In this inaugural series of articles we will cover the basics and key trends of both major and lesser known industries to help the reader navigate the increasing complexity of the finance world. We will start with an overview of the broader industry and dig deeper to understand the players and drivers that are moving the market. Dulcis in fundo we will present a valuation primer based on multiple analysis to put the industry into numbers. We hope this new framework will prove useful to you, the reader, in preparing for interviews and deciding which industry to work in and even further down the line to offer some key insights into new industries. We wish you a great read!

TMT

The world in the 21st century is dependent on digital networks and automation in every aspect of life, ever bolstered by the rapid advancement in technology witnessed in the last decades. Central to this is the TMT sector, which stands for Technology, Media and Telecommunication. This is a very broad classification, and especially with the increasing dominance of the tech companies, one that is less and less useful; therefore, the broad industry is analysed through its subsectors.

On the Technology side, companies can be distributed into 5 subsectors: Software, Hardware & Equipment, Internet Companies, Semiconductor Producers and IT Service Providers. As of 17 Feb. 22, most valuable companies in Tech are Apple [NASDAQ: AAPL] with $2.81bn market cap, Microsoft [NASDAQ: MSFT] with $2.24bn, and Alphabet [NASDAQ: GOOG] with $1.8bn.

As for Media, there are 3 subsectors, namely Film & Television, Print & Digital Media and Gaming. Walt Disney Co. [NYSE:DIS] and Netflix [NASDAQ: NFLX] are major players, with market caps of $284bn and $176.7bn respectively. The gaming sector has been particularly active in recent years, which BSIC covered in detail in 2 articles, you can access the first here.

The Telecommunications sector and its services are now a basic necessity for consumers and businesses alike, and can be categorised under 3 subsectors: Telecom equipment, which covers everything related to building and maintaining the hardware, including the cell towers and transmission lines; telecom services, which is about operating through that hardware for the actual transmission of data, and wireless connection, providers of primarily cellular or wireless telecommunication services, including paging services. Historically, the sector was dominated by large incumbent operators, and in the cases of many European countries like France, Germany and Italy, state-owned businesses. Since the late 1990s, however, a wave of deregulation occurred, increasing competition and innovation but decreasing the profitability of the incumbents. Although in the period 2010-2019 total revenue of the sector increased by a CAGR of 1.39%, a McKinsey analysis titled “ A blueprint for telecom’s critical reinvention” found that Return on Invested Capital (ROIC) of 25 global telecom operators fell from close to 6% over the Weighted Average Cost of Capital (WACC) to just 1%. Now, let’s take a closer look at said incumbents.

Europe

Deutsche Telekom: The largest telecommunications company in the continent by revenue, Deutsche Telekom (DT) has a market cap of $97.93bn and the German government retains a 14.5% stake. With its brand name T-Mobile, DT fully owns telco service providers in 7 countries in Europe, and has a 46.8% stake in T-Mobile US. In its Annual report for 2020, DT posted a record high revenue of $114.8bn.

Telefonica: The Spanish telecom giant boasts a market cap of $28.27bn and recorded $48.9bn of revenue in 2020. Alongside subsidiaries in Europe, Telefonica has significant operations in Latin America, operating the largest fixed-line network in Chile, Peru, Brazil and Argentina.

Vodafone: With operations in 22 countries and affiliate networks in another 48 countries, the British service provider has a very recognizable brand around the world. In Europe, it operates in 13 countries and has partnerships in 20 others. In the year 2021, Vodafone posted revenues of $49.79bn and currently boasts a $50.34bn market cap.

Orange: With a market share of 45.4% in France, the company enjoys a solid customer base of 150 million. It boasts a market cap of $33.23bn and reported a $48.28bn of revenue in 2020. Orange has operations in 26 countries, with a significant presence in Africa.

United States

AT&T: With revenues of $181bn, AT&T is the largest telecommunication company in the world. Through a long history of m&a deals, AT&T became a Media giant, owning brands like HBO, CNN and DC Entertainment. AT&T currently holds a $169.5bn market cap.

Verizon: Coming in 2nd with a market share of 29.1%, Verizon reported a revenue of $128.29bn in 2020 and holds a $225.3bn market cap. The acquisitions of AOL and Yahoo’s core internet service in 2015-16 expanded the company into Media and Internet as well.

Industry outlook and trends

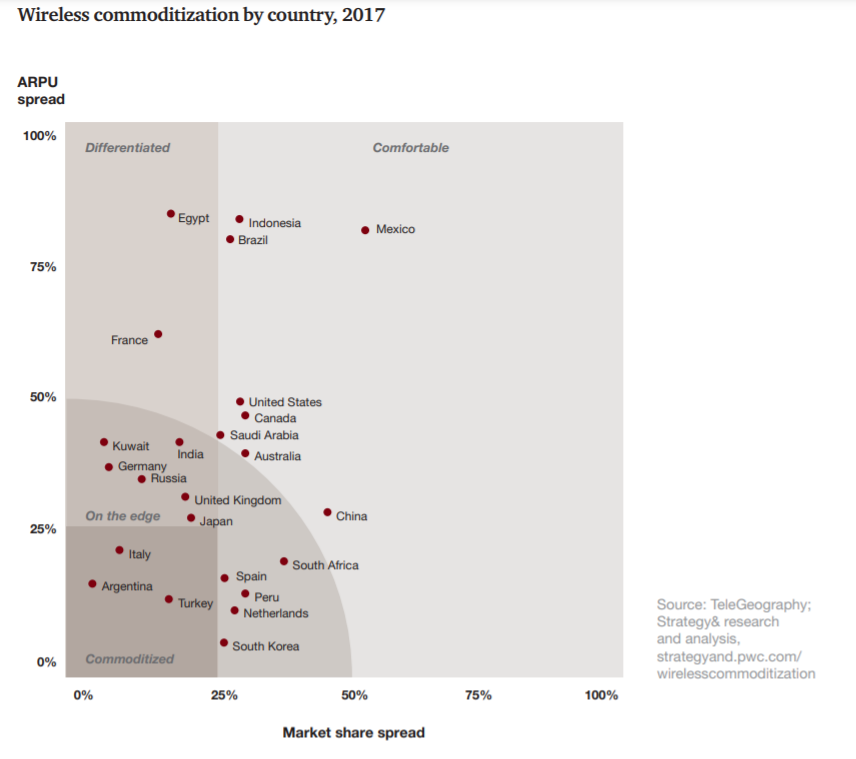

The global wireless telecom industry is getting increasingly commoditized. Thanks to saturated markets, booming data demand, new market entrants, ongoing consolidation, and vicious price wars, wireless service providers are fighting for market share and, as a result, the average revenue per user (ARPU), the key metric in telecommunications, is declining in many markets around the world. A strong wave of commoditization risks turning telecom companies into utility-like, stale companies just generating enough revenue to cover costs. Analysing the strength of this trend in each market, PWC looks at the ARPU spread, the difference between the highest and lowest ARPUs of the market’s players, and market share spread, the difference between the market shares of the largest and smallest players. Smaller spreads indicate a more commoditized market. In the period 2006-2017, the North American market was getting commoditized at the fastest rate, but still remained the most differentiated market. At the opposite end of the spectrum, the European market moved in the same direction and was marked as “on the edge” of getting fully commoditized by the PWC research. The Asia-Pacific region saw little change, while the Middle East and North Africa market was an interesting case of market share spread declining but the ARPU spread rising. On the country level, some of the most commoditized markets are those of Italy, Argentina and Turkey, while Mexico is one of the least commoditized, with its borderline monopolistic market dominated by America Movil.

Source: TeleGeography, PwC

Source: IDATE DigiWorld, ETNO, Statista

The powerful winds of change in the telecom industry were set into motion by technological advancements. The article “Ritual Sacrifice” by BSIC in March 2021 gives an overview of the historical evolution, but briefly, bundles in cableTV, mobile and internet services used to dominate the sec-tor, and given that they were run through the same cables, having a customer use all three saved costs enough to justify a large discount. However, now the mobile and broadband services are completely different infrastructures, as high speed broadband is delivered via fiber-optic cables to the customer. Correspondingly, the advantages of operating one’s own Telecom infrastructure are waning. Operators are increasingly focusing on B2B services rather than mass consumer demand with the deployment of the 5G technology, which requires a large initial investment. Therefore, selling off infrastructure assets like telecom towers gained popularity as an option, evidenced notably by Cellnex’s acquisition of Arqiva’s telecom towers in a £2bn deal in 2019, which, along with the trend itself, was covered by BSIC in the article “Reaching for the Sky” in October 2019. Furthermore, by spinning off the towers, there is the chance to realise higher valuations than they had under mobile network operators’ ownership, which could be explained by a series of motives here listed but developed more in depth in the article “Rise of the Specialists”. First, the more experienced management, with towers as their key focus, would be improved, leading to greater operational efficiency. Secondly, by controlling solely the towers, a firm’s business model would be much simpler and would generate more stable revenue flows than those of an operator. Also, since the towers in independent hands can service multiple clients, their revenues are less affected by cyclical market downturns. As a result of the lower presumed risk, average cost of capital (WACC) of TowerCos in the US and Europe is lower in comparison to Mobile Network Operators (MNOs) who operate both the infrastructure and telecom service. Thirdly, the ability to monetise the asset would be better by charging subsequent site tenants the same price as the first, something which operators cannot do. Lastly, TowerCos can handle a more debt-heavy financing structure, thanks to their relatively stable cash flow, which will be explored more in depth in the next section. In 2020, 20% of telecom towers in Europe and 90% in the US were held by independent telecom tower companies. Significant TowerCos in Europe are Cellnex (Market Cap: $29.7bn) and Inwit (MC: $9.55bn), while the US market is largely shared between American Tower (MC: $104bn) and Crown Castle (MC: $70.2bn). Separately, but stemming from similar trends, the “Fiberco”s, operating the FTTH (Fiber-to-the-home) assets in the infrastructure, have emerged. Fibercos are more local focused, some notable ones include Italy’s OpenFiber and Germany’s Deutsche Glasfaser.

Another strong trend since the early 2000s is the challenge to MNOs posed by Mobile Virtual Network Operators (MVNOs) that do not operate the infrastructure but rent it from TowerCos and FiberCos, like Iliad in Italy, who offer coverage through the towers of Wind Tre. A uniquely low fixed cost allows MVNOs to offer competitive pricing. This business model came to fruition thanks both to technological and regulatory factors. Throughout the 1990s, Telecom sector in Europe saw a wave of liberalisation and pro-competition regulations, one of which stipulated tower operators to leave a share of traffic available and offer it to competitors. The $36bn global MVNO market size in 2012 skyrocketed to $73.5bn in 2020 and is expected to hit $88bn this year. Europe has some of the highest market shares for MVNOs, with the UK at 23.5%, Italy at 11.3% and France at 11%. A study by McKinsey titled “Virtually Mobile: What Drives MVNO Success” identified that positive relationships with an MNO and pursuit of excellence in marketing and operations were among the factors to MVNOs success.

Additionally, room to grow for telecom companies is narrowing. In a mature sector with razor thin profit margins, new investment opportunities are out of reach with so little pricing power. Although the market is expected to grow at a compound annual growth rate (CAGR) of 5% between 2020 to 2027, constant price competition causes scepticism as to how much of that could translate into sustainable profitability. Especially in Europe, allowing consolidation may be the only way left to support new investments. Such a necessity was likely behind Iliad’s offer to acquire Vodafone Italy in early 2022, which was rejected. Simultaneously, Telecom Italia is considering a similar acquisition offer from PE Group KKR, which was thrown into doubt following the insistence by the Italian Government, who owns a 10% stake, to retain some assets key to national security.

A Telecommunication Valuation primer

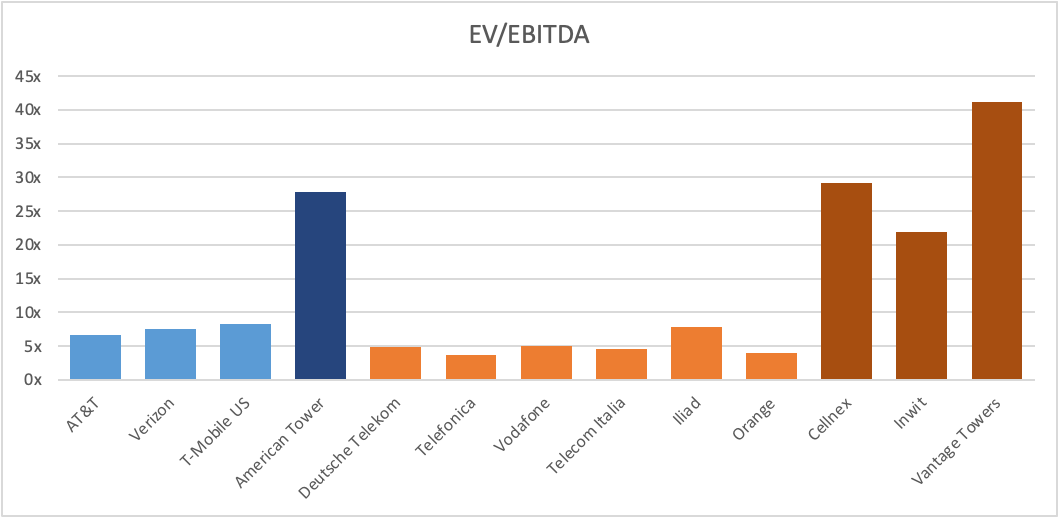

As shown by the Exhibit 1, the EV/EBITDA ltm multiple is tendentially higher in the US than in Europe, and they are uniform across geographies for MNOs and MVNOs.

However, it is important to highlight the particular case of Iliad, the French company, which presents a higher multiple with respect to its European peers. The difference can be related to the recent expansion (2018) of the company in the Italian market through a network roaming agreement with Wind-Tre: its highly competitive prices, paired with good services and a successful marketing strategy, earned it in 4 years a 12% share of the Italian market of mobile phones services. Iliad is also now considering a further expansion in Italian rural areas through an acquisition of 5,000 towers across Italy and through partnerships with Cellnex and EI Towers, two independent tower companies, which could grant more than 10,000 towers. The company’s growth and the potential further expansion justify the higher multiple, also demonstrating the success of the model adopted by MVNOs.

Tower Companies instead show consistently higher EV/EBITDA multiples across continents with respect to MNOs. These independent wholesale wireless infrastructure providers, thanks to higher operating expenses efficiencies, higher rates of co-location (since they are independent) and lower cost of capital, have in fact been able to grant themselves a constant source of income by MNOs and MVNOs, which are now increasingly outsourcing towers and selling/renting to TowerCos. Therefore, the higher efficiencies and overall lower WACC translate in a lower cost of capital and higher valuations.

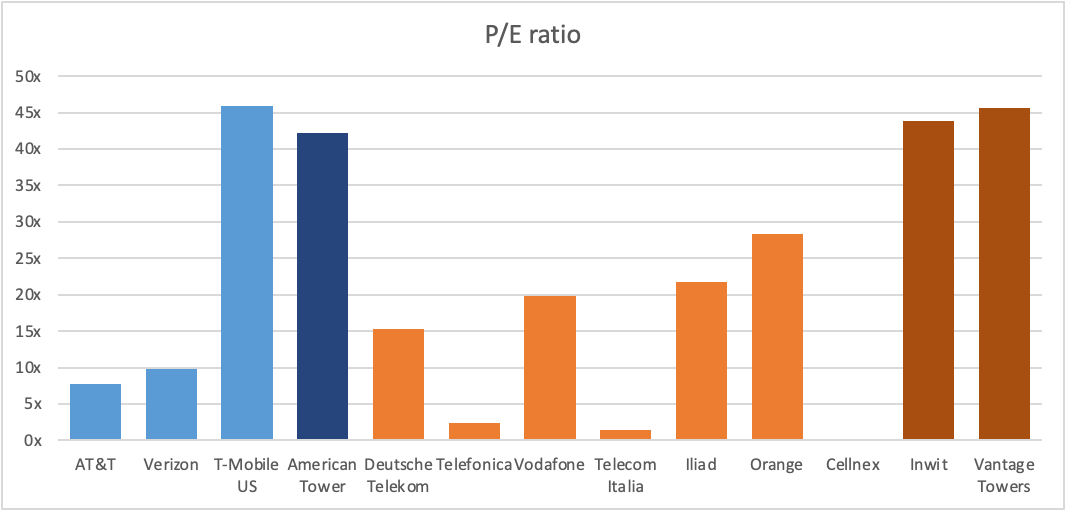

The high P/E ratio* of T-Mobile (Exhibit 3) has been driven by the announced share buybacks. Also, the earlier investment of T-Mobile in the development of 5G has helped it gain competitiveness against its two US competitors, AT&T and Verizon, which are still relying mainly on C-band spectrum. In the European market, the P/E ratios are quite uniform and slightly higher than those of AT&T and Verizon, with the exception of Telefonica S.A., a Spanish wireless company, and Telecom Italia, that present significantly lower P/E ratios.

Telecom Italia, after having been in talks in November with KKR for an acquisition, which has now been delayed, is weighing reducing its Italian workforce by as much as one fifth. This is due to the lowering of profits, especially after the pandemic, and the increased competition in its home market. The economic distress and the likely future reduction of headcount significantly reduced the prospects of growth, thus motivating the low P/E ratio. A similar situation is being faced by Telefonica, which has reduced its workforce by 15% in December. It has also sold 50% of its Cornerstone Telecommunications Infrastructure (Ctil), communication towers of a joint venture with Vodafone, and the mobile towers of Telxius to American Tower for €7.7 billions in cash earlier to try to settle part of its huge debt.

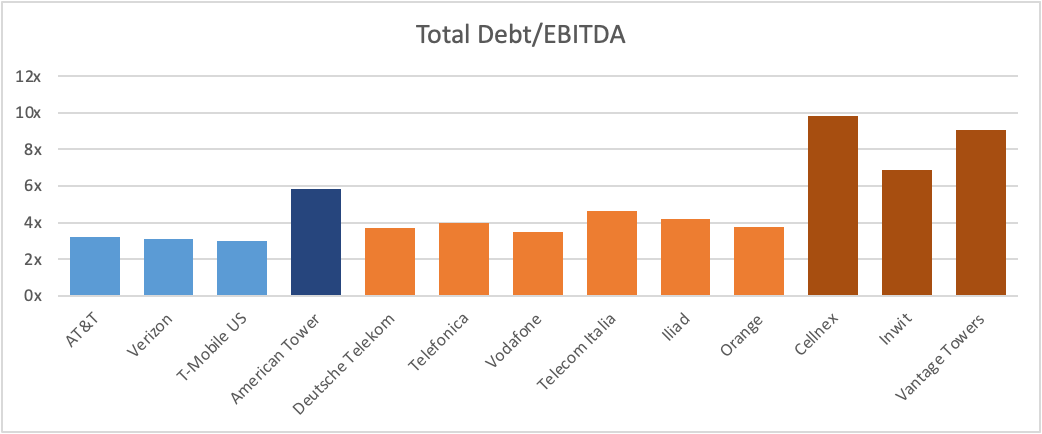

As we can see from Exhibit 2, both Telefonica and Telecom have quite high Total Debt/EBITDA ratios. Even if there could still be room for growth for both companies, the high debt could result in a problem in the case in which it could be necessary to take on more debt.

Consistently with the higher EV/EBITDA multiples, Tower Companies also present higher P/E ratios due to the expectations of growth in the future (Exhibit 3). Because of it, they also have Total Debt/EBITDA ratios even higher than Telefonica or Telecom Italia, the multiples illustrate the growth of this sector compared to MNOs and MVNOs: the rapid expansion of these companies, especially in the 5G technology, which requires high fixed investments, necessitated of initial huge investments in this new technology, not yet fully exploited by wireless companies, and it is now paying off with high prospects of growth and higher multiples.

*the P/E ratios could be influenced by incomplete data and driven by expectations and differences in business models

Exhibit 1

Exhibit 2

Exhibit 3

0 Comments