Context

Markets witnessed the second largest bank collapse in US history since the fall of Lehman Brothers in 2008, as SVB was taken over by regulators on the 10th of March. Since March 2022, the FED has frenetically increased its target fund rate in an effort to tame persistent inflation. As the economy contracted, the tech startups and VC funds that were SVB’s primary customers withdrew their deposits. SVB had no choice but to announce a $1.75bn capital raise on the 8th of March as it wanted to avoid selling its treasuries for a loss. This sparked a wave of withdrawals as investors became wary of the situation, causing the bank to file for bankruptcy two days later. US regulators decided to back non-insured deposits by issuing a “systemic risk exception” and announced the creation of a new funding facility that would allow banks to exchanged treasuries for 100% of their face value to prevent further bank runs and assure that banks had the liquidity.

In Europe, the banking instability environment alongside its series of important losses and scandals got the most of Credit Suisse which saw its stock plunge more than 30% last week, as Saudi National Bank announced it wouldn’t inject more cash. The Swiss Central bank failed to reassure customers and investors after it announced a $54bn loan to increase its liquidity, and an emergency merger had to be made with UBS during the weekend. This move prevented a wider banking crisis, but its terms remain debated because the wipeout of 17bn of AT1 bonds reminded investors that this asset could be written off in extreme scenario – questioning the seniority of debt over equity.

This brought back the spotlight on how medium-large banks had to be regulated and furthermore, in a period of high inflation, should the central bank focus on price or financial stability?

US

Markets traded higher Monday morning following a historic weekend of negotiations over the UBS-Credit Suisse deal. Indeed, investors looked past the ongoing banking crisis and eyed Wednesday’s FOMC meeting where a quarter point hike was now expected and was later confirmed. Markets reacted positively to the end of half-point hikes as the FED had to deal with a fragile banking sector that was lacking liquidity.

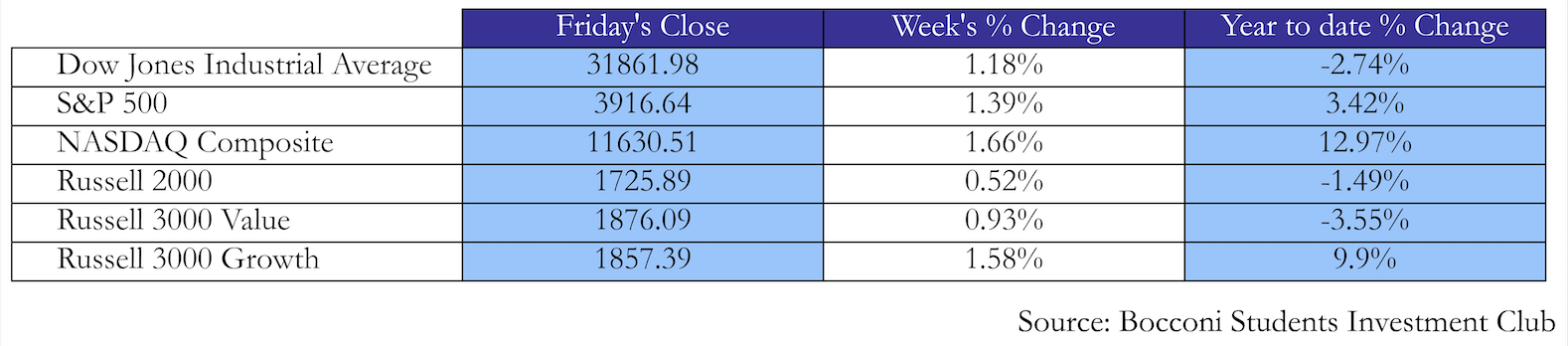

Every major US index had a positive week, starting strong and then correcting on Thursday after the FOMC announcement, finally recovering on Friday. The NASDAQ Composite leading the pack with a 1.66% weekly change, as they recovered from the strong labour market announcement of previous weeks. The S&P500 Index and Dow Jones followed closely with a WoW climb of 1.39% and 1.18% respectively. The Russell 2000 index saw a more modest climb of 0.52% for the week. This overall strong performance was propelled by investors expecting fewer hikes due to the ongoing banking crisis.

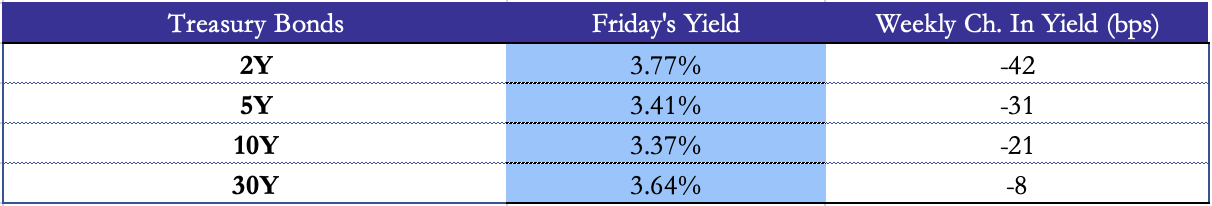

This can be seen with US Fed futures as the probability of a 50bp fell went from 78% on March 8th to almost zero a few days before the announcement, as the predominant view became a 25bp or no hike, with investors pricing a 73% of 25bp increase in rates at the start of the week. Following the FOMC meeting, the FED unanimously decided to lift its federal fund interest rate to a new range of 4.75%-5.00%, the highest level since 2007. This was justified as they described the US banking system as “sound and resilient” but were still uncertain of the extent at which the failure of SVB and Signature bank would affect the economy. A strong signal that initially sent equity markets up was that the FED was confident we were nearing the end of increase in rates, as the quote “ongoing rate increase” was replaced with “some additional policy firming may be appropriate” to bring back inflation to the 2% target. However, the dismissal from Powell that rates would be cut before the end of the year sent a negative signal to stock that erased their previous gains. The two-year treasury note contracted as investors priced in lower expectations of interest hikes.

The communication service was the strongest performing sector, with a 3.40% WoW increase, closely followed by energy, materials, and information technology, 2.29%, 2.12% and 2.04% respectively. This week’s worst performer was real estate with a decline of 1.38%, as the US mortgage rates fell for the second week straight, bringing the 30-year to 6.42%.

Focusing on the banking sector, the KBW Nasdaq bank index registered some early gains after a month of depreciation. On Monday, worries about a possible contagion were over as investors looked forward to the FOMC meeting. At midday trading, the KBW Nasdaq Bank Index rose 2.8% with some of its main actors leading the way with JP Morgan and Citigroup up 1.7% and 1.9% respectively. The banking sector then suffered more 7% losses as the week unraveled, as Janet Yellen, US secretary of the treasury commented that she will not assure all deposits. Yellen said regulators aren’t looking to provide “blanket” deposit insurance. She then tried to play down her comments, but this didn’t prove efficient as the banking index continued to plunge. An interesting debate will play out in the coming weeks as the congress debates whether to lift the $250,000 FDIC insurance. Today, deposits are insured above this amount only if the bank’s failure is deemed a “systematic risk”.

Bond yields across the curve dropped as investors lowered their expectations for interest rate hikes due to the more fragile than expected financial system, with the most significant move found with the 5-year note.

Some worries about continued Fed’ hikes however were spurred Thursday’s unemployment claims announcement, showing the continued resilience of the US labour market, which saw weekly jobless claims come at 191,000, with a 4-week moving average under 200,000. An increase in the ISM Manufacturing PMI to from 47.3 to 49.1, beating market expectations of 47, coming as a sign that inflationary pressures. The ISM services PMI rose from 53.8 in March, from 50.6.

Accenture rallied 6.9%, making it one of the top performers in the S&P 500, after the consulting firm said it planned to axe about 19,000 jobs over the next 18 months.

EU

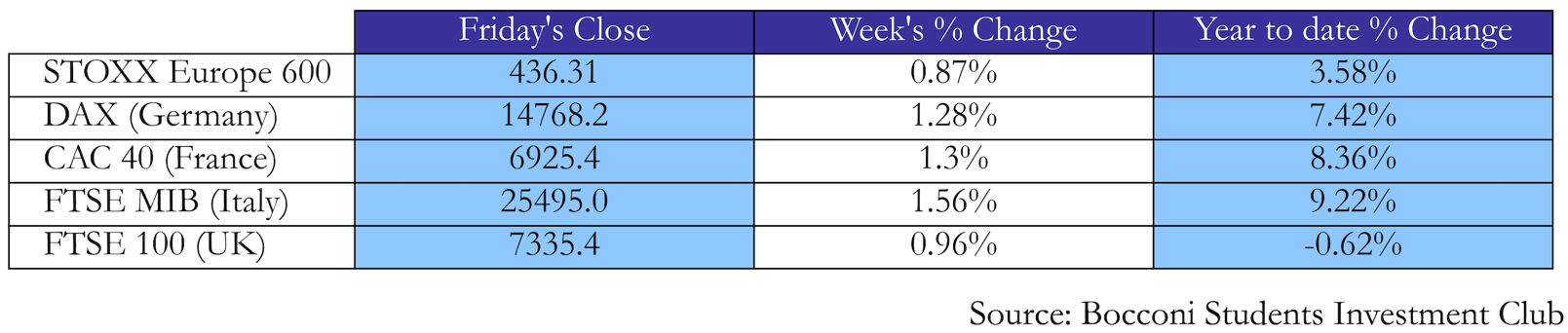

European stock markets extended their gains in the beginning of the week as investors were reassured from the regulatory moves to contain contagion risks in the financial system. Stoxx 600 Banks index rose 5.1% on Tuesday, partly recovering previous week losses. Major indices were following their US peers with the CAC 40 up 1.3%, the Dax up 1.28%, and the FTSE 100 in the UK up 0.96% for the week. Observing the effect of the FOMC decision of European stocks, we see that markets struggled for a direction after the FED’s announcement with the region wide Stoxx 600 gaining 0.2%, while the CAC 40 finished 0.3% up.

After a weekend long of negotiations, the Swiss Central bank unexpectedly hiked its target rate by 50bp, in an effort to signal stability and strong commitment to reduce inflation pressures even as the country faces financial instability. The decision to write-down 17bn of Credit Suisse AT1 bonds sent waves across the markets as investors rebalanced the risks of this specific assets. EU and UK regulators sent out a statement during the week to assure that debt seniority will be respected under their jurisdictions, to reassure investors. On Monday, UBS wiped-out losses of 14%, trading 2,3% higher after the merger over the weekend with Credit Suisse and was up by more than 20% mid-week.

On Wednesday, UK inflation jumped unexpectedly to 10.4% in February, with core at 6.2%. This motivated the BoE to increase its target rate on Thursday by a quarter point to tame inflation down. ECB’s president Christine Lagarde warned against “tit for tat” dynamic between workers and company that militate for higher wages and margins, pushing inflation pressures even higher. Analyst still expect more hikes to come as it still has to catchup compared to its transatlantic peers who are only expect one more hike.

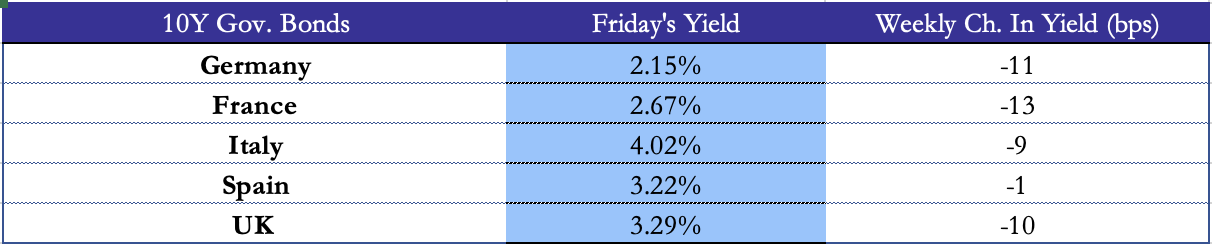

On the EU bond market, yield on the 2-year gilt were down 21bps, reaching 3.25% while the 10-year bond was less impacted, down 9bps after the BoE’s decision. Spreads across the yield curve, against the German benchmark, were down between 10bps and 20bps during the week.

European consumer confidence was down 10bps from the previous month, signaling the still important impact of energy prices, that are then repercuted on to a wider range of consumer products. On the outlook for the coming weeks, it’s important to keep an eye out for future labor market announcements across the EU which will guide the ECB in its coming decisions. Looking back, it could have been a better decision to start hiking its rate earlier, before than inflation had become “sticky”. The effect of Biden’s IRA could also play a role, as the EU will announce it’s the coming week its plan to boost green investment in the region, in an attempt to retain all major corporations who already have announced plant constructions in the US. How will the monetary policy play a role it this it still left to be determined, but it is essential not to be counterproductive with increases in rates and an expansionary financing solution.

Rest of the World

In Asia, market woke up to news of the deal and shares in major bank fell as investors and wealth managers reconsidered the risks of AT1 debt. “It is a wake-up call to investors that AT1 bonds carry real risks of being written off in extreme scenarios, which is also the purpose of having such bonds,” said Gary Ng, senior economist at Natixis in Hong Kong. Shares in HSBC declined 7.1% on Monday before recovering during the week.

Hong Kong’s Hang Seng Index started slowly but ended up with gains nearing 3%, while its Japanese and mainland China counterparts closed the week with gains of 1.73% and 1.71% respectively. Markets having already priced the Chinese reopening, the attention was focused on the US-European banking crisis and the FED’s FOMC announcement.

On Thursday Toshiba has accepted a $15bn buyout offer from a group of Japanese consortiums, setting the group on a path to become private. The flash manufacturing PMI was announced at 47.4, from 48.9 in the previous month.

Japan’s core-core inflation, which excludes food and energy price but includes alcohol, surprised the market as it came higher than expected at 3.5%. Along with an average increase of wage of 3.8% at all major companies, this will challenge the BoJ ultraloose monetary policy. Japan Chief economist at UBS is arguing that “The pass-through [from wholesale prices to consumer prices] that did not happen last year is now occurring.” Markets now turn to see how Kazuo Ueda will respond to this, as the predominant view is that the BoJ will release the yield curve control policy later in June or July.

On Tuesday, Canadian February CPI data came out at 5.2%, announcing a decrease from January’s 5.9%.

Australian’s main equity index lost 0.32% weekly, supported by a sharp drop in the flash manufacturing PMI, from 48.7 to 50.5 on the previous month. Turkey and Mexico led the way in the emerging markets sectors, with their main equity indexes up 3.04% and 2.84% respectively. Brazil’s equity index, Bovespa, contracted with losses of 1.9% WoW.

FX & Commodities

Sterling strengthened 1.9% this month against the dollar as BOE increase in its target rates by a quarter point, while ECB president’s warning again increases in wages and profit margins sent the euro up 0.9% to its strongest level since early February. Dollar fell to the euro as investors expect more hikes from the ECB in the coming months.

Spot gold prices fell 1.3% midweek before recovering from its losses on Friday, after briefly touching their highest level since March 2022 on Monday.

Something to look out for in the coming weeks in how the copper price is going to evolve with the Chinese reopening, as it recently fell because of fears of still increasing interest rates. The general 6-month trend shows an increase of 25% of its futures.

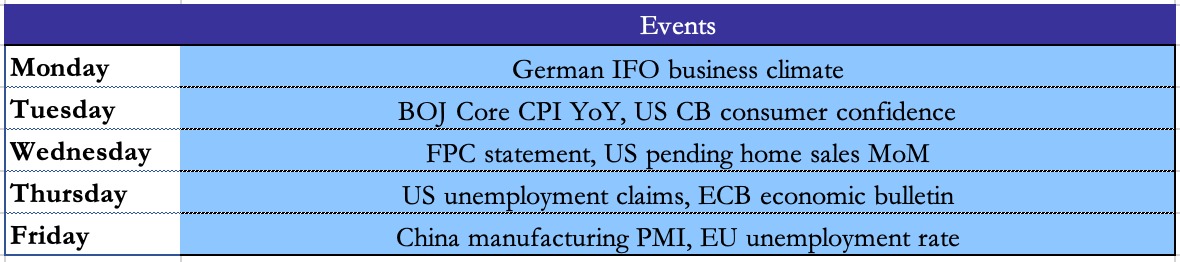

Next Week’s Events

Brain Teaser #37

There is a tribe of perfectly logical people living on an island when a visitor comes with a strange order: All the blue-eyed people must leave the island as soon as possible. There will be a flight out at 8 PM every evening. Each person can see everyone else’s eye color, but they do not know their own (nor is anyone allowed to tell them). Additionally, they do not know how many people blue eyes have, although they do know that at least one person does. How many days will it take for the blue-eyed people to leave?

Solution: Assume that there are n people on the island and c of them have blue eyes. We are explicitly told that c > 0. If c = 1, exactly one person has blue eyes. The blue-eyed person should look around and realize that no one else has blue eyes. Since, he knows that at least one person has blue eyes, he must conclude that he is only one who has blue eyes. Therefore, he would take the flight that evening. If exactly two people have blue eyes they would see each other but would be unsure whether c is 1 or 2. They would know from the previous case that if c = 1, the blue eyed-person would leave on the first night. Therefore, if the other blue-eyed person is still there, he must deduce that c = 2 which means he himself has blue eyes. Both men would then leave on the second night.

As we increase c, we can see that this logic continues to apply. If c = 3, then those three people will immediately know that there are either 2 or 3 people with blue eyes. If there were two people, then those two people would have left on the second night. So, when the others are still around after that night, each person would conclude that c = 3 and that they, therefore, have blue eyes too. They would leave that night. This same pattern extends up through any value of c. Therefore, if c men have blue eyes, it will take c nights for the blue-eyed men to leave. All will leave on the same night.

Brain Teaser #38

Nine mathematicians meet at an international conference and discover that among any three of them, at least two speak a common language. If each of the mathematicians speak at most three languages, prove that there are at least three of the mathematicians who can speak the same language.

Source: USAMO 1978

0 Comments