USA

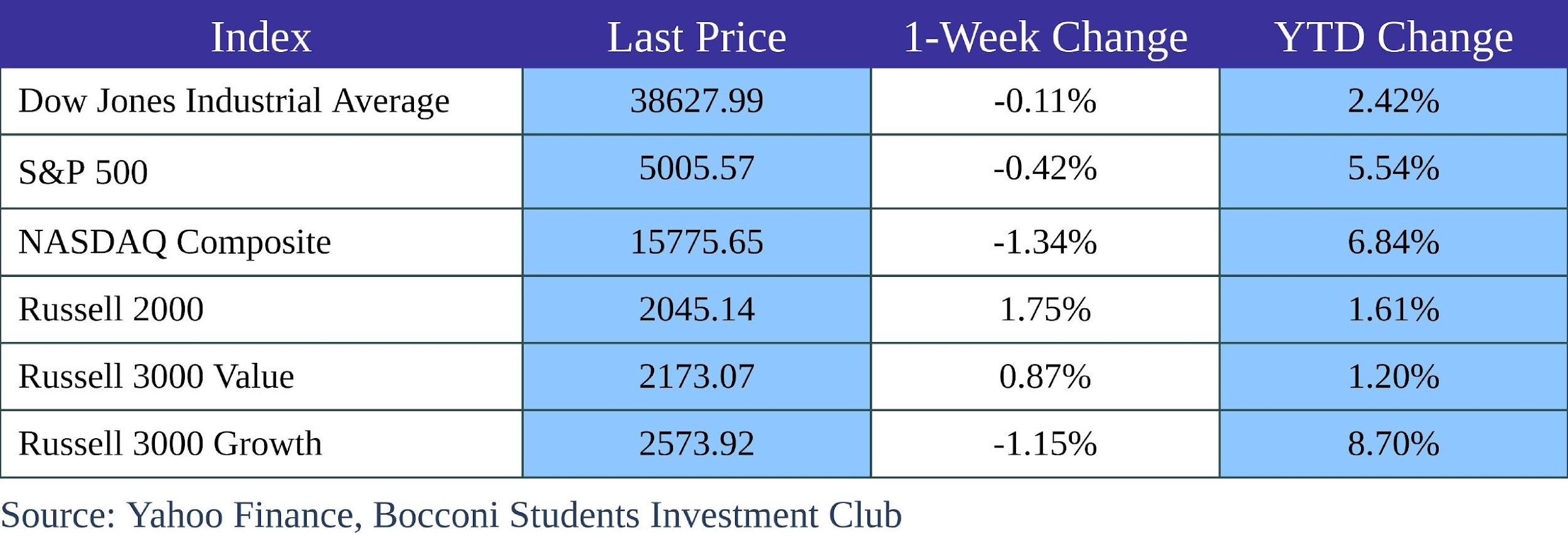

This week in the US, which was headlined by the upcoming CPI print, the markets showed mixed results. The Dow Jones managed to only grow by 0.2%, while the S&P 500 could not outgrow Monday’s opening numbers overall decreasing by 0.1%. NASDAQ experienced even a larger decline than S&P 500 and fell by 1%, and the Russell 2000 outperformed the rest of the indices growing by 1.7% this week. The same, however, does not apply to, The Russell 3000 Value and Russell 3000 Growth indices with the former growing by 0.3% and the latter falling by 0.6%.

On Monday, most of the investors were not willing to make any bets before the upcoming inflation data, so the S&P continued trading above the 5000-points threshold slightly improving the all-time high at the level of 5031 points.

On Tuesday, the US stock markets saw the higher-than-expected inflation data which pushed the markets down (3.1% YoY vs 2.9% YoY expected). Core inflation held steady at 3.9% – 20bp above expectations. S&P and NASDAQ reacted by falling by around 2%. The next day the stocks rebounded by around 1% following a slightly better than expected December PPI data (-0.2% MoM vs -0.1% MoM expected). On Thursday Retail Sales data came out shrinking by 0.8% MoM after a 0.4% MoM increase last month. US Jobless Claims came in at 212000, slightly below the market consensus of 220000.

By the end of the week, US stocks were on a path to recover all of the week’s losses but were put in the red after the January’s PPI data came above forecasts (0.3% MoM vs 0.1% MoM expected).

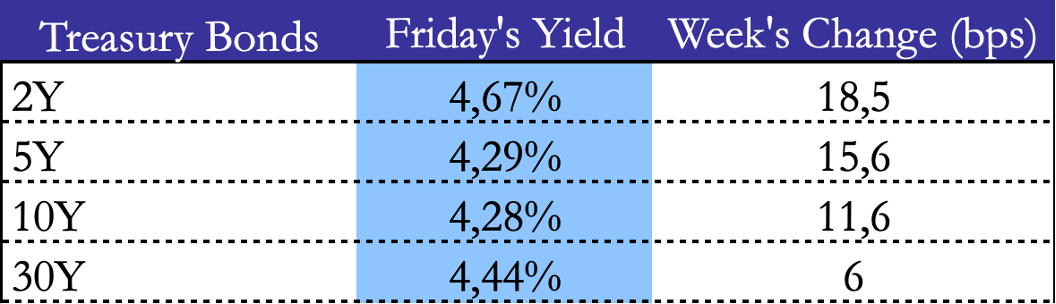

On Monday the rates traders were hesitant, awaiting the Tuesday’s CPI data and a result there was little movement with 10-year Bonds trading around 4.17%. The next day the rates surged to 4.28% as a reaction to the hotter-than-expected CPI print and a consequent delay in rate cuts. Although the retail data provided some relief for the bond market, by the end of the week 10-year Treasury Notes traded above 4.32% reacting to bad PPI data.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

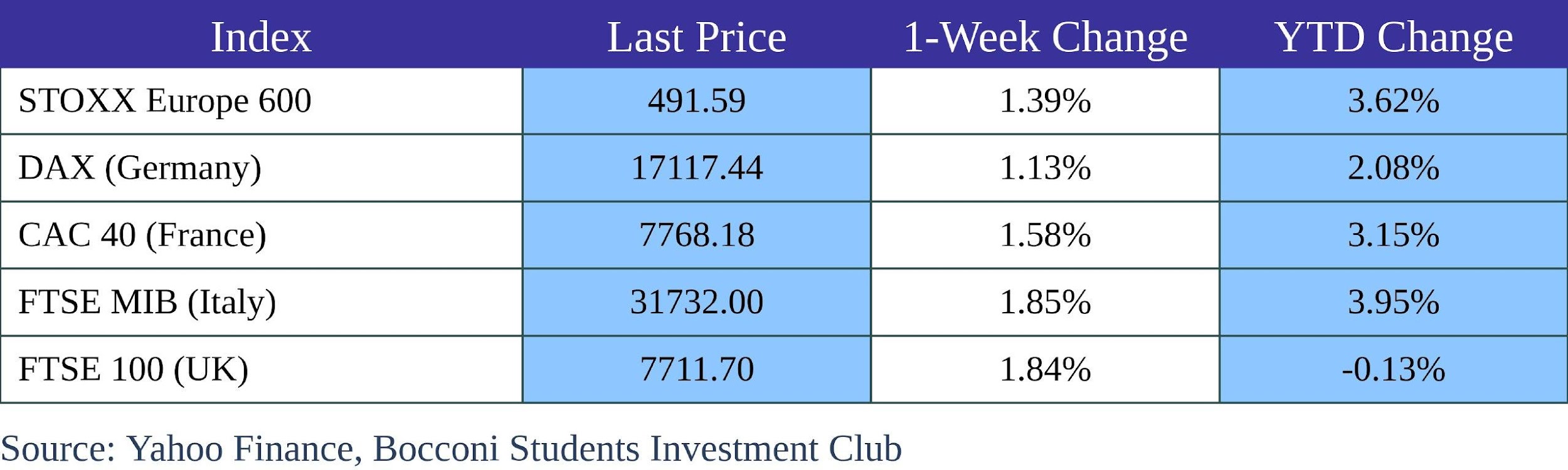

European markets this week remained resilient to downward pressure originating in the US. The FTSE MIB in Italy rose by 1.14%, the FTSE 100 in the UK rose by 1.84%, and the STOXX Europe 600 grew by 1.25%. The DAX and the CAC 40 showed similar results with the German stock market gaining the least amount and finishing the week only 0.8% above Monday’s opening, and with the French index gaining 1.23%.

At the start of the week, European stock markets continued last weeks positive momentum closing with a slight increase. UK’s unemployment data came out better than expected at 3.8% vs 4% expected giving some uncertainty about BoE’s policy outlook. The next day brought the same consequences for the European stock markets as it did for the US with most of indices dropping by 1%.

By Friday, after Wednesday’s Eurozone GDP data (+0% QoQ vs -0.1% QoQ previous), UK’s lower than expected inflation report (4% YoY vs 4.2% expected) and strong corporate earnings, European and UK stocks managed to extend the rally and record solid gains, despite the UK entering recession with QoQ GDP contracting for 2 quarters in a row (-0.3% QoQ vs -0.1% QoQ previously).

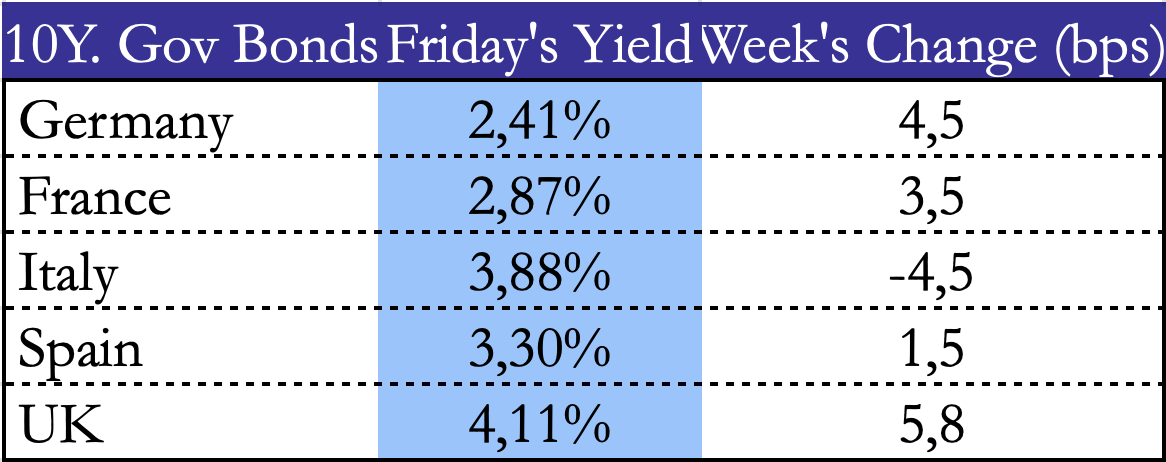

Early in the week, UK 10-year yields approached the highest level since the beginning of December topping at 4.16%. By the end of the week, following poor GDP data in the UK, rates fell below 4%, anticipating policy easening but rebounded above 4.1% after strong retail sales data. European bonds followed the same pattern.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Rest of the World

In Asia, the Nikkei 225 and Hang Seng significantly outperformed Western stock markets showing 4.31% and 3.77% weekly return respectively. The CSI 300 and Shanghai Composite remained closed for the Lunar’s New year celebration.

At the week’s start, the Nikkei 225 started strong, led by a technology stocks rally. On Wednesday Hang Seng returned from the Lunar New Year celebration and finished the day 0.8% higher. Despite Japan entering into a recession in Q4 (GDP -0.1 QoQ vs -0.8% QoQ previously) stocks continued rallying with hopes of BoJ shifting its monetary policy, ending the week on a positive note.

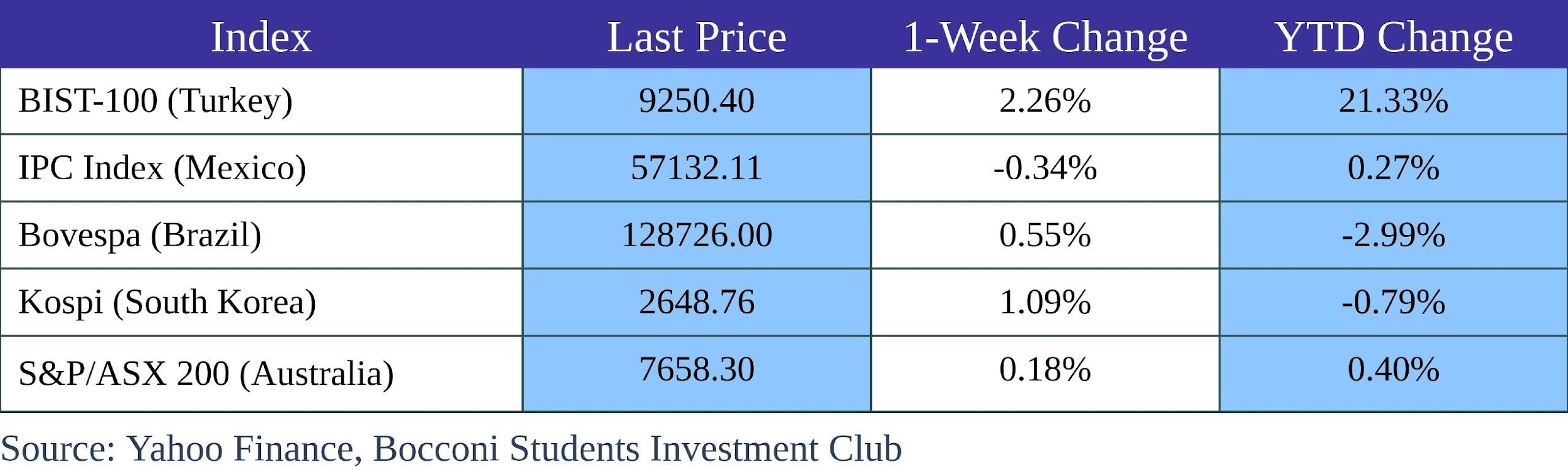

Other global markets like Turkey’s BIST-100, Mexico’s IPC Index, Brazil’s Bovespa, South Korea’s Kospi, and Australia’s S&P/ASX 200 showed mixed results with Turkey’s stock market showing the best results and gaining 2.26%, followed by South Korea gaining 1.09%, then Brazil growing by 0.55% and Australia’s and Mexico’s stock market growing the least with the former increasing by 0.18% and the latter falling by 0.34%.

FX and Commodities

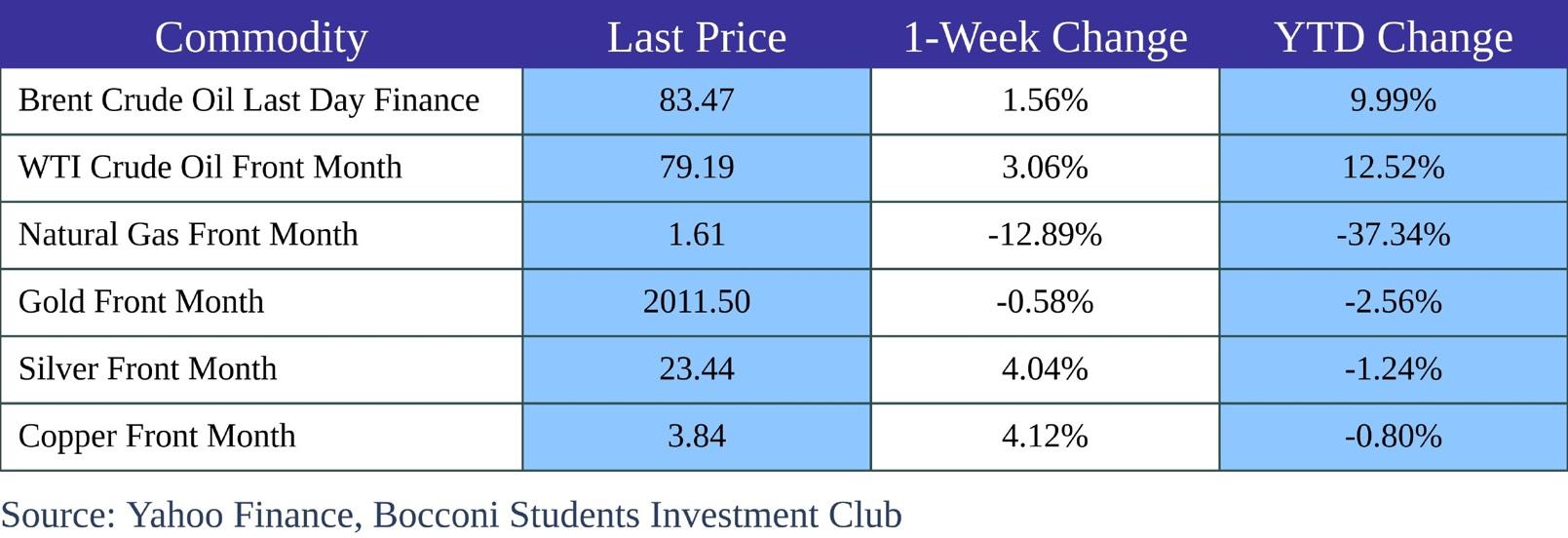

This week, oil prices followed the trends in the US reflecting the changes in Fed’s policy expectations showing positive momentum in the beginning of the week, then dipping by 10% and reversing the losses by Friday. Gold, however, after a similar drop mid-week is still trading below the week’s opening. Natural gas continued the downward-sloping trend and lost another 13% this week.

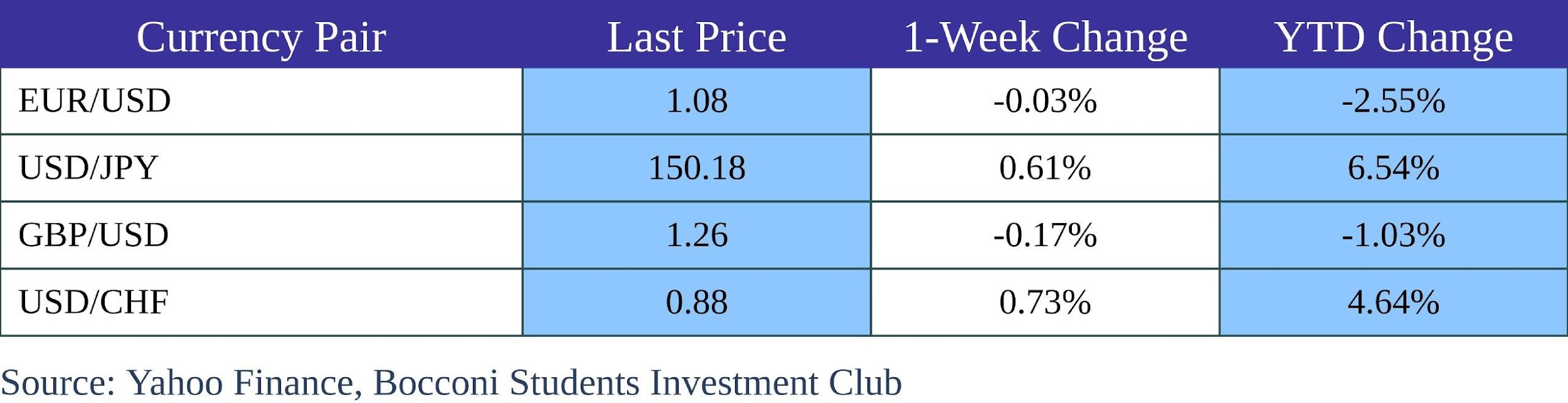

In the currency markets, the Japanese Yen continued depreciating and finished the week above 150.

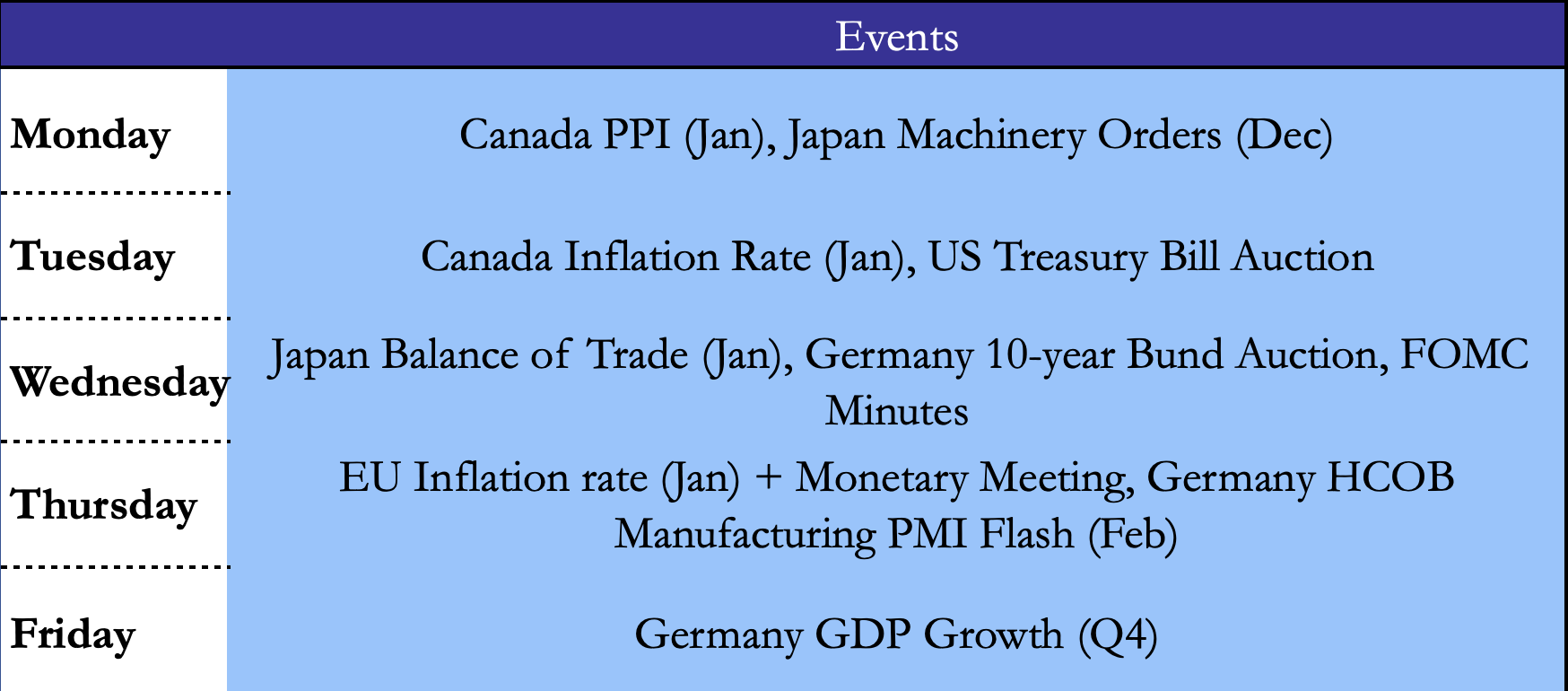

Next Week Main Events

Source: TradingEconomics, Bocconi Students Investment Club

Brain Teaser #09

In a certain matriarchal town, the women all believe in an old prophecy that says there will come a time when a stranger will visit the town and announce whether any of the men folks are cheating on their wives. The stranger will simply say “yes” or “no”, without announcing the number of men implicated or their identities. If the stranger arrives and makes his announcement, the women know that they must follow a particular rule: If on any day following the stranger’s announcement a woman deduces that her husband is not faithful to her, she must kick him out into the street at 10 A.M. the next day. This action is immediately observable by every resident in the town. It is well known that each wife is already observant enough to know whether any man (except her own husband) is cheating on his wife. However, no woman can reveal that information to any other. A cheating husband is also assumed to remain silent about his infidelity. The time comes, and a stranger arrives. He announces that there are cheating men in the town. On the morning of the 10th day following the stranger’s arrival, some unfaithful men are kicked out into the street for the first time. How many of them are there?

SOLUTION

It must be 10 husbands kicked out. If there was only 1 cheating husband in the town, there will be 99 women who know exactly who the cheater is. The 1 remaining woman, who is being cheated on, would have assumed there are no cheaters. But now that the stranger has confirmed that there is at least one cheater, she realizes that her own husband must be cheating on her. Now let’s assume there are 2 cheaters in the town. There will be 98 women in the town who know who the 2 cheaters are. The 2 wives, who are being cheated on, would think that there is only 1 cheater in the town. Since neither of these 2 women know that their husbands are cheaters, they both do not report their husbands in on the day of the announcement. The next day, when the 2 women see that no husband was kicked, they realize that there could only be one explanation – both their husbands are cheaters. Thus, on the second day, 2 husbands are kicked. Through induction, it can be proved that when this logic is applied to n cheating husbands, they are all kicked on the n th day after the mayor’s announcement.

Brain Teaser #10

We are given 4 numbers, denoted a, b, c, d, which can be multiplied in 6 different ways – a*b, a*c, a*d, b*c, b*d, c*d. The results of five of these products are know (though not which product corresponds to which) and are: 2, 3, 4, 5, 6.

What is the sixth product?

0 Comments