United States

The post-financial crisis US equity rally continues this week, with the S&P 500 closing at $2,502.22 ( +0.08% over the week).

Apple’s share price slide led it to its worst week in 17 months because of the mixed reviews for its new iPhone 8, as it offers just a minor upgrade to the previous model. Apple fell 5% to $151.89 this week with a decline of 1% on Friday.

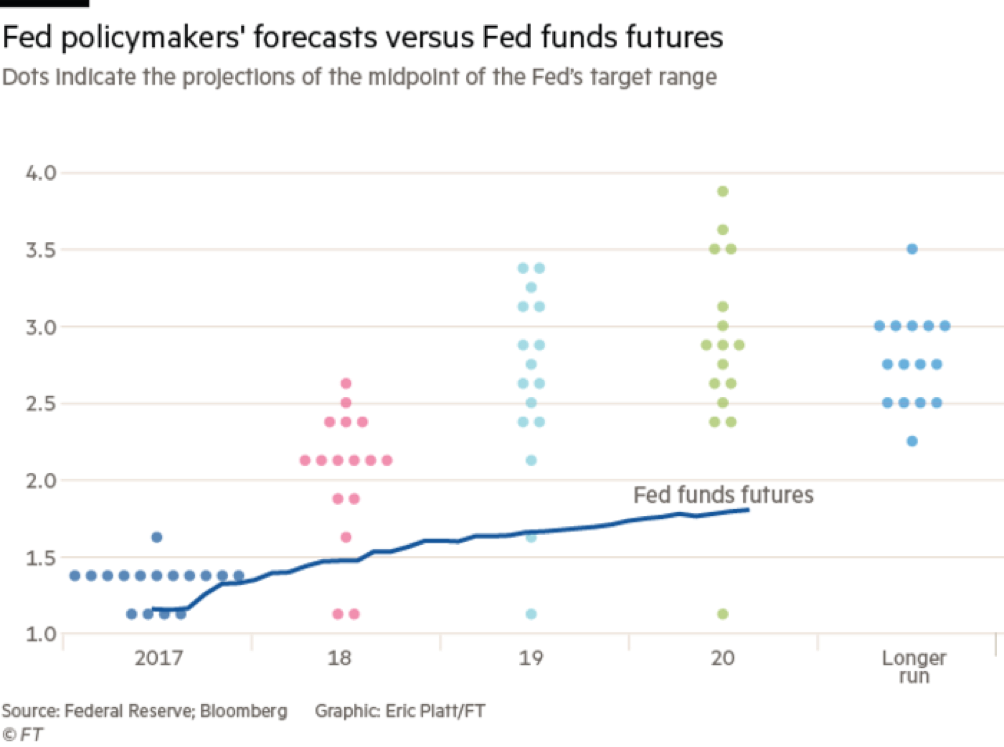

On Wednesday 20th September, Janet Yellen declared that the FED would discontinue QE and, beginning from the next months, it would start to unwind its $4.5tn balance sheet. The Fed fund rates were kept constant at 1-1.25%. but a third rate rise before the end of the year is still in the cards.

The central bank’s policy committee remains divided over the urgency of further tightening, given a string of poor inflation figures. The median Fed policymaker now does not expect core inflation to hit the 2 per cent target until 2019, compared with 2018 previously.

After the statement and Ms Yellen’s press conference, the yield on the 10-year Treasury climbed, from about 2.24% immediately preceding the announcement to 2.27% soon afterwards, while the policy-sensitive two-year yield jumped from 1.38% to 1.43%. In the following days, after the sudden jump, the 10-year US Treasury yield closed at 2.253%.

Regarding the Forex, the dollar index closed at 91.95, helped by the FED announcements. The Euro/USD closed the week at 1.1951 USD.

Next week important news will be the consumer confidence survey on the 26th, and the 2Q GDP data on Thursday.

Source: Federal Reserve, Bloomberg

Eurozone

European markets closed higher on Friday compared to the beginning of the week, with gains in almost all the major markets. The German DAX gained 0.59%, the CAC 40 rose 1.29% and the FTSE MIB increased by 1.36%. German vote seems not to concern investors, with Angela Merkel predicted to easily win her fourth term as German chancellor. However, Sunday’s election will be still watched closely as Mrs Merkel is unlikely to win an outright majority in the Bundestag, and she will probably need once again to put together a coalition to govern the country. On the other side, Spanish IBEX 35 closed slightly negative, with a loss of 0.32% on the week, due to rising tensions in Catalunia, the richest and biggest region in Spain. Separatists have planned a referendum for October 1st, which has however been declared illegal by the Constitutional Court.

European stocks were boosted by positive economic data, which point at a strong growth in the third quarter. In particular, the EU PMI index rose to 56.7 points in September, thanks to positive German and French performances, a big surprise given August level of 55.7 and expectations of a decline to 55.6. The euro maintained its level at $1.194 (+0.03%), but gained 0.53% to the GBP. The European bond market remained flat, with German 10y bund yield at 0.45%, the French respective at 0.73% and the Italian one at 2.11%.

Next week, after the aforementioned German federal elections on Sunday, we will receive on Thursday the Euro Area Business Confidence level for September, while on Friday the YoY inflation rate for the EA will be published.

UK

Over the course of the last week, the most important drivers of the UK markets were the speech of the BOE governor Mark Carney and the UK prime minister May’s speech in Florence. Mark Carney in Washington signaled that any increases in interest rates in the coming months will be gradual and limited, in order to bring back inflation to its 2% target. The inflation reached 2.9% in August as the effect of the depreciated sterling.

Theresa May in Florence proposed to remain in the single market for a transition period of around two years after Britain leaves the European Union. Moreover, her speech signaled she was open to payments beyond the £20 billion offer, in order to cover the hole in the EU coffers in 2019 and 2020. This would help to secure this transaction period. However, she failed to give any concrete details for how Britain might retain preferential access to the EU’s single market, a crucial point of the negotiations. This uncertainty caused weakness in the pound. In addition, in the final minutes of trading on Friday, Moody’s downgraded the UK to an Aa2 rating from Aa1 over concerns about public finances and economic growth.

UK retail sales data came out on Wednesday. It was unexpectedly robust, up 1% in August from July, well above the 0.2% expectations. It suggests stronger consumer confidence and it increases the likelihood of a near BOE interest rate hike.

Following the speech of May and UK’s credit rating downgrade, the pound closed at lower levels, 1.3491 USD and 1.1297 EUR on Friday. On the other hand, the FTSE 100 closed up 1.3% at 7310.63 from the 7215.47 previous week close. The weaker pound explains the rally in UK equities. Regarding fixed incomes, the yield on the 10-year government bond, i.e. the 10-year Gilt, continued the upward trend during this week, closing on Friday at 1.364% at higher levels from the previous Friday rate of 1.309%. The yield of two-year UK Gilt closed at 0.456%.

The London High Court ruled that the court case over a $700m Islamic bond will go ahead next week without Dana Gas, the United Arab Emirates-based energy company. The case revolves around a sukuk bond sold to global investors (that include BlackRock and Goldman Sachs) that Dana Gas announced was no longer compliant with Islamic law.

Next week on Wednesday will be released the QoQ and YoY GDP growth rate, that are expected to be 0.3% and 1.7% respectively.

Rest of the World

The dollar was down 0.3% against the yen at ¥112.09. It hit a nine-week high of ¥112.71 on Thursday. Against the franc, the dollar was slightly lower at SFr0.9704. Hong Kong’s Hang Seng and the South Korean Kospi were the biggest decliners, falling 0.6% (27,880.53 on Friday) and 0.5% (2,406.50 on Friday) respectively. Japan’s Topix (1,668.74 on Friday) and the markets in Shanghai and Shenzhen were all down approximately 0.3%. Taiwan’s benchmark Taiex was down 0.5% at 10,449.68. The 10-year Japanese government bond was up 0.4 basis points at 0.014 per cent, while the equivalent Australian note yield was down 4.1bps.

The debate over the recent mania of Bitcoin has gotten even fiercer. A high number of central bankers have dismissed the cryptocurrency as “an instrument of speculation”, saying that its sharp rise in value is akin to the 17th century tulip craze.

Taiwanese smartphone maker HTC jumped to a five-month high on Friday when it agreed on a $1.1bn deal with Google. The US technology giant is set to acquire its 2,000 employees and has signed a non-exclusive license agreement for HTC’s intellectual property.

A recent study has also pointed out the recent rise in debt offerings in the Asian region. According to Dealogic, sales of dollar bonds in the region have rocketed this year, with $359bn issued so far. Sales have also more than doubled their levels in 2010.

From the political global news, after that Donald Trump threatened to “totally destroy” North Korea in his first UN address, North Korean leader Kim Jong Un warned that Donald Trump would pay dearly for statement. Kim Jong Un also said that North Korea would detonate a hydrogen bomb in the Pacific. On Thursday, the Trump administration unveiled new measures designed to force countries and companies to stop trading with Pyongyang.

Donald Trump opened a new front with Iran during his UN address. Trump called Iran a “corrupt dictatorship” and “an economically depleted rogue state” that exported violence and bloodshed. Mr Rouhani said it would be a shame if this landmark diplomatic deal “were to be destroyed by a rogue newcomer to the world of politics”. Mr. Rouhani also added that Tehran did not need permission from any country to bolster its missile program.

Download the PDF of this article: Market Recap 24-09-17

0 Comments