Stocks have risen sharply since 2011, while earnings have lagged

Consider this: Since the beginning of 2011 the S&P 500 has risen by more than 60%. On the contrary, aggregate GAAP earnings of the companies included in the index have actually dropped, while Non-GAAP income (a measure that generally smoothes GAAP earnings for extraordinary items) expanded by a mere 10%. Consequently, the benchmark’s overall Price-to-Earnings ratio (P/E) has risen sharply from 14.5x at the end of 2011 to 23.6x today, a level at the upper range of historical values.

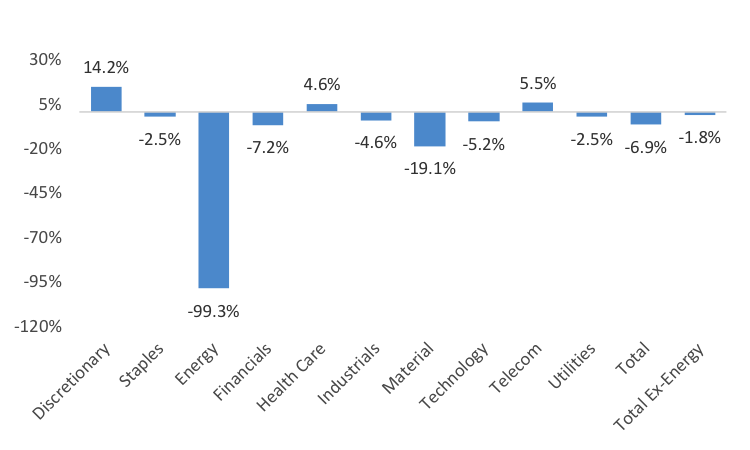

Keeping this in mind and thinking about the S&P 500 going forward, we try to shed some light on the current earnings season for the first quarter of the year. According to estimates from Thomson Reuters Q1 earnings are expected to drop by 6.9% (1.8% excluding the energy sector) compared to the same period one year ago. This would mark the fourth consecutive quarter of declining earnings since the aftermath of the financial crisis. It is probably fair to state that although the broader US economy is moderately growing, corporate earnings are facing a recession.

Chart 1: 7 of the 10 sectors of the S&P 500 are expected to see lower earnings year-over-year

Source: Thomson Reuters I/B/E/S

Interestingly, weakening earnings have even started to affect sectors that have sustained growth in the recent past such as for example the health care space. According to Factset, the latter group has already issued negative earnings guidance in 17 cases. The broader picture offers no more reason for complacency. Factset reports that a total of 94 S&P 500 firms have warned that their EPS might miss analyst consensus estimates, the second highest level over the past 10 years.

More downward revisions to earnings are likely to come given persistent over-optimism

With expectations for earnings at such low levels, couldn’t one argue that the worst was already priced in and that we would likely see some positive surprises given the low bar for companies?

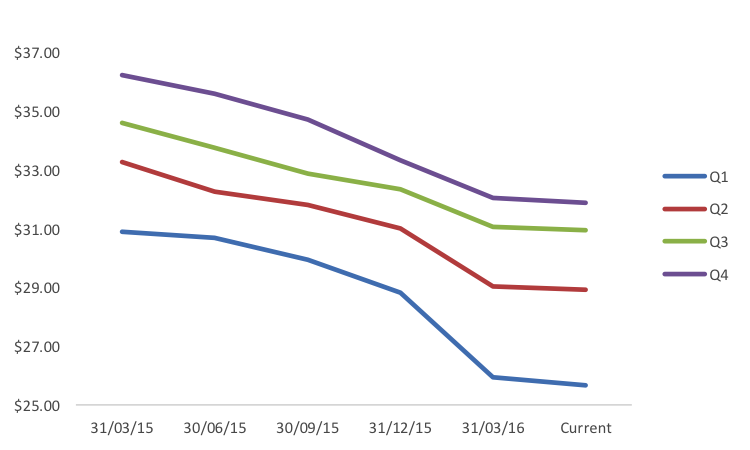

To some extent this might be a valid argument and it would be foolish to dismiss the prospect of stocks moving higher. Despite reporting lower earnings the gloomy expectations might just be low enough for companies to still beat them, hence, for firms to surprise on the upside. However, this is only looking at the very short-term. In contrast, current data shows that although Q1 earnings estimates have been trimmed substantially since the start of the year, the same cannot be said about Q3 and Q4 data.

Chart 2: S&P 500 Q3 and Q4 earnings estimates have seen little revisions yet

Source: Thomson Reuters I/B/E/E

Given the aforementioned weak momentum in corporate profits, the year-end outlook might well be overly optimistic. Throughout the past decades, research analysts have been remarkably good at overestimating the earnings potential of US firms. With only a few exceptions profit projections have started high going into a year and then gradually declined to converge to actual earnings. And this doesn’t seem to have changed.

Subsequent downward revisions throughout this year might act as a resistance for stocks and even drag prices lower with them, particularly against the backdrop of a FED that is less accommodative than it was over the past years. In fact, the FED talking about multiple rate hikes earlier this year might have led some analysts getting ahead of themselves, overestimating the pace of the US’ economic recovery.

Chart 3: Earnings projections (rebased to the beginning of the respective year) have been revised lower throughout the year for most of the last three decades

Source: Minack Advisors, Woodford

Overall, with corporate profits at a record-high as a percentage of US GDP, peak profit margins, a considerable amount of cash spent on stock buybacks over the past years and top-line growth now in negative territory, the current weakness is probably not only a one-off oil-related weakness.

Sell the S&P 500 from here with a stop at 2125 and a target of 1800

That said, a possible trade would be to go short the S&P 500 from these levels (the index closed Friday’s trading session at level of 2081), setting a stop right above the most recent highs around the 2125 level with a target of around 1800 points, the level from which the market rebounded in February.

Although a break-out above 2100 combined with the already strong short positioning (as measured for example by the high costs of put options on the index at the current levels displayed for example through Credit Suisse’s Fear Barometer) could ignite an upside rally, the risk/reward ratio of a short position looks favorable at this point.

Resurgent oil and a weaker dollar as a risk to our trade

Given the recently strong correlation between the price of oil and stocks, a sustained oil price recovery would probably give stocks a lift higher and would bode well for the beaten-up energy sector. Moreover, a further weakening of the US Dollar which already dropped by almost 3% on a trade-weighted basis in the first quarter would serve as tailwind for corporate profits, hence, counterweighing the negative momentum we outlined before.

[edmc id= 3769]Download as PDF[/edmc]

0 Comments