US

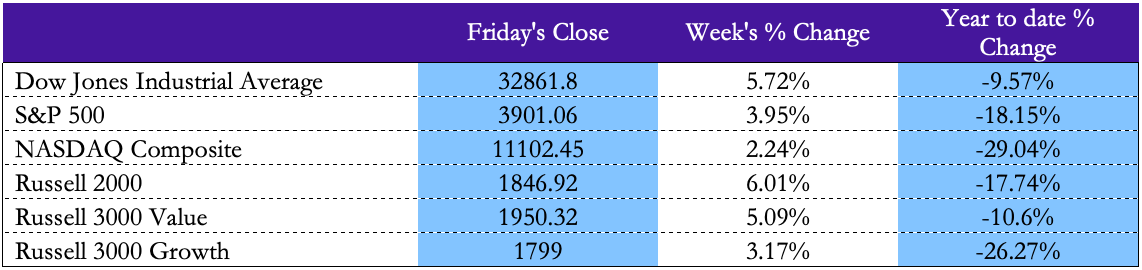

Major US indices performed well this week despite intra-week turmoil, particularly in the Nasdaq 100 and Nasdaq Composite. Russell 2000 showed the largest increase, topping last week’s close by 6.0%, with the Russell 3000 Value performing better (+5.1% WoW change) than the Russell 2000 Growth (3.2% WoW increase). DJIA recorded an increase of 5.7% from last week, while the S&P 500 (closing at 3,901) and the Nasdaq composite recorded a WoW increase of 4.0% and 2.2% respectively. S&P 500 volatility, conveyed by the VIX, fell by 13.3% this week.

The Nasdaq Composite rallied early in the week, as investors expected corporate earnings reports to beat usually cautious corporate projections. Despite conservative guidance, many giant techs failed to meet their projected earnings, resulting in a fall of the index on Wednesday. Meta stocks fell by 23.9%, reaching their lowest price since early 2016. Other tech giants including Amazon, Google, and Microsoft disappointed investors with lower-than-expected earnings. The index rebounded by the end of Friday, to close at approximately 11,103 (+2.2% WoW change).

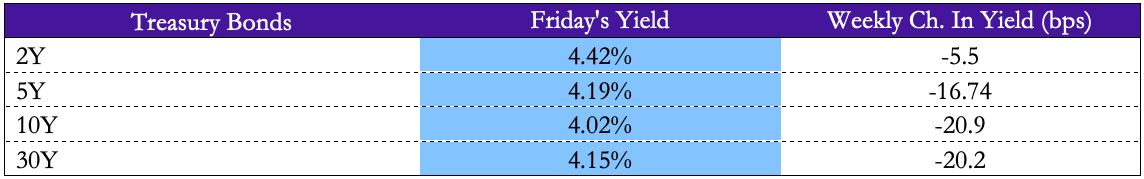

Despite disappointing earnings in growth stocks, the US economy showed strength through its GDP release of 2.6% YoY, above its 2.4% YoY forecast, recovering from the 1.6% and 0.6% GDP drops in the first and second quarters of 2022, respectively. Tight monetary measures emerged in the real estate market, with mortgages reaching 7.2%, the highest level since 2001. Investors are demanding lower bond and stock yields, partly due to better-than-expected GDP figures, and partly due to expectations of easing the monetary tightening.

EU

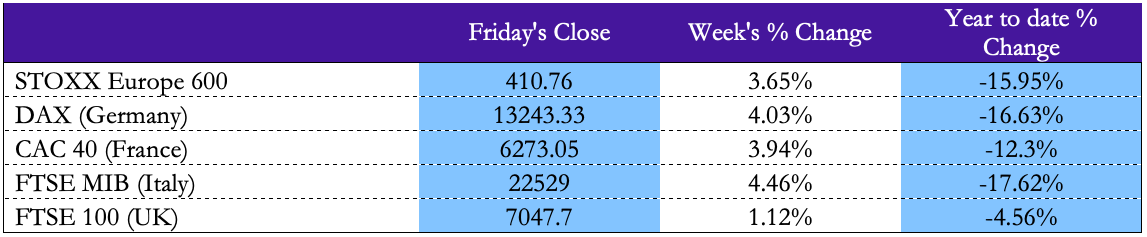

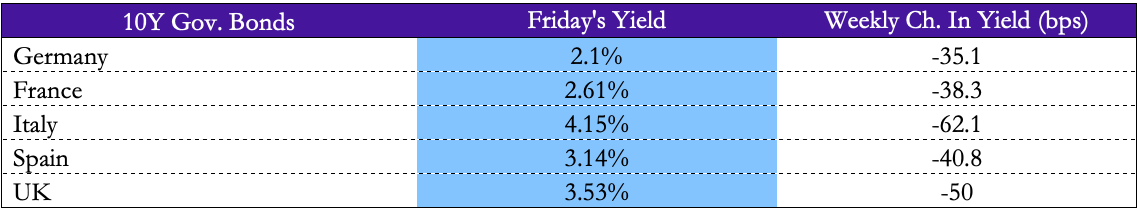

FTSE MIB outperformed DAX and CAC 40 this week reporting a WoW gain of 4.5% against DAX’s 4.0% and CAC 40’s 3.9%. Bond markets rallied: 10-year government bond rates decreased by 31.7bps in Germany, 36.3bps in France, 59.0bps in Italy and 43.8bps in Spain from last week’s close. Let us examine what contributed to these changes.

The week opened with positive news on European gas prices, falling under €100/MWh. The decrease is partly caused by mild temperatures – taming gas demand – and by high gas inventories. Whether prices will stay this low (given no substantial changes in the Russia-Ukraine conflict) is explained by many exogenous factors. Principally Europe’s weather will determine the usage of gas inventory (currently sitting at 93% of its maximum capacity) and demand for gas.

Also on Monday, Linde, one of the largest companies in the DAX with about €140bn market cap as of October 29th, announced its plan to de-list from the Frankfurt Stock Exchange. Linde stock prices declined about 4% in early trading and the plan raised questions about how it will alter the importance of Frankfurt as a global financial hub.

On 26 October, the ECB raised their policy rates by 75bps. The deposit rate is now at 1.5%, reaching the highest level since 2009. To curb Eurozone inflation, Lagarde announced the ECB will also contract its balance sheet by cautiously selling some of the accumulated €5tn bonds and making TLTRO terms less attractive, possibly by reducing negative lending rates for banks.

Friday’s posting of Italian, German, and French CPIs MoM (October) were all above their estimates. Analysts from Goldman Sachs raised their prediction for Eurozone YoY inflation rate from 9.9% to 10.9%, echoing the market’s expectations of higher inflation in the area. Germany’s GDP print surprised to the upside, reaching a QoQ increase of 0.3% against -0.2% expected, and a YoY GDP growth of 1.1% against a 0.7% expected growth. A bullish stock market can be explained by Germany’s GDP performance as well as a change in investor’s monetary policy expectations.

UK

FTSE 100 still closed at +1.1% from previous close on 21 October. 10-year yields on Gilts decreased back to 3.5%, down from its maximum of 4.4% on October 10th, following Kwarteng’s tax cut mini-budget.

Britain’s Composite, Manufacturing and Services PMIs, announced last Monday, were below the 50-level mark, as most PMIs in Europe. They also underperformed predictions, reaching 47.2, 45.8 and 47.5 respectively. The negative effect of these recession-predicting manufacturing indices was overcome by the hopes driven by Rishi Sunak’s takeover from Liz Truss. Rishi Sunak, leader of the Conservative Party, was appointed Prime Minister on Tuesday after Liz Truss resigned on October the 20th.

On Thursday, Sunak and new Chancellor of the Exchequer Jeremy Hunt announced fiscal contraction, with tax raises and government spending cuts collectively amounting to £50bn, to “fill massive fiscal black hole[s]”. However, the major fiscal budget decision was deferred, as Sunak highlighted it will imply “tough decisions” which must not be underestimated and carefully announced, to avoid repeating investors’ reaction to Truss’ tax cut.

As a response, the spread of UK dept over Bunds decreased from 164.0bps to 139.4bps by the end of the week, proving that the British government is regaining control of its economic stability. Although to a lesser extent than the US and EU, the British economy has overall shown resilience this week.

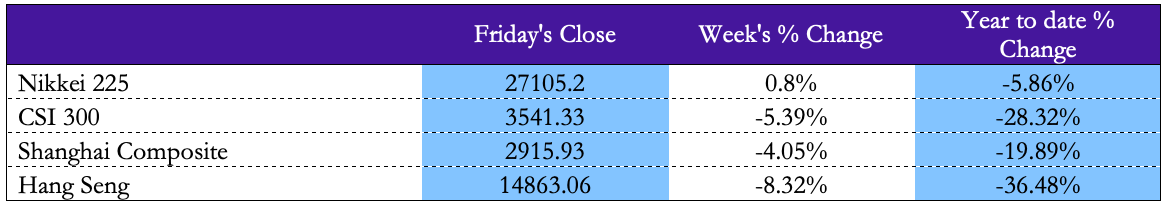

Rest of the World

Hong Kong’s Hang Seng was one of the worst performers at global scale this week. China’s CSI 300 also performed weakly, down by -5.4% from 21 October. Contributing to these downturns are mainly two announcements made last Sunday at the 20th Congress of the Communist Party. First, Xi Jinping’s confirmation as general secretary of China, and secondly, his wish to commit to the Zero-COVID strategy again led to major sell-offs of Chinese and Hong Kong stocks on Monday and Friday especially. US-listed Chinese companies tracked by the Invesco Golden Dragon China ETF fell by about 20% on Monday (Nasdaq Composite instead recorded a gain on Monday), touching its lowest level since 2009.

The Nikkei 225 closed at 27,105, 0.8% higher than past Friday. Nikkei 225 rose during the week but dwindled after Wednesday due to lower Q3 earnings than expected. The benchmark’s decrease continued Friday, following the Monetary Policy Statement and Outlook Report (YoY) by the BoJ, and the Fiscal Policy statement by the Prime Minister. The BoJ adjusted its forecasted inflation rate from 2.3% to 2.9% and maintained a very dovish interest rate view, upholding its key short-term rate at -0.1%, as part of its plan to continue monetary easing to shield Japan from a recession. Fumio Kishida announced a $200bn government expenditure stimulus plan. The Central Bank of Russia also kept its interest rates of 7.5% unchanged on Friday.

Australian QoQ CPI was released on Wednesday and reported quarterly inflation of 1.9% higher than the predicted 1.6% inflation. This 32-year-high figure is the consequence of expansionary measures after COVID restrictions.

FX and Commodities

GBP/USD closed at $1.16 on Friday, growing by about 300 bps in just 48 hours and recovering from its trough of $1.10 on October 11th.

Despite the ECB’s rate hike, EUR/USD again dropped below parity and closed at 1.00, and bond yields fell, reflecting a change in investor expectations. Investors are pricing a more dovish future ECB monetary policy stance, due to “likelihood of a recession […] more on the horizon”, hinted at by Lagarde in her speech on Wednesday.

USD/JPY now sits at 147.46. While speculation on JPY seems to have calmed down, the Yen still faces extreme downward pressure from Japan’s import dependency, which forces high demand for USD and supply of Japanese domestic currency. BoJ interest rate policy also contributes to the currency’s depreciation.

Commodity prices declined from last week, including Gold and Coffee. Energy indices reflect a temporary slow-down in energy demand: DJ Commodity Energy down 1.26% and Petroleum -1.11% WoW performance. Speculation on Energy price decreases continues, as shown by the +9.76% in Natural Gas Futures x3 Short Leveraged index which closed at 46.95. Only Heating Oil, Lead, Silver, Palladium are exceptions to the losses faced this week by Commodity indices.

Next Week’s Economic Events

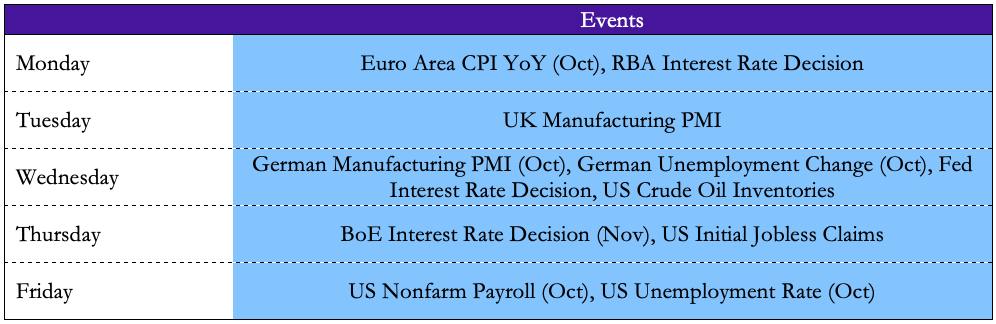

Next week Australia, the BoE, and the Fed will make their monetary policy decisions. Market participants have reported on the FedWatch Tool that they expect a 75bps hike, with 81% probability, and a 50pbs raise with a much lower, 19%, likelihood as of October the 30th. The US will also publish its Crude Oil Inventories, Initial Jobless Claims, Nonfarm Payroll and Unemployment Rate at the end of the week. Additionally, the UK will report its Manufacturing PMI. Main economic indicators from the EU published next week include CPI YoY on Monday, and Germany Manufacturing PMI and Unemployment Change for October on Wednesday.

Brain Teaser #28

1, 11, 21, 1211, 111221. Can you tell us which will be the next numbers in the sequence?

Solution: This sequence is called the Look and Say sequence. Hence, the following numbers will be 312211 (three digits of 1, two digits of 2, and one digit of 1), 13112221, and so on.

Brain Teaser #29

Twenty-five BSIC members are seated at a round table. Three of them are chosen – all choices being equally likely – to write the upcoming article. Let P be the probability that at least two of the three had been sitting next to each other. If P is written as an irreducible fraction, what is the sum of the numerator and denominator?

Problem source: AIME 1983

0 Comments