Bristol-Myers Squibb Company (NYSE: BMY) – market cap as of 10/2/2019: $81.98bn

Celgene Corporation (NASDAQ: CELG) – market cap as of 10/2/2019: $61.56bn

Introduction

On the 3rd of January 2019, Bristol-Myers Squibb Company (NYSE: BMY) announced the acquisition of Celgene Corporation (NASDAQ: CELG) in a cash and stock transaction with an Enterprise Value of approximately $90bn (equity value $74bn. Under the transaction Celgene shareholders will receive one BMS share as well as $50 in cash for each share of Celgene. The acquisition will combine two of the world’s largest cancer drug businesses in the biggest pharmaceutical deal ever.

In 2018 Both Bristol-Myers and Celgene faced separate challenges and combining the two companies should give Bristol more scale and strengthen its position.

Bristol-Myers Squibb

Bristol-Myers Squibb is an American pharmaceutical firm, headquartered in New York City and was established through the merger of Bristol-Myers and Squibb in 1989. The company develops, manufactures, licenses and sells synthesized drugs and biologics, such as Empliciti, Opdivo, Sprycel and Yervoy. Overall, Bristol-Myers Squibb supplies 63 countries worldwide, manages a portfolio of more than 100 products and owns 20 development sites.

Bristol-Myers Squibb generates 55% of its revenues in the Unites States and 22% in Europe. In 2016, the firm spent $4.9bn on research and development and currently has 33 compounds near commercialization, which are focused on the following areas – oncology, immunoscience, cardiovascular and fibrosis.

In FY2017, Bristol-Myers Squibb reported revenues of $20.78bn, a slight increase (+6.9%) compared to the $19.43bn figure in the earlier year. The company’s diluted earnings per share decreased (-76.9%) from the 2016 record of $2.65 to $0.61 in 2017, due to tax charges attributed to tax reform ($1.76 per share). Furthermore, net income and EBITDA shrunk respectively from $4.46bn to $1.01bn (-77.3%) and $6.46bn to $6.11bn (-5.41%), due to an increase of the cost of products sold as well as research and development expenses, while free cash flow increased (+129.3%) from $1.84bn to $4.22bn in the same time period.

Celgene

Celgene is an American biotechnology firm, headquartered in New Jersey, that focuses on the discovery, development and commercialization of drugs for cancer and numerous other inflammatory conditions. The company employees more than 7000 individuals and operates on a global scale. The most well-known products include REVLIMID, POMALYST, OTEZLA and ABRAXANE. Recently, Celgene has also requested to gain approval for a drug, which aims to treat patients with relapsed or refractory AML.

The firm has historically been very active in terms of M&A activity. In 2016, Celgene acquired EngMab, which specializes in the creation of engineered monoclonal antibodies, for $600m. In order to expand the company’s autoimmune disease therapy capabilities, Celgene purchased Delinia in 2017 for $775m. Additionally, two major acquisitions were announced in 2018 – Impact Biomedicines for $7bn and Juno Therapeutics for $9bn.

In FY2017, the firm announced revenues of $13.0bn, which represents a considerable increase (+15.7%) compared to $11.23bn in the previous year, largely driven by continued volume demand. The company’s net income and EBITDA grew from $2.00bn in 2016 to $2.94bn (+47.0%) and $3.37bn to $5.30bn (+57.2%) in 2017. Furthermore, diluted earnings per share increased from $2.49 to $3.64 (+46.1%) and free cash flow improved by 26.5% in the given period.

Industry Overview

The acquisition of Celgene by Bristol-Myers Squibb represents the biggest deal in the pharmaceutical industry history. In 2018 increasing competition for main cancer treatments and clinical setbacks lead to falling share prices of both companies and investors raised concern about future performances. The leading product of Bristol is the immunotherapy drug Opdivo, which accounts for roughly a quarter of its sales but that has fallen behind a rival medication from Bristol’s leading competitor Merck. For Celgene, its lead product, Revlimid, accounts for 60% of the company’s revenue but the patent is expected to run out in 2022 and then Celgene will experience increased competition with a potential decrease in revenues. The deal of Bristol with Celgene is a bet that a combined company will be able to overcome the issues confronting their respective lead products as well as the obstacles of the current market conditions.

There are several reasons for companies to engage in M&A in the pharma business. First, big players in the industry try to strengthen their position by finding the next successful cancer drug, which involves acquiring relatively underpriced biotech companies who pioneer in R&D. In 2017 more than 70 % of clinical pipelines belonged to emerging companies, according to BIO, a US-based organization. Finding a drug that can dominate the market has become even more important as governments and health insurers increasingly insist that a drug demonstrates superiority to rivals before they will agree to fund it. Furthermore, more and more companies want to hedge against downward pressure on pricing by diversifying their drug portfolios through acquisitions.

Another reason for an increase in M&A activities is that biotech companies are trading at historically low price to earnings ratios. Celgene, for instance, was trading at price to earnings of 6x and the profitable large biotechs at 10-12x, which represents an all-time historical low and creates the opportunity for a potential accretive deal. As most large pharmaceutical companies have cancer products in their portfolio, which represent some of their highest profits, it is likely they feel pressured to search for a new blockbuster drug by engaging in similar takeovers as Bristol.

This mega deal also raises further deal speculation in the market. Other large biotechnology companies whose revenues depend highly on single and older drugs faced similar problems and suffered in shares last year. Others gained through speculation that they can be takeover targets or engage in an acquisition themselves. One reason for that is that pharmaceutical industry experiences political pressure as the US President Donald Trump and his administration show efforts to decrease excessive prices of drugs. Moreover, companies in the industry are dealing with the threat of expiring patents and disappointing clinical trials for some cancer drugs and this sets the conditions for increasing M&A activities.

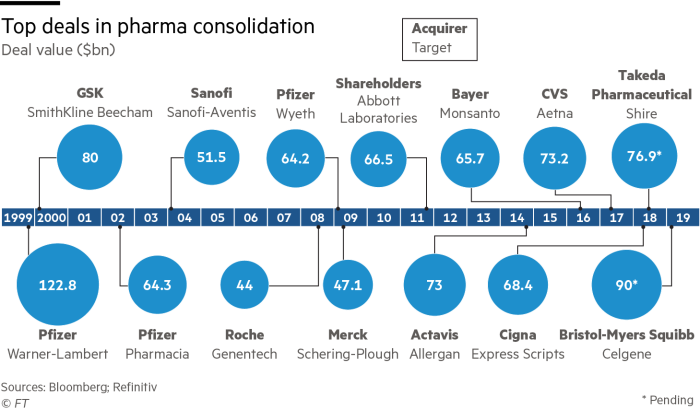

Consolidation arose as a need to survive the increasing pressure from stricter regulations on drug prices and patent expiration. One of the biggest deals in the history was in 1999 when Pfizer and Warner-Lambert merged and created the world’s second-largest pharmaceuticals company under the name Pfizer. Pfizer engaged in further M&A activities and acquired in 2002 Pharmacia and created so the world’s leading research-based pharmaceutical company with a search and development budget of $7.1 billion in 2003. In 2009 Pfizer, being the world’s largest drug maker at that time, announced the acquisition of its rival, Wyeth, for $68 billion to create cost synergies and portfolio diversification. In the recent years the trend of mega deals continued with the acquisition of Aetna by CVS in 2017 and in 2018 with the deal between Japan’s Takeda and Irish rare-disease specialist Shire for and equity value of $62 billion. The deal between Takeda and Shire transformed Takeda into a top 10 drug maker with a sizable footprint in the U.S.

Source: Financial Times, Bloomberg, Refinitiv

Deal structure

The acquisition will be financed through a mixture of stock and cash. The cash portion of the acquisition will be financed through a combination of “cash on hand” and debt. As outlined by a press release, published by the two companies, Celgene shareholders will receive one Bristol-Myers Squibb share and $50.00 in cash for each share of Celgene. Furthermore, Celgene shareholders will obtain a CVR for each Celgene share, which entitles them to an extra $9 if three of the six drugs, which are currently under development, receive FDA approval. Given the aforementioned information, the overall consideration is valued at $102.43 per Celgene share and represents a 51% premium to the 30-day average closing price. After the completion of the deal, Celgene shareholders are anticipated to own 31% of the combined entity, whereas Bristol-Myers Squibb shareholders are expected to hold a 69% ownership stake.

Deal Rationale

With low success rates and billions spent on R&D, predicting the future success of pharmaceutical companies can sometimes feel like a shot in the dark. Fortunately, Big Pharma’s rationale and strategies often prove easier to predict than its future profitability. Bristol-Myers Squibb’s recent acquisition of Celgene Pharmaceuticals can be understood by looking at a variety of factors, the first of which is industry consolidation. Over the past 4 years, and especially throughout 2018, deal making in the biopharma industry skyrocketed to record levels. In the first half of 2018 alone over $220bn in biopharma acquisitions were initiated, exceeding levels recorded for all 12 months of 2016 and 2017. In this context, the Bristol-Celgene deal is merely an extension of an industry consolidation that has grown in recent years due to market dynamics and industry pressure. The influences spurring this level of consolidation include upcoming patent cliffs, increased competition from generic manufacturers, and rising drug development costs. Between 2018 and 2025, more than $250bn worth of branded drugs will see their patents expire; thus, pushing the expected profitability of their parent companies into a state of uncertainty. To offset this development, large pharmaceutical companies are increasingly focused on improving efficiency and filling profit gaps with big returns on fewer investments. Increased competition from generic manufacturers accounts for another factor behind consolidation, as generic drugs have risen from 19% of all drugs prescribed in 1984 to nearly 88% in 2017. Finally, rising drug development costs are also hurting the profit margins of pharmaceutical companies; for instance, in 2018 the average cost of bringing one drug to the market was $2.6bn, compared to an average of only $1.2bn in 2010.

Mergers and acquisitions are being viewed as a holistic solution to many of these problems, as they hope to provide cost savings, greater efficiency, and most importantly, a larger pipeline. In healthcare, the number of drugs a company has in each phase (I through IV) of their pipeline determines everything from profitability forecasts to investor confidence and market reactions. Phases I through III of pharmaceutical development represent the different stages of clinical trials, with each phase characterized by a growing number of participants and a higher chance it could eventually be approved by the FDA. Phase IV comes after the final stage of testing in phase III, and is distinguished by post-marketing surveillance and evaluating the drug’s long term effects on the public. But, with the average probability of FDA approval being only 10%, a number which drops even further to 2% or 3% when looking at oncology and orphan drug development, the importance of having a plentiful pipeline becomes clear. But while quantity is clearly one of the keys to success, few pharmaceutical companies have the capital or time needed to invest in hundreds of phase I drugs, the majority of which will be failures. Considering this, Bristol-Myers Squibb looked to Celgene as not just as a way to strengthen their market position, but also as a complimentary product pipeline that could be combined with their own. Despite the fact that one of Celgene’s most successful assets to date (Revlimid) could lose its patent by 2020, Chief executive of Celgene Mark Alles stated that drugs launched in the next 18 to 24 months “will go a very long way to diversify the company in a time where Revlimid will only just be beginning to see its erosion on the market.” Additionally, Bristol-Myers Squibb cites that the deal will bring them 6 Phase III assets, representing a significant expansion to the end of their pipeline and nearly $15bn in revenue potential. The combined company is also expected to boast an expanded early stage pipeline, with 50 high potential phase I assets offering a promising view of future profitability. In this sense, Bristol-Myers Squibb is making a bet on the future with the Celgene acquisition; but in an industry where product development takes longer than a decade, there truly is no other way to wager.

In addition to the aforementioned benefits, the merger is also expected to enhance Bristol-Myers’s strong financial position. The combined company is predicted to have strong cash flows, improved margins, and an EPS accretion greater than 40% during the first year. In addition to combined revenues exceeding $1bn per year, the merger is expected to yield $2.5bn in run rate cost synergies by 2022. In a time where pharma giants, such as Takeda, are taking on billions in debt to finance costly acquisitions, these financial highlights will help assure investors of Bristol- Myers’s ability to maintain a strong investment grade credit rating and the financial flexibility needed for future R&D.

Market reaction

Following the announcement of the deal on the 3rd of January, Celgene’s share price rose 22% to $81.28. Meanwhile, Bristol Myer Squibb’s share price, which closed the day before at $52.43, fell 14% to $44.53. The drop in Bristol’s share price may indicate investor doubts in the costly acquisition. Celgene, while once a great biotech star, is pinned by industry analysts as a company particularly threatened by upcoming patent cliffs. Despite Bristol’s attempts to emphasis how this merger will expand their pipeline, investor doubts are understandable.

Financial Advisors

Bristol-Myers Squibb is receiving financial advice from Morgan Stanley, Evercore, and Dyal Co, with Kirkland and Ellis as its legal counsel. On Celgene’s side, advisement is coming from JPMorgan Chase and Citi, with Wachtell Lipton as legal counsel.

0 Comments