Company Overview

BYD [SHE: 002594], founded by Wang Chuanfu in 1995, is a company focused on technological innovations, namely the manufacture of electric vehicles, renewable energy, rail transit and other electronics. The name stood for “build your dream” and the company initiated as a producer of mobile phone batteries. Today, the business generates 80.3% of its revenue from selling automobiles and related parts and the remaining 19.7% from mobile phone parts and other products.

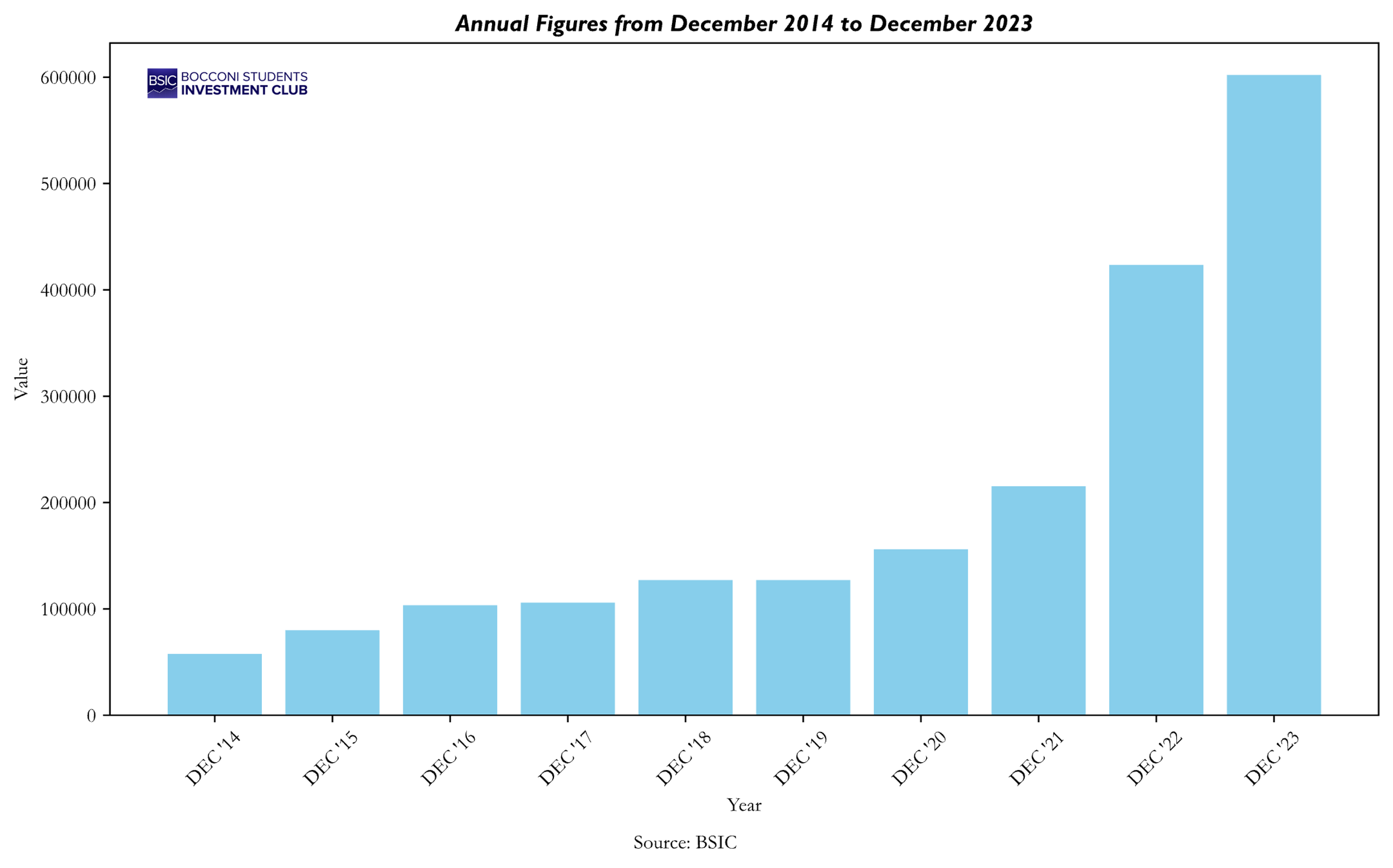

In 2023, it captured 73.4% of its total revenue of ¥602bn (€78.3bn) in China. In the graph below, the revenue growth for BYD in the past decade can be seen, all values are in Chinese Yuan.

While the figures for revenue are already impressive, take a look at net income: for 2023, it soared 80.7% to ¥30.04bn. Despite such a jump, BYD missed the expected earnings by less than $140m, causing its stock to drop. Today, it trades at ¥208.16, which is equivalent to $29.35. Through its innovation in the automotive industry, BYD has gained attention from customers and competitors alike. The company is best known for its EVs, where it outshines similar companies in the technology used. BYD’s proprietary technology includes its Blade Battery, e-Platform 3.0, semiconductor chips and even the infotainment system used in its cars. Today, these components are used under 3 different brand names – BYD, Denza and Yangwang – in 10 different models with varying specifications. With the help of these efforts, the company sold more than three million new energy passenger vehicles in 2023.

In attempts to diversify its product range, BYD has recently launched the all-new Yangwang U9 sports car with a starting price of $230 000. This introduction would allow BYD to compete with familiar brands like Ferrari, and, combined with the launch of new plug-in hybrid cars, with Toyota, Volkswagen, and others. Being known as the best-selling EV producer in the world, introduction of PHEVs might seem like a step back to some. However, such move now puts the company in direct competition with gasoline cars, priced up to 40% lower than competitors’ models in the Chinese market. Complimenting this move is a simultaneous expansion into the European market, where the BYD Seal U DM-i, set at $23 000, will go on sale in the coming months. At a time when hybrid sales are surging around the world, even more so than EV sales, this strategic decision could allow BYD to tap into yet undiscovered market potential. Since today the environment of the automotive industry is arguably changing at a faster pace than ever, most pure EV production faces net losses in the end. For hybrids, older technology and a semi-maturely developed production enables production-cost advantages. BYD’s increasing sales in the hybrid market caused its profitability to increase. The company’s operating margins have risen to 5% from 3% two years ago, despite price cuts in recent years.

Sector Overview

The electric vehicle sector is rapidly growing worldwide, although at different rates across different regions. In Q1 2023, Tesla[BIT: 1TSLA]’s Model Y became the world’s top-selling passenger car model in the first quarter, beating both EVs and traditional vehicles, marking a significant shift towards electric mobility on a global scale.

As of 2023, there were approximately 13.7 million plug-in electric vehicles registered, which is about 16% of total global vehicle sales. The Asia-Pacific region is at the forefront of the EV market, with China accounting for around 60% of global electric car sales in 2022. This dominance is supported by aggressive government policies that incentivize both consumers and manufacturers, along with significant investments in charging infrastructure. Looking beyond China, the Asia-Pacific region is projected to see continued growth in the EV market, as other countries like Thailand and Indonesia strengthen their policy support schemes for EVs. Despite starting from a lower base, these emerging markets are experiencing notable growth, potentially offering insights for other countries looking to accelerate EV adoption.

Under the Biden administration, the United States introduced a series of EV tax credit subsidies as part of the Inflation Reduction Act. This legislative move is designed to reinforce the U.S. as a leader in electric mobility by offering up to $7,500 in tax credits for consumers who purchase EVs manufactured in North America. These incentives form part of a comprehensive approach to encourage the adoption of electric vehicles, support domestic vehicle production, and assert the nation’s commitment to reducing carbon emissions. However, EVs still only make up 10% of all new car sales in the US, indicating that EV adoption is still in its early stages in the region. While these incentives boost US manufacturing, they limit consumer choices, which could skew the market towards certain brands and models. This situation is particularly relevant for BYD as it seeks to compete in the US market, where its eligibility for full incentives depends on expanding its manufacturing within the country.

Range anxiety is a significant hurdle to EV adoption, which is the fear of running out of power without access to charging infrastructure. This concern is particularly prevalent in large countries such as the US, where the charging network is yet to match the extensive gasoline station infrastructure. To address this, BYD and other manufacturers must either increase the range of their vehicles or establish partnerships to expand charging options’ accessibility. The EV sector also faces several headwinds, including raw material supply constraints and geopolitical tensions that could affect market stability and cost structures. However, tailwinds such as increasing environmental awareness, technological advancements, and supportive regulatory frameworks globally are likely to propel further growth. BYD’s proactive approach to expanding its charging infrastructures and improving vehicle range positions it well to capitalize on these market dynamics.

Investment Thesis

Starting from the beginning of 2023, BYD recorded a 22% drop in its valuation, with stock price hitting a 3-year low in February 2024. However, we believe that this drop is due to an overly pessimistic view of the company current standing, a situation we are confident BYD is well-equipped to manage effectively.

Several factors contributed to this significant decrease in BYD’s valuation. First, the overall negative outlook held by most investors towards the Chinese electric vehicle market in 2023 played a crucial role. This sector was characterized by an unexpected growth slowdown, which led to a general inventory backlog and an increase in competition. Nonetheless, we remain positive about the industry’s prospects, with the second quarter potentially posing a major turning point. Positive signals that have emerged in the recent period include a recovery in passenger flow/order volume, and the realization of new products, such as BYD’s expansion in the luxury and hybrid car segments. Despite the expectation that intense competition leading to a price war will continue, we anticipate that costs of batteries, which represent the most expensive component in an EV, will decrease and economies of scale will improve. For instance, recently, there has been a noticeable enhancement in battery quality and a decrease in their costs, attributed to advancements in technologies like 4C/5C fast-charging battery technology, and we expect this trend to persist in 2024. China’s ability to manufacture batteries at a reduced cost is largely attributed to its positional advantage due to the conformation of its territory. The Chinese EV industry benefits from a proximity to several fundamental raw material supplies. For instance, in 2022 China was responsible for 70% of the world’s rare earth production, a key element for battery production. This dominance places Chinese battery firms in a critical juncture of the supply chain, granting them both strategic advantages for pioneering new battery technologies and leverage in negotiations with suppliers of materials beyond just batteries.

Furthermore, we believe BYD is in a strong position to succeed in this highly competitive industry by growing internationally and improving its market share in China. Holding a 35% market share, BYD is the leader of the Chinese EV industry. Our analysis indicates that this controlled proportion of market, which has been growing significantly over the past few years, is expected to increase by approx. 7% over the next five years, primarily because of the company’s ability to take advantage of economies of scale and produce batteries at incredibly low costs. Noteworthy, BYD is the only player with a market share of more than 10% in the Chinese EV market, with Tesla, whose market share is approx. 8%, at the second place. In 2023, The BYD Song was the best-selling car in China, with an average of over 50,000 units sold per month.

On the other hand, investors generally have a pessimistic sentiment regarding a potential oversea expansion, mostly due to the strong political uncertainty around Chinese EV exports to major markets like the U.S. American concern over the dominant position of China in electric vehicles is growing. The Biden administration hinted last month that it was looking into whether Chinese-made automobiles could be a threat to national security and that it may impose restrictions on them. However, we believe that BYD will be able to pursue this oversea expansion, and that it will be one of the main drivers of the firm’s growth over the next 5 years.

In fact, BYD is pursuing a strategy that entails focusing on nations with weak domestic car industry, where they are more likely to face favorable political conditions and policy headwinds. Indeed, the company is currently building factories in Thailand, Brazil, Indonesia, Hungary and Uzbekistan. This strategy will allow BYD to increase sales significantly and become the market leader in these nations, taking advantage of low production costs due to economies of scales. Even if BYD is competing with its main rival Tesla in this emerging markets’ expansion, we believe that the former has some competitive advantages over the latter in these areas. This is mainly because BYD offers a high number of models in the mass market, while Tesla exclusively makes more premium-priced cars. Additionally, BYD’s product portfolio includes hybrid cars, which are strongly beneficial for emerging markets, where battery-charging infrastructure is limited. Southeast Asia is anticipated to remain BYD’s strongest overseas market in the short term as the company works towards doubling its car exports from last year to 500,000 in 2024.

Regarding the US market, we believe that BYD’s expansion is still viable, given that the firm is expanding in Brazil and has its sights set on Mexico, on the US border. The potential building of a factory in Mexico (an option that the company is considering) would represent an opportunity to export from that country to North America. Mexico is part of the USMCA and there is a free trade agreement between United States, Mexico and Canada, which was enacted by these nations in 2020.

Finally, the European market represents a meaningful opportunity for BYD to expand its operations, as demand for electric vehicles is constantly growing, due to the region’s aim of reaching a long-term sustainable growth. In 2023 BYD announced it would open a factory in Hungary, with production set to begin in three years.

Valuations

DCF

Our DCF analysis highlights BYD’s key growth drivers: increased market share in China and international expansion. We forecast sustained revenue growth for BYD due to its continued penetration into these markets. Additionally, we anticipate an improvement in EBIT margins as the company benefits from cost-effective production strategies, positioning it favorably in competitive pricing scenarios.

We expect capital expenditure to decrease compared to previous years, which featured significant investments, yet we predict they will still exceed 10% of sales. This is due to the ongoing expansion efforts of BYD, which necessitate substantial investment.For calculating the terminal value, we employed the Gordon Growth Model, using China’s GDP growth rate of 3% as the perpetuity growth rate.

Our analysis suggests a fair value of ¥282.75 for BYD’s stock. As of the close on April 12, 2024, this represents a 34.6% upside.

Multiple Analysis

Multiple Analysis

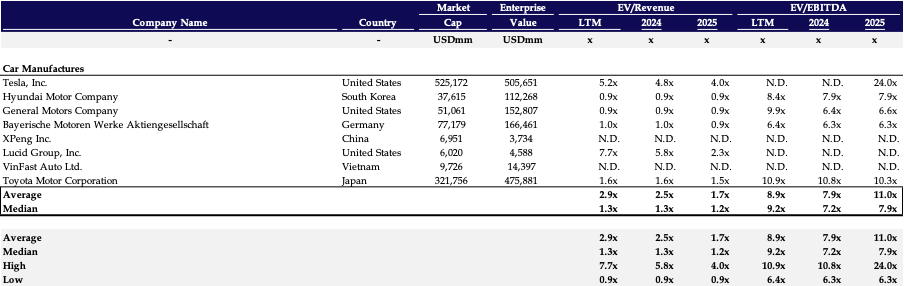

Aiming to achieve a more comprehensive valuation, we integrated the DCF analysis with a multiples analysis. We used trading multiples approaches focusing on comparing BYD to other similar companies in order to highlight the significant discount in the stock compared to its competitors.

The Enterprise Value multiples of EV/Revenue and EV/EBITDA were considered in our analysis. We decided not to use EV/EBIT because BYD’s complete vertical integration and substantial investments in expansion and new factories could lead to inconsistencies in their depreciation and amortization figures. We chose to complete the valuation using the median. While BYD has significant advantages over its peers in economies of scale and supply chain integration it also naturally suffers a discount in the market for being a Chinese company, as well as severely lagging competitors in technology inside their cars, therefore a caution approach was maintained.

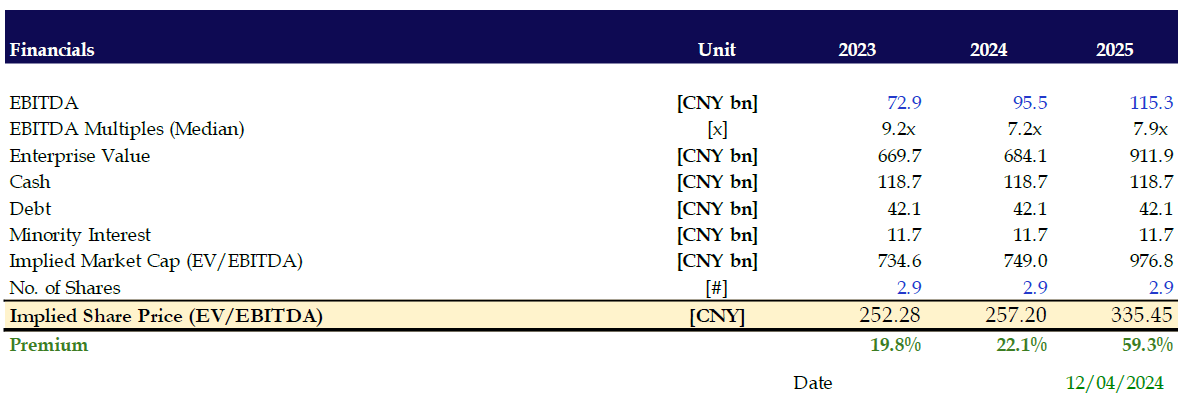

The result of the Valuation implied an EV/Revenue LTM multiple of 2.9x and an EV/EBITDA LTM multiple of 8.9x median when comparing to its peer’s. We used these figures to compute the Enterprise Value and, through the equity bridge, we obtained the Equity Value.

Using this calculation, we arrived at an implied 252.28 Chinese Yuan share price implying a 19.8% premium according to the stock price as of 12/04/2024. The implied equity value of 734.6bn Chinese Yuan, roughly corresponding to $103.3 bn. The lower price with respect to the DCF analysis, which resulted in a 34.6% premium, can be attributed to the impact our positive long-term assumptions had on the DCF valuation.

The multiples analysis, along with the DCF highlights the highly discounted price we assess for BYD stock. We expect the stock to rise in the long term because of this steep discount.

Risks: Competition (Lack of software) & Price wars

Increase competition

As aforementioned, BYD is China’s best-selling EV brand, and in Q4 of 2023, BYD became the world’s top EV maker, selling nearly 420,000 more vehicles than Tesla. Driven by its broader lineup of cheaper models, BYD has consistently grown its market share, feeding off demand for low-end EVs. BYD managed to control roughly one-third of sales of plug-in hybrid (PHEVs) and battery-powered electric vehicles in China for 2023.

However, BYD doesn’t quite have a moat or differentiating factor defending its market share for EVs besides price. Companies with software-intensive cars bring heavier demand offering smart dashboards and connected features. Data from the start of 2024 suggested BYD’s share of new energy vehicle sales in China fell from 30.8% to 4.2% in January and February. This is mostly because of new competition in the Chinese EV market. Newer rivals like XPeng[NYSE:XPEV] and Li Auto[HKG: 2015] had already been chipping away at BYD’s market share. With the introduction of Huawei and Xiaomi[HKG: 1810]’s new push into the automotive industry, Huawei’s success story, the Aito brand grew 24% YoY, and sales further increased to 54,000 units in the first two months of the year when most EV brands in China decreased sales. On the other hand, Xiaomi recently announced, on April 1st, that potential buyers of their new SU7 electric sedan could face a wait time of four to seven months as pre-orders hit 88,898 in the first 24 hours.

Beijing has recently increased support for autonomous driving initiatives, and Level 2 systems (some automation but requires human attention at all times) are increasingly common in China. Up until a year ago, BYD publicly expressed skepticism about the viability of autonomous driving systems. They argued that high costs and legal barriers made the technology impractical for broad adoption. Yet the EV industry is heavily investing in the development of these technologies. Tesla’s R&D expenses increased 35% YoY, and other competitors like XPeng, Nio, and Li Auto invested roughly 10% of total revenue in R&D, while BYD only averaged 4.9%.

It isn’t the first time BYD lost market share due to competition. In 2017 they dominated the PHEV market with 60% market share, but by 2020 that fell to 19%. Through new releases of cars and price cuts sales grew by 52% YoY. This stance indicates that BYD is vulnerable to new disruptive or even cheaper cars. With competition intensifying in the Chinese EV market—which accounts for 90% of BYD’s sales—the company is vulnerable to disruptive innovators. It will become increasingly challenging for BYD to distinguish itself unless it continues to slash prices and maintain market control.

Price war with Tesla

Warren Buffett-backed BYD has always severely undercut other EV manufacturers in China, exploiting their vertically integrated supply chain and margin advantage to push out other manufacturers from the packed Chinese sector. Traditionally, operating margins for EVs are slimmer than those of traditional carmakers, yet, BYD and Tesla have sacrificed short-term profits to win the cut-throat battle for market share.

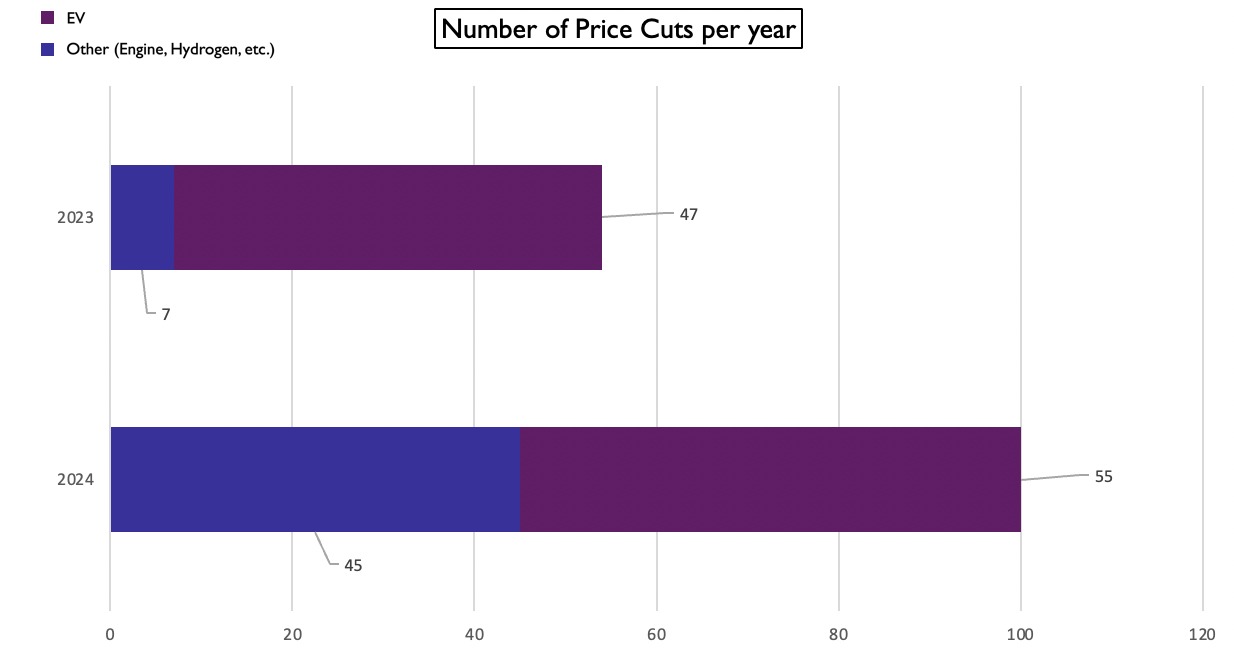

In the face of slowing demand, Tesla slashed prices on some Model 3 and Y cars in China in January, marking down the Model 3 by 5.9% and the Model Y by almost 3%. Tesla then proceeded to offer cash discounts from the Model Ys’ in February. BYD promptly responded with even bigger discounts on every nonluxury model of their new cars.

March 1st Tesla unleashed insurance incentives, discounting their top-selling cars up to 34,600rmb or $4,800. On March 6th BYD responded by cutting the price of its cheaper car the Seagull by 5%, and the car now starts at $9,7000. BYD embarked on a series of price cuts, cutting deeper and with broader models than any other EV manufacturer in China. These cuts come from a marketing campaign run by BYD stating that a “new era of electricity is cheaper than oil”

Tesla hiked Model Y prices in China by 5,000 yuan ($691.24) starting April 1, but also offered a time-limited zero-interest financing scheme for buyers of the base Model 3 model. BYD lowered starting prices for nine models including four under its premium brand Denza by 4% to as much as 20.5%.

This price war between Tesla and BYD has prompted an entourage of price cuts in the entire EV sector in China, where many smaller firms are feeling the pressure on their margins but bigger firms like Tesla and BYD can absorb the costs. The cuts don’t seem to be futile though as firms are not only competing for existing market share but they are also seeking to win customers in smaller, rural cities who couldn’t previously afford an EV.

Source: BSIC

A price war stands to benefit BYD but it could turn out to be a double-edged sword for two reasons; the geographic location of the price war and the nature of BYD’s cash cows. Firstly, 90% of BYD’s sales are domestic to China, therefore a price war being fought on their domestic terrain could be tricky to come back from if their market share does decrease, posing a big threat to the company’s books. Secondly, BYD has a relatively higher proportion of smaller cheaper cars compared to Tesla, therefore slashing prices on an $11,000 compact EV is significantly harder than on a $38,000 model like Teslas.

These price cuts aren’t just fueling a bitter rivalry between Tesla and BYD there are already notable effects in the entire market. The hefty discounts are supercharging sales; vehicle sales rose in March, compared to a weaker February regarding sales volume.

Economies of scale, supply chain control

BYD’s Qin Plus and Seagull sales topped the sales charts in January and February, with the effects from the EV markets price war being felt in the entire Chinese automotive industry. A year ago today Nissan and Volkswagen held the crown for the top selling sedan and hatchbacks in China but these were both surpassed by BYD Qin Plus which was the top selling Sedan or Hatchback in the month of January of February in the Chinese market. As EV companies cut prices, the stress also impacted combustion-engine vehicles, many of which have reached the limit of their discounting ability.

This influx of competition in the Chinese EV market is making the specific sector and the overall automotive market in general extremely overpopulated. In China, numerous brands, models, and new competitors are entering the market. The ensuing price war reflects BYD’s and Tesla’s responses to this fresh competition, which is forcing market consolidation. Competition adds urgency to slash prices because EV manufacturers know that growing market share is crucial to reaching a break-even point. The EV sector naturally has very high fixed costs, so many of these newer manufacturers have yet to reach profitability. BYD stands to gain significant market share in a diluted market if it can absorb low prices for longer.

Here lies BYD competitive advantage, originally founded as a battery maker in the 90s BYD has experience in making batteries at scale, EV most expensive component. Furthermore, with annual sales exceeding 3m car’s it has a significant enough market to absorb low prices and keep average costs low even with high fixed costs, unlike new manufacturers. The ability to lower production costs is also becoming increasingly important. Another strength to BYD economies of scale is its vertical integration, and ability to stabilize and lower production costs. From owning lithium mines to in house chip manufacturing BYD has the most control of its supply line, by far, compared to any other EV maker. BYD is also the second largest NEV battery supplier in China, with consolidated financials as they most deliver batteries in house.

Lately, BYD has also begun building a sodium-ion battery plant in China. Although sodium-ion batteries may perform worse, they could potentially lower the cost by around 40%. This cost reduction could enable BYD to significantly undercut any other car manufacturer, including other EV producers.

References

[1] International Energy Agency, “Global EV Outlook 2023,” 2023.

0 Comments