USA

Following signs of a more hawkish central bank policy, bond markets in the US sold off substantially over the course of the week. On Tuesday, Charles Evans, the Chicago Fed’s president defined a year-end range for the policy rate between 2.25 and 2.5 per cent as realistic, while remarks by the St. Louis head James Bullard spurred speculation about a potential three quarters-percentage point hike at one of the upcoming meetings. Speaking on an IMF panel on the global economy on Thursday, Jerome Powell solidified the markets’ expectations of a 50-basis-point hike at the upcoming meeting in early May.

Given the communication was mainly focused on policy rates, the selloff was most pronounced on the shorter end of the yield curve. The yield on 2Y Treasury Notes which closely tracks policy rate expectations closed 22.17bps higher on Friday compared to its level a week prior. For longer maturities, the impact was less dramatic with the yield on 10Y Treasury Bonds increasing by 7.7bps to a level of 2.9% by the end of the week.

Besides increases in nominal rates, especially the rise in yields on the Treasury Inflation-Protected Securities (TIPS) gained substantial attention. These so-called “real yields” adjust nominal yields on Treasury securities by projected inflation. On the benchmark maturity of ten years, the yield briefly broke into positive territory for the first time in over two years before retracting on Thursday and Friday, closing at -0.12%. This level still constitutes an increase of 92bps YTD.

Source: BSIC, Yahoo Finance

In equities, markets were focused on the ongoing release of first quarter results with S&P 500 large caps such as Tesla, Procter & Gamble, and Bank of America reporting on their performance during the first three months of 2022. While these companies delivered solid results, beating analysts’ EPS forecasts across the board, the overall market sentiment was depressed by Netflix’s report on the contraction of its customer base.

On Wednesday, the streaming platform announced that it lost around 200k customers during the last three months and expects a further reduction of 2m in the current quarter. Markets reacted heavily to this news release, leading to Netflix losing almost 40% of its market value in intra-day trading. The stock closed at $216 on Friday, still down more than 36% on the week. Crucially, these results also raised further questions on the medium- to long-term outlook of the streaming sector, dragging down the stocks of other major players in the sector such as Disney (-10% on the week) and Spotify (-19%).

In the ongoing scramble for power at social media platform Twitter, Elon Musk unveiled the financing package in support of his $43bn bid to take the company private on Thursday. The plan was submitted to regulatory authorities and showed that the Tesla CEO plans to pledge more than a third of his stock (market value around $63bn) as collateral for loans of more than $25bn from a consortium of banks. Also the billionaire intends to contribute more than $21bn in cash for the deal.

The US homebuilder index confidence index showed a decline for the fourth consecutive month in April mainly caused by rises in mortgage rates, as well as increases in construction costs. The measure summarizes sentiment of companies in the sector of residential construction. Additionally, the Fed’s Beige Book, analyzing the economic activity in regions across the country, emphasized the economic risks posed by continued supply-chain disruptions, labor supply shortages and rising input costs for the US economy.

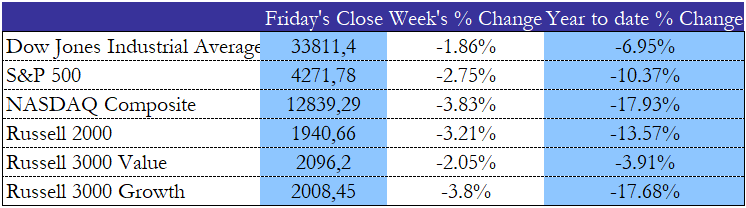

Overall, equity markets in the US experienced another difficult week, amidst the prospects of a more hawkish central bank and more gloomy economic outlooks. Both the S&P 500 and the Nasdaq declined for the third consecutive week with losses of 2.8% and 3.8%, respectively. The Dow Jones even fell for the fourth week in a row with a loss of 1.9% by the closing bell on Friday. These results come ahead of a crucial week for equities with Microsoft, Alphabet, Meta, Apple, and Amazon releasing their Q1 results. Additionally, March data for the Fed’s favourite inflation gauge, the Personal Consumption Expenditures Price Index, will be released on Friday.

Source: BSIC, Yahoo Finance

Europe and UK

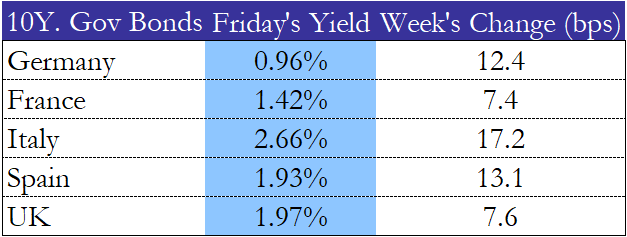

European bond markets largely mirrored the selloff in US securities with the benchmark yields for the 2Y and 10Y German Bunds closing 23.5bps and 12.4bps higher on Friday. While these increases were partially seen as a reaction to the Fed’s more hawkish communication, also comments by ECB officials indicate a tougher stance on inflation. Although Christine Lagarde, speaking at the same event as her US counterpart, pointed to the substantial difference between the two economic areas and the risks to Eurozone growth, ECB vice-president Luis de Guindos opened up the possibility of the first rate hike to appear as early as July.

Source: BSIC, Yahoo Finance

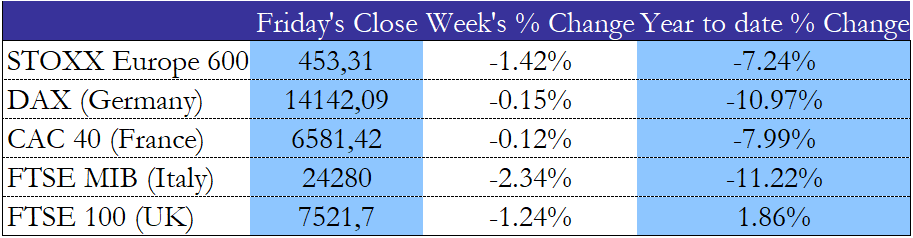

Further, the new offense by Russian forces in Eastern Ukraine strained the economic outlook for Europe at the beginning of the week. The main European indices opened lower as market participants weighed the implications of the war at its Eastern borders. Despite the ongoing conflict, continued supply chain disruptions and skyrocketing energy prices, the release of the S&P Eurozone PMI Composite Output Index revealed an unexpected robustness of the currency union’s economy. Growth accelerated in March above analysts’ expectations, largely driven by a robust performance in the services industry. Nevertheless, the index stands lower than in the beginning of the year, with substantial inflationary pressures and the war in Ukraine seen as main reasons for a pessimistic outlook.

Also in the UK, investors digested the release of new economic data over the course of the week. Contrary to the Eurozone composite, output index data showed a more pronounced decrease in business activity in March. The outlook for Europe’s second largest economy was further dampened by data releases on consumer confidence and retail sales on Friday morning by the research company GfK and the Office for National Statistics, respectively. Data showed that consumer sentiment fell to the lowest level in almost four decades while retail sales were near an 18-month low in March.

In response to the data releases and persistent inflationary pressures, Andrew Bailey, governor of the Bank of England, acknowledged the central bank would have to “walk a fine line” to avoid creating a recession given the weak outlook. What is more, prime minister Boris Johnson threatened to take unilateral action to alter the Northern Ireland protocol, a key element in the ongoing negotiations about the country’s future relationship to the EU. These factors also led to a selloff in UK bonds, with the 2Y and 10Y benchmarks closing higher by 15.5bps and 7.6bps at 1.72% and 1.97%, respectively. Especially the more cautious BOE signals contributed to sending the pound to its weakest level against the dollar in almost two years with a closing level of $1.284 on Friday.

Source: BSIC, Yahoo Finance

Overall, equity performance was rather mixed in the past week, given the developments described above. The German and French benchmark indices were rather stable, while both the Italian FTSE MIB (-2.34%) and the UK’s FTSE 100 (-1.24%) retracted. The composite Stoxx Europe 600 also decreased by 1.42% to close at a level of 453.31 on Friday evening. For the upcoming week, Europe awaits the results of the second round of the French presidential election that will be held on Sunday, while the discussions around a potential embargo on gas imports from Russia are expected to continue as well.

Rest of the world

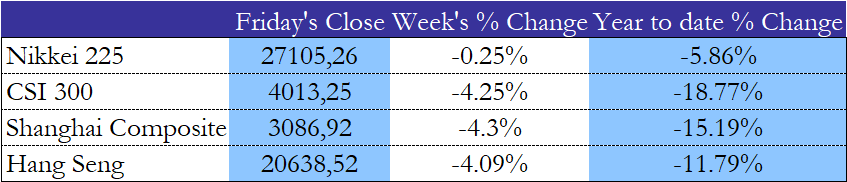

On Monday, China’s first quarter GDP growth exceeded expectation by showing an increase of 4.8 percent against the expectation of 4.4 percent. Nevertheless, given Beijing’s Zero-Covid strategy and the related strict lockdowns in major cities further dampened the economic outlook in the medium-term. Besides its more pessimistic outlook on global growth in 2022, the IMF warned that countries which built up large amounts of private debt during the pandemic, like China, were likely to be substantially hindered in their recovery path in the upcoming years. In this context, the fund reduced its 2022 growth forecast for the world’s second largest economy to 4.4% from 4.8% in January.

Besides the growth outlook, the government’s continuing crackdown on social media platforms and the broader technology sector sent the Hang Seng Tech Index down early in the week. The National Radio and Television Administration announced it would ban the broadcasting of unauthorized games on public livestreams, tightening its grip on China’s highly profitable streaming industry. The Hang Seng Tech Index dropped by around 3 per cent in early trading on Tuesday before closing the week off with a loss of more than 7%.

Source: BSIC, Yahoo Finance

In Japan, focus remained on central bank communication ahead of the Bank of Japan’s policy meeting next week. Speaking at Columbia University on Friday, Governor Haruhiko Kuroda reiterated the need for continued monetary stimulus given the small uptick in consumer price inflation of 0.8% in March. The measure is forecasted to reach the BOJ’s target of 2% in the coming months, potentially increasing the pressure to adjust its ultra-accommodative monetary policy stance. In the past week, the central bank was again forced to intervene in the bond market to keep the 10Y JGB below its upper limit of 0.25%. The Nikkei 225 was rather stable over the week, posting a small increase of 0.04%.

Source: BSIC, Yahoo Finance

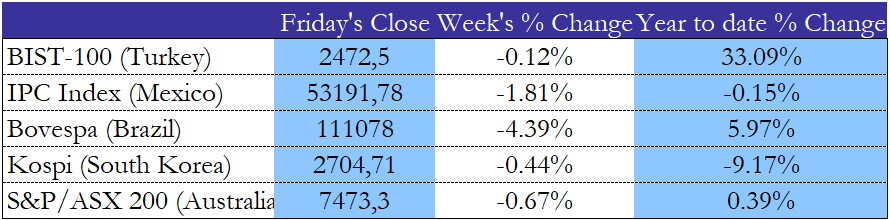

Further equity indices around the world were also moving sideways with Turkey’s, South Korea’s and Australia’s benchmark indices realizing minor losses week-on-week. Contrary to this, the Mexican IPC index gave in 1.81% amidst continuing uncertainties around the debt repayments of the state-owned oil firm Pemex. Despite a temporary rally spurred by bilateral talks between the Brazilian and US governments over future increases in oil output by South America’s largest economy, the Bovespa index lost 4.39% during the week. This result was mainly driven by underwhelming earning reports, leading to the third consecutive week of negative returns on the benchmark.

FX and commodities

The commitment of the Bank of Japan to a continued accommodative monetary policy in contrast to the Fed’s hawkish turn further weakened the yen. The currency traded close to its 20-year low for the entire week and even briefly crossed the psychologically important mark of ¥130 on Tuesday. Analysts believe the currency could come under further pressure after BOJ Governor Haruhiko Kuroda did not mention the weak exchange rate in his remarks on Friday, indicating the central bank’s clear focus on the inflation target. Nevertheless, this might be susceptible to change in the next weeks as more companies report the exchange rate’s adverse impacts on imports.

While remaining on an elevated level in historical comparison, oil prices decreased by almost 5% in this week’s trading. Brent and WTI crude closed at $106.65 and $102.07 on Friday, respectively. While supply concerns due to the war in Ukraine persist, attention turned to the reduced growth forecast, as well as tighter financing conditions this week, pushing oil prices down week-on-week.

The price of gold fluctuated during the week, while remaining close to the $2000/troy ounce level. On Monday, amidst the concerns about global GDP growth, the safe-haven asset rallied as much as 1.2 percent before giving up most of these gains over the course of the week and closing down 2.0% at $1931/troy ounce. The main reason behind this loss can be seen in the increased yields for US Treasuries after the Fed’s hawkish comments.

Next week main events

Brain Teaser #23

1964 IMO P4. Seventeen people correspond by mail with one another – each one with all the rest. In their letters only three different topics are discussed. Each pair of correspondents deals with only one of these topics. Prove that there are at least three people who write to each other about the same topic.

Solution:

We observe that each person corresponds with all the other 16. Now we choose a specific person from the group and call him Bob. Because only there are only three topics, Bob discusses one topic with at least six other people, say topic A. If there is a pair that discusses topic A among the six Bob’s correspondents, then the proof is complete. Otherwise, those six people discuss only topics B and C. By choosing a particular person out of the group of 6 (call her Anne), we are guaranteed to find at least another three people out of the five left that discuss one topic, say topic B. If among the three people there is a pair that corresponds to each other on topic B, then Anne and that pair form the three people who write to each other about the same topic. On the contrary, the three people all discuss topic C.

Brain Teaser #24

Positive real numbers are arranged in the form:

![]()

![]()

![]()

![]()

![]()

Find the number of the line and column where the number 2022 stays.

Problem source: JBMO 2002 shortlist

0 Comments