MoM inflation came in at 0.8%, a level which is undoubtedly inconsistent with the ECB long term target of 2%. For this reason, an additional 25 bps hike is still to be considered as the ECB base case.

On this conviction, reinforced also by the robust data on economic activity, both short and long-term rates increased across the various jurisdictions, with the 10y Bund now above 2.4% and the 10y BTP yielding close to 4.3%.

Lastly, this week marked the beginning of earning season also in Europe, with Louis Vuitton (LVMH) reporting stellar earnings on Wednesday, with a sale jump of 17%, more than doubling the expected 8% growth. The stock bounced by more than 6% this week (+30% YTD), and with a market capitalization of over $500B, the LV group is now one of the top 10 largest companies in the world.

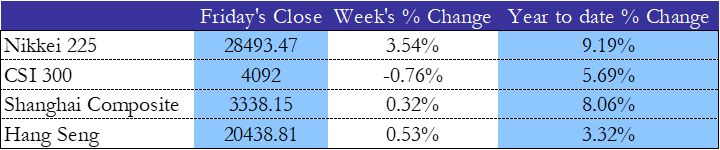

Rest of the world

Asian markets were mixed this week. The Japanese Nikkei 225 closed off an extraordinary positive week adding 3.54%. On the other hand, Chinese stocks struggled, with the CSI 300 down 0.76%, the Shanghai Composite up 0.32% and the Hang Seng up 0.53% in the last five trading days.

The rise in Japanese stocks seems to be driven mostly by the comments made by the legendary investor Warren Buffett in a recent interview. Buffett stated that he intends to increment his stake in five Japanese trading houses, Itochu, Mitsubishi Corp., Mitsui & Co., Sumitomo Corp., and Marubeni and that he is also considering investing in other Japanese companies. Trading houses are complex diversified firms, whose exposition ranges from energy and minerals, to food, retail, and healthcare and that therefore guarantee a broad exposition to the Japanese economy.

In China, the reopening is starting to show up in the data, with exports unexpectedly surging in March, up 14,8%, reverting five straight months of declines and stunning economists, who were expecting a 7% fall. The rebound was due to rising demand for electric vehicles, but analysts cautioned that the improvement reflects suppliers catching up with unfulfilled orders and that the global demand outlook remains subdued.

Moreover, on Thursday morning, Alibaba stock sold off massively after the announcement that the Japanese group SoftBank decided to sell almost all its remaining shareholding in Alibaba. SoftBank, that used to own up to a 34% stake in BABA, sold 389 million shares at an average price of $92, and stated that the transaction reflects a shift towards a more defensive approach to assess economic uncertainty.

Both Canadian and Australian markets closed off the third positive week in a row, delivering returns of +2% and +1.98% respectively.

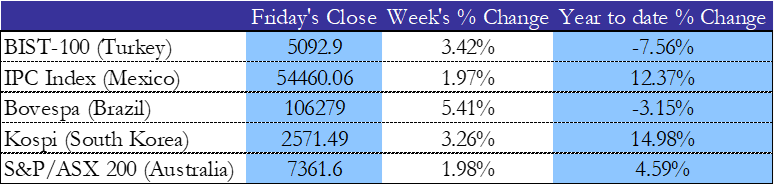

The non-Asian emerging markets had a really good week too, led by Brazilian Bovespa up 5.41% for the week and by the Turkish BIST 100, up 3.42%. The same is true for the Mexican IPC index, which added 2% throughout the week.

FX and commodities

The Dollar Index declined by almost half a percentage point this week, as investors shifted to risky asset, feeling to be close to the end of Fed’s tightening and seeing a severe recession as unlikely.

The index trended down the whole week with economic data pointing to a resilient economy. DXY registered an eleven-month bottom of 100.8 on Friday morning but recovered half of the weekly losses in the afternoon, after University of Michigan surveys showed consumers are now expecting 4.6% inflation in the next twelve months, vs 3.6% in March, while 5 years consumers’ expectations remain well anchored at 2.9%. Higher inflation forces the Fed to tighten more for longer and it has therefore a positive effect on the dollar. Overall, against the euro, the dollar depreciated by 1.43% this week.

After the production cut announced by OPEC+ at the beginning of April, the Crude continued to appreciate this week, adding almost 2%, also benefitting from the strong data on economic activity across the various jurisdictions.

Apart from oil, natural gas, copper, and lumber surged as well, leading the Bloomberg Commodity Index to a positive performance of 1.39%.

Finally, after being close to its all-time high on Thursday, gold retreated on Friday and closed the week barely changed but preserving an outstanding risk-adjusted performance YoY of almost 10%.

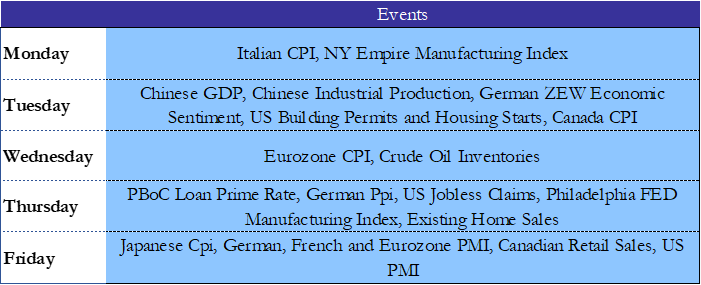

Next week’s Events

Brain Teaser #39

On a given circle, six points A, B, C, D, E, and F are chosen at random, independently, and uniformly with respect to arc length. Determine the probability that the two triangles ABC and DEF have no common points.

Source: 1983 USAMO – Problem 1

Solution: first we give the circle an orientation (e.g., letting the circle be the unit circle in polar coordinates). Then, for any set of six points chosen on the circle, there are exactly 6! ways to label them one through six. Also, this does not affect the probability we wish to calculate. This will, however, make calculations easier.

Note that, for any unordered set of six points chosen from the circle boundary, the number of ways to number them such that they satisfy this disjoint-triangle property is constant: there are six ways to choose which triangle will be numbered with the numbers one through three, and there are (3!)^2 ways to arrange the numbers one through three and four through six on these two triangles. Therefore, for any given configuration of points, there are 6^3=216 ways to label them to have this disjoint-triangle property. There are, however, 6!=720 ways to label the points in all, so given any six unordered points, the probability that when we inflict an ordering we produce the disjoint-triangle property is 216/720=3/10.

Since this probability is constant for any configuration of six unordered points we choose, we must have that 3/10 is the probability that we produce the disjoint-triangle property if we choose the points as detailed in the problem.

Brain Teaser #40

Adults made up 5/12 of the crowd of people at a concert. After a bus carrying 50 more people arrived, adults made up 11/25 of the people at the concert. Find the minimum number of adults who could have been at the concert after the bus arrived.

Source: 2022 AIME II – Problem 1

TAGS: market recap, US, Europe, FX, commodities, equities, bond

0 Comments