USA

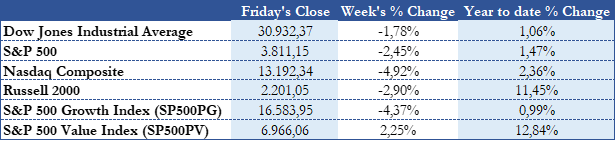

US indexes decreased sharply during the week, mainly due to a steep rise in longer-term Treasury yields and increasing inflation expectations. The S&P 500 posted its biggest weekly drop in a month, while the Nasdaq suffered its worst decline since October, as an increase in rates is a particular threat to big tech sky-high valuations because it would diminish the present value of their future cash flows, that are so distant in time. Consumer discretionary sector performance was weak, in part because of a steep decline in Tesla, while the energy sector outperformed with rising oil prices, and more in general the rotation into cyclicals continued, driven also by vaccine progresses. This shift led value stocks to outperform growth ones, bringing the year-to-date difference in performance to more than 10%.

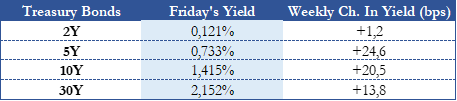

On Wednesday, in testimony before Congress, Jerome Powell confirmed Fed’s dovish monetary policy, highlighting that inflation does not show signs of huge increases this year and that it might take more than three years to reach the 2% inflation goal. The statement calmed the markets on Wednesday, but on Thursday the 10Y Treasury yield rose to 1.61%, the highest in over a year. This was mainly due to the inflation worries that in investors’ minds would lead the Fed to begin removing monetary stimulus sooner and because more inflation would reduce the expected real returns brought by bonds. Other reasons can be technical factors and weak auction results.

The 10Y yield closed lower at 1.42% on Friday, the 2 year was stable at 0.121% during the week, while the 5-year yield, in the eye of the storm on Thursday, fell back to 0.73%.

During the week robust economic signals fed inflation worries, weekly jobless claims hit their lowest (730,000) in three months, and personal incomes, reported Friday, jumped 10.1%, largely thanks to payments from the coronavirus relief package of December. Meanwhile, early on Saturday morning, the Democratic House of Representatives has passed Biden’s 1.9 trillion $ coronavirus relief package, which includes 1,400$ of direct payments and an extension of federal unemployment benefits. The legislation will be soon discussed in the 50-50 divided Senate and is likely to be modified. Democrats aim at finishing the law before March 14, when some federal unemployment assistance expires.

Rising rates and inflation concerns also impacted the municipal bond market that suffered through most of the week. IG corporate bond spreads widened, and HY were negatively impacted too, especially in longer-duration, higher-quality, and lower coupon bonds.

Europe and UK

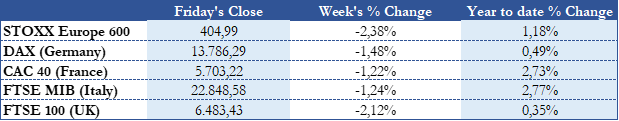

Europe’s major indexes fell during the week along with global markets. The week was volatile mainly because of the concerns that central banks may act sooner than expected to suppress inflationary pressures that could follow an economic recovery, doing so policymakers could remove some of the stimulus put in place. The STOXX Europe 600 Index decreased 2.38% during the week, almost erasing the year-to-date gains. Continental stock indexes declined, united with the UK’s FTSE 100, under pressure from a strong pound near the highest level in almost three years. This was primarily due to the recovery hopes fueled by the rapid rollout of COVID vaccines and investors’ pricing of an interest rate peak over the next two/three years.

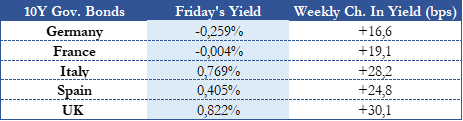

Similarly to US Treasuries, eurozone government bond and UK Gilt yields rose united with the other developed markets. As already mentioned, supportive rhetoric from Jerome Powell failed to calm fears of inflation rising, these triggered a severe sell-off across most developed markets. The president of the European Central Bank, Christine Lagarde, united with other policymakers, warned that they were monitoring borrowing costs, but the decline in yields resulting in the announcement was short-lived. On Friday morning the German 10Y Government bond yield rose to -0,20%, the maximum in almost a year. The yield closed the week at -0,259%, a weekly increase of 16bps and a YTD surge of 31bps. The German 2Y yield also rose, closing at -0.654%, a weekly expansion of 5bps. The UK 10Y Gilt closed at 0.822%, the highest value in more than one and a half years, posting a weekly surge of 30bps (+62bps YTD).

During the week, the fourth-quarter German GDP data were revised up unexpectedly to a growth rate of 0.3% (0.1% estimate) due to strong exports and solid construction activity. The full-year number rose to -4.9%. The Economic Sentiment Indicator of the eurozone rose to 93.4 from 91.5 of the previous month, the highest since March last year. Moreover, surveys indicated consumer confidence improving in Germany and Italy. Despite these improvements, the European Union is still lagging other developed countries in its vaccine rollout and European Commission President Ursula von der Leyen stated that only 6.4% of its population has received a vaccine.

Through the week Boris Johnson revealed a plan for gradually lifting lockdown restrictions in England starting from March 8 and ending on June 21. By May 17 nearly the whole economy is likely to be reopened. British Chancellor of the Exchequer Rishi Sunak is likely to extend the jobs support program until May in his budget next week, and there may be state support for industries hit hardest by the lockdowns as well.

Rest of The World

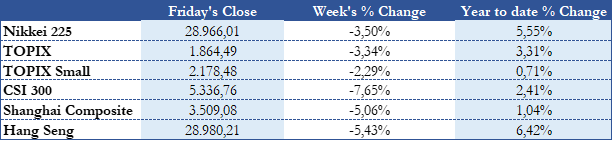

Japan indexes had huge losses on Friday and closed the shortened week in the red. Japan markets were closed on Tuesday, for the Emperor’s Birthday. During the week, the Nikkei 225 declined 3.50% but is still ahead 5.55% year-to-date. The other equity market benchmarks, the large-cap TOPIX and the TOPIX Small Index followed similarly. Early in the Friday’s session Japanese 10Y government bond yield reached 0.18%, the highest level since the BoJ announced the introduction of the negative interest rate policy in early 2016. The yield closed the week at 0.158%, up 9bps in the week and 13bps YTD.

Finance Minister Taro Aso, stated that Japan’s GDP growth in the first quarter is expected to slow, despite this he said that the government is not contemplating adopting fresh stimulus measures and that it will likely maintain its current pace of bond issuance and fiscal stimulus. BoJ intends to conduct a policy review in March to continue to provide ultra-loose monetary policy. Moreover, the Reuters Tankan sentiment Index recorded, for the first time since mid-2019, a positive sentiment between manufacturers.

Chinese shares fell with the global sell-off. The Shanghai Composite Index shed 5.06%, while the large-cap CSI 300 decreased 7.65% in its worst week since October 2018. In China, there was a rotation into names that are expected to see an increase in demand since travel and quarantine restrictions are relaxed, as airlines and Macau gaming companies. Differently highflying companies, related to semiconductors, electric vehicles, and automaking underperformed. The yield on the Chinese sovereign 10Y bond was broadly flat at 3.30% and the official loan prime rate (a reference rate for new renminbi loans) was unchanged for the 10th straight month.

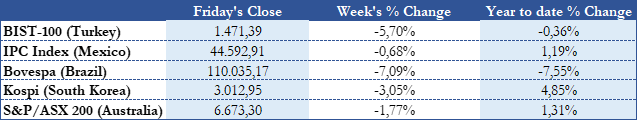

In Turkey, the BIST-100 Index, returned -5.7% during the week, erasing YTD gains. Shares were under pressure by rising U.S. Treasury yields, a weaker Turkish lira respect the USD and weakness among several world markets. Brazil Bovespa closed the week 7.09% lower (-7.55% YTD). Petrobras shares went down more than 20% on Monday after President Bolsonaro ousted its CEO that will probably be substituted in the coming weeks with an army general who has no experience in oil and gas – Petrobras is the biggest Brazilian company, and the government holds a 36.8% stake with 50.5% of voting rights. 10Y Australian sovereign bond yields rose 66 bps during the week closing at 1.894% on Friday, while the S&P/ASX 200 (Australia’s benchmark) dropped 1.77%. Reserve Bank of Australia announced on Friday an unscheduled 2.3bn USD purchase of 3Y government bonds to protect its target yield.

FX and Commodities

Oil prices rally also continued this week. Brent crude increased 5% during the week and 28% YTD closing at 65.97$ a barrel. While West Texas Intermediate crude surged 4% (+26.4% YTD) to 61.61$ a barrel.

Gold dropped 2.7% during the week, to $1,734.78 on Friday, and is down 8.65% YTD. While silver decreased 2.5% weekly to $26.68 and is almost flat year to date. Lumber futures reached record highs, while copper prices are at their highest in a decade, this was also due to inflation in the housing sector, as proved by the new data, released on Tuesday, that US home prices increased 10.1% in December from the previous year.

On the currency side, the dollar was stronger, and the Bloomberg Dollar Spot Index rose 0.57% last week closing at $90.88, with the change EUR/USD slightly lower at 1.2076. The Yen depreciated against the dollar 1.1% during the week, closing at 106.60. GBP/USD closed the week slightly lower (at 1.3935) but still near its highest level since March 2018, thanks to the fast vaccine rollout. The renminbi was steady versus the USD, rising 0.4% in the week to close at 6.461, while policymakers are trying to limit the strong appreciation (about +6.5% in 2020). AUD/USD closed at 0.7706 on Friday, trading near a three-year high as the country’s economic recovery from Covid-19 has gained momentum.

Next week main events

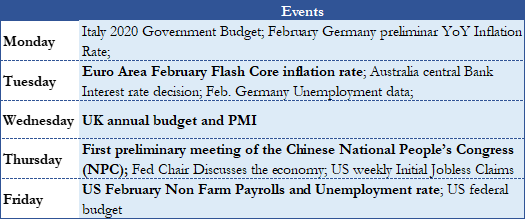

The following week is full of important events. On Tuesday, the Euro Area February Flash Core inflation rate will be released. On Wednesday, the Chancellor of the Exchequer will host the UK annual budget where he is likely to extend the jobs support program until May. On Thursday it will be the First preliminary meeting of the Chinese National People’s Congress (NPC), which will last 7 days and will offer info on future economic plans. China unveiled its annual GDP and other official targets at past NPC meetings, although last year it did not, because of the pandemic. On Friday, US February Non-Farm Payrolls and Unemployment rate will be revealed.

0 Comments