USA

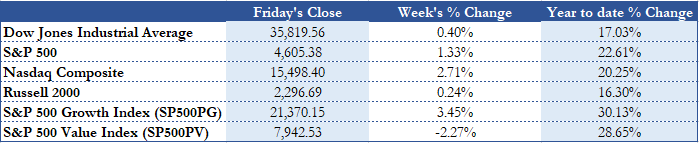

U.S. equities rallied to new highs as the busiest week in earnings season came to an end, marking October as the best-performing month of 2021. The S&P 500 breached the 4,600 mark and closed 1.33% up on the week, at 4,605.38. The tech-heavy Nasdaq composite also reached new territory after a 2.71% increase to 15,498.40 with the Dow Jones achieving similar results, albeit by a lesser margin, concluding the week 0.40% higher than last week. Small caps performed the worst out of the major indices, only realizing a 0.24% gain this week.

Growth stocks fared better than value stocks with the respective S&P 500 Growth Index growing by 3.45% whereas the S&P 500 Value Index shed 2.27% as persistent supply-chain disruptions, high energy prices leading to high near-term inflation expectations, and weaker than expected GDP growth troubled investors. The Growth Index was supported by Tesla’s historic accomplishment of being the first car manufacturer to have a market capitalization greater than $1trn after the announcement that Hertz, a car rental business, is going to buy 100,000 electric vehicles from the Austin-based manufacturer. This also explains how the S&P 500 Consumer Discretionary Index outperformed the rest of the market, closing 3.98% higher than last week.

Information technology closed out 1.97% above last week’s levels with many firms posting bumper profits, although the index was weighed down by some of its biggest constituents in Apple and Amazon. The Silicon Valley based firms published weak earnings and forecasted lower growth because of the semiconductor and labor shortages, resulting in their share prices tumbling on Friday, by 1.81% and 2.15% respectively. This allowed Microsoft to replace Apple as the most valuable public company in the world following a weekly increase of 7.24%, partly because of persevering demand for its flagship services. In the wake of numerous scandals linked to the firm’s negligence and alleged negative social impact, Facebook Inc. decided to rebrand to Meta, and coupled with decent financial performance, helped the company’s share price to appreciate 1.0% in value over the course of the week.

Moreover, the energy sector suffered a -0.77% decrease this week due to crude oil prices cooling down from multiyear highs. Healthcare, consumer staples, materials, real estate, and communication services served more modest increases to investors, whereas industrials, utilities, and financials plummeted in value.

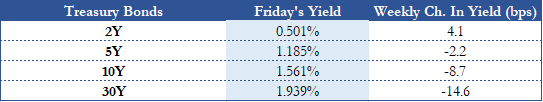

Mid- and long-term Treasuries experienced increased prices this week as sluggish GDP growth became apparent. Q3 GDP increased 2.0% on an annualized basis, contrasting consensus estimates of 2.7% and is a clear slowdown from Q2, where growth of 6.7% was reported. Because 2020 Q2 GDP was very low due of the pandemic, 2021 Q2 annualized GDP growth might have appeared greater than it actually was. Yet supply-chain constraints, the semiconductor shortage, labor scarcity, and rising energy prices are now in full effect, explaining the rapid deceleration.

They also help explain persistent inflation: core inflation remained constant from last month at 3.6% on an annualized basis. Signs of a persistent rise in consumer prices makes it all the more likely for hawkish policies from the Federal Reserve, as to prevent temporary inflation in the world’s largest economy. Hence, the yield curve flattened with nearer-term bills rising in yield – such as the 2-yr note with an increase of 4.1 basis points – and long-term treasuries decreasing in yield, for example the 10-yr which decreased by 8.7 basis points.

Moreover, the tumultuous week gave plenty of space for markets to move. Volatility was up on the week, with the VIX having increased 5.38%.

Europe and UK

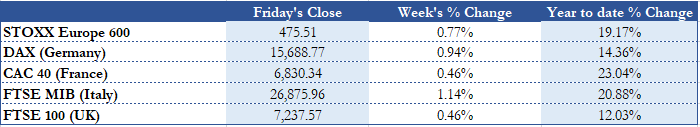

European stocks similarly gained in value this week, with solid earnings and a reduction in fears of energy shortages throughout the continent. The Stoxx Europe 600 Index increased by 0.77%, closing at 475.51, and reached its own all-time high on Tuesday. Germany’s recently expanded DAX Index rose by 0.94% and France’s CAC 40 is slowly but surely approaching the 7,000-mark, with weekly growth of 0.46%. Italy’s FTSE MIB increased by 1.14% while the UK’s FTSE 100 grew by 0.46%. European equities’ moderate increase came as GDP growth has slowed down, therefore indicating that high earnings growth might not be sustainable.

In Germany, strong earnings by car manufacturers led to the industry gaining around 2.27% this week, though technology firms outperformed the other sectors. Akin to the movement in German markets, the French tech sector led the pack this week with financials at second and oil, gas and utilities sectors that trailed the rest. In Italy, the consumer durables sector rose by the greatest margin, with firms such as Ferrari taking the lead. Finally, in the UK, industrial transportation and household goods were at the forefront with aerospace & defense as well as mining which underperformed.

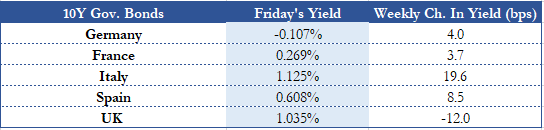

In mainland Europe, government bonds rose in yield as investors are betting that the ECB will lift rates by mid-2022. This came about after the ECB’s Thursday announcement that they were going to keep rates constant at zero. European economies displayed modest GDP growth in Q3 with Germany underperforming in Q3 with 1.8% quarter-on-quarter growth against analysts’ 2.2% forecast. France posted a 3.0% rise, Spain 2.0%, and Italy 2.6%. The Eurozone monthly inflation rate exceeded expectations of 3.7%, reaching 4.1%, up from 3.4% in September.

UK gilts dropped in yield by 12 basis points as the consensus for next week’s Bank of England interest rate decision has consolidated. The prediction is a 15 bps increase to 0.25%, although it is unclear how the vote will be split which may herald future behavior within the United Kingdom’s central bank. “Inflation in September was 3.1% and is likely to rise to average 4% over next year”, the Office for Budget Responsibility stated. Also, the BCC forecasts 2021 GDP growth to be 7.1%, greater than its pan-European counterparts. Furthermore, Downing Street’s 2021 Autumn budget was unveiled by the Chancellor of the Exchequer, Rishi Sunak. The budget entails relatively large spending funded by some tax increases, though a surcharge on financial services companies will be cut to promote the City of London’s dominance in the post-Brexit era.

Rest of the World

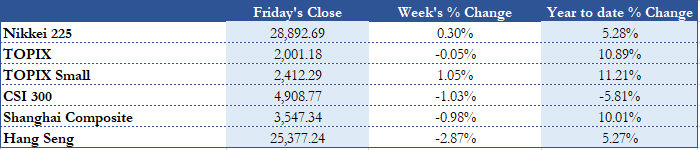

Ahead of Japan’s general election, markets closed mixed on the week, with the Nikkei 225 increasing by 0.30%, the TOPIX decreasing by 0.05%, and the TOPIX Small Index rising by 1.05%. On Thursday, the Bank of Japan announced the interest rate decision to keep its rate constant which caused the yield curve to flatten. One argument for growth is the weakening Yen which implies cheapening exports, and as Japan is an exporting country, can therefore signal greater earnings growth for its firms. Also, earnings published by Japanese companies were robust. On the other hand, major industries like the auto and tech-hardware industries are taking big hits to their sales because of the semiconductor shortage coupled with global supply-chain bottlenecks.

Contagion from the collapse of property developer Evergrande is still being felt in Chinese markets. Not only has the sector been hit with a decrease in activity following one of its biggest firms unable to produce at former levels, but there also have been plenty of defaults and missed bond payments. For instance, Modern Land – another developer – missed a dollar-denominated bond payment of about $250m. The sector, roughly accounting for a third of economic output, therefore weighed down on markets this week, though not by too much as the reverberations of Evergrande’s narrow avoidance of a default are being felt. The CSI 300 and Shanghai composite shed 1.03% and 0.98% respectively, while the Hang Seng dropped by 2.87% due to negative market sentiment and weak earnings across the board.

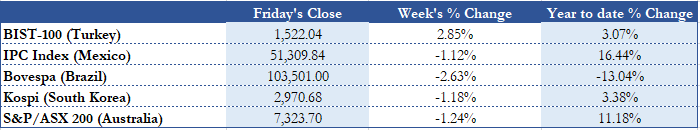

On the back of soaring inflation and a rapidly weakening Lira, Turkish central bank governor claimed on Thursday that the rate cuts introduced this year will stabilize the domestic currency and double-digit inflation by diminishing the current account deficit. Although the Lira has experienced devastating blows in the past months, it remained flat this week. This supported the BIST-100, which made solid gains on the week, increasing by 2.85% to 1,522.04.

This year, Brazil has experienced inflation in double-digit territory, mainly as a result of high energy prices and a weaker real. The BCB thus decided to step in again with an interest hike of 150 bps to 7.75%, marking the sixth consecutive rate increase this year. Although a positive step, Brazilian markets still suffered losses with the Bovespa Index decreasing by 2.63% due to investors’ projections of weak sales growth commodities prices wane, but more importantly, supply-chain difficulties remain.

Australia’s core inflation rose, prompting fear among investors that inflation will prove to be temporary in the services and commodities dependent economy. With weekly decreasing commodities prices such as Iron ore and Aluminum, the S&P/ASX 200 fell by 1.24%.

Fx and Commodities

Foreign Exchange markets have had a volatile week due to economic data and central bank policy anticipations. The U.S. Dollar Index closed 0.53% higher on the week after Friday’s 0.85% rally following Treasury-bond yields soaring on the release of GDP and inflation figures. The index is now sitting at 94.13. A big factor affecting that movement was the Euro’s relative decline, finishing the week 0.71% down against the greenback. The Euro similarly fell against the Swiss Franc and the British Pound, by 0.66% and 0.26% respectively. The Japanese Yen decreased by 0.39% against the Dollar, following a trend this year, where the year-to-date change has been a 9.33% decrease. Finally, the Chinese Renminbi was more solid in comparison and only lost 0.32% with even better year-to-date results of a 1.98% appreciation.

Brent crude hit a multiyear high of $86.40 on Tuesday because of widespread belief that supply cannot keep up with demand, but then ended the week lower at $84.38, a 1.87% decrease on the week. WTI similarly decreased by 0.49% and closed at $83.25. UK and European natural gas prices fell this week after Russian President Putin’s intervention to increase supply. Also, Moldova signed a new deal with Russian energy provider Gazprom to ease the energy scarcity hit the country due to its heavy reliance on Russian supply.

Gold plummeted this business week to 1,783.83 per ounce, marking a 0.51% decrease, as the dollar rallied. Silver decreased for similar reasons, finishing the week $0.68 lower at $23.87. Next week’s Fed interest rate decision will be key in the outlook for the respective markets. Bitcoin finished the business week up 2.15% at around $62,300.00, a cooldown from the highs of $66,000.00 it reached last week after the ProShares Bitcoin Strategy ETF finally hit markets.

Next Week Main Events

Next week is another laden with important events. Most importantly, various central bank decisions are due: Australia’s RBA announces on Tuesday and the United Kingdom’s Bank of England on Thursday. Analysts are quite set on their forecasts; do not expect any surprises. Conversely, the world’s foremost central bank, the U.S. Fed – which declares its policy on Wednesday – has analysts and markets uncertain and is just one reason why Wednesday may prove to be a watershed moment in the post-COVID economic era.

Earnings season is not quite over yet. Next week, though less full, features some of the most influential company’s third quarter results: Berkshire Hathaway, Alibaba, Toyota, Pfizer, Qualcomm, BP, and Uber are only some of the blockbuster names reporting their finances to investors.

Moreover, nations will report their set of unemployment rates which will aid giving a fuller picture of this week’s GDP, headline, and core inflation figures. These are to be supported by Non-Farm Payrolls data, Purchasing Managers’ Indices (PMI), and more.

Brain Teaser #11

Player A tosses five coins, whereas player B tosses six coins. What is the probability that player A gets more heads than player B?

Solution:

This problem is equivalent to a simpler version: players A and B each toss five coins, and if they have the same number of heads, one more coin is tossed to decide the winner. Furthermore, we can notice that the two phases of the game are symmetric, and thus each player has equal chances of winning the game. We can conclude that the probability that player A gets more heads than player B is 0.5.

Brain Teaser #12

How many traders should there be on a trading floor such that the probability that two traders have the same birthday is more than ½?

0 Comments