Pension funds are key investors in the market, with around $27.6tn in assets as of 2018. In this article, we will present a brief overview of pension schemes and funds around the world, with a focus on the challenges that pension funds will have to face in the near future.

In the first part, different types of pension schemes are presented and some specific terminology is introduced. The second part analyses asset allocations and market dynamics in recent years, while the third part lays out challenges and potential dangers that are impacting pension markets. The fourth part is a conclusion for the discussion.

I.

Pensions are one of the oldest forms of social security, with records dating as far back as the Roman Empire, where it was awarded to army veterans and known as praemia militiae. Nowadays, during their working life, employees are expected to save part of their wages through some sort of pension schemes which will provide for them after retirement. In this part, we classify pension schemes and introduce some terminology. Note that, across countries, pensions and retirement policies are regulated in very different manners and some entities may escape a clear classification; throughout this section, we will give general characterizations without delving too much in country-specific details.

A first, somewhat obvious, clarification is needed with regards to pension plans and pension funds. The former are retirement plans which lay out the required contributions needed from an enrolled participant and the types of benefits he can expect after retirement. The latter are instead funds managed by proper asset managers, which give effect to pension plans. Their assets come from workers’ contributions while their liabilities are the pension payments they will have to pay out in the future. Clearly, a single pension fund can manage several pension plans and it can either be publicly or privately managed. In many countries, employers provide for pension plans and, depending on the tax regime, may match workers’ contributions in their schemes. Finally, most countries have some types of public schemes, which usually provide a basic minimum pension.

Pension plans can be broadly categorised as unfunded (pay-as-you-go) or (fully) funded. Unfunded pension plans, which used to be more common in the past, are structured so that current workers’ contributions are paid to current retirees. As such, unfunded pension plans have no assets. You can think of them as SPVs, whose sole job is to transfer payments from current workers to current retirees. A problem appears when contributions from current workers are not sufficient to provide for reasonable pensions to current retirees, more on this later.

Funded pension schemes, on the other hand, are based on personal contributions. During his life, a worker will deposit part of his wage in a pension fund, which will invest on his behalf and deliver pension payments once the worker retires.

A further distinction is between Defined Benefit (DB) and Defined Contribution (DC) plans. The former, which according to the terminology above can be either funded or unfunded, entails a guaranteed benefit received by the retiree, regardless of the performance of the fund (if any). Under Defined Contribution plans, the accrued benefit due to the retiree is solely attributable to the individual contributions, accrued as investment gains over the years. 401(k) plans in the US are an example of DC pension schemes.

DB plans constitute the sheer majority of pension plans in Europe and in the US public sector, while DC plans now represent roughly 90% of private pension plans in the US. Indeed, it easy to see why DB plans are unpopular with private employers: should the assets of the pension fund be insufficient, the employer would be liable for the remainder of the defined payment.

When discussing pension markets one often hears about the P7 group. This is simply the group of the seven largest pension markets in the world and includes Australia, Canada, the Netherlands, Japan, Switzerland, the US, and the UK. These markets account for around 90% of total pension assets, roughly equally split between DB and DC.

A final consideration is needed with regards to discount rates. Pension funds have usually some leeway when computing discount rates. For example, the EU has taken several steps to harmonise pension funds regulation across the block, leaving however the choice of the discount rates at the national level. This is evidenced by the very different methodologies for setting interest rates across countries.

Source: EIOPA, Stress Test Report 2017

This might create some distortion when doing comparisons. As an example, the UK has one of the highest deficits of assets to liabilities – but also one of the most conservative discount rate in the EU.

Across the pond, research has found an increasingly widening gap between reported discount rates and independently reported ones. By using the latter instead of the former, there would be an estimated increase of more than $350 bn in funding gap for the 100 largest US plans.

II.

Pension funds are inherently long-term investors and constitute key players in global markets. In this section, we take a look at the dynamics of this market as well as giving a general overview of asset allocations.

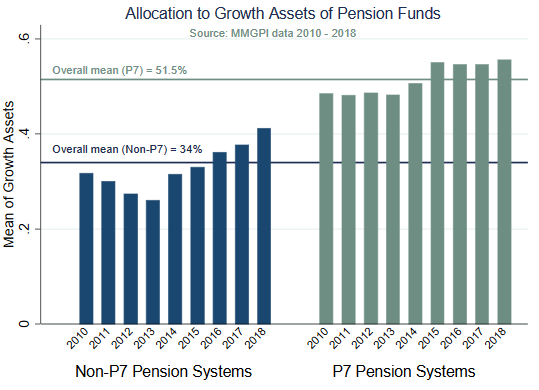

Asset allocations in pension funds can vary significantly across countries, reflecting both different managerial approaches and market regulations. As an example, pension funds across the world allocated on average 38% to growth assets during 2010-2018, but the allocation was over 80% for Argentina and Peru and less than 10% in South Korea and India. Allocation to different assets classes might depend on the specific pension plans and the general risk level of the fund. Overall, asset allocation was found to explain over 90% of the variance in pension funds’ returns.

Source: OECD Global Pension Statistics; Bank of Japan. Data refer to 2018 allocations

Allocations also depend on country-specific regulations. For instance, P7 markets tend to have higher shares in growth assets because they have generally no limit on this type of investments. Another big difference is whether a pension plan is managed by a public or private institution. Public pensions are generally more likely to be DB, have a lower risk profile and hence it’s natural to assume a higher share in defensive assets, on top of regulatory limits. For private systems different investment strategies are available and the decision usually rests in the individual enrolled in the program.

Source: MMGPI data

Note that MMGPI splits assets in growth (equities, property, PE and infrastructure) and defensive (fixed income, cash and deposits).

The large allocations in fixed income assets have been suffering from the low-rates environment, which spurred increased allocations in riskier assets such as equities and alternative investments. Another observed trend is that of a general increase in diversification, both in terms of asset classes and geographic exposures. Pension funds seem to have started shifting away from domestic bonds towards foreign bonds of similar credit ratings, as a way to gain exposure to different markets and rates environment.

Another interesting shift is that away from inflation-linked bonds. Note that pension funds have generally a mandate to provide inflation-adjusted payments, either explicitly or implicitly through political pressures. The decrease in allocations to ILBs might be a consequence of the decrease in domestic bonds but could also be a response to the fall of inflation rates around the world.

III.

Pension funds currently face several risks, which threaten the very foundations of Social Security systems across the world. In this section, we take a look at two key issues and their impact on pension markets.

Demographic Shift

A trend observed almost everywhere in developed nations is that of decreasing fertility rates in tandem with increasing mean population age and life expectancy. In the EU, the working-age population started shrinking since 2012 and research suggests that old-age dependency ratios (people over 65 to those aged 15-64) will increase from current levels of around 30% to more than 55% in 2060. This issue is particularly relevant for unfunded pension schemes. As the double threat of low fertility and high life expectancy looms ahead, the liabilities of unfunded pension schemes constitute an implicit public debt which governments find hard to fix, due to their enormous political and fiscal costs.

Many countries around the world have however started to implement reforms to facilitate the transition from unfunded DB to DC plans. These measures generally include a mixture of raising the retirement age, cutting benefits per retiree, and increasing contribution rates. The issue is clearly on how to fund the pensions of retirees who are already on unfunded DB plans, for current workers would have to bear the double burden of keep paying for current retirees while at the same time saving for their DC plans. One of the most successful and most studied reforms is the Chilean pension reform of 1981, which shifted from an unfunded and publicly managed system to a fully funded and privately managed one. However, the reform was largely achieved by exploiting large fiscal surpluses accumulated in the years preceding the reform, a feat which is hardly replicable in the current environment.

Despite these reforms, the decline in pension replacement rates (the percentage of a worker pre-retirement income that is paid out as pension upon retirement) looks almost unavoidable, especially for public schemes. Towards this end, some countries are drafting policies to increase the retirement age and to incentivize the flexibility of the labour market to allow older people to remain for longer in the market.

Low interest rates regimes

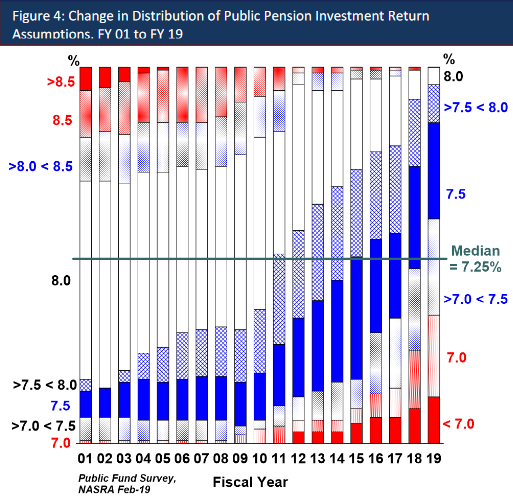

The sustained low interest rates regimes have made it harder for pension funds to deliver growth, especially considering the generally high fixed income asset allocations. This low-rate and low-return environment prompted pension funds to revise their expected return assumptions, down at 7.25% from more than 8% at the beginning of the century. This is also coupled with a greater need for risk to generate returns: as rates decrease, the excess returns over the risk-free necessarily increase, requiring more risk to achieve the same return.

Source: NASRA

The shift to riskier assets in the hunt for yield might be tricky. If interested rates are being cut for fear of a slowdown in global economic activity or a recession, the higher allocation to risky assets might backfire.

IV.

To conclude, pension funds and plans can vary to large extents across the world and their asset allocation reflect both current macroeconomic issues as well as country-specific regulations. As global economic activity seems to start slowing down, two key issues threaten pension funds viabilities. First, the demographic shift, which puts under stress DB plans and is exacerbated by the presence of large liabilities of unfunded schemes. This problem can only be tackled with sweeping reforms to retirements laws and labour markets which, to a certain extent, governments around the world have already started implementing, albeit with mixed results. Second, low-rate regimes have negatively impacted pension funds returns, which have natural large allocations to fixed income products, and prompted them to reallocate to riskier assets such as equities. However, insofar as low rates persist

in response to a general economic slowdown, the increased risks taken by pension funds might backfire and put further strain on the system.

BONUS section: Warren Buffett and long-dated options

Imagine you are a pension fund manager who has to manage assets for a DB pension scheme. Your first concern is to be able to deliver the minimum guaranteed benefit, say 100, so you use part of your funds to buy a safe zero-coupon bond that will deliver 100 at maturity. The cost of the strategy is ![]() where

where ![]() is the relevant discount factor. To boost returns you also want to have some exposure to the equity market, so you also use part of your capital to buy call options on some stock index on a rolling basis.

is the relevant discount factor. To boost returns you also want to have some exposure to the equity market, so you also use part of your capital to buy call options on some stock index on a rolling basis.

This strategy, called a fiduciary call, might become problematic, as in a low-rates regime ZCBs become quite expensive, leaving little left for call options. A possible solution would be to exploit to put-call parity:

![]()

That is, the original strategy can be replicated with a protective put, i.e. with a long position on the index coupled with a put option. The issue here is that your ultimate purpose is still to ensure the minimum benefit so you need to buy long-dated put options. But who would sell 10- or 20-year put options?

Look no further than Warren Buffet.

Mr Buffet, who famously dubbed derivatives as “financial weapons of mass destruction” has sold billions in long-dated put options on account on his belief that Black-Scholes produces “absurd results” if applied to extended periods. He lays out his argument in his 2008 letter to shareholders, published after Berkshire Hathaway posted some $5 bn in paper losses on those contracts. The letter, which we invite the reader to read, doesn’t explicitly say why Mr Buffett believes the model fails price accurately over long periods. A key point of contention seems to be the lognormal diffusion assumption. The assumption implies that volatility increases linearly with the time horizon and indeed there is some empirical evidence that the linearity assumptions fail to hold at long horizons.

Nevertheless, two observations are in order. First, Mr Buffett fails to make a distinction between historical probability, which he uses for his common-sense example in the letter, and risk-neutral probability, which is instead assumed in the Black-Scholes model. For example, his computations seem to imply a 4% equity risk premium instead of the zero risk premium of the risk-neutral world.

Second, the options written by Berkshire Hathaway included a clause that allowed them to avoid posting collateral. This, of course, has little to do with Black-Scholes but rather is a peculiarity of Berkshire Hathaway and its unique positioning in the market.

Sources

- “Pension Funds in Figures”, OECD, 2019

- “Fiscal Alternatives of Moving from Unfunded to Funded Pensions”, OECD, WP

- “Asset Allocation of Pension Funds”, ACFS, 2019

- “Financial Stability Report”, EIOPA, 2019

- “Global Pension Assets Study”, Thinking Ahead Institute, 2018

- “How do Public Pension Funds Invest?”, State Street Global Advisors, 2018

- “Public Pension Plan Investment Return Assumptions”, NASRA, 2019

- “2018 Public Pension Funding Study”, Milliman, 2019

- “European pension regulation: the ending of retirement and the political economy of USS”, USSbriefs, 2018

- “US Pension Market”, Insight Investment, 2019

- “A Pan-European Pension Product”, EPSC Strategic Notes, 2017

- “Warren Buffett, Black-Scholes and the Valuation of Long-dated Options”, B. Cornell, 2009

- “Warren Buffett is Wrong About Options”, J. Seed, 2018

0 Comments