USA

The US main index dropped sharply on Friday, after the Thanksgiving session, following a new Covid variant thread found in South Africa. “This variant has a large number of mutations, some of which are concerning,” the WHO said on Friday. The new variant is still under examination, but health experts are worried that the virus will be more transmissible, threatening unvaccinated people and making existing vaccines less effective. Concerns of a new infection wave are arising among investors, who shifted away from risk assets on Friday and triggered the equity sell-off.

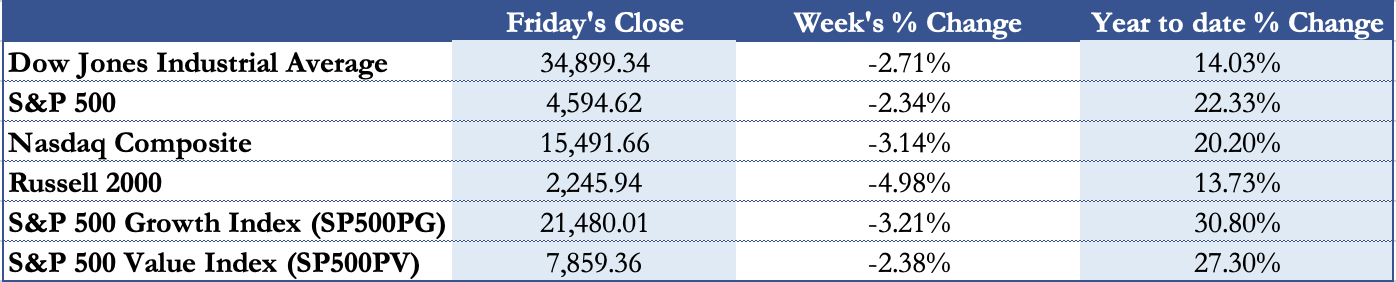

Equity is suffering the worst decline in months after investors have spent weeks positioning for an economic re-acceleration and higher bond yields. In the short post-Thanksgiving session, major indexes have all retreated to the one-month low. The worst performing index is the Russell 2000, which decreased by 4.98% to $2,245.94. Nasdaq followed suit, with a loss of 3.14%, as well as the Dow Jones and S&P500, which plunged 2.71% and 2.34%, respectively. However, US main indexes are still consolidating their double digits YTD performance, with S&P500 and Nasdaq outperforming others by holding respectively 22.33% and 20.20%. On Friday, investors dumped travel-related, energy, and financial stocks as the new variant of Covid emerged. In fact, the market has already priced in for the higher chance of travel restriction, more urgent vaccine programs, and possible lower economic activity, with airlines and energy stocks falling hard and pharmaceutical and biotech leaders rushing higher.

The shortened US trading session probably meant that trading volumes were thin in some markets, which amplified price fluctuations. The jitters were apparent in a broad array of closely watched market barometers. The Vix index, a measure of expected volatility in Wall Street stocks over the next month, rose 10 points on Friday to 29, the biggest increase since early 2021.

On Monday, Jerome Powell was appointed for another four-year term as the president of Fed, while Lael Brainard was promoted to vice-chair. Powell, a Republican, will likely win a smooth confirmation in the Senate, although progressive Democrats may be disappointed by the choice. US Treasury sold off after the news, as traders weighed the prospect of tighter monetary policy to curb inflation and expected the central bank to raise interest rates from near zero in June.

On Wednesday, the third-quarter economic growth results were released; the US economy expanded an annualized 2.1%, slightly higher than 2% in the advance estimate, but below forecasts of 2.2%. The economy’s weak summer performance reflected the slowdown in consumer spending as a spike in COVID-19 cases from the delta variant caused consumers to grow more cautious and made supply chains disruption the cause of the inflation surge. Two other events marked the US economy on Wednesday. US reported Core PCE Price Index, key inflation figure is up 4.1% YoY, marking the highest jump since January 1991, while US jobless claims plunged to the lowest level since 1969 with 199,000 versus 260,000 estimates. The day concluded with The FOMC meeting minutes, which alluded to a more hawkish Federal Reserve. Since the last FOMC meeting in September, inflation has continued to break multi-decade highs, while the labor market has steadily improved. These two benchmarks have strongly increased the Fed’s likelihood to raise lending rates in June 2022. Still, if energy prices and supply chain disruptions appeared to be more persistent than previously projected, the probability of a hike in March 2022 would likely increase further.

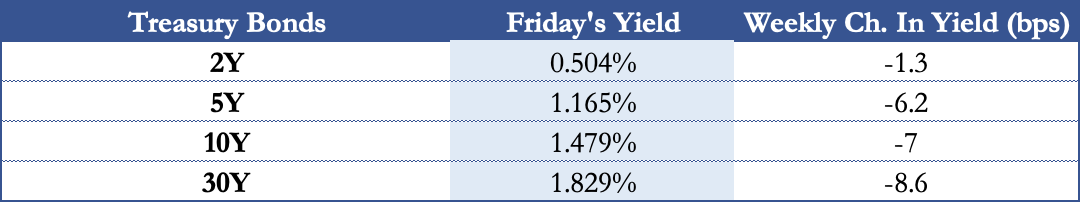

As a result of this week’s news, we have seen continued strength in the US dollar, while US Treasury Yields have risen within the week, more notably on the shorter-dated end to flatten the yield curve. In the short post-Thanksgiving session, the yield of different maturities securities plumped due to the increasing concern of the Covid new variant. In the shortened trading session, 5-year, 10-year, 30-year US Treasury lost 17.5bps, 16.2bps, and 14.4 bps, respectively, wiping out all the week’s gains. Wall Street is now focused on Tuesday’s Fed Chair Powell speech to Congress and Friday’s US jobs report.

Europe and UK

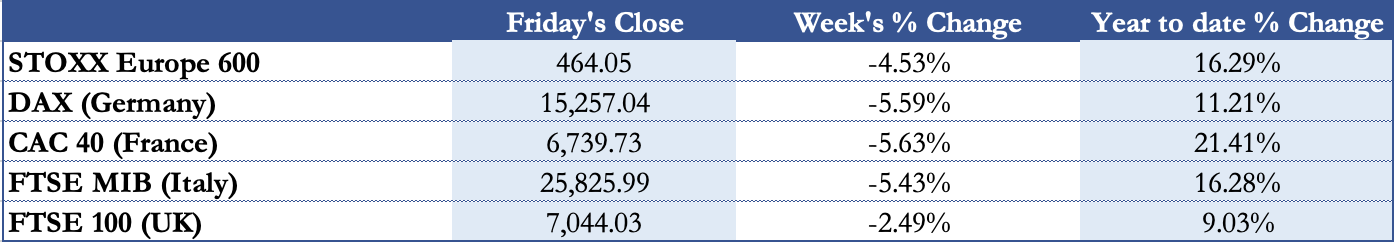

Cyclical-heavy European stock markets were already under stress this week as a resurgence in COVID-19 cases prompted new restrictions in several countries. Like US equity, European stocks plummeted amid widespread selling on Friday and suffered the worst trading session in 17 months on new variant fears. Chancellor Angela Merkel warned that the latest surge in Covid-19 infections is worse than anything Germany has experienced so far and called for tighter restrictions to help contain the spread. In the meanwhile, the UK government is deploying more resources on its coronavirus booster program, indeed, from the following Monday, everyone over age 40 will be invited to have a third dose of the vaccine. The decision relies on the hope that by bolstering immunity within the population, the number of severe cases and hospitalization rates will be limited, and the government can avoid new restrictions. These concerning news have been translated into equity retreats. The pan-European STOXX 600 index sank 4.53%, closing at €464.05, the UK’s FTSE 100 dropped 2.49% to £15,257.04, while Germany’s DAX, France’s CAC, and Italy’s FTSE MIB shed more than 5%.

On the Macroeconomic side, the Bank of England’s Governor Andrew Bailey and the Chief Economist Huw Pill raised doubt about the certainty of an interest-rate increase in December. Governor Andrew Bailey said that risks to the U.K. economy are “two-sided” at the moment, with slowing growth and rising inflation. These uncertainties may give reason to doubt a move next month, which investors have almost fully priced.

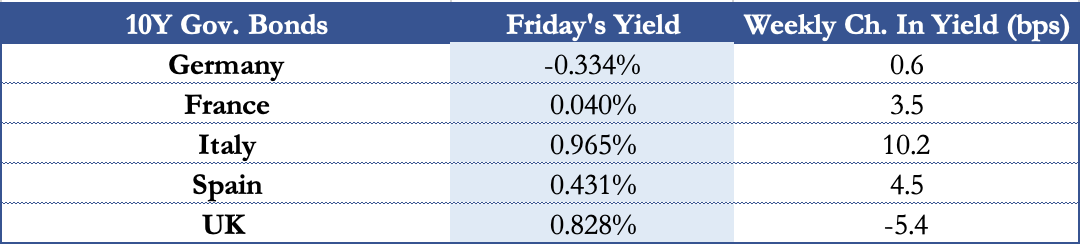

Whereas, the prospect of the European Central Bank lifting interest rates in March 2022 seems inevitable. The Bank of France chief Villeroy is reluctant to commit to more stimulus both because of the elevated inflation and because each wave of the pandemic’s impact on the economy has been decreasing steadily since the high vaccination rate is showing positive results. After Villeroy’s comments on the end of PEPP were published, investors pushed up Italian borrowing costs, the country’s 10-year bond yield climbed eight basis points to 0.94%, widening the premium over German counterparts by three basis points to 124. While he repeated that policymakers still view the recent inflation surge as temporary, he said they are taking supply constraints very seriously and closely monitoring wage developments. “We mustn’t overreact and tighten monetary policy prematurely,” Villeroy said. “But if the situation changes, we shouldn’t hesitate to act.”

Rest of The World

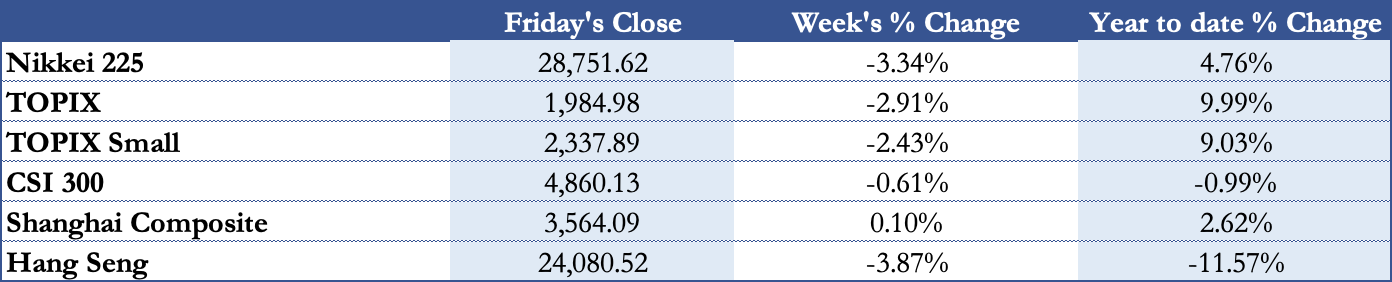

Asian indexes saw a negative performance during the last day of trading on worries that the new coronavirus variant found in South Africa could hinder a global economic recovery. Stocks in Japan and Hong Kong led losses among Asia markets in this week’s trade. The Nikkei 225 Stock Average closed 2.5% lower on Friday. Shares of SoftBank Group plummeted 5.19% following a Bloomberg report that Chinese regulators have asked Didi to delist from the US. These news marked Nikkei’s worst loss since June 21 and led to the declines among major equity indexes around the region.

The new Covid variant was detected in Hong Kong on Thursday, as confirmed by The Centre for Health Protection. Fears of new infection waves have caused Hong Kong’s Hang Seng Index to drop 2.67% to HKD24,080.52, consolidating its double digits YTD loss. On Friday afternoon trading, Baidu slid further in Hong Kong, with China’s market regulator issuing draft guidelines that put restrictions on promoting healthcare, drugs, after-school tutoring, cosmetics and other ads. Chinese stocks are the least affected by the new Covid variant fears, as CSI 300 closed 0.61% lower and Shanghai Composite remained nearly unchanged with a 0.1% gain. China’s economy continued to slow in November, which marked the 6th straight month of slowing expansion. Meanwhile, the debt crisis engulfing the Chinese real estate sector threatens to upend developers who have borrowed billions in green debt to fund sustainable buildings.

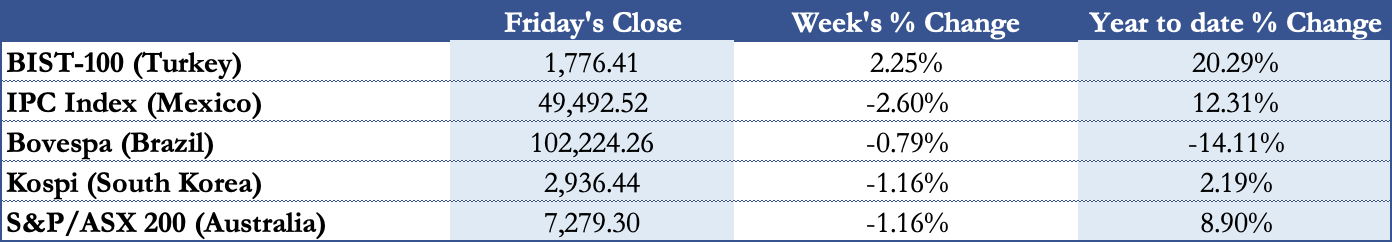

Turkey’s lira plunged 4% again on Friday after President Tayyip Erdogan doubled down on his low-rates policy, concluding a highly volatile week in which the currency plummeted to all-time lows. The Turkish lira is by far the worst-performing emerging market currency this year, it has lost nearly 45% of its value since the beginning of 2021. In the last 10 days, Erdogan’s speeches have defended the central bank’s move to slash its policy rate to 15%, despite inflation of 20%. Erdogan’s promise to ease monetary policy and protect Turks from high-interest rates triggered Turkey’s lira to drop 17% on Tuesday. As expected, the equity index in Turkey rose sharply from mid-October, jumping 32.9% higher and consolidating its 20.29% YTD performance.

Although Australia’s retail sales in October jumped 4.9% MoM, far higher than the 2.5% increase predicted in a Reuters poll, the S&P/ASX 200 fell 1.16% on the last trading day to AUD7,279.30 as a consequence of rising Covid fears.

FX and Commodities

Commodities Futures ended a busy week trading lower as the new Covid variant sparks global demand concerns. The week started with a coordinated move from the US, India, South Korea, Japan, and Britain to release millions of barrels of oil from strategic reserves to cool prices after OPEC+ producers repeatedly ignored calls for more crude. Oil prices jumped higher despite US-led efforts to push them lower. West Texas Intermediate(WTI) crude advanced 1.57%, opening at $78.50 a barrel, while Brent crude gained 3.21%, opening at $81.85 a barrel. The total global release is likely to be in the range of 60-75 million, far less than the 100 million barrels or more investors in the market had expected. The coordinated strategy among countries can deal only with the very short-term issue, whereas the underlying problems remain. “We are talking 50 million barrels coming out of the United States, potentially another 50 from our partners. That’s 100 million barrels of oil — that is one day’s worth of global demand for crude oil,” Schork said. Nevertheless, oil prices dropped more than 10% on Friday. The WTI plummeted 14% to settle at $68.15 a barrel. The international benchmark Brent fell 12% to settle at $72.72 a barrel. Both oil markers had their biggest one-day declines since the oil prices went negative in April 2020 at the height of the pandemic. US natural gas futures jumped more than 7% on Friday, registering their best week performance in nearly two months. The price is still down almost 13.7% from the six-year peak seen in early October, however, it remains on the higher side as upward demand pressures continue.

Gold futures closed the week at $1,792.30, gaining 0.45% on Friday. Although the price was predicted to drop on bets of US Federal Reserve turning more hawkish, it surged on Friday as concerns over the spread of a newly identified coronavirus pushed investors to consider a safer asset. In the meanwhile, silver futures lost 1.49% on Friday, closing at $23,145.

The renomination of Powell, a clearer outlook for monetary policy in the year ahead, and the likelihood of sooner rate hikes pushed the US dollar index to all-time high since July 2020. The dollar index rally reached 96.938 before it retreated 0.82% in the Friday trading session closing at 96,078. The euro fell 0.33% against the dollar for the week, closing at 0.8836 per dollar. Sterling rose 0.81%, closing at 0.7497 per dollar. The Japanese yen lost 0.58%, closing the week at 113.37 per dollar. The Renminbi (RMB) advanced 0.09%, closing at 6.3930 per dollar.

Next Week Main Events

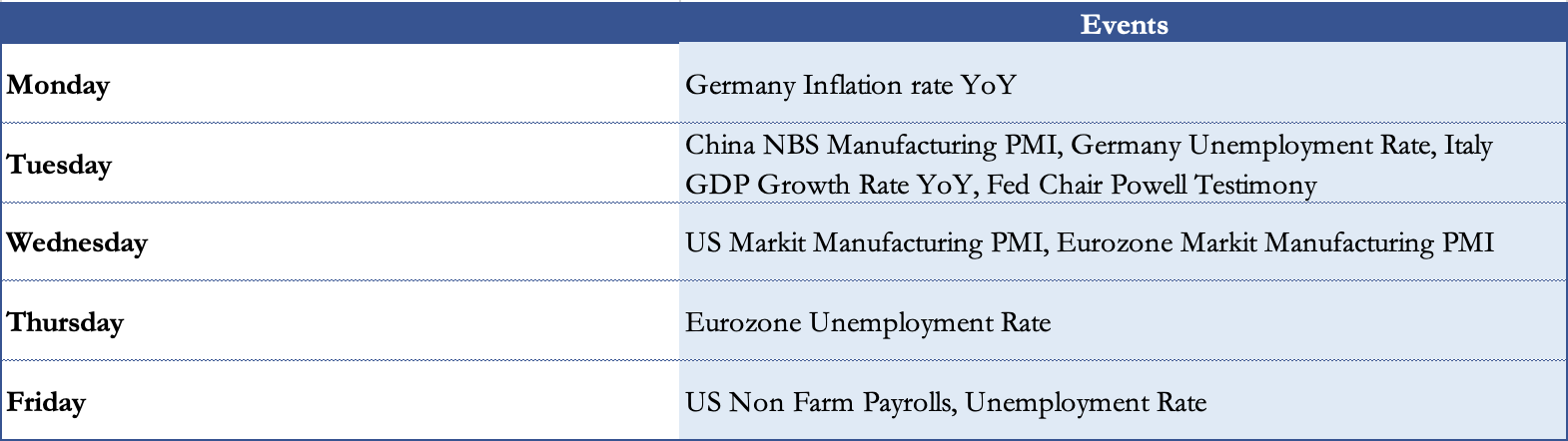

The following week will open with the German Inflation report. On Tuesday, investors will be looking closely for guidance from Fed Chairman Jerome Powell, who will appear before Congress with Treasury Secretary Janet Yellen to discuss the coronavirus and the CARES Act stimulus package. China will release NBS Manufacturing PMI on the same day, a very closely monitored data as October had been the second straight month of contraction in factory activity. On Wednesday, Euro Area Markit Manufacturing PMI and US Markit Manufacturing PMI will be released, forecasted respectively at 58.6 and 59.1. On Thursday, Eurozone’s Unemployment data will be disclosed, and the figure is forecasted at 7.3%. The week will conclude with US’ Non-Farm Payrolls and Unemployment rate figures, which will be under focus as they are Fed’s policymaker closely monitored data.

Brain Teaser #15

Four prisoners are allowed to go free if they succeed at solving a puzzle. A queue with three prisoners is created, such that the tallest prisoner is the last and the shortest the first. This organization allows each prisoner to see all the people ahead of him. On the other hand, the fourth prisoner is in a prison cell such that the others cannot see him, and he cannot see the others. Then, each of the four prisoners is given either a white or black hat, in total two white and two black hats. The rules are such that if any prisoner tells the color of their hat, they are all four released. Instead, if one makes a mistake, they are all executed. What would be a winning strategy for the prisoners?

Solution:

If the third prisoner from the queue saw two hats of the same color ahead of him, it would be easy to infer that his hat is of the other color. Thus, he would be able to tell the color of his hat and solve the puzzle.

On the other hand, if the hats of the first two prisoners in the queue are of different colors, the third cannot deduce anything. Nonetheless, after letting some time pass, the second person from the line can understand that his hat and the one of the prisoners ahead of him have different colors. Therefore, he can know for sure the color of his hat.

In conclusion, we have found a winning strategy for any distribution of the hats.

Brain Teaser #16

Calculate the angle between the hour-hand and minute-hand of a clock at 8:15 PM?

What is the probability of drawing two queens from a card deck?

0 Comments