Introduction

On the 26th of October, Intel’s Mobileye made its debut on the NASDAQ (MBLY:NASDAQ), offering c. 46.26m Class A shares, about 6% of the total shares outstanding (816m). The stock opened at $26.71, more than 27% higher than the IPO Price of $21/share: this brought Mobileye to a valuation of $23bn, making it the largest tech IPO this year and the first large company to surpass its price target range ($18-$20) since December 2021.

Mobileye’s IPO comes at a rock bottom moment for the IPO space, which saw a 94% drawdown in raised money between 2021 and 2022. More and more companies are deciding to delay their public offerings, and investors are starting to look away from riskier bets. The current Mobileye valuation is far away from the expected $50bn provided by Intel last year, when it announced Mobileye would go public.

Thanks to the IPO, Mobileye raised $861m through the public offering and an additional $100m through a private placement to General Atlantic: $600m of the proceeds will be used to repay part of the debt owed by Mobileye to Intel, a move that worried investors, that would prefer funds to be reinvested in the company. Mobileye’s IPO is part of Intel’s bigger strategy of turning around its business, which has lagged behind rivals such as AMD and Nvidia in recent years.

About Mobileye

Mobileye was founded in Jerusalem in 1999 and was later acquired by Intel in 2017 for $15.3bn, at a purchase multiple of 40 times its revenue. With $460m of Revenue in Q2 2022 and $190m EBIT (corresponding to a 41% operating margin), Mobileye supplies more than 50 companies with Advanced Driver Assistance Systems (ADAS) thanks to the EyeQ camera, chips, and software. ADAS include features, such as driver assist, lane-keeping, and automatic emergency braking, that are becoming industry standards and were included in 33% of all vehicles sold in 2021 in the US, Europe, Japan, and China.

EyeQ is the cornerstone of Mobileye’s offering: announced in 2001 and started shipping in 2007, EyeQ was the first full System-on-Chip solution for ADAS; that meant that, while most companies focused on producing either hardware or software for ADAS, Mobileye was able to provide an all-in-one solution that was easy to integrate into the vehicle. This, combined with the accessible cost, made EyeQ suitable for the mass market and convinced major car manufacturers, such as Audi, BMW, Volkswagen, GM, and Ford, to include it in their vehicles.

Since 2013, Mobileye has started to expand in the Autonomous Vehicles space, leveraging its expertise in ADAS: Mobileye Drive is Mobileye’s first fully self-driving vehicle, which is (as stated by the company) ready for commercial deployment for MaaS (Mobility as a Service) and delivery vehicles; furthermore, the research into self-driving allowed Mobileye to further improve its already existing products and create new ones such as SuperVision, a hands-free ADAS (similar to self-driving, but still requires the driver’s supervision). In the long term, Mobileye is planning to make the AV market its primary source of revenue: the company reported that the TAM for Robotaxis alone could reach $160bn by 2030, and if the partnerships Mobileye is signing play out, it would have a good chance of capturing a significant market share.

One of the biggest challenges of Autonomous Driving is Road Mapping, the process of collecting data about roads all around the world to create road maps and train the AI to distinguish the different elements of the streets. Usually, this process is expensive and time-consuming, because you need to use specialized fleets of vehicles to collect data and then map it manually/semi-manually; Mobileye, on the other hand, can leverage the millions of vehicles already equipped with EyeQ to collect anonymous data from users, that gets sent to the cloud and processed to create road maps. Not only this allows to reduce costs and automate the process, but it also ensures that the maps get constantly updated; additionally, since data is collected by actual drivers, the company is also able to collect information on driving culture and local traffic rules. Mobileye reported that, as of the end of Q2 2022, they collected 8.6 billion miles of road data from approximately 1.5 million REM-enabled vehicles (REM is the name of Mobileye’s Road Mapping method), and were analyzing up to 43m miles of road data per day.

About Intel

Founded in 1968, Intel is the world’s biggest semiconductor chip manufacturer, with a total revenue of $79bn in 2021, $19.5bn of EBIT, and $19.9bn of Net Income. Two divisions contribute to 84% of Intel’s, the Client Computing Group (CCG) and the Data Center Group (DCG), accounting respectively for 51% and 33% of total turnover. The Client Computing Group produces commercial and gaming chips for the mass market, such as the Intel Core series, while the Data Center Group focuses on chips optimized for cloud service providers, enterprises, and governments, such as the Intel Xeon product line. Other divisions include Internet of Things Group (IOTG), which focuses on applications for healthcare and industrial segments, Non-Volatile Memory Solutions Group (NSG), which focuses on memory and storage products (e.g. SSDs), Programmable Solutions Group (PSG), and obviously Mobileye, that accounts for 2% of the company’s revenue.

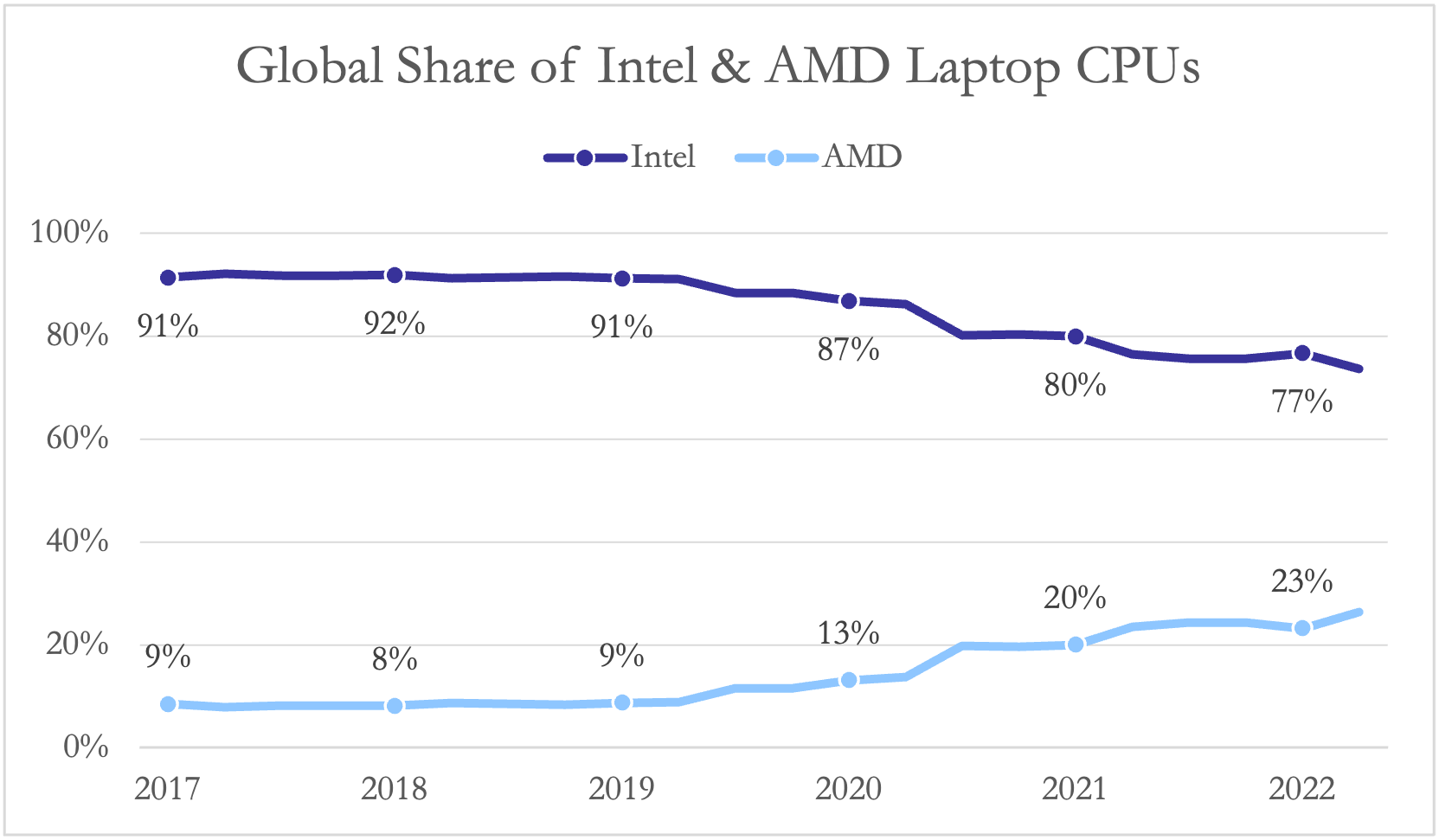

Unlike most of its competitors, Intel still produces its own chips: handling production calls for extreme investments, and Intel reported that in the future capital expenditures could take up to 35% of total revenue. In 2022, Intel partnered with PE firm Brookfield to build two new chip fabrication plants in Arizona, giving up a 49% stake to the Private Equity firm. Mobileye’s IPO is just one piece of Intel’s attempt to turn around its business, which has been suffering from competition in the last years; revenues have decreased 20% YoY in the last quarter (Q3 2022), down to $15.3bn from $19.2bn in Q3 2021; the company made an operating loss, and earnings per share fell from $1.67 to $0.25 (down 85%).

Source: BSIC, Statista

Industry Overview

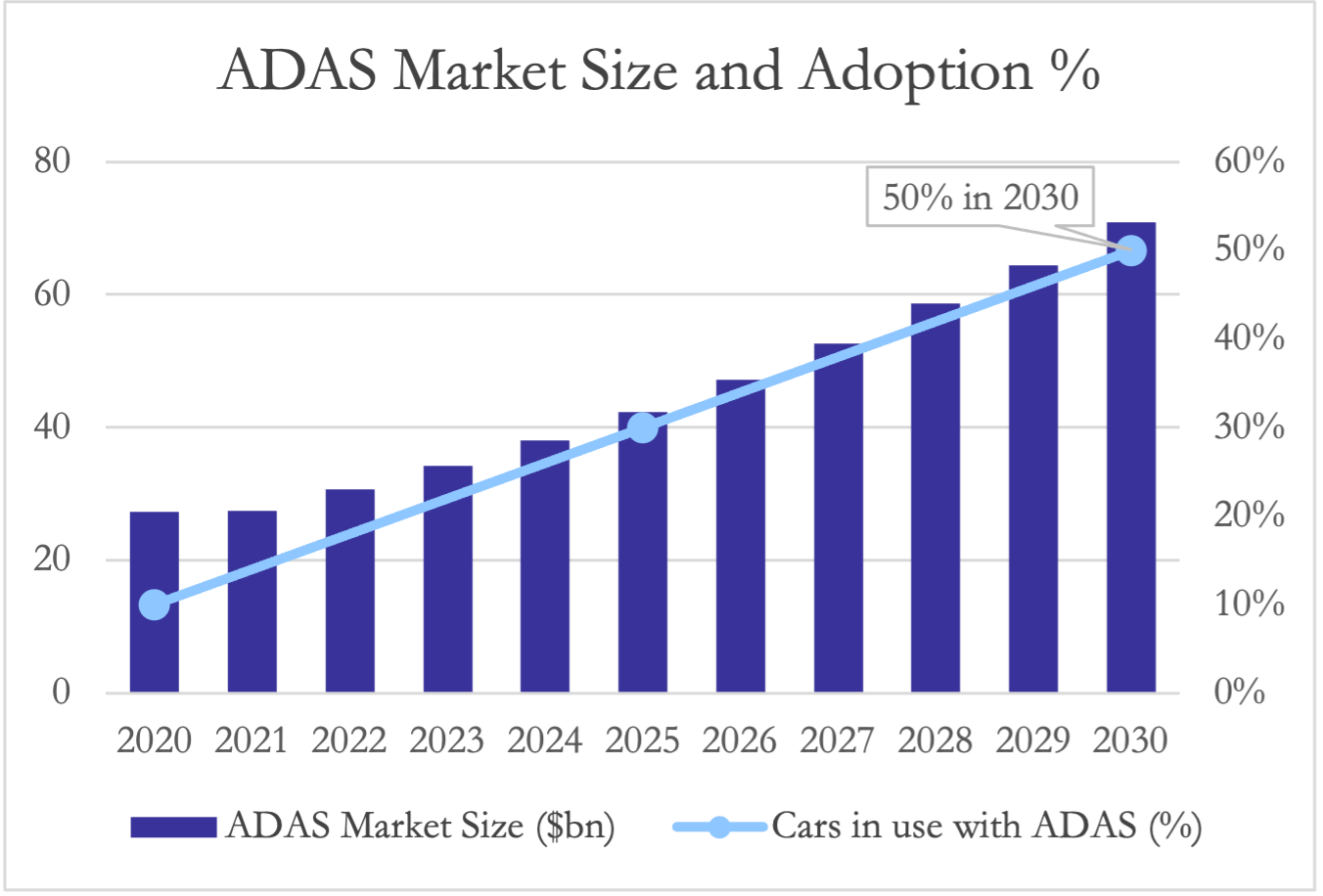

The Advanced Driver Assistance Systems (ADAS) Sector is currently valued at $30.66bn and is expected to reach a valuation of $70.92bn by 2039, at a CAGR of 10%. In the European space, Germany is the center for ADAS Development, due to the presence of key car manufacturers and the steps taken by German authorities to increase passengers’ safety, and accounts for a share of 27% in the region. The presence of ADAS on mass-market vehicles has been increasing exponentially in recent years: if in 2018 only 3% of sold passenger cars in Europe had Level 2 Autonomy driving features, in 2021 approximately 33% of new vehicles sold in the United States, Europe, Japan, and China had them.

However, only about 10% of the 1.05 billions cars on the road in 2020 had ADAS: this is an incredible long-term opportunity for carmakers and particularly their ADAS technology suppliers since it is estimated that 50% of all registered cars will have ADAS by 2030. Government interventions, such as mandatory inclusion of safety features (e.g., Automatic Emergency Braking) or incentives to buy newer, safer, and less polluting cars, will further help to fuel this growth.

Source: BSIC, Canalys, Statista

One of the major threats to the ADAS indusry is whether car manufacturers will start to develop in-house autonomous driving technologies, and some of them already started doing so: General Motors is expected to start producing self-driving vehicles in the coming years, through its subsidiary Cruise; Hyundai and Toyota are investing into AV as well, and Tesla, that used Mobileye’s technology until 2017, is now one of the main competitors of Mobileye. However, there are some major issues in trying to achieve this: first, it takes a lot of resources, both time and capital, to get to a production-ready technology, also because of the regulations in place; most firms don’t have the experience in the field, while companies like Mobileye can have a “bottom-up” approach, building their technology on their expertise in ADAS. Furthermore, moving to more advanced ADAS and potentially self-driving requires a huge amount of data to train the AI, that most of the car companies don’t have.

Source: SAE, IDTechEX

Making the transition from ADAS to full self-driving, on the other hand, is way easier said than done: level 3 technology has been ready since 2017, but car manufacturers have not been authorized to release these features due to legislation, that was still unclear and rather skeptical on the topic. The evergreen example of this is Tesla: where even the “Full Self-Driving” package still requires active driver supervision and “does not make the vehicle autonomous”. Only recently, countries such as Germany, Japan, and the UK have started to allow level 3 vehicles on their roads, and it is expected that significant adoption will happen over the next 10-20 years.

As Autonomous Driving continues to develop and new mobility services become available to the mass market, we could see a decline in private-vehicle sales, with up to 10% of new cars sold in 2030 being shared. This decline, though, will not particularly affect car companies, because it will be offset by increased vehicle sales to fleet operators, such as Uber or Lyft, that could start including AV in their ride-sharing services; vehicle unit sales will continue to grow, although at a slower pace of 2% a year. These vehicles will also be heavily utilized and will have a shorter life span compared to private vehicles, requiring more servicing and increasing new vehicle sales.

However, the transition is a slow process, and we don’t expect ADAS to disappear any time soon: in fact, most companies will keep selling the ADAS enabled vehicles as a cheaper alternative and try to upsell the higher-level features to the customers; McKinsey estimates that, in 2030, 56% of all vehicles sold will be Level 2 or Level 2 Advanced, against only 8% of Level 3 and 4 vehicles.

IPO Rationale

US IPOs, especially in Tech, are on track to have their lowest year in over two decades. With high volatility in the capital markets, high interest rates, and thus, low appetite for offerings, there are a few reasons why companies would choose to push ahead with an IPO to raise capital. Hence, Intel’s decision to spin off Mobileye at a valuation almost three times lower of what it had reportedly previously expected, comes with non-obvious reasons.

Intel’s shares have lost about 47% of their value this year. While the company chose to invest in a company with no natural fit between the two, its rivals have been eating its lunch, partially taking over into Intel’s Core PC business, and other booming varieties of chips and processors sectors. Nonetheless, already under the new CEO Pat Gelsinger, the company has announced plans to turn around its core business, including building and outfitting more chip factories to become a manufacturer for other companies. Hence, the listing of Mobileye fits Intel’s broader strategy, as the proceeds from the share sale, which will be majorly destinated to Intel, could help fund this capital-intensive endeavor.

Yet, Intel’s CEO classified the listing of Mobileye as a market entry rather than a capital raise. Although he publicly recognized the obstacles the industry currently faces, he explained that the autonomous vehicle segment is a strong segment for growth. Thus, the company believes that being listed is the best way to maximize the company’s potential. Further, this matches the decision of selling only around 5% stake of Mobileye, less than the typical 10% to 20% stake for most IPOs. This also limits the financial hit arising from the lower valuation.

Within Mobileye, the proceeds will be used for working capital and corporate purposes, as announced in the filing.

Amidst bad market conditions, Intel and its bankers were also cautious with the shares sale. Reportedly, even before the deal roadshow began, a significant proportion was assigned to two cornerstone investors. The Vanguard Group and Vanguard were the leading buyers of the offer, with the State Street Corp, Capital Group, Geode Capital Management LLC and the Norwegian Sovereign Fund trailing closeby. In total they hold almost 30% of the common class A shares issued.

Deal Structure

The public offering consisted of 41 million shares of class A common stock, each valued at $21 above the guide range $18-$20, and each carrying a single vote per share. Intel retained control over Mobileye, with over 99,4% of the voting rights, holding 750 million outstanding class B shares, which carry 10 votes apiece. As had been previously announced by the company, other $100m worth of class A common shares have been sold to General Atlantic in a private placement at a price per share equal to the IPO prices, which amounted to 5,263,158 shares of Class A common stock. The offering valued the company at $16.7bn, a far cry from the $50bn valuation that Intel was initially hoping to achieve when it first announced its plans to become public.

Further, it was announced on November 7, the full exercise by the initial public offering underwriters of their option to purchase 6.15 million additional shares of Class A common stock at the public offering price of $21.00 per share.

In total, following the IPO, the private placement and the option exercise, Mobileye’s issued and outstanding common class A shares amounts to 52,413,158. Moreover, after deducting underwriting discounts and commissions and estimated offering expenses from the initial public offering, including the exercise of the underwriters’ option to purchase additional shares, and the announced private placement, Mobileye has raised approximately $1bn.

Market Reaction

The debut of Mobileye on the secondary market was a rare positive development amidst the US listing market, the stock increased by more than a third, closing at $28.97, almost 40% above the initial public offering price. Nonetheless, a revival of the IPO market isn’t expected. With still volatile capital markets and deteriorating economic outlook it could be a while until we see companies finally going through with their plans to debut on the stock market. According to Dealogic, excluding the Mobileye IPO, only $7.4bn has been raised in US IPOs this year, 94% lower than in 2021.

Ultimately, Intel and the market still assess Mobileye as a long-term R&D project. And although the IPO should have a positive impact on Intel because of the new unlocked value, Intel’s shares on the other hand remained somewhat stable, nonetheless keeping a downward trend. The valuation of just under $17bn could indeed be a reason for it. It lies just 5% higher than the valuation considered at Mobileye’s purchase, suggesting the deal wasn’t spectacular as previously expected.

Financial Advisors

Morgan Stanley and Goldman Sachs were the lead underwriters of the offering. Bank of America Securities, Citigroup, and Barclays were among the remaining underwriters.

0 Comments