Introduction

When we look at the biggest companies by market cap, many of them are Tech firms, capable of leveraging innovative technologies to create new types of businesses. Most times they offer business models that are so different from the companies we are used to, that we struggle in finding the best way to give them a proper Enterprise Value. A standard DCF valuation would fail to consider the importance of the number of users connected to these online platforms and services, as well as the critical role that growth in the user base has in this sector. Hence, it might be useful to look at these companies from different perspectives, and make an important distinction between valuation in the Tech sector with respect to all the others.

Approaches to Valuation

It is general belief that valuation is more art than science and as such, there are multiple ways in which a company can be valued. A very important aspect to be considered is whether we are looking for the value of the whole company or just the value of some of its assets. In the first case, we talk about aggregated valuation, whereas in the latter we talk about disaggregated valuation. In an aggregated valuation, the entire company is valued, considering 100% of its revenues, earnings and cash flows in a process called consolidation. Through this process Minority Interests, which represent the part of Net Income not attributable to the main shareholders, are recognized separately.

We could also value a company on a disaggregated basis, according to its different business units (Sum of the Parts Valuation). In this case, we value each part separately and then sum the results to find the value of the entire company – this is very common in the case of conglomerates, where different units of the same entity are totally unrelated, as well as in the case of businesses within the same company operating in different geographies. Another approach focuses on the units from which the company generates its revenues (Subscribers, Users) – usually very common if the company has not yet reached profitability (i.e. start-ups and internet companies).

Disaggregated valuation has two main advantages. The first one is related to the possibility of incorporating competitive advantages that apply only to some units of the business and not to others, whereas the second is about showing a greater connection between the (typically user-based) stories of the entrepreneur (or business person) and value.

When valuing users, a distinction should be made between existing users and new ones. Generally, existing users are valued based on their loyalty (user lifetime and renewal rate) and the profits they generate (i.e. cash flow/user). On the other hand, new users are valued following a different approach. Here we would generally calculate, again, profits and consider loyalty of the users, but then subtract the cost of acquiring new users, calculated as the cost of acquiring a new user multiplied by the total number of new users.

Revenue Model

Nowadays, Internet tech companies have developed different strategies to boost profits. In the early days of a start-up, it is rarely clear how the firm will sustain itself overtime and it is not uncommon to present losses for the initial period, until the business reaches maturity. In this context, in order to grow, three alternative models can be identified. None of them is inherently more profitable than the others, but perhaps one of them suits better the characteristic of a particular service.

The first one is the subscription model, which can be on a weekly, monthly or even yearly basis. Its main strength is predictability, since user stickiness is usually high, considering renewal rates over a long period of time. Moreover, revenues per user are steady and reliable, providing a solid basis for forecasts. On the other hand, revenues per user cannot be raised easily and, combined with the high costs to acquire new users, growth results to be a difficult objective – it is especially hard to overcome the obstacle of creating network effects.

The second model is transaction based. The revenues per user tend to be unpredictable and not very high, but at the same time the cost of attracting new users is lower and this fosters the growth in the user base.

The third model finds its source of revenues in ads. Usually consumers are free to enter and exit the service as they please, driving stickiness down, but on average revenues per user are fairly predictable. There are virtually no costs for each additional user, thus the growth rate in the number of consumers is usually high. This model is tightly linked to information and social media companies, thanks to the fact that big data and artificial intelligence have become increasingly more capable of identifying and addressing potential customers with ads. Network effects and sheer size of the user base combined are the biggest advantage of this model.

Briefly comparing two of the largest tech incumbents, Facebook’s strategy is simply to have as many users as possible, whereas Amazon (combination of subscription and transaction) aims at providing the best service to attract and retain consumers. A valuation based on disaggregated DCF of these companies needs reliable information on the number of users, renewal rates, cost of servicing existing users, cost of acquiring new users and time spent on the platform. Those are all essential elements that are however not always easy to collect.

The following are some important value propositions:

1. “A money-losing company that is shrinking providing services to existing users is worth less than a company with equivalent losses, where its major expenses come from customer acquisitions”. Indeed, if a firm is increasing its user base, it means that it is gaining traction, setting up the basis for future profitability.

2. “A company whose expenses are primarily fixed (will not grow with revenues) will be worth more than an otherwise identical company whose expenses are variable (track revenues)”.

3. “Growth from existing users is better than growth from new users, due to the cost of acquiring the latter”. This can be practically seen comparing Snap with Twitter: the former has found a niche positioning, in which its users spend much time and usually tend to stick for a long period of time with the platform; Twitter instead struggles due to the short time spent by users on the social network and tries to cope with it by improving its user base, incurring as a result in even more costs.

Case Studies

Netflix runs a subscription model for its streaming service on which the dynamics previously described can be clearly observed. A company like Netflix will exhibit a stable and predictable stream of revenues and in this particular case, the company has a user base with a very high renewal rate (c. 91%) and the large growth it has seen in recent years will probably set for a limited growth potential for its future, at least with respect to its current operations. Moreover, Netflix benefits from the previously mentioned user value proposition related to its cost structure. Since most of its costs are not dependent on how many subscribers its streaming service has, investors expect that the company will enjoy economies of scale.

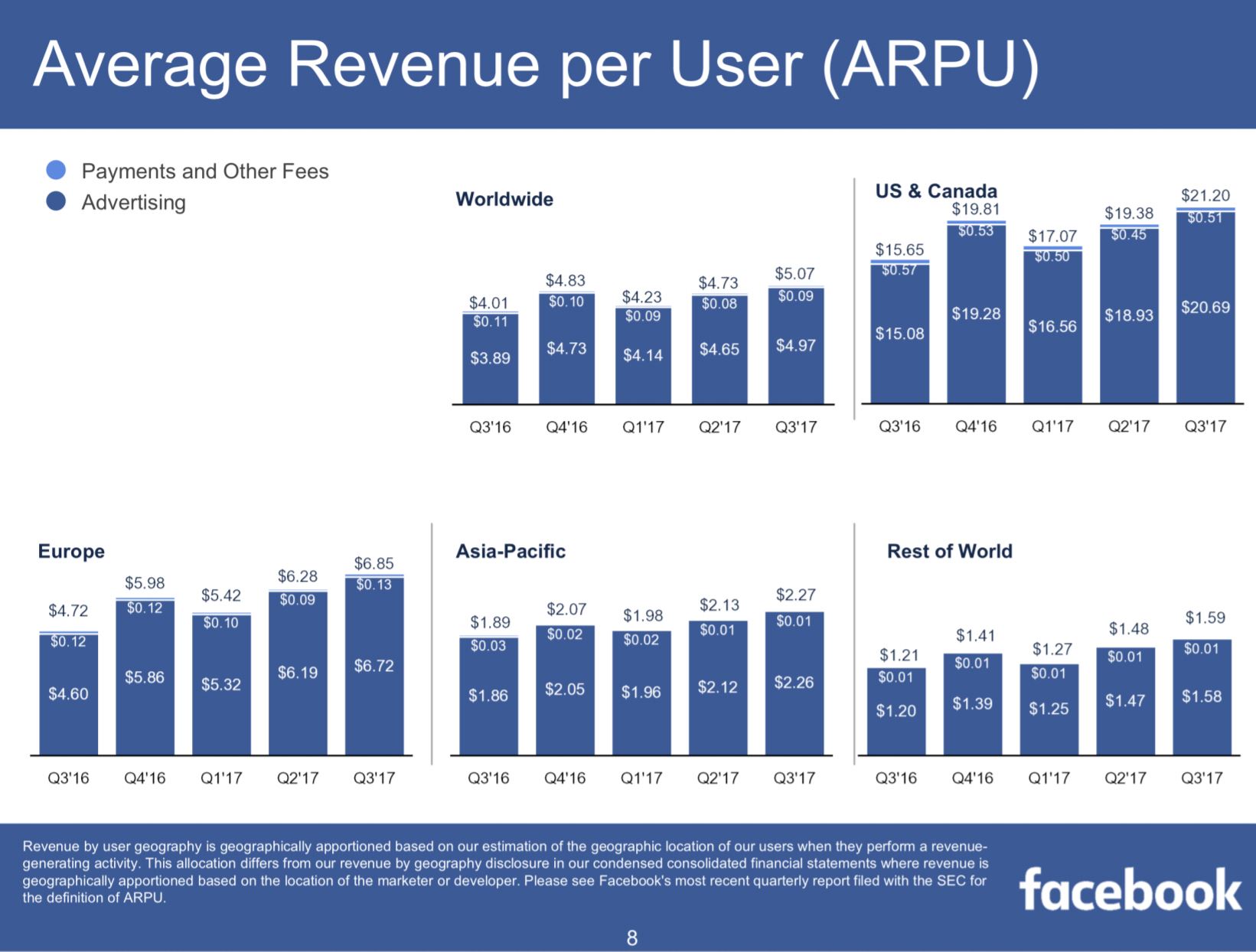

Source: Facebook

Additionally, the peculiarities of valuing users can be clearly seen in the cases of Facebook and Snap. The former has grown astronomically from c. 500m users in 2010 to about 2bn users in 2017, a move which could only come about if the user base inflow came from all over the world. Facebook has also learned that its diverse user base presents different monetization opportunities, with average revenue per user (ARPU) varying from $21.20 in the US and Canada for Q3 FY17 to $2.27 in the Asia-Pacific region in the same period of time. However, such difference is also found between companies who have apparently similar user bases, such as Facebook and Twitter. Facebook commands a value of the ratio of market cap to monthly active users (Mkt cap / MAU) about 5x larger than Twitter ($251 and $45.5 respectively), and such large difference can only be explained by distinct capabilities of actually monetizing their user bases.

However, the user base growth does not need to come from all over the globe and be diverse for a company to successfully monetize it. For instance, Snap has found itself a profitable niche user base, which is smaller than those of most of the other large social media companies, but is composed mainly of teenagers and young adults in their early 20s. Advertisers are keen to target ads to these demographics, as they will be the largest spenders in the future, and this has allowed Snap to create a user base with high value per user.

0 Comments