USA

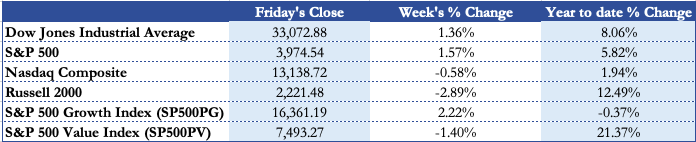

Another whipsaw week in the American markets as investors have weighed signals that the U.S. economy is primed for a spell of rapid growth against concerns about rising bond yields and over concern on the Suez Canal debacle. Wall Street’s main indexes broadly rose on Friday with technology, energy and financial stocks providing the biggest boost as investors bet on what is expected to be the fastest economic growth since 1984.

The Nasdaq composite closed the week down 0.58% after a pullback of almost 2%. The Nasdaq had to battle weakness in biotechs and relative weakness in some major components such as Tesla. Higher yields have posed a particular problem to shares of technology companies, calling into question their current valuations when much of their profits won’t materialize for some time. Several semiconductor stocks outperformed in the Nasdaq 100. Energy stocks jumped 1.3%, tracking a boost in crude prices after a giant container ship blocking the Suez Canal spurred fears of a supply squeeze. The S&P 500 value index, which includes energy, banks and industrial stocks is still outperforming growth shares more than 20%, but this week closed negative -1.40%, while growth stocks bounced back 2.22%.

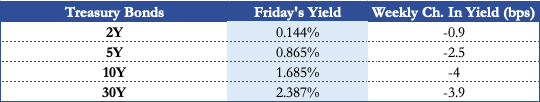

The 10-year yield has retreated from recent highs above 1.7%. That may be in part because pension funds are rebalancing their portfolios heading into the end of the quarter by buying bonds, as Ms Hutchins, head of real return investments at Newton Investment Management, said. “We’ve had a massive move in the 10-year yields since the start of the year,” Ms Hutchins said. “Right now, the market is sort of digesting that move.” She thinks 10-year yields can rise to 2% without causing serious difficulty for shares. Despite closing negative for the week, yields moved higher at the end of the week after the US Treasury department struggled to sell $62bn worth of seven-year securities. Jason Draho, who directs asset allocation for UBS Financial Services in the Americas, now sees “a legitimate possibility” that the U.S. economy may break out of the low growth, low inflation, low-interest rate paradigm that became entrenched after the financial crisis. For now, market pricing reflects expectations that a bounce in inflation much above 2% will prove temporary, he says. But “these views will likely change if the Fed and the Biden administration don’t take their feet off the gas pedal.”

The 10Y yield closed lower at 1.685% on Friday, the 2 year was stable at 0.144% during the week, while the 5-year yield fell back to 0.865%.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, dropped 1.0% last month after rebounding 3.4% in January, the Commerce Department said on Friday. Personal income tumbled 7.1% after surging 10.1% in January. Economists polled by Reuters had forecast consumer spending decreasing 0.7% in February and income declining 7.3%. On Thursday, Federal Reserve Chairman Jerome Powell hinted that the central bank would eventually roll back its support for the economy. Data released by the Labor Department on Thursday showed that the number of jobless claims filed last week also fell below 700,000 for the time since the coronavirus pandemic began just over a year ago.

Europe and UK

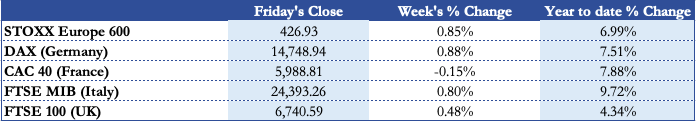

European stocks ended the week close to all-time highs, with miners prominent as investors shrugged off worries about the third wave of coronavirus infections and focused on prospects of a solid global economic recovery. STOXX 600 index rose 0.85% with Friday close, just enough to register its fourth straight weekly rise and seven points short of a record high. Mining and oil & gas stocks gave the biggest boost to the index, while defensive sectors including healthcare and utilities were slightly down. Trading earlier in the week was subdued by worries about new lockdowns and a slow pace of vaccination in the eurozone, but optimism about a stimulus-driven recovery in the United States brightened the outlook for global growth. The London markets jumped higher as sentiment improved at the end of a turbulent week for traders. UK investors were calmed by February’s retail sales figures which unveiled a partial recovery, with sales volumes jumping 2.1% against the previous month although were still 3.7% below the same period last year. Michael Hewson, chief market analyst at CMC Markets UK, said: “European markets have finished a rather choppy week very much on the front foot, despite concerns about extended lockdowns in Europe, tighter restrictions between France and Germany, and the added wrinkle of the blockage in the Suez Canal”

From bond yields to stock prices, European investors are pricing in the potential for months of lost productivity and consumer spending due to a third wave of infections. At the heart of the issue is that Europe is failing to combat the pandemic, while the U.S. is on track for normal life to return within months. The clearest way to see the U.S. and European divergence is via the bond market. Treasuries are pricing in faster economic growth, while German bonds reflect demand for the safest debt and heavy central bank support, causing the yield gap to widen to 200 basis points. The European Central Bank stepped up this month to support the eurozone debt market in an attempt to ward off a rise in borrowing costs against the backdrop of a slower recovery in Europe. The ECB quickened its bond purchases to hold down the rise in yields, which the central bank’s president Christine Lagarde said could “translate into a premature tightening of financing conditions for all sectors of the economy”.

On Friday the German 10Y Government closed the week at -0.344%, a weekly decrease of 4.3bps. The UK 10Y Gilt closed at 0.758%, decreasing from last week’s top of 0.908, but still +55.6bps YTD.

On the data front, U.K. retail sales partly recovered in February, with sales volumes increasing by 2.1% month-on-month, in line with economist expectations. Germany’s Ifo Institute business climate index rose to 96.6 in March from 92.7 in February, outstripping analyst expectations to show sentiment at its highest level in almost two years.

EU leaders on Thursday voiced grievances over a shortage of contracted deliveries of the AstraZeneca vaccine as the continent faces a third wave of infections. The spike in infections has kept stocks on the back foot for much of the week but hopes of a stimulus-driven economic rebound in the U.S. have offered a boost to the global growth outlook. Frustration has grown over the sluggish vaccine roll-out. Around 10% of Germans have received at least a first dose, but this is far lower than the United States, Britain or Israel.

Britain and the European Union agreed to a new post-Brexit financial services pact on Friday that will allow them to co-operate on regulation, but Brussels has said the MoU will not automatically lead to Britain’s large financial industry being able to sell a wide range of products and services to EU clients again. Industry experts said while the framework was useful, it was unlikely to rekindle anything like the kind of access banks and brokers had to the EU before Britain left the bloc.

Rest Of The World

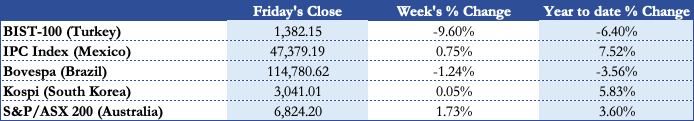

Asia Pacific stocks were up Friday, as raised hopes for an economic recovery from COVID-19, boosted by a U.S. pledge to double its vaccine plan, helped to end the week on a high note. Japanese shares closed higher on Friday, with SoftBank leading the gains on the Nikkei index, but still down more than 2% for the week as the Tokyo Core Consumer Price Index (CPI), released earlier in the day, slowed its annual pace of decline for a third consecutive month. The CPI fell 0.1% in March, a small drop that the 0.2% fall in forecasts prepared by Investing.com and above February’s 0.3% drop. The Nikkei share average ended at 29,176.70, while the broader TOPIX declined to close at 1,984.16. Nikkei heavyweight SoftBank Group rose 1.8% Friday, making it the biggest contributor to the index, followed by chip testing equipment maker Advantest, which jumped 4.65%.

China shares rose on Friday as consumer firms rallied on buying from overseas investors, although major equities remained well below recent highs due to concerns over gradual policy tightening. Hong Kong’s Hang Seng Index ended higher on Friday supported by gains in technology companies, but rising tensions between the West and China led the benchmark index to post losses for the week. The European Union joined Washington’s allies this week in imposing sanctions on officials in China’s Xinjiang region over allegations of human rights abuses, prompting retaliatory sanctions from Beijing. The World Bank’s East Asia and Pacific Economic Update also said that China is expected to lead the economic recovery of East Asian and Pacific economies from COVID-19 in 2021. The report predicts that China’s economy will expand by 8.1% in 2021, compared with 2.3% in 2020. At the close of Friday, the Hang Seng index was up 436.82 points at 28,336.43, after finishing at its lowest close since Jan. 11 a day earlier but slipped 2.26% for the week. China’s main Shanghai Composite index closed up 0.40% at 3,418.33 points, while the blue-chip CSI300 index ended up 0.62% for the week.

Mexico’s IPC closed to 47,379 on Friday and booked a 0.75% weekly gain, as declining Covid cases and the arrival of millions of vaccine doses nudged sentiment. On Friday, officials announced that the 2.7 million doses of the AstraZeneca vaccine coming from the United States will be completely delivered by Thursday. On Thursday, Mexico’s central bank held the benchmark interest rate unchanged on 25 March 2021 after cutting it by 25 basis points in the February meeting, matching market expectations. Brazil’s Ibovespa added 1040 points or 0.9% on Friday but closed negative for the week, as softer inflation in the US and laxer bank regulation nudged sentiment. On the domestic side, the Lower House approved the country’s 2021 budget, with a reallocation of more than 25 billion reais, of which a large part can be used in parliamentary amendments. On the pandemic side, Brazil registered over 97 thousand coronavirus cases in the last 24 hours. The Australian share market added 0.5 per cent on Friday to cap its best week in seven, gaining in four of the past five sessions despite the lack of an obvious lead. Local equities started the week in the shadow of wider European COVID lockdowns and a ricocheting oil price, however, the blockage of the Suez Canal by a giant container ship saw these demand concerns give way to supply issues.

Fx and Commodities

Reeling from the blockage in the Suez Canal, shipping rates for oil product tankers have nearly doubled this week, and several vessels were diverted away from the vital waterway as a giant container ship remained wedged between both banks. The 400-meters long Ever Given has been stuck in the canal since Tuesday and efforts are underway to free the vessel although the process may take weeks amid bad weather. Despite this, Brent crude pulled back more than 6% this week, currently down -0.22%. WTI, following a similar pattern, is currently down -1.02% for the week. The Covid-19 situation in Europe and potentially India, along with a dearth of Asian buyers capped oil prices while supported by the Suez Canal blockage and bargain hunters on the dips. The net result is a very wide and choppy range.

Gold prices gained slightly on Friday but a stronger dollar and a rise in U.S. Treasury yields put the metal on course for its first weekly decline in three weeks. Spot gold edged up 0.3% to $1,732.11 per ounce by but it was down 0.8% this week. Gold’s modest loss came after a firmer dollar and an uptick in benchmark yields, which have weighed on its appeal recently. Bitcoin is down 4.51% this week, after bouncing back from 50.360$

On the currency side, the dollar was roughly flat against major currencies on Friday, but still near four-month peaks, on continued optimism about the U.S. economy, and came close to surpassing a 10-month high against the Japanese yen. Dollar Spot Index stood at 92.72, on track to close out the week with a gain of about 0.7%. It was shrugging off data showing that consumer spending recently fell. USD/JPY also rose as high as 109.80, roughly the highest since June. The pound rose strongly against the dollar Friday on economic data showing U.K. retail sales rebounded last month, but the cable is set to end a second-straight week in the red as experts flag speed bumps ahead but GBP/USD still down -0.56%, to $1.3781 for the week.

EUR/USD has dropped back to 1.1793, down -0.91% for the week. Just as strong PMI data earlier in the week did, Friday morning’s stronger than expected German IFO survey has failed to inject much by way of recovery impetus into the euro on Friday. AUD/USD is down -1.24% for the week at 0.7641.

3 Biggest Movers

SPDR S&P Metals & Mining ETF (XME), an exchange traded fund that tracks an array of U.S. mining stocks and metals stocks closed the week flat, after a 10% pullback followed by an equal rally. The gains for the ETF and other mining stocks come with a broader economic rebound from the coronavirus pandemic. As the economy reopens, some investors are betting demand for metal materials, and demand for more such materials to be mined from the earth, will recover with it.

R H (RH), which operates 68 retail stores in 39 states and Canada offering hardware, bathward, furniture and lighting closed the week +12.41%, after surging 9.28% on Friday. Wednesday afternoon, Luxury home goods retailer RH beat views and gave a rosy outlook. It posted Q4 EPS of $5.07 on sales of $812.4 million. Comps grew 29%, and RH core demand jumped 36%. RH sees Q1 sales growth of at least 50%, well above consensus views for 27.3%, and 2021 revenue growth of 15%-20%, above consensus for 10% growth

Tencent Music EntGrp ADS (TME), China-based company that provides online music entertainment platform and music-centric services, sold off 33.93% this week, after being down almost 50%.Even though the company reported quarterly results in line with estimates, Tencent Music and many other Chinese internet stocks plunged. Beijing reportedly will push internet firms to share their customer data with a government joint venture. Meanwhile, the SEC adopted a new U.S. law that force Chinese firms to delist from U.S. stock exchanges unless they comply with American accounting standards.

Next week main events

The main events of next weeks are the following. On Monday, in addition to Fed Waller speech, the U.K Mortgage approvals for house purchase will be released with a forecast of 95k. On Tuesday, it will be released both the Germany Inflation Rate YoY forecasted at 1.7% and the American CB Consumer Confidence. On the 31st of March, both the NBS Manufacturing Purchasing Manager Index will be released, expected to be 51, followed by the U.K. GDP Growth Rate YoY Final (Q4) expected at -7.8%. In Germany, the unemployment rate will be released, excepted at 6%. The week will close with the release of the U.S.A Manufacturing ISM Report on Thursday and the Unemployment rate on Friday, expected at 6%.

Brain Teaser #1

Ten alumni of the BSIC Markets division are getting together for an annual alumnus meeting in London. They are curious to find the average bonus of the group. Nonetheless, being cautious and humble individuals, everyone prefers not to disclose their reward to the entire group. Can you help them find a strategy to calculate the average bonus without knowing other members’ figures?

Solution:

One alumnus can choose a random number X and tell it to his/her colleague, who adds his bonus (B2) to it and obtains X + B2. This colleague tells the obtained figure to another one, who repeats the process and gets X + B2 + B3. Afterward, the previous procedure is followed by all alumni until it reaches the last one, who after adding his/her reward, has the sum of X + B2 + B3 + … + B10. He/she will give this number to the first alumni, who will do the last operation and obtain X + B1 + B2 + … + B10. In the final step, the random number X will be subtracted from the sum, and this “real” total will be divided by the number of participants – 10. So, we have just calculated the average bonus of the group without knowing a specific one.

NB: This is just one possible solution, as the problem can be approached in various ways.

Brain Teaser #2

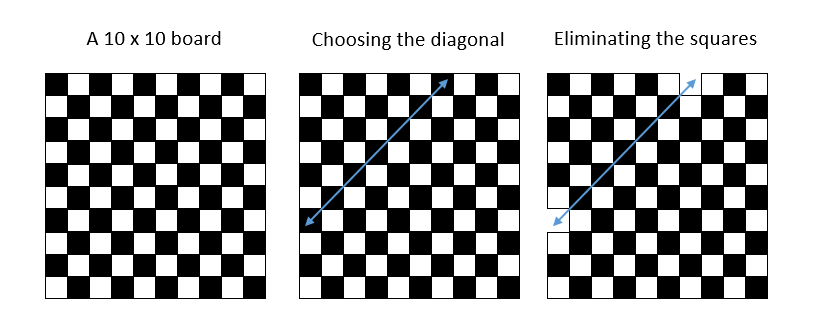

There is a board with 2N x 2N squares, where N is a natural number. We choose one random diagonal from it, and then we eliminate one square from each end. Thus, we now have a board with two missing squares, i.e., 4N2-2 squares. Is there a way to cover this board with 1 x 2 tiles (a rectangular that covers two squares), given that we can place them both in a horizontal and vertical position?

Hint: Below you can find an example for N = 5 of the steps previously described.

In the next Market Recap, we will provide the solution to the Brain Teaser #2

0 Comments