US

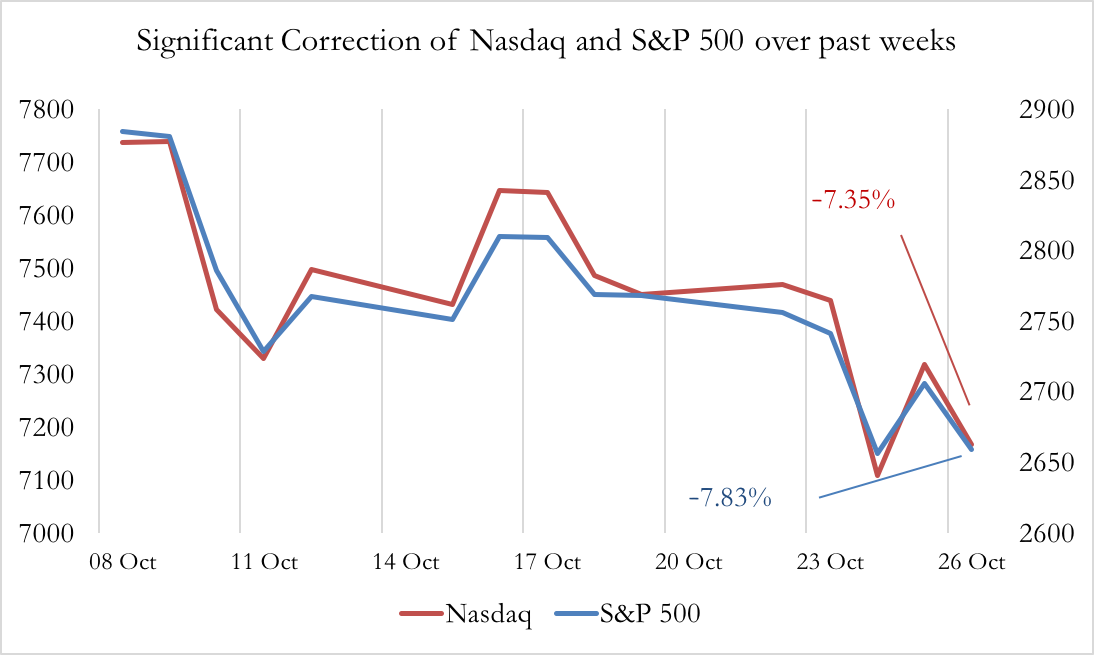

Even though the end-of-October rate increase to 2.25%, it did not catch the market by surprise, the markets experienced some turmoil in the following weeks. Since our last recap on 07/10/2018, there has been a significant correction in the major global indices, most prominently in the US, as you can see on chart below. By Friday 26th, Nasdaq and S&P 500 were down as much as -7.35% and -7.83%, respectively.

There are a number of reasons for this, among which higher expected inflationary pressures due to the imposition of tariffs on a global scale and a faster than expected growth rate of the economy (3.5% 3-quarter GDP growth vs. 3.3% consensus). In fact, these are expected to keep the interest rates rising, which in turn threaten to restrain spending and create a drag on new investment. In addition, the news of Trump’s intended withdrawal from the US-Russia Nuclear Treaty signed by Reagan and Gorbachev in 1987 might have been weighing on the market, albeit to a lesser extent.

USD was up 0.98% over the week, closing at 1.14 dollars per euro on Friday. Brent crude oil was down from 80.05 to 77.69, a change of -2.89%.

Next week, news of the October Manufacturing PMI is due on Thursday 1st, while on Friday some labour market data from October, including, the average hourly earnings, nonfarm payrolls and unemployment rate, will be published.

UK

No significant steps ahead have been made on another EU-UK summit in Brussels that took place on the 17th of October. Among others one of the stumbling blocks remain the dispute regarding the Northern Ireland – Republic of Ireland border. In fact, this last issue proves resolvable so far neither in the Cabinet nor in May’s Conservative party, the latter willing to potentially fire the current PM, according to Bloomberg. However, Japan’s Abe is welcoming UK to the TPP, should the talks with the EU end in no-deal.

FTSE 100 closed at 6939.6 on Friday and was lower -4% since 8 Oct, as the selloff spilled over from the US to global markets. The pound was down -1.87% over the week and closed at 1.28 US dollars on Friday.

On Thursday the 1st, the Bank of England’s interest rate decision is up, and is projected to remain at 0.75%.

Europe

The combined effect of international financial contagion and increasing tensions between the Italian Government and the European Commission brought down all stocks indices across the European region. The Eurostoxx 50 was down by 2,57% and, as expected, Italy’s FTSE MIB faced a sharp decline of 3,94% weekly performance due to a major sell-off in the banking industry. Also France, Germany and Spain followed the downward trend, as the CAC closed at 4.967,37 (-3,72%), the DAX moved from 11.665,68 to 11.200,62 (-4,00% weekly change) and the IBEX fell by 2,88% to its 8.680,6 weekly closing price.

Following last week’s Moody’s downgrade of Italy to Baa3, the BTP/Bund spread experienced large fluctuations, with a weekly peak at 339,1 and a weekly low at 285,3, but closed at 309,8 (-4,53%). Moreover, the 10yr Bund yield moved from 0,48% to 0,35% thus reflecting the investors’ “flight-to-quality” sentiment.

On Friday, Italy avoided a second rating downgrade in a week as S&P Global Ratings decided only to lower its outlook. Next week, data on Eurozone’s 3Q Gross Domestic Product and October’s CPI will be released.

Rest of the World

The renewed “flight-to-quality” sentiment affected almost every Asian stock market with the exception of the Shanghai Stock Exchange. Hong Kong’s Hang Seng Index fell by 3,70% and closed at 24.717,63; in India, the SENSEX Index moved from 34.416,24 to 33.349,31 with a weekly change of -3,10%; Japan faced a major sell-off on its equities and the Nikkei dropped by 5,32% from Monday’s opening at 22.374,21. China was the only country that showed an upward trend with the SSE that increased its price by 1,29%.

In Brazil, the IBOVESPA Index slightly increased from 84.221,85 to 84.993,16 during a highly volatile week. Run-off elections between J. Bolsonaro and F. Haddad will be held on 28 October 2018 and a far-right win may be the major market mover for the next week.

Oil prices are down for the third consecutive week due to the expectations of a supply glut. The Brent moved from $79,9 to $77,8 (-2,63%) and the WTI was down by 2,48%.

Next week the Bank of Japan will release its Outlook Report and will revise its monetary policy announcing its interest rate decision. Also, China’s Manufacturing PMI Index will be released.

0 Comments