Healthcare.

The healthcare sector has gained increasing importance over the last few years, because of the impact that the covid outbreak had on everyone’s life. The healthcare industry is one of the world’s largest and fastest-growing industries, ranking as the fifth-largest sector in the world economy, accounting for a total $8.45tn at the end of 2021. Given the very broad scope of this sector, it is necessary to divide it into 5 main sub-sectors, although it is very difficult to draw a precise line between the different companies.

The biggest subsector is the drug manufacturing sector, including some of the biggest healthcare companies, like Johnson & Johnson [NYSE:JNJ], Novartis [SWX:NOVN], Pfizer [NYSE:PFE] and Merck[NYSE:MRK]. The biotechnology sub-sector is the most disruptive one, focused on the production of healthcare-related products using molecular biology and living organisms: Regeneron [NASDAQ:REGN], Moderna [NASDAQ:MRNA] and Vertex [NASDAQ:VRTX] are creating the new frontier of innovation in the healthcare sector. The third subsector is medical equipment, which involves 3 different areas: Medical devices, medical instruments and medical distribution. Interesting examples of innovation in this sector are Abbott Laboratories [NYSE:ABT] and Intuitive Surgical [NASDAQ:ISRG], two US-based companies that have introduced the use of robotics within the medical equipment industry. An additional subsector is the Managed HC. This sub-sector is dominant in the United States, given the structure of the healthcare market in the country: CVS [NYSE:CVS] and Anthem [NYSE:ANTM] are the most relevant players. Last, but not least, the Healthcare facilities sub-sector occupies a significant relevance in terms of human capital and resources used to support the healthcare system. In particular, Fresenius [ETR:FRE], and HCA [NYSE:HCA] offer an interesting comparison.

In order to have a broader overview, it is necessary to mention health-tech: it does not represent a real sub-sector, but a technological application to the various areas of healthcare.

Europe

Novartis: It is currently the largest medical device firm in Europe having generated a total revenue of $52.88bn in FY 2021. The business activities of the Company are divided into two segments: Innovative Medicines, which includes innovative patent-protected prescription medicines for blood pressure, cancer and other ailments, and Sandoz, which includes generic pharmaceuticals and biosimilars. About 74% of the total revenues come from established markets, while the remaining part derives from emerging markets. In the first quarter, net sales were $12.4bn (-2% cc), driven by volume growth of 3 percentage points, price erosion of 2 percentage points and negative impact from generic competition of 3 percentage points.

Fresenius: With over 300,000 employees in more than 100 countries around the globe, and annual sales exceeding €35bn, Fresenius is one of the European leading healthcare companies. Revenues have been €37.5bn in FY 2021, with an increase of 5% from the previous year. According to analysts, further earnings growth in 2022 is expected despite ongoing COVID-19 effects and cost inflation impact.

United States

Johnson & Johnson: It is the largest US-based multinational company (market capitalization of $436.46bn) that develops medical devices, pharmaceuticals, and consumer packaged goods. The corporation includes some 250 subsidiary companies with operations in 60 countries and products sold in over 175 countries. The company’s business is divided into three major business sectors: Pharmaceuticals, Medical Devices, and Consumer Health. J&J reported $93.77bn in sales in 2021, a 13.6% increase over the prior year. In 2021 Full-Year EPS of $7.81 increased 41.7%, while adjusted EPS of $9.80 increased 22.0%

Pfizer: Pfizer Inc is a research-based global biopharmaceutical company. The Company is engaged in the discovery, development, manufacture, and distribution of biopharmaceutical products. Its global portfolio includes medicines and vaccines. The American company, boosted by the pandemic needs, has registered an all-time record in 2021 reporting a 92% operational growth of revenues, reaching about $81.3bn. The total market capitalization is $267.85bn.

Regeneron: As of February 2022 Regeneron Pharmaceuticals has a market cap of $67.14bn. The company speeds up the traditional drug development process through its proprietary VelociSuite technologies such as VelocImmune, which uses unique genetically humanized mice to produce optimized fully human antibodies and bi-specific antibodies. The company’s net profit nearly doubled to $2.23bn, or $19.69 per share, in the fourth quarter ended Dec. 31, on strong sales of its COVID-19 antibody cocktail. The 56.8% of outstanding shares are held by mutual funds.

CVS Health Corporation: The Company operates through four segments: Pharmacy Services, Retail/LTC, Health Care Benefits, and Corporate/Other. It has approximately 9,900 retail locations, over 1,100 walk-in medical clinics, a pharmacy benefits manager with approximately 105 million plan members, specialty pharmacy services, and a senior pharmacy care business. The revenue growth over 5 years is 10.47%, while the market capitalization is $136.89bn.

Industry outlook and trends

Demographic changes and an aging population are driving the healthcare sector to a new trend, leading to a higher demand for medical goods and health services. According to some studies conducted by US institutes, the world population is expected to increase by 1 billion by the end of 2025, where 300 million of that increase will come from people aged 65 or more. Additional healthcare resources and service innovation are fundamental to delivering the long-term care management services required by an increasing senior population. The Brookings Institute estimates 65% of the global population will be middle class by 2030. New sedentary models and the work-from-home approach adopted during the pandemic are leading to increasing needs for people. Anyway, the growth of the global population is not expected to be equally distributed: Africa’s population will double by 2050, while the European population is shrinking.

Given the increasing long-term necessities and short-term demand led by the pandemic, the healthcare sector is trying to find new forms of innovation by implementing forms of technology, robotics, and artificial intelligence to research and production processes. An increasing focus is given to prevention, through the use of tools that can detect and monitor the possible development of diseases and health disorders in advance: some companies, such as Merck [NYSE:MRK], have taken the acquisition route in order to innovate their product portfolio. In this past BSIC article, the acquisition of Acceleron for £11.5bn in October 2021 shows an interesting case-study.

Partnerships with several markets from industries such as telecommunications, wellness, and fitness are gaining relevance in the health system. These partnerships have opened up a billion-dollar market for several companies that were previously not directly involved in the healthcare sector, but which have found new forms of expansion through exposure to new markets. To give an example, the global healthcare-related IT market is projected to reach $821.1bn by 2026 from $326.1bn in 2021, at a CAGR of 20.3% during the forecast period.

A major accelerating factor for the sector was the pandemic: in this context, tele-health has become increasingly important. Telehealth consists of the distribution of health-related information and services via electronic information and telecommunication technologies; it’s necessary to provide long-distance patient care and advice. According to a McKinsey report, Telehealth utilization has stabilized at levels 38X higher than before the pandemic. Similarly, consumer and provider attitudes toward telehealth have improved since the pre-COVID-19 era. Perceptions and usage have dropped slightly since the peak in spring 2020. Some barriers, like technology security, remain to be addressed to sustain consumer and provider virtual health adoption, and models are likely to develop to optimize hybrid virtual and in-person care delivery. Given the current unpredictability of the world in which we live and the continuous need to reach every single need, the healthcare sector is called upon to implement continuous interactions with the technology sector in order to achieve high levels of accessibility and innovation. In particular, artificial intelligence is playing a key role in this innovative process. Some of the applications of artificial intelligence in healthcare include clinical workflow management, advanced surgery assistance, and medical diagnostics. The AI-associated healthcare market is projected to reach $194.4bn by 2030, growing at a CAGR of 38.1% from 2021 to 2030. Start-ups such as CareAI offer incredible applications of health-tech: for example, CareAI created a platform that connects to the proprietary edge sensors and transforms ordinary rooms into Self-Aware Rooms. The platform improves patient safety, reduces medical errors, and improves the quality of care and clinical efficiency. On the other hand, Ligence is a Lithuanian HealthTech startup that develops tools for cardiac risk diagnosis and measuring instruments. The startup’s automated heart ultrasound imaging workflow reduces the average examination time from 30 to 5 min, as well as improves the accuracy and diagnosis. Already a few years ago, some big tech companies were moving in this direction. One example is Google’s acquisition of Fitbit in November 2019, as covered in our past article.

Given the interference of the public sector in most national health systems, the arrival of the pandemic resulted in significant increases in aggregate public expenditure. At the same time, the pandemic has altered psychological perceptions about the healthcare sector, emphasizing its relevance. World Economic Forum predicts BRICS will reach a 117% increase in health spending over the next decade, while U.S. health expenditures are expected to increase by $3.5tn between 2022 and 2040. The way reforms are produced has also changed: the partnership between the private and public sectors has become increasingly important. Private-Public partnerships offer the advantage of long-term cost savings and the achievement of high-quality benchmarks. In this respect, the fundamental aim of the private sector is to bring innovation within the sector, through health-tech/med-tech applications, process or product innovations. For example, m-Health, which stands for mobile Health, provides access to personalized health information using connected devices. Mobile devices enable visualization of health issues that prevent patient commitment. Through the use of real-time data, smartphone-linked wearable sensors, and medical-grade imaging make healthcare delivery more accessible. mHealth solutions played a critical role in fighting the spread of the COVID-19 pandemic by enabling contact tracing, testing, and gathering of relevant information. According to Precedence Research, the global m-Health market size was worth $54.25bn in 2021, and is expected to surpass around $243.57bn by 2030, poised to grow at a CAGR of 18.2% from 2021 to 2030. In this past article, “Big Pharma in the age of COVID-19”, we discussed how medical innovation would have been a key element in solving the pandemic.

However, there are some significant obstacles that could interfere in the medium to long term: first and foremost, the shortage of doctors and health personnel. Given the continuous growth of the healthcare sector, especially in the area of healthcare facilities, this shortage of doctors could lead to a systematic long-term under-production due to a shortage of the working population in the sector. According to Statista, in 2018 only 28% of doctors were under the age of 46. To this end, a number of structural reforms are therefore being implemented in countries around the world, with the aim of increasing the number of young people employed in the healthcare sector. Also of concern is the wave of doctors of retirement age in the coming years, which could lead to disruptions within the labor market, making the theoretical equilibrium point of employment unattainable. Therefore, current systems will have difficulties keeping up with the health needs of the population. According to the World Health Organization analysis, by 2035, we will face a projected shortage of 12.9 million healthcare professionals globally.

Another relevant problem is that most national health systems are both vast and fragmented: the size is a considerable driver of problems. Although extremely important in terms of democracy and moral equality, the public sector is subject to several obstacles that reduce the overall efficiency of the system. The UK’s National Health System (NHS), for example, is the seventh-largest employer worldwide and Europe’s biggest, but decision-making powers are diffuse: this on the one hand slows down innovation, due to increased internal bureaucracy, and on the other reduces overall efficiency. On the other hand, it is possible, in some specific private sectors, to find a kind of monopoly of some large companies that make it almost impossible for new competitors to enter (due to high barriers to entry in terms of fixed costs) and impose unfair prices on citizens in need of particular care or treatment.

Trends are very different between countries: even though US healthcare is often considered private, it is 48% publicly funded, 52% private, and the public share is rising (CMS 2018; WHO 2020). In contrast, Canadian public sector spending declined from 76% to 70% over the past 40 years. In the UK, though the public system dominates healthcare provision in England, private healthcare and a wide variety of alternative and complementary treatments are available for those willing and able to pay: roughly 11% of the UK population has some form of private medical insurance.

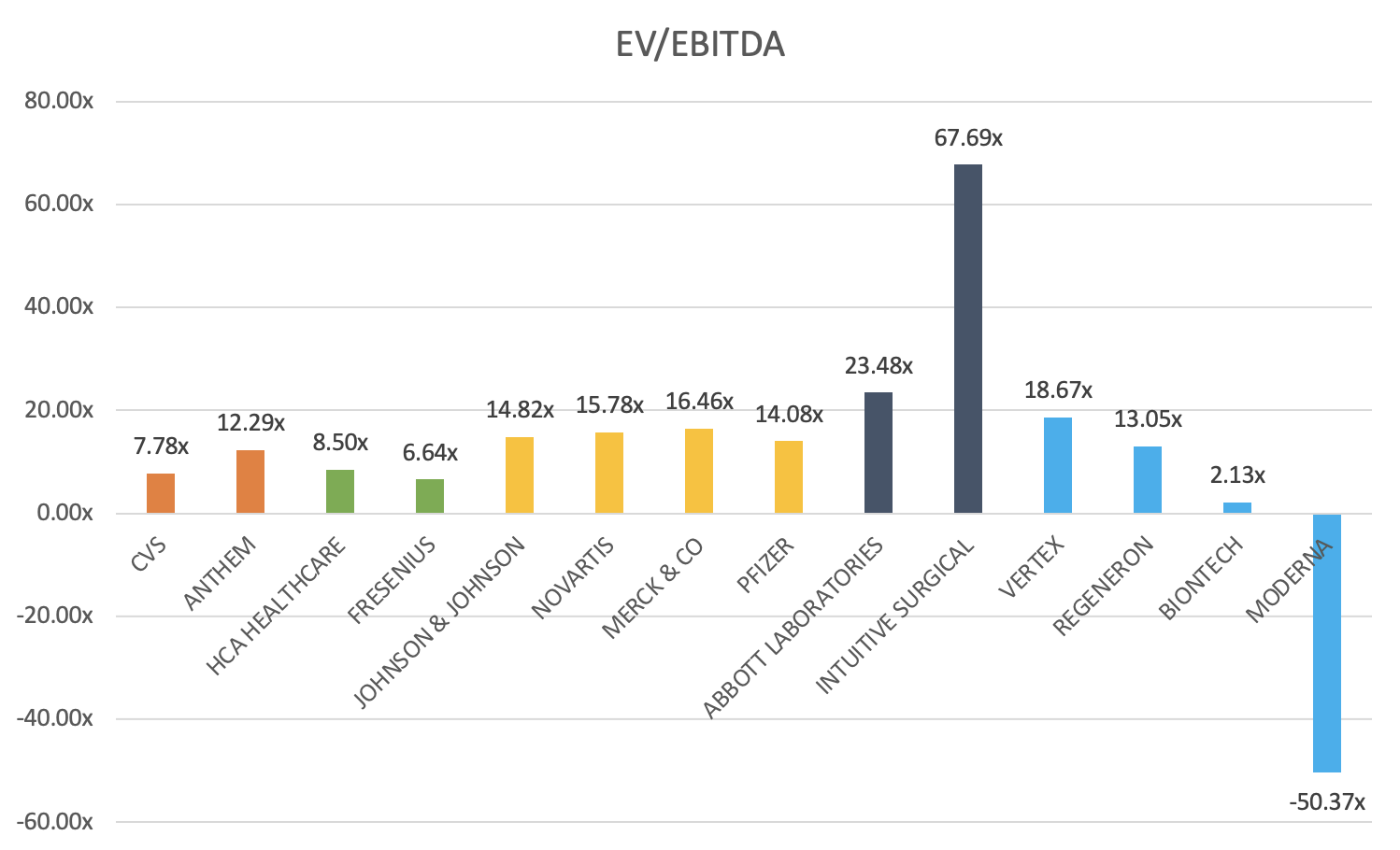

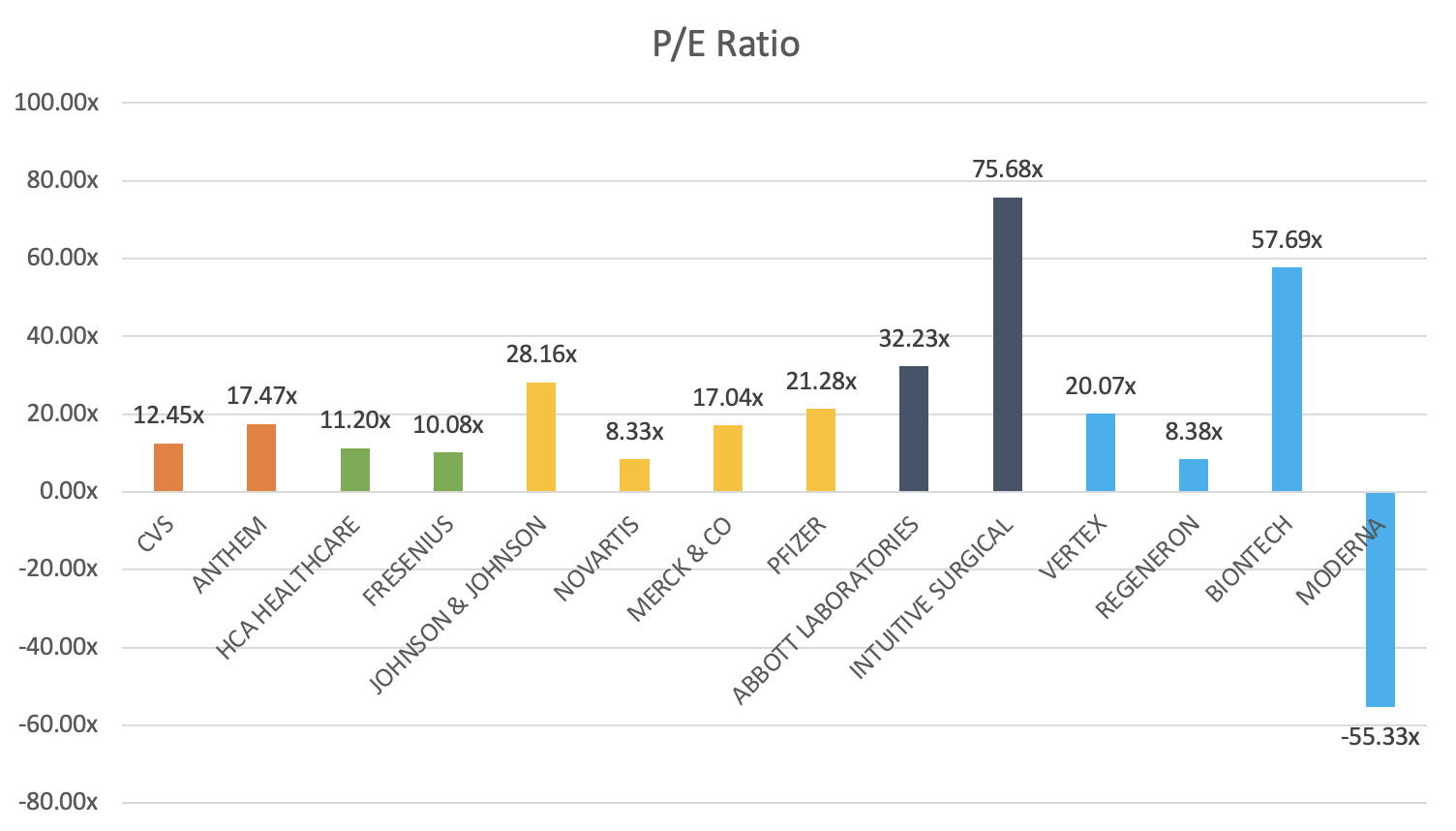

In terms of valuation, the average Beta for the healthcare industry is estimated to be 0.94, taking into consideration the largest 244 companies listed on the stock market. The co-movement of the stock price with the market may be a consequence of the inherent stability: indeed, the healthcare sector is defined as a ‘semi-heaven’, i.e. an industry which, even in times of general market downturn, tends not to collapse sharply. The logical explanation is provided by the rigidity of the market demand curve for healthcare goods; they are defined as “essential goods”. The average WACC for the industry is estimated at 5.48%. The total weight of the sector is 13.14% of the whole market. In H1 2021, there were 1,061 transactions globally in the Healthcare sector. This is slightly down on the preceding 6 months when there were 1,163 transactions. The number of transactions has remained fairly consistent over the last seven years, suggesting there remain plenty of interested buyers in the market.

A Healthcare Valuation primer

In the medical equipment sector, Intuitive Surgical producing surgical robots enjoys particularly high valuation multiples as the world moves towards robotic-assisted surgeries with numerous advantages such as quicker recovery times, minimal levels of invasiveness, fewer complications, and shorter hospital stays. The company, famous for its da Vinci systems, remains the dominant player in the sector, with an 80% market share, and its growth was not significantly harmed by pandemic, in fact, the total number of procedures performed has been steadily increasing. Additionally, the company operates using the “razor and blade” business model and therefore derives most of its revenue from recurring sources, namely disposable instruments and accessories, and services for the machines.

It is worth noting that typical valuation multiples such as EV/EBITDA or P/E ratio are in most cases less relevant in the biotechnology sector as many biotechnology companies do not have revenues. The development process in the industry involves a timeframe for the introduction of the new drug to the market of around 8 years and for this period companies’ cash flows remain significantly negative.

However, among the biggest players, the only company with a negative EV/EBITDA multiple and P/E ratio in 2020 was Moderna, which at that point didn’t have a single profitable quarter since its stock market debut in 2018. The fact was not surprising for a young biotechnology company which in two years has turned its mRNA technology from experiment to medical blockbuster. What is more, vaccines in general tend not to have high profit margins and the fact that Moderna received R&D financing of almost $2.5bn from the US government for its Covid-19 vaccine made charging high prices for doses likely to trigger a public backlash and therefore impossible.

The average EV/EBITDA multiple for the biotechnology industry in 2020 oscillated around 16x, thus placing Vertex Pharmaceuticals above the average. The company specializes in cystic fibrosis market and has basically operated as a monopolist for about 10 years and still remains a clear market leader. Vertex systematically introduces label extensions of its most well-known drugs, with Kalydeco receiving FDA and European Commission approvals in 2020 as the first and only modulator for infants. The company consistently achieves clinical and regulatory wins, recognizes growing revenues and has multiple new products in its pipeline.

In Healthcare Plans subsector, dominated by US players, Anthem has higher multiples than his slightly bigger rival, CVS Health Corporation. A Higher P/E ratio might be a result of the decision to take pharmacy business in-house from 2020 onwards, which according to the estimations was supposed to save the company $4bn annually. The company also announced it would pass on 80 percent of those savings to customers in pricing and 20 percent to the bottom line, thus boosting earnings by $2 per share starting in 2021. Indeed, for the year ended Dec. 31, 2020, company’s new pharmacy benefits business, IngenioRx, brought in $21.9bn in revenue, up 305.6% from $5.4bn in 2019.

EV/EBITDA multiples for industry’s biggest drug manufacturers are comparable. However, when it comes to P/E ratios, Johnson & Johnson’s 28.16x stands as the highest, with Pfizer’s 21.28x ranking as second among the peers. In early 2020, both companies emerged as one of the first ones to announce lead Covid-19 vaccine candidates. Interestingly, the year before that, was not an easy one for Johnson & Johnson, with pending multibillion-dollar legal lawsuits connected to its over-the-counter baby powder. At the same time company’s buybacks and dividends shielded the shareholders from taking too big of a hit. Consequently, J&J high P/E ratio can be linked with the repurchase of $6.32bn shares in the first nine months of 2019—more than triple the $2.06bn it spent during the same time period the year before. In terms of dividends, J&J spent $7.42bn, thus bringing its total shareholder payout to $13.74bn which can be contrasted with $8.12bn spending on research and development in the same period.

0 Comments