Oil has been completely crushed after peaking this summer: much has changed since our last article earlier this year (https://bsic.it/oil-quo-vadis/).

Weakness in the price of crude was triggered by fear of a global slowdown: China growing at its lowest rate since 2009 (only 7.3%), together with cuts in economic forecast by IMF and Europe in particular have caused oil price to fall all the way down to $78.65 for a barrel of WTI and 83.39 for Brent.

At the beginning of this week, OPEC cut demand forecast for the coming years, now expecting for 2015 the lowest level of demand in 17 years.

In the past, falling oil prices were generally supported by cut in supply by OPEC countries. Today, thanks to the shale revolution in the US, OPEC countries only account for 40% of global supply and are no longer in the position of moving prices.

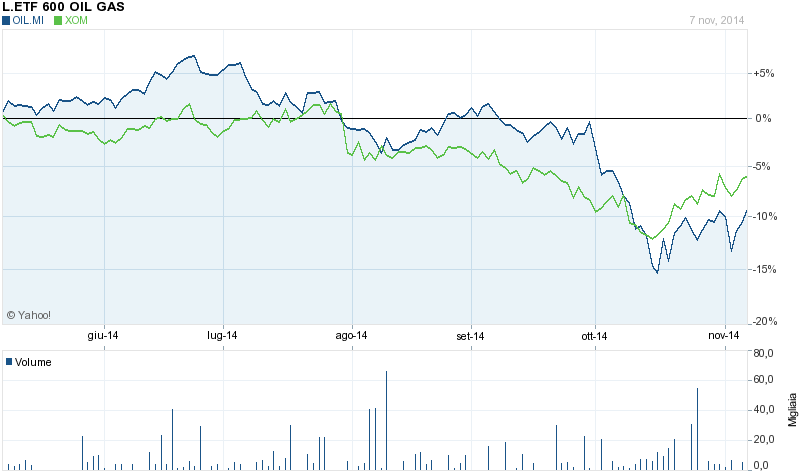

As a consequence of this low oil prices, last month was quite disturbing for major oil producers. As the oil price continued to refresh lows, those companies’ performance has been affected negatively.

However, Exxon benefited from its integrated business model that goes from discovering oil to selling petrol at fuel stations, which acts as a hedge for their earnings against commodity price volatility. Exxon reported net income of $8.07bn in Q3, up 3 per cent compared to the equivalent period in 2013.

The company reported lower profits from oil and gas production (upstream division). However, the outputs of their upstream business is also the “feed-stocks” for their refining operations, and lower prices helped those divisions report higher margins and sharply increased profits. So the impact of the weaker oil price, which cut Exxon’s upstream profits, was mitigated by an increase in downstream profits. (Exxon’s downstream businesses recorded a 73 per cent increase in profits from refining). These results demonstrate the strength of the integrated business model.

Moreover, many long-term investors keep Exxon’s stocks in their portfolios because of its dividend policy. The company has paid dividends since 1911 and increased distributions on its common stock for 31 years in a row. This year the cumulative dividend paid will be $2.70 per share (+9.75% compared to 2013 dividend).

This aggressive dividend policy is attractive for dividend investors, but at the same time, it can affect the liquidity of the company. It is clear from the Cash Flow Statement that the Net Change in Cash has been deeply negative in the last years and one of the reasons is indeed the Total Cash Dividends Paid. As a matter of facts, Cash & Equivalents has dropped from $12.6bn in 2011 to $4.6bn in 2013.

Source: Yahoo Finance

In conclusion, the company’s strengths can be seen in multiple areas, such as its largely solid financial position with reasonable debt levels by most measures, attractive valuation levels and strong integrated business model; considering all these factors, we suggest recent weaknesses are buy opportunities for a long term-horizon strategy. However, a change in expectations on Shale gas production and OPEC meeting on the 27th of November may strongly increase volatility in the short term.

[edmc id=2065]Download as PDF[/edmc]

0 Comments