Prosus NV (AMS:PRX) – Market Cap as of 16th April 2021 €156.3bn

Tencent Holdings (0700.HK) – Market Cap as of 16th April 2021 HK$6,063.9bn

Introduction

Prosus NV, the international asset division of Naspers and one of the largest technology investors in the world, sold a 2% stake in Tencent for an amount of HK$114bn ($14.7bn) in what is the largest accelerated book-building offer (ABO) in history, smaller only than the U.S. Treasury Department’s $20.7bn sale of American International Group Inc. shares in 2012. The deal reduces Prosus’ stake in the Chinese internet company to 28.9%, meaning that it remains the largest stakeholder. However, it will not continue to be the controlling shareholder any longer as HK listing rules require investors to own at least 30% of voting shares in order to claim that status.

According to Prosus, the proceeds from the ABO will go towards new investments in e-commerce companies in emerging markets and for general corporate purposes. The company also announced its commitment not to sell any further Tencent shares for at least the next three years.

About Prosus

Prosus is a Netherlands-listed company that is majority-owned by the South African internet conglomerate Naspers Ltd. In 2001, Naspers made a $32m investment in Tencent, which proved to be one of the most successful venture capital investments ever made. The stake is now worth $240bn and turned Naspers into a global internet firm and the one with the largest market value in the whole of Africa. Nonetheless, Tencent’s massive growth and valuations also created complications for the Johannesburg-based company. For once, Naspers came to dominate the South African exchange, prompting local investors to dump its stock in order to avoid overexposure and to diversify. Additionally, the $240bn Tencent stake created a valuation mismatch with Naspers $100bn market cap. To address these concerns, the firm created Prosus, a new entity to control the Tencent stake, along with other international investments. After a successful IPO in Amsterdam in 2019, which valued the company at $95bn, it is 73% owned by Naspers.

Currently, it is the largest consumer internet company listed in Europe and one of the biggest tech investors globally. Prosus is subdivided into six business areas: Classifieds (digital marketplaces), payments/fintech, e-commerce, food delivery, venture, and travel. Notable interests besides Tencent include a 22% stake in Delivery Hero, a 28% stake in the Mail.Ru group and a number of assets in the Indian e-commerce sector. Its investments have thrived during the last year as the pandemic benefited internet firms and digital transformation. Revenues in 2020 rose by 23% to $21.5bn, while trading profits increased by 16% to $3.8bn. In particular, its e-commerce revenue grew by 33%, while Food delivery revenue grew by 105%.

About Tencent

Tencent Holding Ltd. is a Shenzhen-based internet firm that counts among the most valuable companies with a market cap of $744.7bn. It has over 1.2bn customers all over that globe that it services in what can be grouped into three main categories: Value-added Services (VAS), fintech and business services, and online advertising.

The VAS business comprises two sub-segments, which are gaming and social networks. In 2019, the combination of these two accounted for 53% of group revenues. In 2020, gaming alone contributed 29% of group revenues and is thereby the largest driver of revenue. This is unsurprising as Tencent is the worldwide leading video game producer that can count internationally loved games such as PUBG mobile, and Honor of Kings among its offerings. The other sub-segment, Social Networks, also plays an important role in the company’s growth. Two of its most important platforms here are WeChat and QQ.com. The former has over 1bn recurring users and has evolved from a messaging app to a platform that seeks to support its users in every aspect of life. Functions include mobile payment, ride-hailing, brick-and-mortar shopping. The latter, QQ, is an instant messaging service for PCs that enjoys a lot of popularity, especially in China.

The fintech businesses contributed 28.9% of revenues to the company in 2019. Mobile payment services such WePay are part of this segment. Said service has over 800m monthly users with more than 1bn daily transactions. Other businesses grouped under this category are the wealth management application Licaitong, the digital bank named WeBank, and the cloud service “Tencent Cloud”.

Finally, the last of the three main product categories of Tencent is online advertising and it was making up 18% of revenues. It is divided into Social Media advertising and “normal” media advertising. Proceeds from this sector have grown at a CAGR of 55% over the last six years.

During the pandemic, the conglomerate recorded a 28% boost in revenue to $73.9bn. Profits rose by 30% to $24.4bn, beating estimates of $20bn.

Industry Analysis

The IT services industry is reckoned as incorporating the business process outsourcing (BPO) services, application services, and the infrastructure services markets.

By simply staring at numbers recorded by the industry overall, it underwent robust growth during the latest period, despite a short-lived halt at the outbreak of the COVID 19 pandemic. Nonetheless, this growth is expected to sustain over the following years, with slight abnormalities due to the COVID-19’s fluctuations. Indeed, the IT services industry is profoundly connected with a country’s GDP, hence showing a pro-cyclical pattern. Besides, as technological improvements are progressing, many enterprises are engaging IT services of some sort, chiefly IT infrastructure services, to be fully operative and competitive, making the market as a whole advance at a fast pace.

In detail, the global IT services industry had total revenues of $1.372tn in 2020, representing a CAGR of 12% between 2015 and 2020. In parallel, the Asia-Pacific and US industries flourished with CAGRs of 12.7% and 11.8%, respectively, with many new markets emerging based on cloud computing, making cybersecurity prosper. Indeed, cybersecurity has become decisive for many markets due to various high-level cybersecurity menaces and network technologies’ interconnected realities. This has driven growth in the IT industry and fostered innovation and development. Nonetheless, the industry’s performance is projected to go on, in particular following the surge in digitalization that was caused by the Covid-19 pandemic. The anticipated CAGR for the five years 2020 – 2024 is 13.7%, driving the industry to a value of $2.293.4tn by the end of 2024. Demand for IT services is expected to rise in the coming years, as many companies will employ working from home schemes and business outsourcing in order to be able to cope with potential virus outbreaks or any other kinds of disruption. Hence, businesses will have to invest massively in IT and new technologies that will help them carry on as usual by working from distant locations at any time.

Source: Marketline

When investigating the technology industry, it is unquestionable that mergers and acquisitions (M&As) have always been an essential fount of growth for the leading incumbents. Tech deal volume has mounted in recent years, growing to more than $500bn in 2019, from less than $150bn in 2013. M&A activity in the IT space remarkably slowed down overall in the first months of 2020 but hastened in the next half of the year. Indeed, the pandemic had a catastrophic impact on the number of transactions in the first half of the year. Deal levels dwindled due to a loss of confidence in the global economy and abrupt modifications in transaction execution arrangements.

Following the initial scepticism generated by the COVID-19 pandemic, a resurgence in confidence saw M&A activity pick up distinctly and made deal values in the technology sectors significantly soar. Once the initial collapse of the outbreak passed, tech acquirers more than made up for the lost time. They doled out almost an entire year’s worth of M&A consideration in only the concluding six months of 2020. Therefore, it is reasonable to assert that the pandemic quickened innovations that businesses had been contemplating, pulling forward ages of change into months.

Source: PWC Research

Although vaccines have been rolled out, the pandemic continues to influence everyday lives, so companies still have to adopt technology solutions at a brisk pace. Many major players have recommenced merger and acquisition plans to match increasing demand and boost growth. Representatives of that may be Google’s acquisition of Actifio, a straightforward extension of its data services portfolio, beneficial to improve the Google Cloud business; Salesforce’s purchase of Slack occurred to allow Salesforce to innovate and retain its client base against more active competitors, such as HubSpot and RightNow; lastly, Facebook’s acquisition of Kustomer, an effort to expand into the customers’ service industry.

An even more favourable environment is generated by several tech companies’ massive availability of proper capital to invest, combined with their attempt to augment their technology stack or to acquire critical talent. That is why there is a bullish outlook on the industry’s M&A activity for the next future. Companies will continue to view transactions as a technique to reshape their businesses and achieve market control in an increasingly virtual society. Indeed, the abrupt boom in remote working, contactless delivery, and other technologies during lockdowns may alter many companies’ games and generate occasions for acquirers.

Deal Structure

Prosus NV’s wholly owned subsidiary, MIH TC Holdings, will sell up to 191.89 million shares or a 2% stake in Tencent, for a total consideration of HKD 114,174,550,000 ($14.7 billion), resulting in a price per share of HK$595, leading to a 5.5% discount to Tencent’s close of $HK629.50, the day before the announcement.

Upon completing the deal, Prosus will persist in being Tencent’s single largest shareholder, with 28.9% of the total stake. Nevertheless, it will dissipate its controlling shareholder status, which under Hong Kong listing rules is granted to investors who own at least 30% of voting rights.

Deal Rationale

Naspers created and listed its international internet assets arm as Prosus in 2019. The main reason behind this was to reduce the valuation gap between its own market value and that of its stake in Tencent which is more valuable and to address a wider range of investors who are not willing to invest in South Africa. The recent ABO constitutes the second sale of shares of Tencent after 2018, when Naspers sold for the first time 2% of its original $32m investment in Tencent made in 2001. Prosus said that it intends to use the sale proceeds to “increase its financial flexibility to invest in growth ventures, plus for general corporate purposes”. But what are the concrete plans?

First, Prosus will use the cash to invest in current portfolio companies to promote growth or prevent dilution. Besides the investment in Tencent, Prosus’ portfolio comprises majority and significant minority investments mostly in fintech, edtech, food delivery and internet platform companies in many countries across the world. It develops its business by providing capital for organic growth strategies and bolt-on acquisitions as just recently for iFood (SiteMercado acquisition) and OLX Group (Grupo Zap acquisition). Koos Bekker, chair of Naspers and Prosus, said that through the sale of this small portion, Prosus intends to fund continued growth in their core business lines and emerging sectors, as well as allow for complementary acquisitions. Furthermore, it offsets dilutional effects incurred from convertible securities, employee stock options or stock issuances. As a recent example, after Delivery Hero’s stock issuance related to the acquisition of Woowa, South Korea’s biggest food delivery platform, Prosus acquired an additional 8% in Delivery Hero to offset dilution.

Second, the cash will strengthen Prosus’ net financial position and enable it to make large acquisitions. In 2020, it lost twice in multi-billion-dollar bidding wars: in January, Prosus failed with its takeover offer for Just Eat which was acquired by Takeaway.com for $7.8bn and in July, it failed to acquire eBay’s online classifieds ads business which was bought by Adevinta for $9.2bn. The additional $14.5bn deriving from the sale of Tencent shares will be added to Prosus’ current $4.5bn net cash position, forming a massive amount of liquidity that could be used to win such bidding wars in the future. According to analyst consensus, such a major acquisition would be seen positively by shareholders as a welcome boost for Prosus’ other business segments.

Last, the process will be used for general corporate purposes and to reduce the valuation mismatch. Prosus’ biggest challenge is still the multi-billion dollar discount it faces compared with the value of its stake in Tencent.

Therefore, the company announced a share buyback program with a volume of up to $5bn in October 2020. It will repurchase up to $1.37bn of its own stock and up to $3.63bn of the stock of its majority owner, Naspers. The board of Prosus believes that the transaction can generate significant value for its shareholders. Also major shareholders commented on the transaction positively as they want to earn the proceeds of their investment. Consequently, besides large acquisitions, we can expect further buybacks in the coming years. Furthermore, there is also criticism from some investors who are not convinced of Prosus’ strategy as most of its portfolio companies except Tencent and its online classifieds are loss-making. As a result, rumours about a spin-off of its stake in Tencent to its shareholders persist. However, this will not happen any soon. Despite the sale of the 191.89m shares, Prosus underlined its confidence in the long-term potential of Tencent by committing not to sell any further shares of its remaining 28.9% stake in the next three years.

Market Reaction

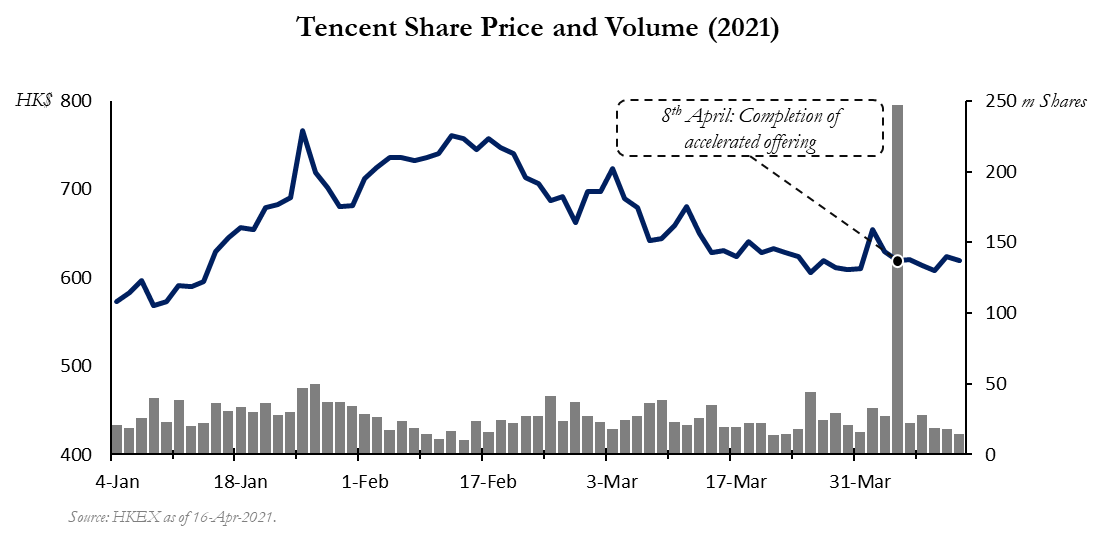

After the announcement on the 7th of April, the share price of Tencent decreased by 3.7% and stabilized the following days at a level of around HK$620. On the 8th of April, the completion of the block trade of 191.89m shares can be easily seen in the massively increased trading volume. The reaction seems expectable as first, a key shareholder is decreasing its stake in Tencent, and second, the supply of free-floating shares increased by 2% of the share capital. Nonetheless, investors believe strongly in the potential of the company and analysts recommend buying the share with the average target price suggesting a 25% upside potential.

Source: HKEX

Investors in Prosus and in Naspers have perceived the transaction negatively. On the day of the announcement, the share price of Prosus declined by 4.6% and the trading volume was high. The following days, the share price levelled at around €95. On the one hand, this seems reasonable as Tencent is the key investment and its dividends are the major cash source for Prosus. Furthermore, the transaction was carried out at a 5% discount on the value of the stake sold. On the other hand, Prosus has now much more investment possibilities in order to boost its

other business and diversify its portfolio, it can continue its value-creating share buyback strategy and the remaining value of its stake in Tencent is still valued higher than its own market value. Analysts remain strongly positive, recommending buying the share and the target price suggests a 68% upside potential. Naspers share is facing a similar situation as its key investment is Prosus.

Source: Euronext

Advisors

The investment banks Goldman Sachs, Morgan Stanley and Citigroup were managing the transaction as joint global coordinators and joint book runners.

0 Comments