US

On Thursday, and parts of Friday, US markets were closed due to Thanksgiving. This was the driving force behind the lack of liquidity and uneventfulness of the week in both the primary and secondary markets.

The Nasdaq and the Russell 3000 Growth index were the only indices to start the week on a negative note but gained ground back on Tuesday and Wednesday in order to finish the week with a 0.72% and 1.18% WoW change, respectively. The best performing index of the week was the Russell 3000 Value index which had a weekly change of 1.83%. The Dow Jones Industrial Average ended the week with similar gains, now trading at a new six-month high. The S&P 500 enjoyed a good week with consistent gains which totalled up to a weekly change of over 1.5%. Performance this week was aided by the stance taken by the Fed, apparent in Wednesday’s minutes, which revealed most officials are supporting a less aggressive approach on rate hikes. This piece of news encouraged investors straight away, as all indices shot up on Wednesday afternoon.

The best performing sectors of the week were utilities, up a staggering 4.90% WoW, retail, up 4.14% and basic materials with a gain of 3.37%. In contrast, the sector that performed worst during the last week was energy, taking a hit of 1.30%.

Some signals of economic contraction were visible, as jobless claims came 15,000 higher than expected, and counting claims hit eight-month highs. Somehow counterintuitively, the market reacted positively to these ‘bad news’ as they continue to be perceived as a signal that the Fed’s aggressive policies are starting to have an effect, and that the end of the rates hike tunnel is in sight. This rally might have short legs, as in two weeks, CPI release and FOMC meeting happen on consecutive days (Dec 13th and 14th). It is probable that if CPI results are encouraging, the FOMC will try to tame the markets, underlining how their 2% inflation target is still very far away and rates will have at least another 125 bps to go, in order to keep the economy under control.

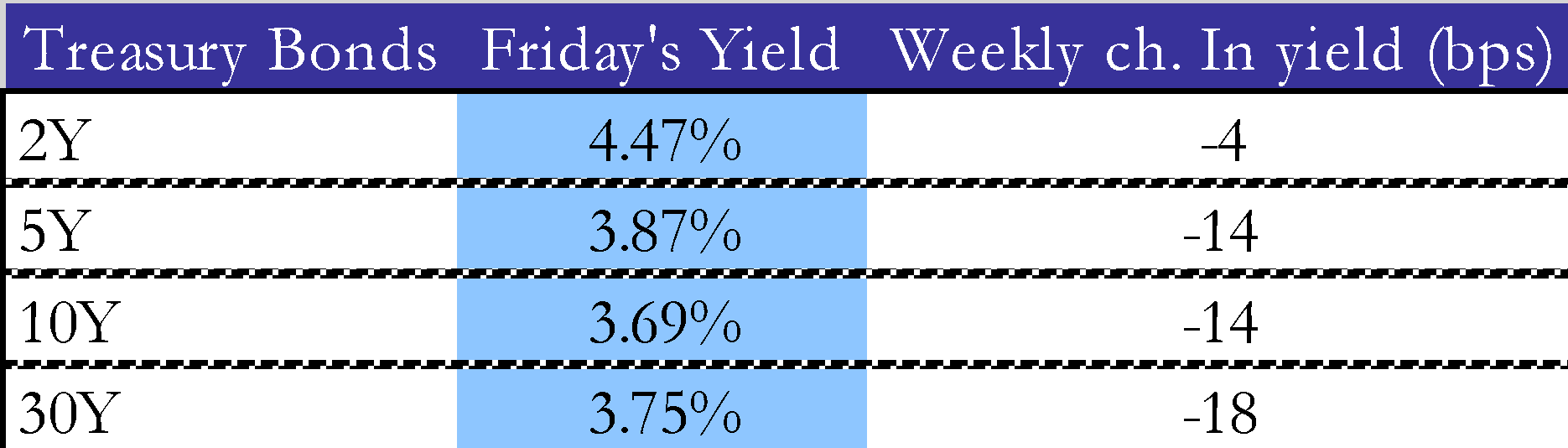

During the last week, yields fell across the board and Treasury prices rose in sessions characterized by low liquidity due to the holidays. The policy sensitive 2Y point was flat before Wednesday’s FOMC minutes and saw a dip in their yields after the somewhat positive conclusions that were reached.

In other fixed income news, investors pumped 16$ billion in US corporate bond funds, as a result of the apparent loosening of inflationary pressure. Investors hope that yields will start to descend, triggering the bond market’s possible overperformance in the next months.

Overall, bond markets primary volumes continue to be depressed reaching $1.23tn (vs. $1.45tn last year) YTD. 2022 is already the record year for days that have seen no new issues at all, surpassing 2008 as the year with most days of primary markets being shut, this underscores investors reticence in buying bonds in periods of high rates volatility.

Major earnings releases of this week included DELL, HPQ, DE and ZM.

DELL crushed their Q3 ’22 earnings expectations, as they reported an EPS of $2.30, compared to an estimated $1.61, which caused the stock to jump 7% in the aftermarket. This result came as a result of supply chain improvements. The sustainability of the new stock price is subject to management’s commentary on the earnings report, which will be crucial considering the difficult year DELL has experienced, compared to major indexes.

HPQ also enjoyed a positive earnings call, beating EPS and revenue by 1.50% and 0.85%, respectively. Alongside the announcement that it will lay-off 10% of its workforce in the next 3 years, these two factors contributed to a 3.1% premarket rise on Tuesday.

These stock jumps have been one of the few positives in the difficult year the computer industry has suffered, amidst declining demand.

ZM greatly surpassed their EPS predictions by over 27%, while revenue met consensus expectations. Nevertheless, the company still struggles to fit in a post-pandemic economy, as shares tumbled 7% in the aftermarket following the earnings report. Zoom will continue to face a difficult period as customers declined 9% since the last quarter.

DE also came out with strong numbers and a solid quarter on the back of receding supply chain concerns. Quarterly EPS came out as $ 7.44 beating consensus of $7.08. This compares to earnings of $4.12 per share a year ago. This continues to support the tremendous performance of the stock across the whole year.

EU

On Tuesday, the European Commission’s Flash Consumer Confidence Index rose to -23.9 in the eurozone, and to -25.8 in the EU for a respective MoM increase of 3.6 and 2.8 points. Although the data exceeded consensus expectations by about 1.5 points, it is still well below its long-term averages, so the long-term economic gains that can be expected from such figures are still marginal, especially considering the ongoing macroeconomic environment the continent is experiencing.

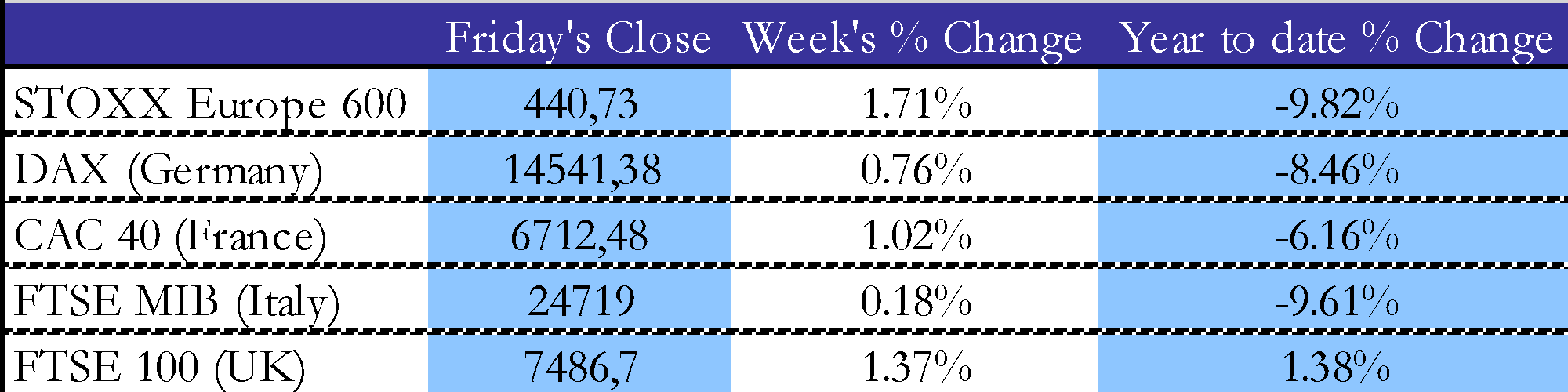

Stocks reacted to this positive piece of news accordingly, as the STOXX Europe 600 rallied during the whole week, closing 1.82% higher than the previous. The largest gains in the continent were made by the UK’s FTSE 100 which is up 1.37% WoW, while Italy’s FTSE MIB underperformed its peers with a weekly gain of a mere 0.18%. The DAX and the CAC 40 concluded the somewhat uneventful week with mild gains of 0.76% and 1.02%, respectively. Another factor which helped European stocks hit three-month highs was the better-than-expected German business confidence index which gave investors the hope of a gentler fall in the continent’s largest economy. Overall, European stocks had a similar performance to their counterparts over the pond.

More positive news flooded the continent on Friday as Germany’s economy expanded 0.4% quarter on quarter and 1.3% on the year, results which narrowly beat consensus predictions. The economic expansion was mainly fuelled by an increase in household spending, as almost all COVID restrictions have been lifted, resulting in greater expenditure.

Notwithstanding, the duration of the rally that Europe has enjoyed the last couple of months is very much in question as ECB’s Holzmann is favoring 75-bps increase in December in order to counter inflation, which hit a staggering 10.6% in October, amidst high food and energy challenges stemming from the Russia-Ukraine conflict. He remarked that there are “no signs” that price pressure is easing.

In contrast, a Bloomberg report stated that following this week’s ECB meeting, the intensity of rate hikes will decrease. This has resulted in a lower repricing of implied volatility, which remained high, amid the macroeconomic turmoil that surrounded Europe. “This is typical when the end of the rate cycle is in sight” concludes Bloomberg.

Another major event which transpired this week is that London dethroned Paris as the biggest equities market in Europe after having lost the title just 10 days earlier for the first time in history. The initial shift came as a result of the falling Pound since the Brexit, and great optimism over French stocks, however a midweek Pound rally turned the tables back in London’s favor.

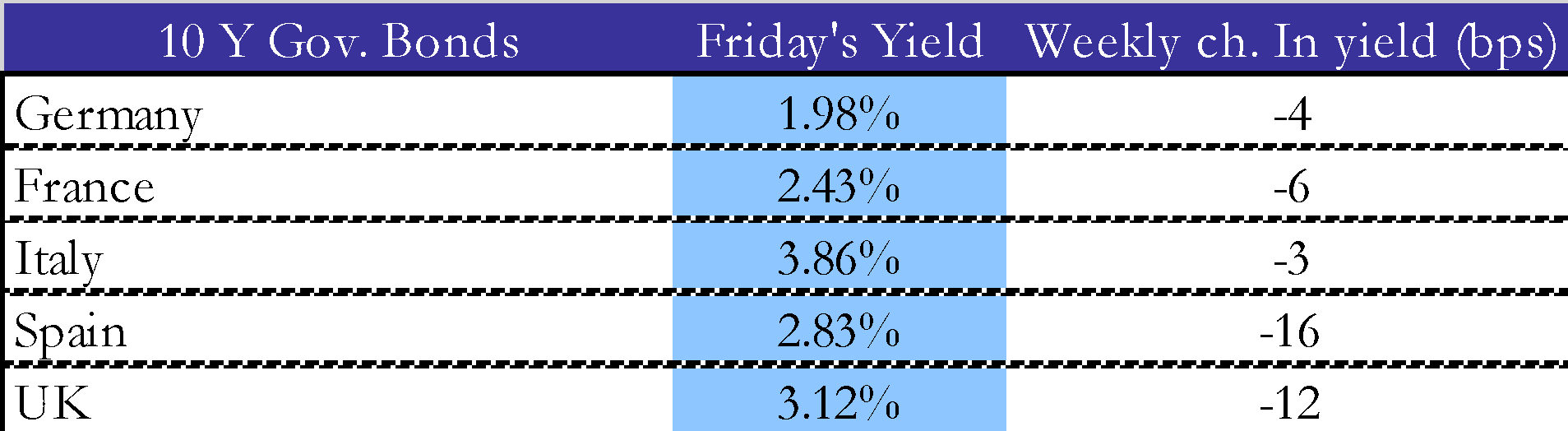

The Spanish 10-year government bond saw the biggest decrease in yields, losing 16bps in the last seven days, while its Italian and German counterparts were more rigid, losing less than five basis points each. The UK 10-year bond was also a big mover with a WoW variation of 12 basis points, with France settling for a happy medium of a 6bps decrease. The rally continues to support the idea of a more dovish approach of the ECB to rates and the possibility of the central bank thinking about different instruments other than its policy rates to fight inflation.

Primary market activity continues to be subdued with both corporate and government bonds activity winding slowly down ahead of the year end.

Rest of the World

On Monday, the People’s Bank of China kept their 1Y Prime Loan rate at 3.65%, and their 5Y rate at 4.3%. It is the third consecutive month that these key lending rates have remained unchanged. These measures come as a consequence of the conflict China has between spurring an economic rebound, and widening its monetary policy compared to western economies. This will continue to be a difficult dichotomy to handle, due to the continued downward pressure that the yuan has suffered in the last several months and the rising COVID cases that have once again caused lockdown restrictions across the nation.

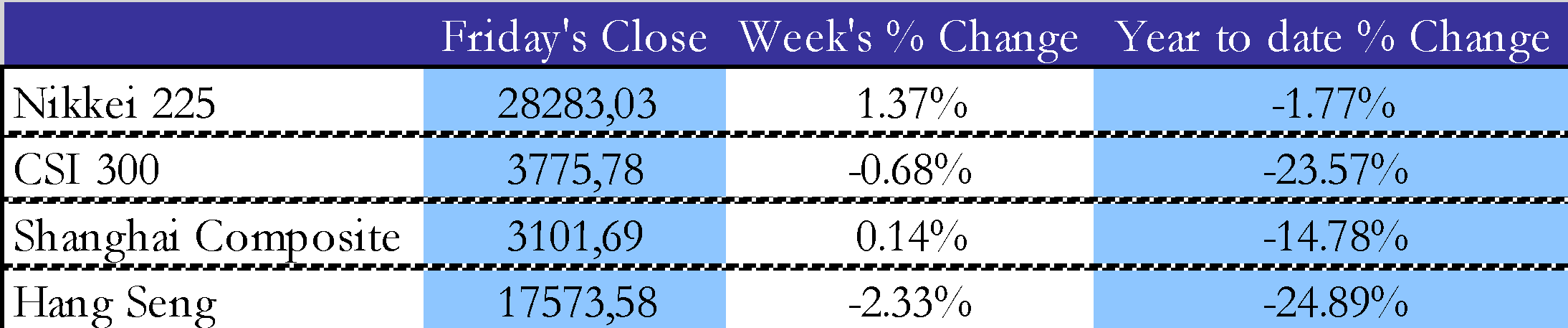

Asian Indices had very mixed performances. Japan’s Nikkei 225 led the pack with a 1.37% WoW gain, while Hong Kong’s Hang Seng lagged behind severely, losing 233 bps, following a tumultuous week for the city given the currency speculations we will comment below. On the other hand, the Shanghai Composite, and the CSI 300 made relatively small movements of 0.14% and -0.68% respectively, after the People’s Bank of China’s inactivity earlier in the week.

In other world news, Turkey is determined to continue their rate cutting streak in order to fulfill their “growth at all costs” strategy. The consequences of these measures have been dire, as they not only have helped to push inflation to over 85% but have also hampered the Turkish Lira. The BIST-100 shot up again this week, indicating a WoW increase of 7.68%, breaking new all-time high records for the index.

Mexico’s IPC Index moved very little during the last 7 days with a variation of only 19 bps. Similarly, Brazil’s Bovespa index remained practically unchanged from last week’s total with a small increase of 0.09%. Lastly, South Korea’s Kospi lagged behind all of them closing the week with a small loss of 0.27%.

FX and Commodities

On Wednesday, hedge fund manager Bill Ackman announced he had a “large notional short position” against the Honk Kong dollar. The main motivation behind his blockbuster move was his argument that the peg to the US dollar made no sense and was bound to break. Pershing Square’s boss sees the peg as an inconsistency, due to the large influence China has over Hong Kong. However, not all analysts and investors are siding with him, as they point to the ample reserves held by the Hong Kong Monetary Association as the pillars which could defend the peg in an eventual weakness. Bill Ackman’s announcement follows a prolonged period of softness for the Hong Kong Dollar, which has been trading around HK$7.85 for the past 6 months. This is significant as it is the low end of its US Dollar trading band.

The US Dollar continues to weaken against the Euro confirming the trend that every time the end of the rate cycle seems in sight, the American currency seems to suffer. We have seen the EURUSD surpass 1.04 during the week, approaching its 200-day moving average. Next stop seems to be 1.05, which commentators believe to represent an important resistance at the moment.

In Commodities news, the EU plans to ban Russian imports of crude starting from next month. Baltic Index rates for ‘dirty’ crude tankers are at an 18 year high, up to $110,000 per day. This will likely result in continued pressure on the supply side for the foreseeable future. In contrast, doubts over future demand continue to outweigh these supply issues, causing prices for oil to continue their descent. The global oil market continues to be influenced by the outlook for weaker demand, including from Asia, with the China COVID concerns casting doubts over consumption of the world’s biggest oil importer.

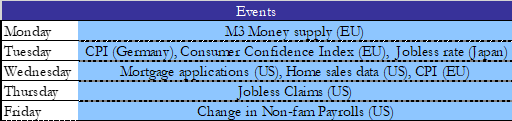

Next Week’s main events

Brain Teaser #32

Four dice are thrown. What is the probability that the product of the four numbers equals ![]() ?

?

Source: Dutch Mathematical Olympiad 1992

Solution: We can quickly determine that the only four-number combinations from 1 to 6 whose product is 36 take the following form:

![]() ,

, ![]() ,

, ![]() ,

, ![]() .

.

The elements in the first combination can be arranged in ![]() different ways. Similar reasoning can be applied for the other ones, obtaining

different ways. Similar reasoning can be applied for the other ones, obtaining ![]() ,

, ![]() , and

, and ![]() ways to arrange the dice for the second, third, and fourth basic combinations, respectively. Thus, the number of feasible combinations of four numbers ranging from 1 to 6 is

ways to arrange the dice for the second, third, and fourth basic combinations, respectively. Thus, the number of feasible combinations of four numbers ranging from 1 to 6 is ![]() . Any four numbers between 1 and 6 may be chosen in

. Any four numbers between 1 and 6 may be chosen in ![]() ways, hence the probability is

ways, hence the probability is ![]() .

.

Brain Teaser #33

A palindrome is a word that doesn’t matter if you read it from left to right or from right to left. Examples: OMO, lepel and parterretrap.

How many palindromes can you make with the five letters ![]() and

and ![]() under the conditions:

under the conditions:

– each letter may appear no more than twice in each palindrome,

– the length of each palindrome is at least ![]() letters.

letters.

(Any possible combination of letters is considered a word.)

Source: Dutch Mathematical Olympiad 2006

0 Comments