USA

Equities markets dropped for a second consecutive week following continued angst of a Russian invasion of Ukraine. Shelling in the border region prompted fears that Russia was fishing for a pretext for war and was exacerbated by U.S. President Joe Biden’s remarks that he is convinced that Russian President, Vladimir Putin, had decided to launch an attack imminently. A comparable scenario to the one we are currently facing was Russia’s invasion of Crimea in the early months of 2014. Then, the S&P 500, for example, shrugged it off, posting gains in Q1 of that year. Wall Street’s “Fear Index”, the VIX, a measure of market volatility, was generally subdued at the time. The same can be said about this week, where the VIX decreased by 5 points overall and did spike throughout.

Aside from the obvious malicious effects the conflict could have on the world economy, this narrative drove oil and gas prices to new highs as Russia’s influence over global energy markets was asserted. Brent crude almost reached $97 a barrel; a price level last seen 7 years ago.

This plays into another narrative that is making markets look particularly shaky: inflation. Minutes released by the Federal Reserve – notes taken at last month’s meeting – has been perceived as dovish. Statements made by some Federal Reserve officials contrast the sentiment, for instance St. Louis Fed President James Bullard’s remark that persistent inflation is putting the Fed’s “credibility on the line”. Therefore, he expects a full percentage-point increase in the federal funds rate by June. Additional evidence is mounting that the world’s foremost central bank has to step in: producer prices rose by 1% on the Month in January according to the Labor Department, a bellwether for future jumps in consumer prices as businesses may pass on surging input costs to consumers.

On the other hand, other indicators point to a labor market that has not yet reached its full potential, or in Fed Speak, “full capacity”, with weekly jobless claims rising for the first time in a month. Fed Chair Jerome Powell emphasized in past meetings that the full recovery of the labor market is a requirement for the Fed to be able to increase rates. Numbers relating to housing did not point to any argument. In any case, core PCE figures are made public this Friday, an important moment leading to March’s Fed meetings.

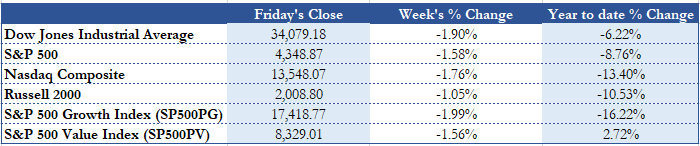

All in all, the Dow sank by 1.9%, the S&P 500 1.58%, and the tech-heavy Nasdaq 1.76% on the week. That marks a 13.4% decline this year. Similarly, the Russell 2000 ended the week 1.05% lower, with the S&P 500 Growth and Value indexes dropping by 1.99% and 1.56%, respectively. Value stocks have outperformed this year while growth stocks, with their sky-high valuations, got crushed by investors toning down their exposure to long duration, risk-on assets. The best performing sector was consumer staples, aided by strong performance by Walmart and Procter & Gamble, whereas the worst performing sectors included health care, information technology, and perhaps surprisingly, energy.

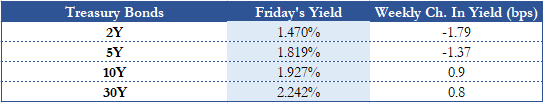

Inflation, being at the elevated levels that it currently sits at, is also rattling bond traders. After diminishing in price early in the week and briefly sitting at a yield above 2%, the 10-year T-Bill’s price recovered later in the week as anxious participants rushed to pile into the safe-haven asset. Another worrying development for bulls was that the 10-7-year Treasury yield spread became negative, an inversion in the gut of the yield curve. This highlighted the continued flattening and rise of the yield curve in light of the Fed’s struggle to tame inflation without committing some sort of policy error, for example by waiting too long for inflation to calm and then raising rates aggressively at a point of no return, a scenario which many fear would lead to a recession.

Overall, notes and bills were largely unchanged over the five-day period, with the short side faring better in price terms, posting modest increases as opposed to the long side.

Europe and UK

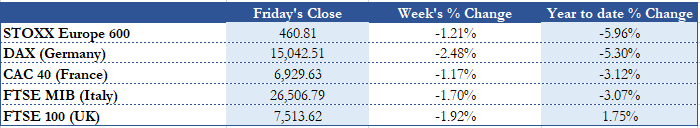

European stocks suffered more than American stocks as the region dealt with immediate concerns of full-scale conflict. Germany, for example, is reliant on Russian natural gas to power its many industries, being one the biggest importers in continental Europe and is also at the top of the list for its share of energy imports that come from Russia as a share of its total energy imports. Therefore, the benchmark DAX index plummeted by 2.48%, with the French CAC 40 down 1.17%, the Italian FTSE MIB down 1.70%, and the British FTSE 100 down 1.92% on the week. British equities have largely outperformed Pan-European markets with the FTSE having risen in value by 1.75% in 2022 as opposed to the other named nations, whose indexes are all negative for the year. In total, the STOXX Europe 600 returned 1.21% this week, marking a 5.96% fall on the year. Conversely, the FTSE 100 has returned a net positive year-to-date, more exactly gaining 1.75%.

The crisis’ effects on European stock markets, with performance being a function of exposure to Russian energy imports exposure, can be best seen in Spanish markets. Spain is less dependent on Russian energy, importing its energy from a wide range of regions, such as France, Saudi Arabia, Mexico and more. That makes their industries’ shares less inclined to react adversely to developments in Eastern Europe. Punters might be interested to buy Spanish stocks to seek regional diversification that gives some sort of protection from the windfall associated with the conflict to their portfolios. Also, their economy is not as industrial as other European economies, instead being a services economy with the obvious contrast being Germany. Thus, the flagship Spanish IBEX 35 index – which counts companies from financial services, communications, and other industries as members – retained its value from last week, having increased by 0.09%.

10-Year government bonds from the major European countries rallied in price this week as traders turned to the safe-haven assets in these uncertain times. German 10-Year Bunds contracted in yield by 8.7 basis points with UK Gilts down 16.8 basis points on the week. Similarly, French and Italian 10-year government bonds were down 9.0 and 10.4 basis points, respectively. Again, it can be seen that direct exposure to Russian energy played a role in performance: Spanish 10-Year government bonds only decreased by 3.7 basis points.

A crucial narrative that is building up in the Eurozone – the countries that have the Euro as its domestic currency and therefore have some of their monetary policy set by the European Central Bank (ECB) – is one regarding inflation. Unlike in the U.S., where the Fed is planning on raising its benchmark rate in March, the ECB has been dovish. Earlier this year, ECB President Christine Lagarde said that she is forecasting no tightening in their monetary policy in 2022. She, and many Governing Council Members, are steadfast in retaining that position. Now, though, troublesome inflation figures are continuing to pile up in many of its constituent regions. ECB Chief Economist Philip Lane commented on that, stating that withdrawing stimulus at an earlier stage is gaining credence within policy circles. Moreover, he opined that it is unlikely inflation undershoots the ECB’s long-term 2% inflation rate by the end of the year, as these heightened levels of CPI growth have been baked into consumer and investor expectations, and are further reinforced by structural changes to the economy following the pandemic.

On the other side of the English Channel, the Bank of England is expected by an increasing number of market participants to raise its benchmark rate a third consecutive time in its upcoming session in March. This has come about due to inflation figures; YoY inflation hit a 30-year high in January, 5.5%, which is an increase from December’s figure of 5.4%. Some analysts are pointing to the labor market to justify their distress: low unemployment at 4.1% and open positions having increased to almost 1.3 million is signaling a squeeze in the already tight labor market, a possible sign of wage push inflation which is a development that, when paired with surging interest rates, could ensue a recession.

Rest of the World

Japan’s stock markets returned negative this week, and this was mostly a reaction to U.S. and European markets’ turbulence amid the conflict in Eastern Europe. The Nikkei 225 was down 2.07%, with the TOPIX down 1.95% and the TOPIX Small also down, but only by 0.29%. Japanese markets are poised to see some action in the coming weeks as the government is preparing to ease COVID-related restrictions, for instance allowing foreigners back into the country and loosening the stringent travel requirements. The country’s prefectures, though, are still likely to keep their rules strict as long as vaccination levels remain at their relatively low levels and the COVID cases at their relatively high levels.

In contrast, Chinese markets saw some gains, in part because of reassuring comments made by the central bank which is to carry on with providing stimulus to financial markets. Other prominent figures of the market made it clear that they were to support the economy that is recovering from the pandemic, a path that has been made difficult by China’s strict zero-COVID rules, prompting region-wide lockdowns at sight of a single case. Also, the PPI and CPI figures came in lower than forecasted by analysts, highlighting the divergence between Western and Chinese economies and monetary policy. Thus, the CSI 300 and Shanghai Composite gained 1.57% and 0.80%, respectively. The Hang Seng, Hong Kong’s main index, dropped by 2.32% this week following a surge in COVID-19 cases that is driving the population-dense city into yet another lockdown.

In emerging markets, performance in developed markets set the tone for a week of negative performance. The BIST-100, which has greatly outperformed other global markets this year because the weak Lira has supported the many exporter companies that make up the index, making their exports cheaper and therefore making the companies more competitive internationally. Although it shed 0.91% this week, the Turkish index is up 9.41% in 2022.

The Mexican IPC Index shed 1.78% because of expectations of a dwindling economy; preliminary data is indicating that GDP has decreased month-on-month. This, by no means, determines that Mexican equities are going to suffer, though. Mexico entered a technical recession in the final quarter of 2021, yet the IPC Index rallied to all-time highs as its relative stability has attracted emerging markets investors.

The main Brazilian index, the Bovespa, also declined, losing 0.61% of its value as compared to last week. It has also outperformed other markets due to elevated commodity and energy prices. The South Korean Kospi and the S&P/ASX 200 traded flat this week, decreasing by 0.12% and increasing by 0.06%, respectively.

Fx and Commodities

The story of the week is undoubtedly energy prices. As previously stated, Brent Crude hit multi-year highs as it hovered at about $96 at one point, finally cooling down and closing at $93.61. WTI closed at $91.55 a barrel. Natural Gas futures traded in New York gained 11.2% this week after the events in Ukraine occurred.

The Dollar Index traded flat this week, closing at 96.11. The Greenback continued to strengthen against the Euro following this week’s events as well as the continued prospects of higher interest rates in the U.S, closing up 0.25% at 0.8832 EUR. On the other hand, the Dollar weakened against the Japanese Yen, shedding 0.36% and is now at 115.03 JPY. The Swiss Franc also gained in value against the dollar, increasing by 0.42% and ended the week at 0.9216 CHF.

Gold rallied 2.16% this week and is up to $1,900 an ounce, recovering back to a point it last hit in June of 2021. Silver inched up 1.48% and closed at $23.95 an ounce. Bitcoin ended the working week down around 6% and sat at about $40,000 on Friday night, with the rest of the Crypto market closely following its price action throughout.

Next Week Main Events

Next week is filled with important economic events which do not include the evolving conflict on Ukraine’s eastern border. Most importantly, the U.S. Core PCE is being released on Friday, a key moment ahead of next meting which may hint at whether Fed Chair Powell will be inclined to raise rates by more than a half of a percentage point in the next meeting. This figure will be supplemented by numbers on durable goods orders for January, one of the key drivers of inflation until now. In others, the Eurozone will report core inflation values for January, another indicator to help determine whether the ECB will change course from its earlier standpoint on tightening.

Brain Teaser #17

A four-digit number written on the board can be replaced by another, adding one unit to two neighbouring digits, if both are different from 9, or subtracting one unit from two neighbouring digits, if both are different from 0. Is it possible with a finite number of such operations to obtain the number 2022 from number 1234?

Solution:

Consider f(abcd) = (b + d) – (a + c). We notice that after the operations described above, the value of the function f does not change, because each parenthesis either increases by 1 or decreases by 1. So, to obtain from the number 1234, the number 2022 we must have f(1234) = f(2022). But f(1234) = 2 and f(2022) = -2. Therefore, it is not possible with a finite number of such operations to obtain the number 2022 from number 1234.

Brain Teaser #18

Prove that the number of people (from the universe) who have shaken hands an odd number of times is even.

0 Comments