SoftBank Group CO [9984:TSE] – Market Cap as of 26/11/2018 JPY 9.614T

Introduction

SoftBank group (SBG) is a true believer in WeWork’s idea, with a total combination of debt and equity funding in the loss-making U.S. shared office space provider of $8.4 bn. This month, WeWork received an additional $3bn injection from SoftBank Corp, in the form of a warrant, delaying again any IPO plans for the startup. The dynamics behind the last large investments in WeWork by SoftBank can be disentangled by explaining a series of events which started back in the summer of 2017: in August 2017 Vision Fund, SoftBank Corp.’s investment arm, confirmed a $4.4bn investment in WeWork, including $3bn into the startup directly, via primary and secondary shares, and $1.4bn invested into three subsidiaries, WeWork China, WeWork Japan and WeWork Pacific. One year later, SoftBank Corp. injected a further $1bn into WeWork through a convertible debt. As part of that deal, SoftBank agreed to set a floor on WeWork’s valuation at $42bn if another investor was to lead a funding round of $1bn or more. In October 2018, according to The Wall Street Journal, SoftBank was believed to be planning to take a majority stake of up to 50% in WeWork, considering an investment between $15bn and $20bn, which would account for more than 20% Vision fund’s AUM.

About SoftBank and Vision Fund

SBG created the SoftBank Vision Fund in November 2016 aiming at large-scale long-term investment and at financing the next age of innovation, by making use of SoftBank’s deep technology expertise and investment experience. Masayoshi Son clarified the idea behind the massive investment vehicle, stating the following: “Technology has the potential to address the biggest challenges and risks facing humanity today and the businesses working to solve these problems will require patient, long-term capital and visionary strategic investment partners with the resources to nurture their success”.

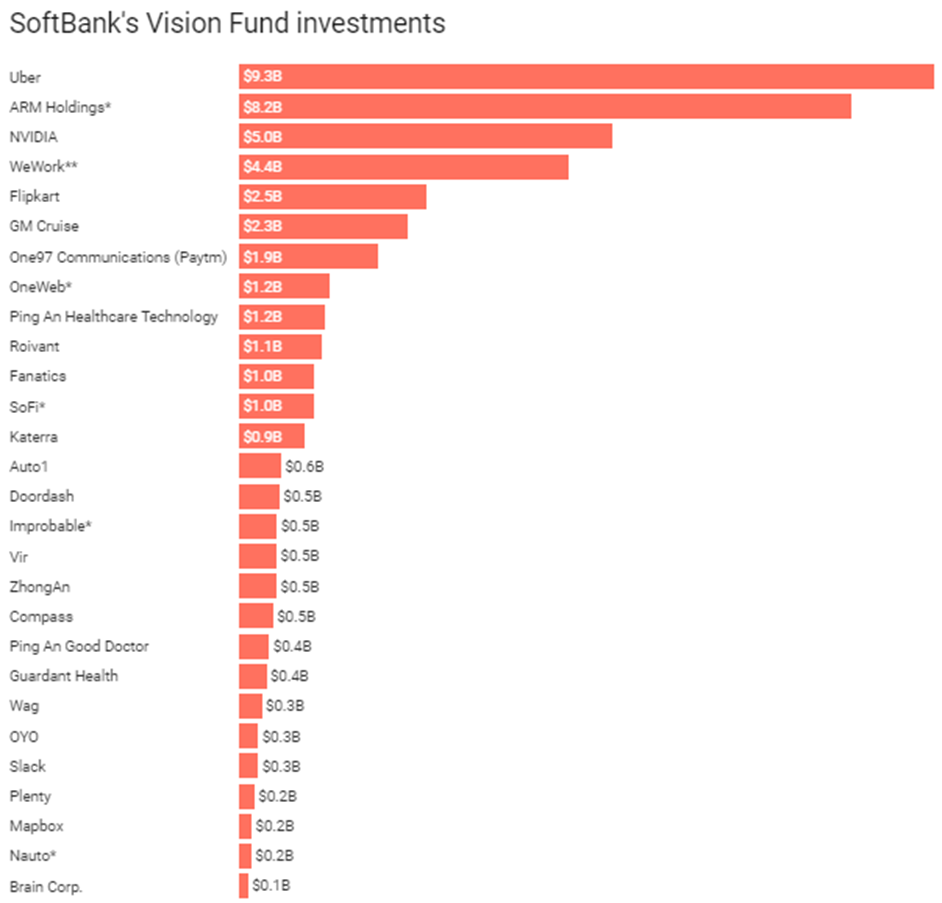

The bold fund has over $93bn of committed capital: $45bn coming from the Saudi Arabia and Abu Dhabi wealth funds, and $28bn directly from SBG. Investors in the Fund also include the Mubadala Investment Company of the United Arab Emirates ($ 15bn), Apple Inc. ($ 1bn), Foxconn Technology Group, Qualcomm Incorporated and Sharp Corporation ($ 1bn). In July 2018, Vision Fund revealed that it had already invested $40 bn of its capital under management in a 65-company portfolio (see the chart below), with investments that range from around $100 million (such as the ones in Nauto and Brain Corp) to $10 bn investment, such as the one in the ride-hailing giant Uber. In five years’ time the fund plans to have invested in 70-100 technology unicorns, privately held startups valued at $1bn or more.

Source: Recode (July 2018)

While SoftBank Corp.’s investment arm seeks to invest in the technology sector, in a broader context SBG showed a relevant interest towards real estate industry. More specifically:

- Through Vision Fund has backed Opendoor, a platform for buying and selling homes, with $400m;

- Poured $400m in the real estate brokerage startup Compass;

- Invested $865m into the construction tech business Katerra.

The Fund is advised by wholly-owned subsidiaries of SBG, known collectively as “SB Investment Advisers”.

WeWork

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey. In eight years, thanks to more than $6bn in investments coming not only from SBG but also from Hony Capital and JPMorgan’s asset-management arm, the shared office space provider has grown from a single office in Lower Manhattan to a workspace giant that rents more than 268,000 desks in 287 buildings. The company has said it is the largest real estate tenant in New York, London and Washington and it ranks in the top five in many other major cities. Neumann believes in a further expansion for the company and he already made public the idea to develop entire open space offices, as well as WeWork-run apartments, gyms and even schools. As a matter of fact, in the last months it launched an elementary school and bought a stake in a wave-pool business.

The New York-based real estate giant’s core business is office leasing: it takes on long-term leases (10 to 15 years) for raw office space and builds out the interior with flexible spaces and modern design that it then subleases to freelancers and startups, as well as big businesses, on a flexible, short-term basis. It is precisely the WeWork’s deal terms structure that makes its success a topic of debate. Some are scared that flexible contracts, while ideal for small companies, may become a double-edged sword in an economic downturn, where startups would begin to delay or miss their payments by causing a distressed financial situation to the office provider. Another big issue the company has to deal with is whether or not it can balance its extraordinary growth with the fact that is has not yet achieved profitability: by looking at the 2018 results, while in the first quarter revenue more than doubled (from $198.3 million to $421.6 million), its losses over the first half rose more than fourfold from the same period a year ago, reaching $723m. The missed profitability and the large fixed investments against a flexible offer structure might scare off venture investors and therefore provoke a revision of its frothy valuation.

Industry Overview

Before the turn of the century, sharing a workspace with anyone other than your cubicle-enclosed colleagues would have been unthinkable. But with the advent of the internet came the freedom to personalize careers and break from the corporate mold. A new wave of jobs like “digital nomad”, “freelancer”, and “self-employed entrepreneur” began to populate business cards, facilitated in large part by the technological strides made in the ’90s and ’00s. This increased career flexibility opened the door for a new type of office to emerge: the coworking space.

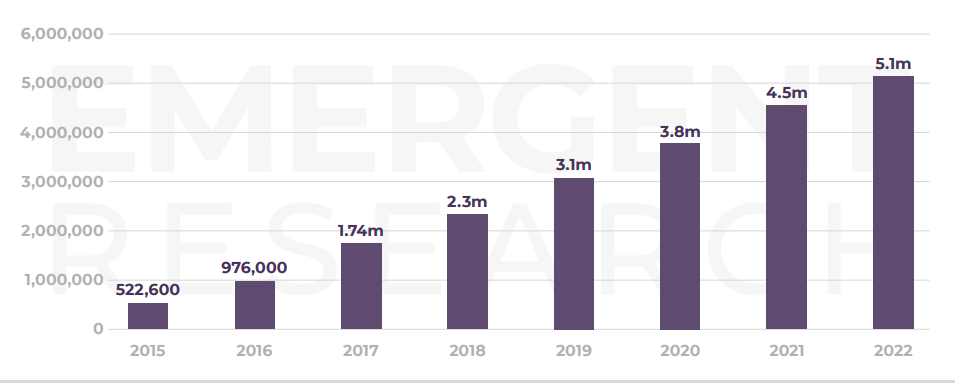

Critics credit the beginning of the coworking industry to Brad Neuberg’s 2005 opening of the San Francisco Coworking Space, which he created to provide an inclusive community and workspace to the SF startup industry. The opening of that small establishment would spawn recreations on a global scale, as increasing numbers of people would get behind the idea of a working community. Since then, the industry has grown from a handful of locations to 17,725 locations globally, with a 24.2% annual growth rate expected to increase the number to 30,432 locations by 2022. The number of global coworking members is expected to more than double from 2.3m members in 2018 to 5.1m members in 2020.

Source: Emergent Research

Chart: Number of Global Coworking Members, GCUC

Since 2005, the Coworking industry has developed through numerous startups and two larger companies: WeWork and Impact Hub. With a presence in 65 cities around the world and a growing membership pool of over 200,000 people, WeWork dominates the market. Additionally, WeWork offers the greatest scope of product offerings, including everything from dedicated desks to private offices for large enterprises. In comparison, Impact Hub spans 81 cities with its 92 locations and 16,000 members. Its product offerings, like most other startups in the coworking space, are often limited to traditional individual working areas. Other competition in the industry includes regional startups such as Knotel, Industrious, Serendipity Labs, and Spaces. These startups’ foreign counterparts, such as Chinese Naked Hub and Singaporean SpaceMob, often get acquired by larger companies like WeWork because of the acquisition-focused growth strategies of larger players. However, many critics believe that competition to coworking companies also comes from a mélange of other industries it threatens to destabilize, such as facilities management and real estate. For instance, WeWork’s biggest competition comes from Regus, a facilities management firm that is 3 times older than the tech unicorn. Founded in 1989, Regus was one of the first companies to offer and market shared office space. While it boasts nearly 3,000 working spaces globally, its attempts to capture the coworking market pale in comparison to WeWork’s results. With a primary focus on long-term rentals, Regus is incapable of curating the community atmosphere that defines the modern coworking space and is rapidly becoming irrelevant, like many of WeWork’s competitors. Other facilities management and real estate firms, such as Boston Properties and Vornado, face not only this dilemma of being incapable of moving into the coworking market but also find themselves threatened by WeWork’s movement into their markets with its long-term offerings.

Deal Structure

On November 1, 2018, WeWork entered into a warrant agreement with SoftBank. The $3bn injection is structured in warrants, which means that SoftBank will provide up to $3bn next year that WeWork can withdraw in two equal tranches on January 15 and April 15. In case the cash is taken, SoftBank will get warrants that will be converted automatically, on September 30 (the “Outside Date”), into preferred shares at an exercise price per share of $110, giving to WeWork a $42bn valuation.

However, if certain conditions are met before the Outside Date then the warrant will be exercised immediately, and the outcome shall be different. First, if WeWork files for IPO, the exercise price for the stocks will be the higher between $110 and the IPO price. Second, in case of a private investment of at least $1bn, the exercise price would be the higher between $110 and the lowest price per share paid by the non-SoftBank investors if $2bn+ were provided by the external investors, while it would be the higher between $110 and the price offered by the unique non-SoftBank investor that injected at least $1bn of capital, if any. Third, if WeWork was sold to another company, the warrants will turn into preferred stock issued at exercise price per share of $110, which will likely be sold to the acquirer.

Although WeWork, in its presentation, refers to the potential investment as “warrants”, as we have done in the previous paragraphs, usually warrants give the holder the right to buy a new share of a company at a fixed price. In this case, we face an obligation to buy the mentioned shares, so the arrangement works more like a convertible bond with a zero coupon. The reason behind not directly choosing convertible note, as it has already been done in the $1bn investment in WeWork of August, is related to SoftBank’s financial situation: at the end of the third quarter, SoftBank had a Net Debt-to-Ebitda ratio of 5.2x, which suggest a very high leverage. While a convertible note would have increased the debt level, the warrant, working like a loan commitment, figures as an off-balance-sheet activity and therefore the investment of SoftBank in WeWork won’t have any impact on the balance sheet. At the same time, the warrant will ensure all the benefits of a convertible bond (i.e. share in any upside if a liquidity event comes and manage the cash position), paying only a price, that is the zero coupon.

From WeWork’s point of view, the deal structure is helpful since SoftBank’s investment guarantees WeWork extra liquidity over the next nine or so months, which for a business on course to lose $2bn in this financial year, with public markets looking shaky, provides a safety net for the business by securing equity financing in advance.

Deal Rationale

Understanding SoftBank’s decision to invest in money-losing WeWork is as simple as looking at the purpose of the Vision Fund: to develop industry-changing technology for a modern age. WeWork holds the potential to transform the way the world looks at not just coworking spaces, but facility management, renting, and real estate. It also represents the perfect investment into this market because of three factors: its market dominance, diversification strategies, and brand focus. WeWork dominates the market to the point that critics claim it has no serious competitors, but the company has not allowed this lack of competition to let it relax. Rather, the firm has actively worked to entrench itself even further in the market by developing greater efficiencies and a broader scope than its lackluster competitors.

In addition to entrenching itself within the market, WeWork has looked to revenue and product diversification as a way to reduce risks associated with economic downturns and to enhance revenue growth. Rather than just maintaining their original coworking offerings, the company has expanded into long-term rentals for corporations and other renting needs. While these additions do push WeWork further towards the real estate industry, the steadier revenue streams will better protect the company from sudden dips in individual users’ consumption. Additionally, expanding their product line should help facilitate greater growth across diversified lines of business. Finally, WeWork presents an attractive investment opportunity because of its focus on cultivating a brand that promotes healthy communities and workspaces. In recent years, the company has introduced everything from services like WeLive, an apartment rental platform, to facility management and fitness classes.

Critics argue that these offerings paint WeWork like any other startup with overreaching ambitions about helping the world, but, despite WeWork’s recent losses, Softbank certainly seems to believe it can turn profitability around. The decision to complete another round of funding can be seen as a confidence shot for the company, but is also justified by the desire to capture a greater stake as its growth continues to quicken. Artie Minson, WeWork’s Chief Financial officer, discussed the opportunistic nature of the funding while commenting that, “The way to work with Softbank emphasis speed…that speaks to the overall momentum in the business”. With a run rate of $2bn a year and losses by the third quarter quadrupling from their 2017 value, speed does seem like an apt description for WeWork, albeit not with the same connotation its CFO implied. Time will tell if Softbank’s remarkable trust in WeWork’s ambitions was well placed.

Market Reaction

Following the announcement of the $3bn loan commitment to WeWork, Softbank Group Corp. closed at ¥8,941 in Tokyo on November 13, a 1.87% increase from the day before. This reaction is in contrast with the fall of 5.4% of SoftBank’s shares that took place on October 10 after the Wall Street Journal reported rumors on the $15bn-$20bn investment to guarantee a majority stake in WeWork. However, that operation would have been in contrast with Mr. Son’s strategy of taking a holding in technology start-up through the Vision Fund without having to manage the individual companies itself, since, depending on the investment’s size, SoftBank could have even gained control of more than half of the company’s equity.

Advisors

Advisors of the transaction have not been disclosed.

0 Comments