USA

The main U.S. indexes fell this week after data on consumer sentiment was below expectations, raising doubts about the pace that the economic recovery will take and the inflation outlook. The moves in stocks show investors grappling with mixed economic data in the U.S. and China, the spread of the Covid-19 Delta variant and concerns about inflation. This week began with the first sign of inflation easing (Consumer prices rose 0.3% in August) and an unexpected boost to retail sales, but ended with a slight rise in Americans applying for initial jobless claims.

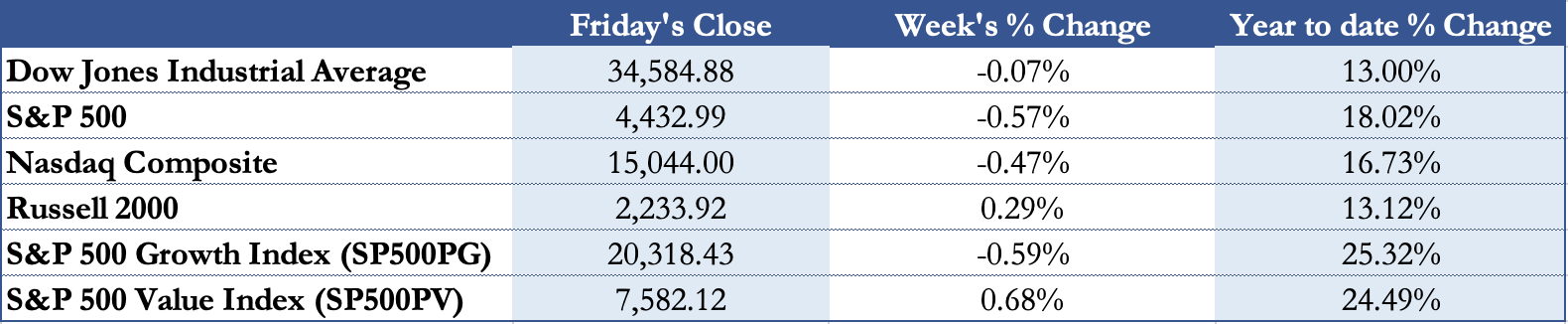

The Dow Jones Industrial Average closed nearly unchanged with a decrease of 0.07% that pushed it to $34,584.88. On the other side the best performing index among the main ones was the Russell 2000 which gained 0.29%, consolidating its double digit YTD returns now at 13.12%. With the policy outlook remaining uncertain both the S&P 500 and the Nasdaq Composite fell to their lowest level in almost a month; the first one decreased by 0.57% to $4,432.99 while the second one after a decrease of 0.47% closed at $15,044.00. However, they still hold their position with an above average performance YTD where the SP 500 gained 18.02% and the Nasdaq Composite 16.73%. Moving to the comparison between Growth and Value, the S&P 500 Value Index overperformed the Growth one with a 0.68% weekly return while the S&P 500 Growth Index lost 0.59%, but still holds its position as the best performing index this year with an YTD return of 25.32% against 24.49% of the Value Index. These values confirm that inflation has slightly moderated, and investors are shifting back from value stocks to growth ones. In addition, data based on Bloomberg consensus earnings estimates for the next four quarters shows that the price investors are paying for stocks relative to corporate earnings is elevated, with the current price-to-earnings ratio for the S&P 500 at 21.4, well above the average of 16.5. Explanations for this number can be found in strong expected earnings growth and low interest rates. The VIX surged nearly 10% this week reaching 20.81, considered a high volatility level. The top performing sector this week was Health Care while the biggest losers were Communication Services, Utilities and Information Technology.

While the softer-than-expected inflation data appeared to ease investors’ worries of expedited tapering, the solid manufacturing and retail sales data, along with technical trading factors, contributed to higher yields as the week progressed. Meanwhile, buyers were patient amid expectations for higher levels of issuance through the end of October. Nonetheless, the week’s primary muni market deals, including California’s issuance of $2 bn in general obligation bonds, were met with solid overall demand. The yield on the benchmark 10-year U.S. Treasury note touched 1.363%, well below the 1.72% high reached this spring due to inflation worries. While data seemed to support Fed Chair Jerome Powell’s assertion that spiking inflation is transitory, concerns surrounding corporate tax increases and the impending deadline to raise the U.S. federal debt ceiling were noted. “We see tapering of bond purchases as a six to eight-month process starting in December and then for rates to rise around the turn of next year,” said Christopher Jeffery, head of rates and inflation strategy at Legal & General Investment Management.

All the attention now is focused on the Federal Reserve’s meeting next week, at which it is expected to offer clues about when it will reduce its $120bn a month of crisis-era bond purchases. Fed Chief Jerome Powell has said the so-called tapering could occur this year, but investors are waiting for more specifics.

Europe and UK

Shares in Europe weakened for the third week in a row as concerns about the impact of the coronavirus’s delta variant on the global economy outweighed expectations of continuing central bank support. Most of the indexes underperformed witnessing a lack of direction in this moment, but news that Britain was mulling easing travel restrictions boosted airlines and hotel groups.

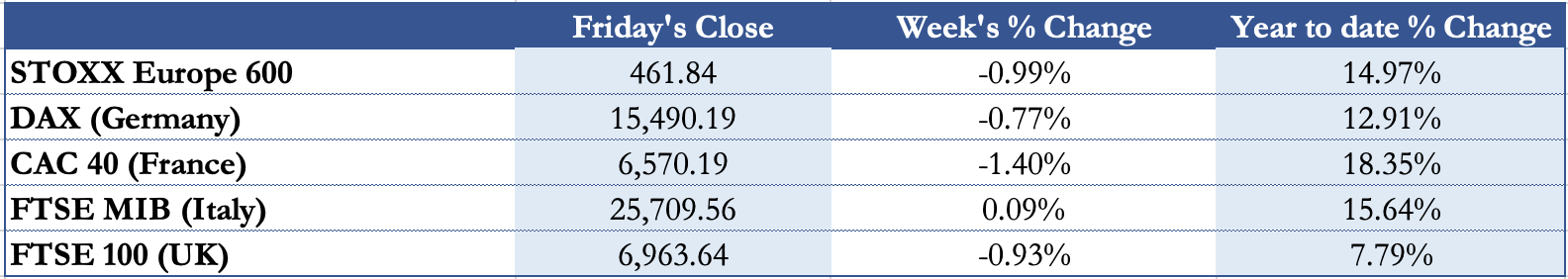

The pan-European STOXX 600 lost nearly 1% this week closing at €461.84. Italy was the only one avoiding a negative weekly return and remained near parity with a 0.09% gained approaching the €26,000 level. On the other side France was the top loser decreasing by 1.4% but still remaining the best index so far this year with a 18.35% YTD return. Lastly the DAX decreased too with a weekly loss of 0.77% stepping down from the 13% YTD level. Data showed British retail sales unexpectedly fell again in August in what is now a record streak of monthly declines. This pessimism was translated in a weekly loss of 0.93% by the FTSE 100 which is the only index which still has not reached 10% level on the YTD return. Travel and leisure led gains across European sectors since Wizz Air, British-Airways-owner IAG and InterContinental Hotels rose between 2% and 5% after Britain said it would simplify COVID-19 rules for international travel. In addition, China-exposed luxury stocks such as LVMH, Kering, Hermes and Richemont rebounded, following sharp losses earlier this week on fears of fresh coronavirus-related restrictions and regulatory moves in China.

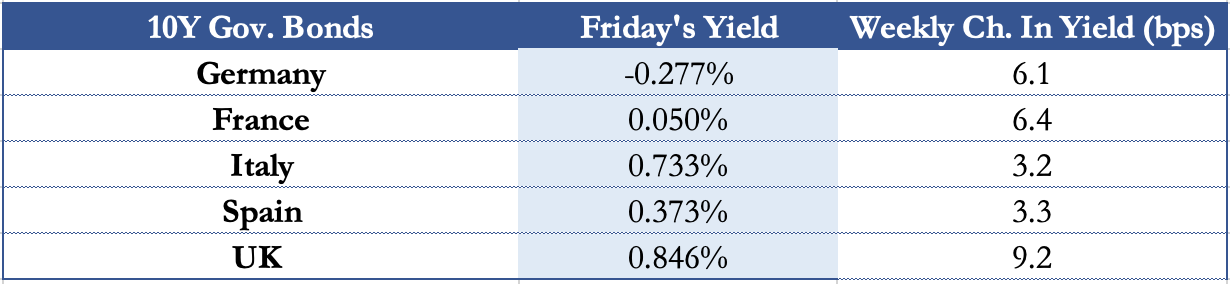

The prospect of the European Central Bank lifting interest rates earlier than many analysts had expected hit eurozone bonds this week, pushing German yield to the highest in more than two months. The moves came after the Financial Times reported that the ECB expects to hit its 2 % inflation target by 2025, according to unpublished internal models that imply a rate rise from record lows could happen as soon as late 2023. That worried investors since it would be well before many economists expect. A day later the ECB said in a statement that the idea of it raising rates in 2023 was “not consistent with our forward guidance”. The ECB also denied the FT’s news that ECB chief economist Philip Lane had said during a call with German economists on Wednesday that “the euro area will reach 2% inflation soon after the end of the ECB’s projection horizon”. However, the forecast of a 2023 rate rise is not a surprise to market participants. Futures markets linked to short term interest rates were already pricing a rise to minus 0.4% by autumn of that year. Nevertheless, some investors are sensitive to any suggestion that worries over inflation could lead to an earlier tightening of monetary policy. “It’s perhaps not surprising that the ECB has models that predict it will eventually hit its inflation target, even if that’s some way off,” said Antoine Bouvet, a senior rates strategist at ING. “But this comes at a time when current inflation numbers are rising and there’s more talk about inflation in general. It definitely struck a chord with some investors and that’s what’s driven the market move.”

Eurozone inflation reached a decade-high of 3% in August, but official ECB forecasts indicate it will fade next year, as it is “transitory”, and reach 1.5% in 2023. It is due to publish 2024 forecasts in December, which will be closely watched by investors to see how close it is to its target. Next week could be pivotal in determining near-term market direction, with the U.S. Federal Reserve and the Bank of England’s policy meetings, as well as German elections coming.

Rest of The World

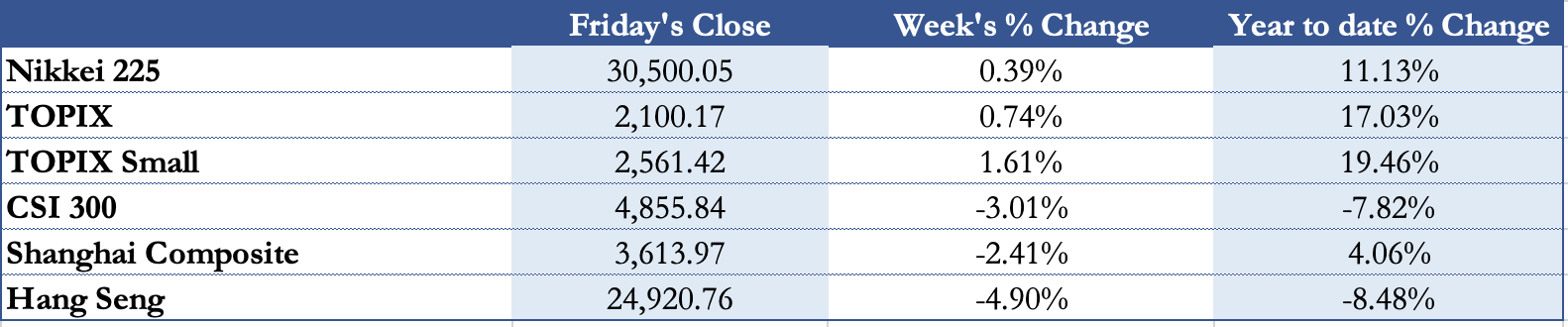

Japanese shares gained also this week reaching a new 31-year high thanks to vaccination effort and new government hope. The Nikkei 225 stabilized above 30,000 with a YTD return of 11.13%. Gains were also boosted by heavyweight chipmakers jump that investor caught up. Both the Topix and the Topix Small overperformed the Nikkei 225 closing respectively at 2,100.17 and 2,561.42. Campaigning began to become the next president of the ruling Liberal Democratic Party and succeed Yoshihide Suga as PM. On the pandemic front, the country’s top coronavirus adviser, Shigeru Omi, said that the peak of the fifth COVID-19 wave has largely passed. He warned, however, that a close eye must still be kept on the country’s overburdened medical system. The government is aiming to ease the scope of coronavirus restrictions in November, once most of the population has been vaccinated. Opposite weekly epilogue for Chinese stocks which lost more than 3% this week and nearly 8% YTD. Causes can be found in weak August economic data, a fresh coronavirus outbreak in Fujian province, the growing debt crisis at embattled property developer China Evergrande Group, and the threat of tighter gaming regulations. Evergrande this week lost more than 30% due to worsening debt problems (its debt exceeds $300 bn) and their inability to pay interests to banks due in September. In addition, economic data are extremely weak and shows the impact of continuous coronavirus outbreaks across the mainland: industrial output, retail sales, and fixed asset investment all missed expectations. Finally, Hang Seng shares closed at 10 months low after this weak loss of 4.9% that makes it the worst index so far this year in the Asia Pacific region.

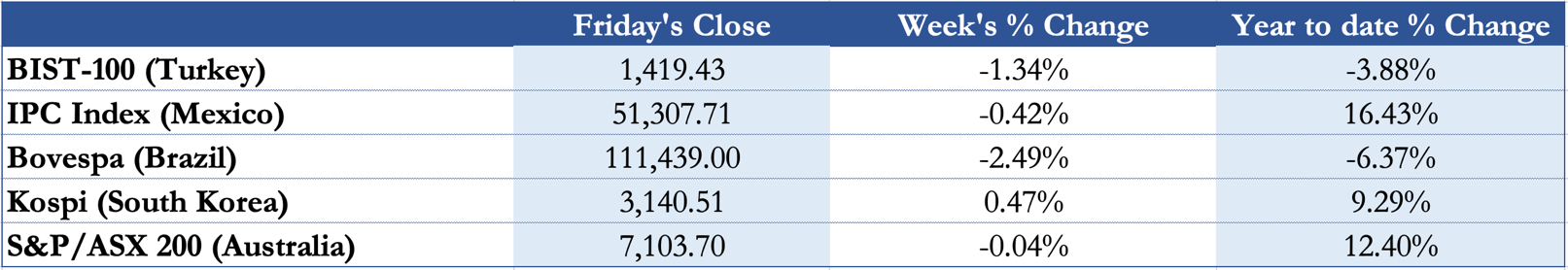

Brazil’s shares fell this week due to central bank chief worrying traders when indicating that there is no interest from them to combat inflation with more rate hikes. His commentary led to a broad sell off of Brazilian shares and the Bovespa closed at 111,439.00 after a weekly loss of 2.49%. The BIST-100 lost 1.34% this week due to rising inflation in Turkey that has now reached 19.25% in August, exceeding expectations. Turkey’s central bank is expected to keep its one-week repo rate unchanged at 19% next week, according to a survey, even though a possibility of a near-term monetary easing increased after Governor Şahap Kavcıoğlu’s recent comments saying that policy was tight enough to bring consumer prices down in the final quarter have led economists to project that monetary easing was on the way. Mexican shares closed near parity on Friday losing just 0.42%, but the IPC Index remains the top performing among this basket thanks to renewed talks with U.S. and an overall economic positive outlook. Soeul stocks bounced back this week closing at 3,140.51 thanks to the increasing pace of the economic recovery from the pandemic. Trading volume was moderate at about 575 million shares worth some 14.6 trillion won ($12.4 bn), with losers outnumbering gainers 491 to 380. Australian stocks too closed near parity this week with 146,000 people losing their work in August as Australia’s double-dip recession deepened amid lockdowns in New South Wales and Victoria.

FX and Commodities

Oil prices posted a 3% weekly gain as energy companies in the Gulf of Mexico were hit by hurricanes and had to stop production. Now Gulf Coast crude oil exports are flowing again after hurricanes Nicholas and Ida took out 26 million barrels of offshore production, but restarts continued with about 28% of U.S. Gulf of Mexico crude output offline. The Brent has stabilized around $75 a barrel while the WTI is at $71.9.

European power prices have spiraled to multi-year highs on a variety of factors in recent weeks, ranging from extremely strong commodity and carbon prices to low wind output. The October gas price at the Dutch TTF hub, a European benchmark, climbed to 79 euros ($93.31) a megawatt-hour on Wednesday. The contract has risen more than 250% since January, according to Reuters, while benchmark power contracts in France and Germany have both doubled. By far the biggest driver is considered gas, with its prices reaching new highs due to Russia who slowed its delivery of piped natural gas to the Euro zone.

The dollar climbed to a three-week peak, making gold more expensive for other currency holders. The U.S. Dollar Index closed at $93.25 getting back to its spring level this year. Consequently, both the EUR/USD and the GBP/USD lost this week about 0.7% and closed respectively at $1.1724 and $1.3736, witnessing that with inflation worries fading away the dollar is strengthening over other currencies.

3 Biggest Movers

Helbiz, Inc. (HLBZ), an Italian-American intra-urban transportation company, soared 97% after the company struck a deal with FOX Networks Group. Helbiz’s new streaming service, Helbiz Media, possesses exclusive media distribution rights to the popular Serie B, the second-highest division in the Italian football league. Helbiz Media will now work with FOX to broadcast the Italian Serie B championship in the U.S. and the Caribbean live on its FOX Sports network. The partnership includes three games per week for the next three seasons.

Innate Pharma, Inc. (IPHA), an American clinical-stage biotechnology company, rocketed higher in response to successful clinical-trial data for an experimental cancer drug called monalizumab. Investors surprised by the results pushed the stock 107.8% higher. Some of the enthusiasm later fizzled and the stock’s gain was reduced to 43.7% this week.

Protagonist Therapeutics, Inc. (PTGX), a clinical-stage biotechnology company, are plummeting today. The stock price has fallen 62.9% this week in response to news of a clinical hold from the FDA. Protagonist Therapeutics is advancing an ambitious pipeline with five new drug candidates in clinical trials right now. Without any approved products to sell, the biotech lost $55 million in the first half of the year.

Next week main events

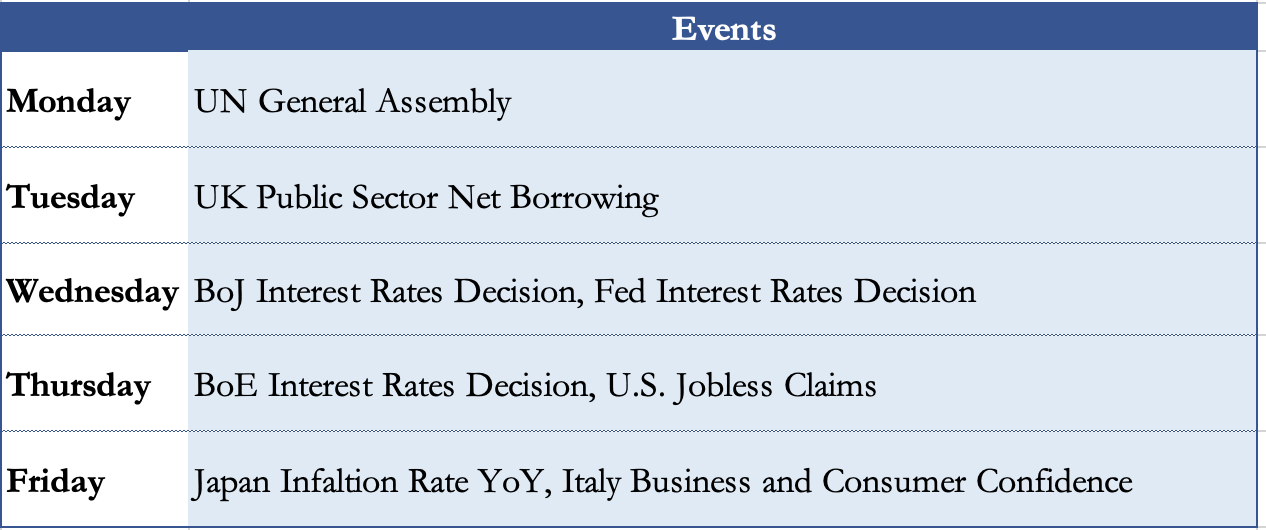

An important week is ahead of us with interest rates decision by Japan, U.S. and United Kingdom. The first two are programmed for Wednesday while Bank of England will speak on Thursday. Other than this Japan will release another important data on Friday: inflation rate YoY.

Brain Teaser #7

A BSIC member wants to reach another floor of the university. He can climb either 1 or 2 stairs at a time. In how many distinct ways can he climb all the stairs if there are N stairs to climb?

Solution:

If we denote the number of distinct ways in which the member can climb N stairs with F(N), we can easily observe that for N = 1, while for N = 2, the member can climb the steps in 2 ways (either all at a time or by making a step two times). Thus, F(2) = 2. Now, we can observe that for climbing N stairs, one can either begin from the N – 1th stair (and make just one step) or from the N – 2th stair (and make two steps). Hence, F(N) = F(N – 1) + F(N – 2). For N = 3, the number of ways the member can climb the stairs is the sum of the possibilities to climb 1 and 2 stairs, respectively F(3) = F(1) + F(2) = 1 + 2 = 3. Finally, we conclude that the answer to this brain teaser is the Fibonacci numbers, where F(1) = 1, and F(2) = 2, while the general term can be represented as F(N) = F(N – 1) + F(N – 2).

Brain Teaser #8

You and your colleagues know that your boss A’s birthday is one of the following 10 dates:

Mar 4, Mar 5, Mar 8

Jun 4, Jun 7

Sep 1, Sep 5

Dec 1, Dec 2, Dec 8

A told you only the month of his birthday and told your colleague C only the day. After that, you first said: “I don’t know A’s birthday; C doesn’t know it either.” After hearing what you said, C replied: “I didn’t know A’s birthday, but now I know it.” You smiled and said: “Now I know it, too.” After looking at the 10 dates and hearing your comments, your administrative assistant wrote down A’s birthday without asking any additional questions. What did the assistant write?

Source: “A Practical Guide to Quantitative Finance Interviews” by Xinfeng Zhou

0 Comments