NVIDIA Corporation (NVDA : NASDAQ) – market cap 24/9/2020: $305.1bn

ARM Holdings – privately held by Softbank

Introduction

On the 13th of September, Softbank agreed to sell its UK subsidiary Arm Holdings to Nvidia in a $40bn deal. The cash-and-stock transaction will be the largest in the history of the semiconductor industry. The US company will pay to the Japanese conglomerate $21.5bn in common stock and $12bn in cash, which includes $2bn payable at signing. Furthermore, an additional $5bn cash payment will be made if Arm reaches specific financial performance targets. The disposal of Arm will result in Softbank becoming one of Nvidia’s largest shareholders with a stake of around 7%. The purchase highlights Nvidia’s strategy to become the main supplier of core technologies used to power large-scale data centers, a market today almost entirely controlled by Intel. Moreover, the acquisition will allow the US company to broaden its range of products, as Arm designs several small chips that are integrated into all kinds of smartphones and computer systems.

About Nvidia

Nvidia is an American multinational technology company headquartered in Santa Clara, California. The firm’s primary business is in the engineering of integrated circuits, which are used in a wide range of devices, from electronic game consoles to personal computers. Furthermore, the company is a leader in the development of graphics processing units (GPUs). The GeForce products, high-end GPUs Nvidia produces, are close competitors of the Radeon products manufactured by Advanced Micro Devices’ (AMD). The company was founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem that within the first year raised $20m of venture capital funding from Sequoia Capital and other investors. Nvidia received major recognition in 1998 when it launched a new series of graphics processors called RIVA, and when in 1999, it released the first model of the GeForce 256 GPU. Later in 1999, Nvidia went public raising $42m by offering 3.5m shares at $12 per share.

Since 2014, Nvidia has changed business strategy, shifting its focus to develop new products for four specific markets: gaming, professional visualization, data centers, and auto. Nvidia’s differentiation in the range of products offered was definitely backed by the market, causing Nvidia to become the world’s most valuable chipmaker after passing Intel in July of 2020. Moreover, as of today, Nvidia is widely known to have a competitive advantage in the field of artificial intelligence, as the company graphics processors can run power-hungry AI algorithms more efficiently than those of competitors. Therefore, Nvidia is well-positioned to seize the huge opportunities of this fast-growing market to become a dominant player in the AI sector.

As of January of 2020, when the financial year for Nvidia ended, the company registered more than and $10.9bn of revenues, which decreased from the $11.7bn of the previous year. Moreover, the American company had $17bn of assets that comprises almost $11bn of Cash & Short-term investments. Overall, net income in the last financial year reached $2.8bn, resulting in a 32.48% decrease YoY, whereas EPS decreased from $6.63 to $4.52, a 31.82% decrease. Even though Nvidia’s last year results seem disappointing, the company still outperformed analysts’ estimates and in its 2021 financial year, it is showing strong improvements. Indeed, in Q1 FY 2021 which ended in April, EPS surged 105% recording the company’s fourth-fastest rate of earnings growth in the past 17 quarters.

About Arm

Arm Limited is a British company specialized in the development and design of several software and processors. Arm was founded in 1990 as Advanced RISC Machines Limited, a joint venture between Acorn Computers, Apple Computer, and VLSI Technology. The company was created to further develop the Acorn RISC Machine, a processor used in the Acorn Archimedes selected by Apple for its Newton project. On the 5th of September 2016, the company was bought by the Japanese multinational conglomerate SoftBank Group, with a deal that valued the company at $32bn (£23.4bn).

Unlike other big players in the sector, Arm business strategy is based on creating and licensing its technology as intellectual property rather than manufacturing its products. Today, Arm’s business model is mainly focused on developing and licensing its ARM processors (CPUs). However, the company also designs software development tools under the name of several popular brands, as well as system-on-a-chip (SoC) infrastructure and software. The company is widely regarded as one of the largest players in the market for processors and chips for mobile phones, tablet computers and smart TVs with current licensees of Arm CPUs including Apple, HTC, Nokia, and Samsung.

Arm was first listed on the London Stock Exchange and NASDAQ in 1998 and, before being acquired by Softbank, it was also a constituent of the FTSE 100 Index. Since 2016, Arm’s annual revenues have risen from $1.2bn to $1.9bn, not reaching, however, investors’ expectations, as other direct competitors largely outperformed the UK company. The Japanese conglomerate led by Masayoshi Son provided Arm with more financial resources that allowed the British corporation to expand through five acquisitions, resulting in a personnel increase of more than 900 employees which now totals 5,700.

Industry Overview

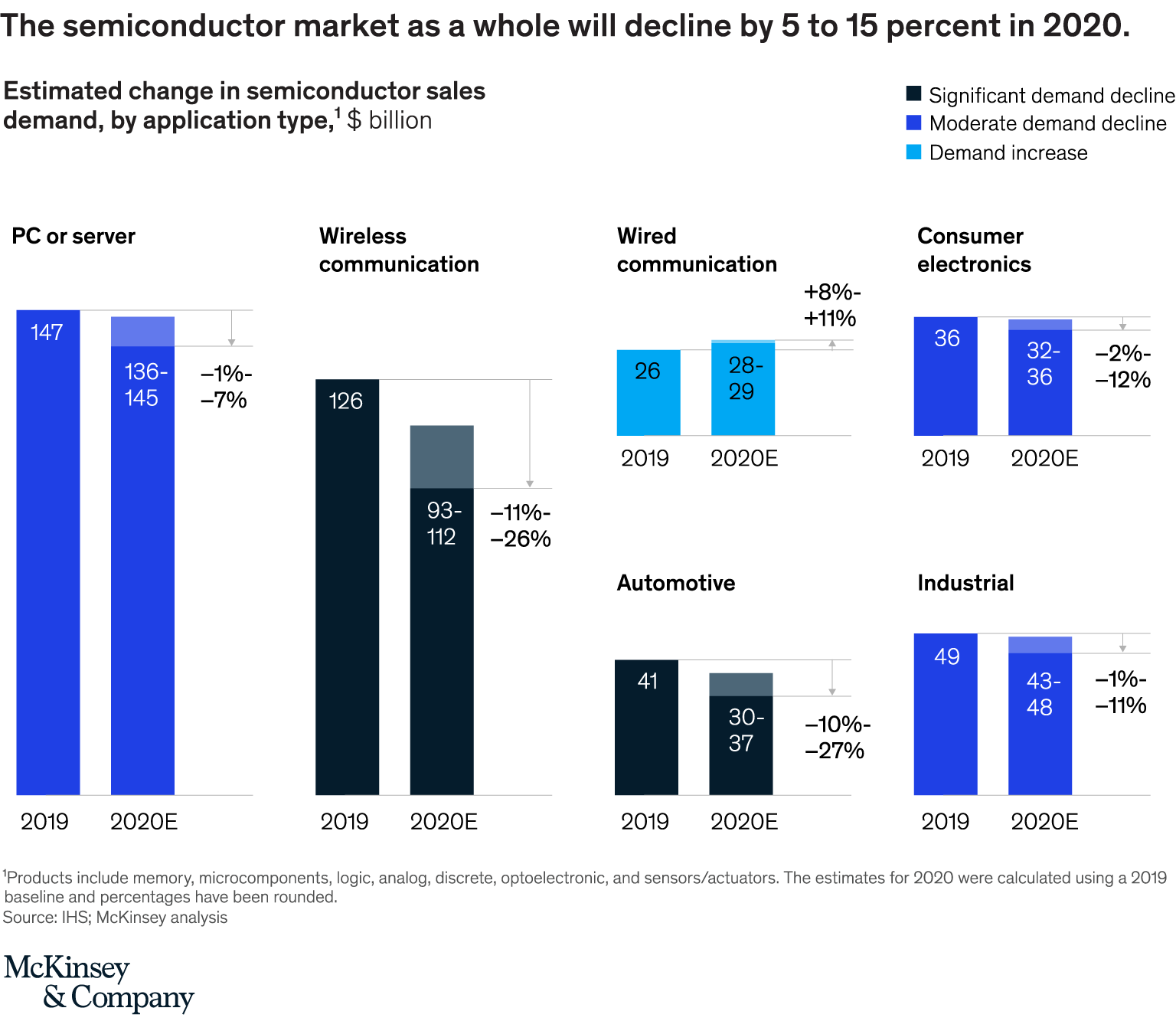

Because of the COVID-19 pandemic, demand in the semiconductor industry has fallen, shifting towards major semiconductor end markets, such as PC or Server, Wireless and Wired communication, Consumer electronics, Automotive, and Industrial applications. The industry is expected to decline by 5 to 15% compared to 2019, according to a McKinsey report that evaluates two scenarios for global GDP recovery, which is assumed to happen either in Q4 2020 or until late 2022.

If we break demand down into markets, we can observe that some will suffer a steeper decline than others, depending on various drivers (figure below).

Laptop and Tablet demand will remain moderately stable in contrast to falling (by est. 3 to 9%) demand for PC semiconductors. The first is due to consumers upgrading their private IT infrastructures for work or school-related activities, while the drop in PC semiconductor demand is caused by delayed hardware upgrades and long-term migration projects by different companies. If consumers cut spending even more and the economic downturn continues, such upgrades will not be repeated at previous scale, leading to further decrease in semiconductor sales after 2020.

The semiconductor market for servers could increase by 1 to 7% towards the end of the year, driven by the increase in video streaming and conferencing as work from home continues. Demand for enterprise cloud solutions is expected to stay stable or suffer minor declines as some companies impose IT budget cuts. If the global economy continues to shrink after Q4 2020, more companies will cut IT budgets, an effect that will outweigh any additional increases in video streaming.

Semiconductor demand in Wireless communications is expected to suffer one of the sharpest falls in the industry, one of -11% to -26%. This would be due to the expected drop in the sales of mobile phones and consumers shifting preferences to cheaper models. In terms of Wireless communication infrastructure (5G development in particular), demand patterns vary. Telecom providers that that have not yet launched 5G networks are likely to postpone investment and focus on improving existing services, while the ones already developing 5G solutions are expected to keep up with their investments.

Source: McKinsey & Company

Another positive trend in semiconductor demand lies in wired communication, a market that is set to increase by 8 to 11% this year due to several COVID-19-related factors, such as the overall increase in internet traffic, video streaming & fixed broadband usage (resulting in higher sales of cable and wireless routers), alongside a push in security updates in IT infrastructures as more people work from their homes.

Demand for semiconductors in Consumer electronics (semiconductors for video games and televisions), Automotive, and Industrial applications, is expected to drop as well, but not as much as demand for wireless communication. The drop in Consumer electronics relates to the recent upward trend in videogaming, purchases of kitchen appliances and audio equipment, another consequence of the COVID crisis, while as car sales volumes shrank significantly this year, a fall in global automotive semiconductor demand comes as a natural response. However, demand for such products could rise again if governments incentivize the use of hybrid electric vehicles (HEVs) and electric vehicles (EVs), since they contain more semiconductors than vehicles with a combustion engine. The major demand drivers in Industrial applications include investments in markets such as medical electronics, energy products, and aerospace equipment. Overall, demand in these markets has fallen, except for the case of medical electronics directly related to the management of the COVID-19 pandemic, where demand has, unsurprisingly, surged.

As to if and how the semiconductor industry could emerge stronger after the COVID-19 crisis, another report by McKinsey forecasts negative YOY revenue growth in the semiconductor industry in 2020. Researchers expect an improvement in the situation in 2021 as the markets recover and the starting point from 2020 will be much lower compared to that in previous years.

Source: MCKinsey & Company

Nvidia’s emblematic acquisition of Arm marks the evolution of Moore’s Law – the perception that computer speed and capabilities increase every couple of years while their price diminishes accordingly – into a new one, Huang’s Law (named after Nvidia’s CEO Jensen Huang) – an observation that advancements in graphics processing units (GPUs) grow at a much faster rate than traditional central processing units (CPUs). In other words, it states that chips that power artificial intelligence more than double their performance about every two years. Jensen Huang observed that Nvidia’s GPUs were 25 times faster than they were five years ago, whereas Moore’s law would have expected only a ten-fold increase. GPUs have been Nvidia’s specialty for a long time, with its chips’ performance increasing 317 times for an important class of AI calculations from November 2012 to May 2020. The industry has been experiencing quite a power surge in recent years, improving AI applications that will make a whole new range of uses possible – from self-driving cars to optimized storage systems. A McKinsey report about the opportunities that AI reveals to semiconductor companies highlights that AI could allow these companies to capture 40-50% of total value from the technology stack and will create most value in compute, memory, and networking. Through the acquisition of Arm Holdings, NVIDIA will give a further boost to the development of AI processing.

Deal Structure

The Nvidia-Arm deal is about to become the biggest M&A transaction in the history of the semiconductor industry. After overtaking Intel, the acquisition of Arm comes as another step in Nvidia’s uprise as top chip maker worldwide. Nvidia will acquire Arm Limited from SoftBank for $40bn, of which $21.5bn in 44.3m of Nvidia’s common stock and $12bn in cash (including $2bn payable at signing). An additional amount of up to $5bn may be transferred to Softbank in cash or stock, depending on the accomplishment of specific financial performance targets by Arm. Nvidia will issue $1.5bn stocks to Arm employees and plans to finance the cash part of the transaction with balance sheet cash. The transaction expected to be immediately accretive to Nvidia’s non-GAAP gross margin and-GAAP EPS. SoftBank will hold less than 10% ownership stake at Nvidia. Nvidia has stated that it would not change Arm’s business model, nor it would move Arm’s headquarters from Cambridge. The deal excludes Arm’s IoT Services Group and is expected to close in approximately 18 months.

Deal Rationale

Through this deal Nvidia targets to become the premier computing company for the age of artificial intelligence, accelerating innovation while expanding into large, high-growth markets. However, it may be difficult to combine the two very different business models of Nvidia and Arm.

Indeed, Nvidia is primarily a manufacturer of GPUs, graphic chips that are required for all the large high-growth opportunities such as cloud-computing, artificial intelligence and robotic automation. Instead, Arm licenses blueprints for general-purpose chips, or central processing units (CPUs), and then the client companies produce their own.

Arm has a keystone position in this market, having among its customers Apple, Qualcomm and Samsung. However, since it was acquired by Softbank in 2016, revenues have stagnated, and the firm has made a small but persistent loss (see chart). Among the causes of this flat trend, there is a slowdown in the smartphone market and increasing competition from companies that provide free and open designs, such as the RISC-V architecture. In addition, its parent company Softbank, being under pressure to shore its flagging stock price, has committed itself to a $41bn asset disposal programme at the height of the coronavirus market rout in March.

Therefore, Softbank is not receiving an amazing return on this deal, given the growth of tech in the last years. If the additional cash payment of $5bn, that is linked to some performance measures, and the $1.5bn of stocks granted to Arm’s employees are deducted, the amount received by Softbank is equal to $33.5bn. This is only 5% higher than the $32bn paid in 2016, but slightly less than this consideration adjusted for inflation, equal to $34.5bn.

Source: The Economist

With this acquisition, Nvidia would gain the ability to own the whole chip stack, across mobile phones, computers and cloud-computing data centers. For example, in the lucrative market of the data centers, currently dominated by Intel, Arm’s technology could be used to build Nvidia’s versions of the CPUs that power the data-centers computers into which Nvidia’s accelerators are installed. Nvidia CEO Jensen Huang has repeatedly expressed his appreciation of Arm’s technology, describing it as incredibly energy efficient, a central feature to obtain very high-performance levels even with data-intensive tasks like artificial intelligence.

Moreover, Nvidia could expand beyond its existing markets: as a basic level of artificial intelligence is applied to many day-to-day objects, the company will design new chips for an even wider range of devices. In case of cheaper devices, Nvidia plans to adopt Arm’s business model: packaging Arm’s processor design with its graphic technologies to create integrated blueprints for other chipmakers.

If the deal structure is considered, this acquisition seems particularly convenient for Nvidia: $21.5bn, more than half of the consideration that Nvidia will pay for Arm, will be given in 44.3m of its common shares. As demand for its products that serve the data center and video-gaming markets have soared amid the pandemic, the company share price has more than doubled in 2020, making it 2020’s second-best performing stock in the entire S&P 500 Index after Carrier Global Corp. Therefore, the stock part of any transaction is cheaper for Nvidia.

However, other than Qualcomm, no other major chip group has ever succeeded at selling chips and licensing intellectual property for other companies to produce their own, mainly because of the differing requirements when it comes to developing, documenting and testing fundamental chip technology. Moreover, Arm does not compete with its customers by selling chips. Nvidia, instead, may be tempted to tweak Arm’s products to favour its own goals or to make use of Arm’s latest technology first, to get an edge over rivals that depend on access to the same technology.

Mr Huang has given public assurances that Arm will keep operating fairly and that it will maintain its current business model, but analysts have wondered whether that will be enough to reassure Arm’s customers. According to some industry experts, RISC-V will now attract new investments from companies seeking an alternative to Nvidia, while the largest Arm customers will eventually switch to designing their chip architectures.

Another important factor to consider is the geopolitical risk. Given the large size of the deal, it will require regulatory approvals from the European Union, the U.S., United Kingdom and China. Britain’s government may impose strict conditions on the takeover of one of Britain’s most important homegrown technology companies and potentially trigger an extensive review by the Competition and Markets Authority; Nvidia has already pledged to protect jobs and maintain Arm’s base in Cambridge.

However, the approval of Chinese regulators is the most difficult to get. This deal would give the US control of irreplaceable technology for China, as 95% of locally designed chips use Arm technology, including Huawei. Those processors power key industries, everything from facial recognition to drones, on which China has bet its economic future. If Arm and Nvidia pushed ahead with the deal in the face of Chinese opposition, they would lose 30% and a quarter of their sales, respectively. Furthermore, Arm and Nvidia would lose access to growth: China is the largest and fastest-growing market for datacenters outside the US and it is a crucial market for artificial intelligence computing chips.

Market Reaction

Nvidia shares gained around 5.82% on the Nasdaq on the day after the announcement, rising to $514.89. Analysts were excited about potential for the combination, but many of them had some doubts on how the merger will play out.

Bernstein analyst Stacy Ragson admitted that the idea of Nvidia, or any individual semiconductor company, buying Arm is a bit of a head-scratcher, as the current value proposition of ARM stems from their independence. However, he wasn’t totally pessimistic, and he said that if the company if the company can pull it off then Nvidia’s dominance will be extended into virtually every important compute domain. He reiterated his outperform rating and $545 price target.

Evercore ISI analyst C.J. Muse took a similar view, arguing that the two companies together would make for a powerful combination though deal approval could be tricky. Indeed, many players will likely complain about this deal, including China, the UK and the existing Arm licensees. According to the Evercore ISI analyst, a time to close, at a minimum, would be 18 months. He maintained an overweight rating and $600 price target on the shares.

Jefferies analyst Mark Lipacis was more upbeat, writing that the deal could be transformative and raising his price target on the stock to $680 from $570, the highest target available so far. The merger puts Nvidia in a position not just to capture 80% of the ecosystem value in the data center, but also unify the compute ecosystem between the edge and data center.

On the same day, Softbank shares gained around 8.96% on the Tokyo Stock Exchange, rising to ¥ 6,385, as investors were celebrating the sale of an undervalued business. Nonetheless, Softbank enterprise value is still 41% less than its steeply valued tech investments.

Financial Advisors

Softbank was advised by Raine and Zaoui & Co, while it is unclear whether Nvidia was advised on the deal.

0 Comments