US

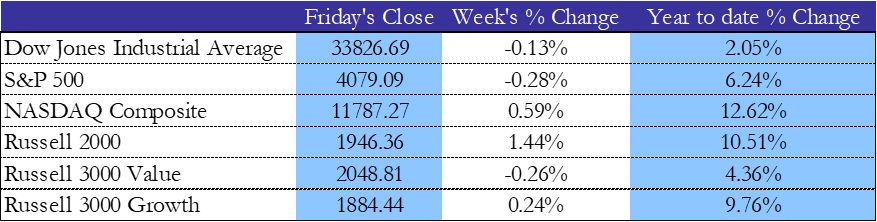

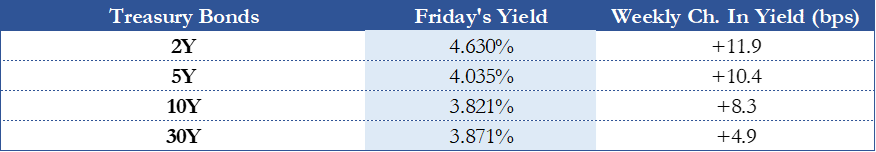

Equities started off the week strong, with most major indexes surging, in anticipation of Tuesday’s CPI report, where inflation slowed ever so slightly to 6.4% from 6.5% in December, less than market forecasts of 6.2%. The inflation reading was the first to be calculated by the Bureau of Labor Statistics’ new methodology: from now on, the CPI will be based only on a single year of consumption data instead of 2 years. The main drives for this higher-than-expected print were the increasing cost of shelter (7.9% vs 7.5% in December) and energy (8.7% vs 7.3%), and the decelerating prices of food (10.1% vs 10.4%), fuel oil (27.7% vs 41.5%), and electricity (11.9% vs 14.3%). Treasuries yields increased, as investors started factoring in the possibility of interest rates remaining high for a longer than anticipated period, due to the persistence of inflation beyond previous expectations.

On Wednesday, the unexpected jump in retail sales caused equities to move higher. The US experienced a 3% MoM increase in retail sales, right after the -1.1% drop the prior month. This was the highest reading since March 2021, surpassing the market’s expectations of a 1.8% increase (retail sales are not adjusted for inflation). The largest increase in sales was recorded at department stores (17.5%), food services and drinking places (7.2%), motor vehicles and parts (5.9%), furniture stores (4.4%), electronics and appliances (3.5%), miscellaneous stores (2.8%) and clothing (2.5%). The data points to robust consumer spending, amid a still-tight labor market, and increasing salaries. This, in turn, may incentivize Fed officials to raise interest rates even more, given the strong demand and persistent historically high inflation, as markets are pricing in at least two more rate hikes in March and May.

The Producer Price Index report on Thursday backed the above conviction, revealing a 0.7% MoM increase in producer prices, well over the 0.4% estimate, the highest one since summer last year. Goods prices were the main cause, recording a 1.2% rise, led by a 6.2% surge in gasoline cost. Bond yields continued climbing, as the 10 Year Treasury almost reached a peak of 3.9%, before consolidating back to 3.82% on the next day. On the last trading day of the week, equities tanked on the back of the hawkish comments of St. Louis Federal Reserve President James Bullard who stated that a 50 bps interest rate hike in March should not be ruled out as a possibility. In the meantime, financially healthy consumers and strong fundamentals may serve as a buffer against a potential economic decline.

EU

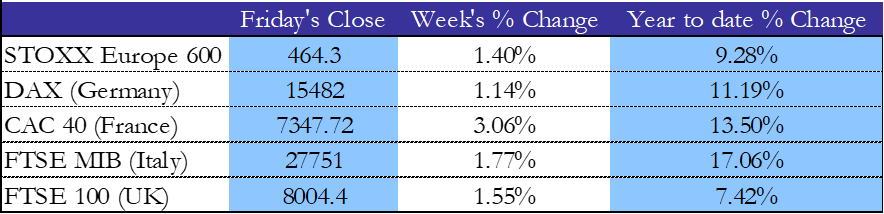

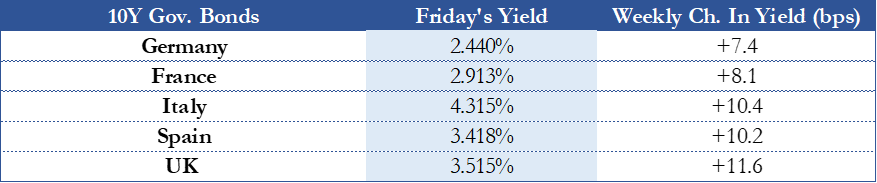

At the beginning of the week, European shares rebounded as stronger-than-anticipated corporate performance allowed markets to overlook concerns on further interest rate hikes. On Tuesday important financial and consumer reports came out for both the UK and Europe. The UK recorded its 3rd consecutive Unemployment Rate reading of 3.7%, which was in line with expectations, while the Euro Area Employment Rate rose by 0.4% in Q4, beating expectations of 0.2%. Europe’s GDP also expanded by 0.1% QoQ, avoiding a contraction for the 7th consecutive quarter, despite facing challenges like elevated inflation, increased borrowing costs affecting domestic demand, and ongoing supply chain bottlenecks that have hindered economic activity. Amongst the EU’s largest economies, GDP grew in the Netherlands (0.6% vs -0.2% in Q3), stayed flat in Spain (0.2%, 0.2% in Q3), decelerated in France (0.1% vs 0.2% in Q3), and contracted in Germany (-0.2% vs 0.5% in Q3) and Italy (-0.1% vs 0.5 in Q3).

On Wednesday the headliner was the better-than-expected UK Inflation Report, revealing an annual inflation rate of 10.1% exceeding market expectations of 10.3%, and marking the 3rd successive inflation deceleration since the peak of 11.1% in October last year. The most significant contributors were transport (3.1% vs 6.5% in December), and restaurants and hotels (10.8% vs 11.3%). On the other hand, inflation grew at a faster pace for housing and utilities (26.7% vs 26.6%), alcoholic beverages and tobacco (5.1% vs 3.7%), and health (6.3% vs 5.1%). In comparison to the prior month, the CPI experienced a significant drop of 0.6%, marking the largest decline since January 2019 and the first decrease in a year. Notably, there were significant decreases observed for fuels (-3.8%) and air transportation prices (-41.7%).

Later that week, the EU recorded a trade deficit of €8.8bn, which was still better than the expectations of €12.5 bn, as exports rose by 9% to €238.7bn, and imports rose by 8.7% to €247.5bn. Industrial Production on the other hand dropped by 1.1% MoM, lower than the anticipated 0.8% MoM decrease. This was mostly due to the decline in the output of intermediate goods (-2.8% vs 0.5% in November), followed by the production of durable consumer goods (-1.4% vs -0.1%), non-durable consumer goods (-1.0% vs 1.3%) and capital goods (-0.4% vs 1.2%). Later that day, the European Central Bank governing council member Gabriel Makhlouf shared that ECB would possibly increase rates above 3.5% and is not likely to cut them again this year.

On Friday, the UK Retail Sales report came out, beating market forecasts of a 0.3% decline, with a 0.5% move to the upside. This drift was caused mainly by non-store retailing in which sales volumes rose 2%, and sales at non-food stores increased by 0.6%, significantly influenced by seasonal sales promotions.

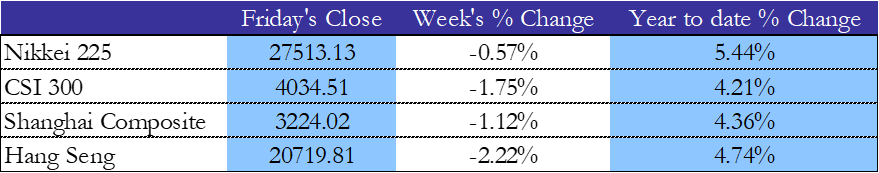

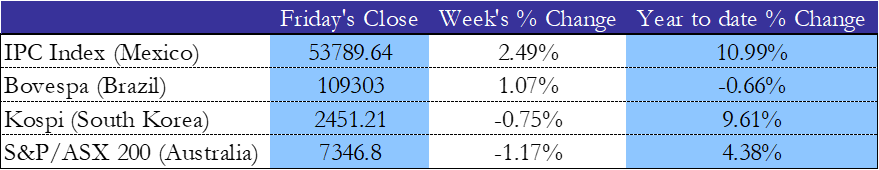

Rest of the world

Japan’s GDP Growth Report failed to satisfy the expectations of a 0.5% rise, as the country’s GDP only expanded by 0.2% in Q4, from its previous contraction of 0.3%. Industrial production decreased by 2.4% as well, the largest decrease since last year. On Thursday, Japan’s Balance of Trade report showed a record-high trade deficit of ¥3,496.6bn, marking the 18th straight month of trade shortfall. As imports climbed by 17.8% YoY to ¥10,047.8 bn, and exports rose by only 3.5%, to ¥6,551.2bn, concerns were raised over the strength of the county’s recovery. On top of that, the nomination of Kazuo Ueda as the next Bank of Japan governor prompted further speculation about the future trajectory of the central bank’s monetary policy.

China’s reopening has been a major topic recently, as the country abandoned its Zero-COVID Policy earlier than initial expectations and began its path to economic recovery. Prices for new homes dropped by another 1.5% YoY in January (the 9th straight month of decrease), as demand begins to stabilize. The Chinese government has started to introduce various measures to support the struggling sector as it seeks to boost economic growth in the country. Economists expect the government to announce more policies during or after the annual Parliament meeting, which commences in March. In the meantime, the People’s Bank of China PBOC has injected an additional CNY 199bn into the country’s fiscal system through its one-year medium-term lending facility. This move was widely anticipated by investors as the PBoC aims to keep pace with the sharp rebound in economic activity following the government’s sudden removal of pandemic-related restrictions in December. The PBoC has vowed to implement precise measures to strengthen financial support for vital areas and vulnerable links in the economy, which includes promoting steady loan growth, providing targeted housing credit policies for specific cities, and extending financial services to meet housing demands.

Despite this, Chinese equities registered a decline for the 3rd straight week, mainly due to concerns of escalating geopolitical tensions with the US, after they added Chinese firms to an export blacklist amid alleged links to the “Chinese Spy Balloon” program and the numerous UFO sightings that had taken place during the last couple of weeks.

FX and Commodities

This week oil was the main topic in the commodities sector, as the Department of Energy announced a 26-million-barrel release from the strategic reserve to bolster supply in the marketplace and ease pricing pressures. WTI futures dropped by 4% to $75 a barrel, on Friday, further driven by concerns for weaker demand due to hotter-than-expected consumer data, at a time of constant inventory increase. The last EIA report shows a jump in crude oil inventories by 16.283 million barrels, making a total of 842.973 million. The IEA and OPEC have also revised their forecast for the growth of oil demand in 2023, taking into account the foreseeable increase in consumption in China. In the FX space, the USD appreciated against the Euro, amid expectations that the Federal Reserve would stick to its hawkish monetary policy, while aggressive policy tightening from the ECB, coupled with the continuous deceleration of GDP growth, point to looming recession in Europe. The Japanese Yen also weekend, trading at around 134 per dollar, due to uncertainty in the trajectory of the BOJ monetary policy, and stronger than expected US economic data.

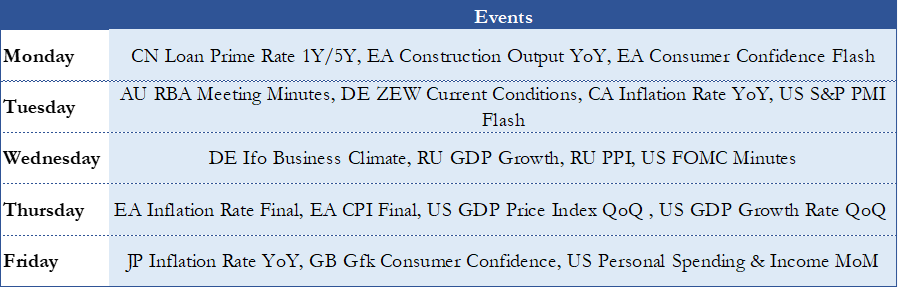

Next Week’s Main Events

Next week’s main events will include the EA Consumer Confidence Flash, China Inflation Rate, US S&P PMI Flash, Russia GDP Growth & PPI, EA Inflation Rate & CPI, Japan Inflation Rate YoY, US FOMC Minutes, US GDP Price Index QoQ , and US GDP Growth Rate QoQ, Australia RBA Meeting Minutes.

Brain Teaser #35

The director of a prison offers 100 death row prisoners, who are numbered from 1 to 100, a last chance. A room contains a cupboard with 100 drawers. The director randomly puts one prisoner’s number in each closed drawer. The prisoners enter the room, one after another. Each prisoner may open and look into 50 drawers in any order. The drawers are closed again afterward. If during this search, every prisoner finds their number in one of the drawers, all prisoners are pardoned. If even one prisoner does not find their number, all prisoners die. Before the first prisoner enters the room, the prisoners may discuss strategy but may not communicate once the first prisoner enters to look in the drawers. What is the prisoners’ best strategy?

Source: The cell probe complexity of succinct data structures – Peter Bro Miltersen

0 Comments