US

On Monday Meta announced that it planned to lay off thousands of people as early as Wednesday. Despite this, its stock price jumped by 3%. Apple stock, on the other hand, fell by 1% because of warnings that it might produce three million fewer iPhone 14 than they initially expected earlier this year. Palantir, the big data analytics company, announced on Monday in third-quarter results that it has doubled its business clients in America to 132 from 59 the previous year. Palantir’s earnings grew by 22% to $478 m, surpassing analysts’ expectations. The chief executive announced that those results were achieved not despite, but because of austerity measures. He claimed that “The metaverse and other idiosyncratic pursuits of the technocratic elite may be luxury goods. But foundational data platforms are not.” Despite this. Palantir’s shares have fallen 60% over the year.

Goldman Sachs cut 2023 earnings expectations for the S&P 500 companies. They expect that companies will not generate earnings growth, following weakening margins in the third quarter.

On Tuesday, US voters cast their ballots in the midterm elections, to determine who will hold power in Congress. Republicans were expected to win a majority of seats in the House, while the race for the Senate is supposed to be determined by swing states like Nevada, Pennsylvania, and Georgia. Surprisingly, however, Democrats have managed to avoid a sweeping defeat. Joe Biden announced in a speech, on the day after the elections, that he might be running again for president, but that ultimately, he must make this decision together with his wife.

On Wednesday, Mark Zuckerberg announced massive layoffs at Meta. The company cut 13% of its workforce or 11,000 employees. The job cuts are a part of a sector-wide cull. Companies that rely heavily on advertising have been forced to cut their budgets because of the high costs of debt and inflation. The layoffs signify a shift towards moderation in the sector.

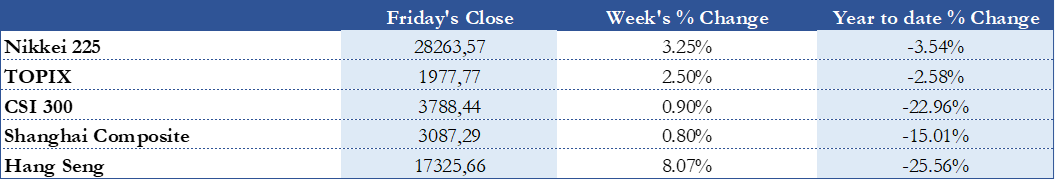

On Thursday, before the CPI data was released, equities fell after a strong selling on Wall Street, where the S&P 500 index fell by 2.1%. Asian equities fell as well with the Japanese Topix declining by 0.6%, and the Hang Seng index losing 2.1%. This selling is in part caused by investors grappling with tighter-than-expected midterm elections. Results suggest that so-called “red wave” predictions have been wrong.

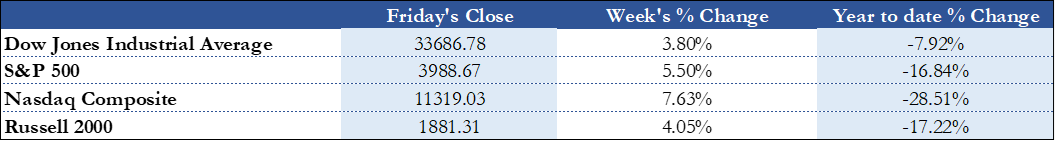

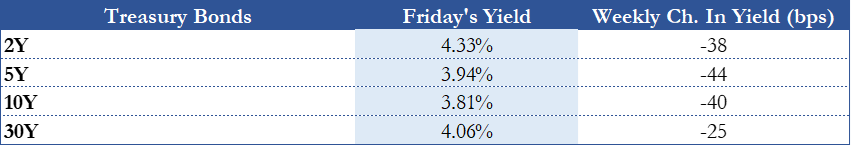

On Thursday, The Bureau of Labor Statistics released the CPI data for October. The consumer price index rose by 0.4% in October, and the annual rate slowed down to 7.7%. The lower-than-expected CPI readings ease the pressure on the Federal Reserve to keep raising interest rates. The data caused both stock and bond markets to rally. The S&P 500 closed 5.54% up, and the Nasdaq was up by 7.35%. The yield on the 2-year Treasury, slipped 0.26 percentage points to 4.36%. The yield on the 10-year Treasury fell by 0.23 percentage points to 3.91%.

EU

On Monday, the S&P Eurozone Construction PMI was released and showed the sixth consecutive month of a contraction in output. The index fell to 44.9 in October 2022 from 45.3 in the previous month.

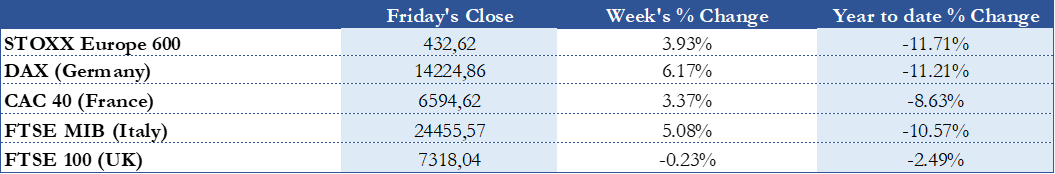

Markets reacted well to the release of better-than-expected German economic data. Industrial production rose by 0.6% month on month in September, which is better than the 0.8% decline that was expected by economists.

Ryanair announced half-year revenues of €6.62bn, which is three times more compared with the €2.15bn of last year. The company’s earnings before tax were €1.42bn, compared with the €100m loss in the six months before September. The company increased its forecast for passenger traffic, despite the nervousness around the war in Ukraine and the possibility of a recession. The chief executive, Michael O’Leary says that there is still the possibility of “adverse news” that might affect passenger traffic.

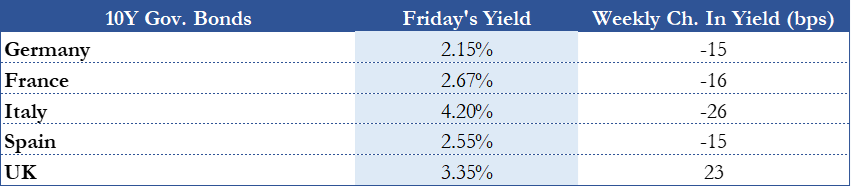

Senior members of the ECB pushed against the idea of a “dovish pivot” by saying that they expect interest rates to rise above the threshold of reducing growth. Joachim Nagel, president of the German central bank said that he would ensure that the institution continues its normalization of monetary policy, even if it would dampen growth.

Eurozone Retail Sales dropped 0.6% YoY in September, which was better than the forecast of a 1.3% decline. Christine Lagarde repeated on Monday that inflation is “much too high”, and that it must be brought down through more continuous interest rate rises.

Turkey has begun paying for Russian gas in roubles. This is done to deepen the economic ties between the Black Sea neighbours. This is going against the EU and US, who have warned countries not to for gas in roubles. Turkey has refused to join sanctions against Russia and is trying to act as a mediator in the conflict in Ukraine. Trade between Russia and Turkey has increased, with imports and exports totalling $6.2bn in October alone.

Brussels is set to investigate Microsoft’s $75bn acquisition of Activision Blizzard. There are concerns that the acquisition will allow Microsoft to restrict the accessibility to Call of Duty across different platforms. Microsoft responded to these criticisms by stating that its goal is to increase access to video games, not restrict it. Margrethe Vestager, the EU’s executive vice-president in charge of competition policy, said that the gaming sector is evolving at a fast pace, and diversity in the market must be protected.

In their quarterly report, the European Commission revised up the Eurozone 2022 GDP forecast, expecting GDP to grow by 3.2%, and stated that they expect a bigger slowdown in 2023. They forecast Eurozone inflation to be 6.1% in 2023 and 2.1% in 2024.

Rest of the world

Sembcorp, a Singaporean energy company will sell its Indian coal business to a private Omani consortium. The sale will be financed through a 15-year deferred payment note. Sembcorp will retain liabilities in relation to the coal assets. This means that the Indian business will remain a financial asset to Sembcorp. The company claimed that the sale was made in search of a greener portfolio, but critics say that the sale does not reduce the carbon footprint of Sembcorp.

Chinese exports and imports declined YoY by 0.3% and 0.7% respectively. These declines surprised economists, who expected a 4.5% growth in exports. According to the research group Capital Economics, this decline signifies the end of the Chinese pandemic-era export boom. Furthermore, China’s producer prices fell by 1.3% YoY. This has been caused by weaker demand and lower confidence in the Chinese economy because of lockdowns. Further Covid-19 restrictions in Guangzhou will further contribute to China’s economic slowdown. The city is the capital of southern China’s Guangdong province and is the manufacturing capital of the country. The city is currently experiencing China’s worst Covid-19 outbreaks. Four districts in Guangzhou are under partial lockdown, and millions of citizens are subject to mass testing and home isolation. In response to deflation and a decline in imports and exports, China announced that it would be trimming Covid-19 quarantine periods. This led to a 7% jump in the Hang Seng index. The Hang Seng Tech index rose by 10%.

Emirates posted record profits of $1.1bn in the first half of its financial year. This is compared to a loss of $1.6bn in the same period last year. These profits are a result of rising demand in the air travel sector as many countries lift pandemic-era travel restrictions. The company expects the demand to stay strong throughout the 2022-2023 financial year, but it is also weary of potential headwinds such as inflationary costs, and macroeconomic challenges such as a strong dollar.

FX and Commodities

Centrica, the energy group behind British Gas, announced a $250m stock buyback, as a result of robust performance stemming from its electricity generation assets and gas it sells, and its energy trading arm. This has led to the UK government facing calls for a larger windfall tax. To avoid that, Centrica said that it would set aside £25m to help customers, on top of £25m that it has already committed.

Oil prices jumped because of China’s easing of Covid-19 measures. Brent crude futures rose by 3.1% to $96.53 a barrel. These prices are also reinforced by the lower-than-expected CPI reading because it might lead to a slower increase of interest rates, and a softer landing for the US. The same factors are influencing the rise in industrial metals prices. LME aluminium was up 4.1% at $2,423 a tonne, zinc rallied 5.4% to $3,039.50, nickel gained 3.1% to $26,750, lead rose 3.4% to $2,170 and tin was up 3.2% at $20,965.

The American Dollar plummeted against all its major rivals as analysts rushed in to price in a Fed pivot. The EUR/USD traded at a high of 1.03, GBP/USD at 1.17, and USD/JPY at 139.

Next Week’s Main Events

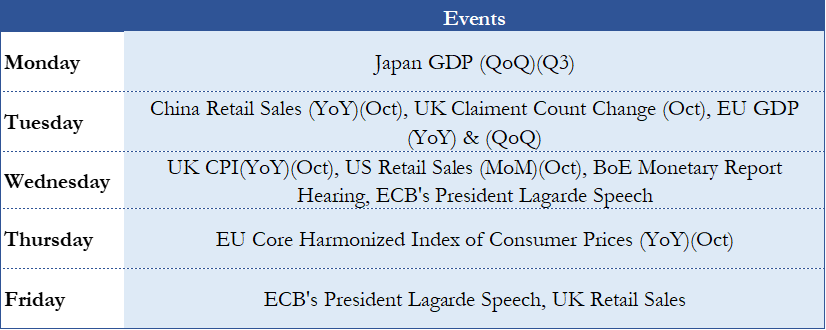

Next week’s main events will be the release of the EU GDP, Chinese Retail Sales, US Retail Sales, and UK CPI. The expectations for the EU GDP are for a 2.1% growth YoY. The consensus for Chinese Retail Sales is 1% growth. The lower expectation is due to the continuous lockdowns and other Covid-19 measures. The expectation for the UK CPI reading is to be 10.6% higher YoY. This is higher than the previous reading of 10.1% and is still much higher than the 2% target. US Retail Sales are expected to grow by 0.9% MoM.

Brain Teaser #30

Determine the last four digits of ![]()

Solution: Considering that for any ![]() we obtain

we obtain ![]() . Therefore,

. Therefore, ![]() i.e.,

i.e., ![]() . By multiplying the previous equation by 2021, we obtain that the last four digits of the desired number are 8125.

. By multiplying the previous equation by 2021, we obtain that the last four digits of the desired number are 8125.

Brain Teaser #31

What is the greatest number of pawns that can be placed on cells of a chessboard so that on every row, column or diagonal there is an even number of pawns? Now solve the problem for a ![]() chessboard.

chessboard.

Source: All-Russian Olympiad 1993

0 Comments