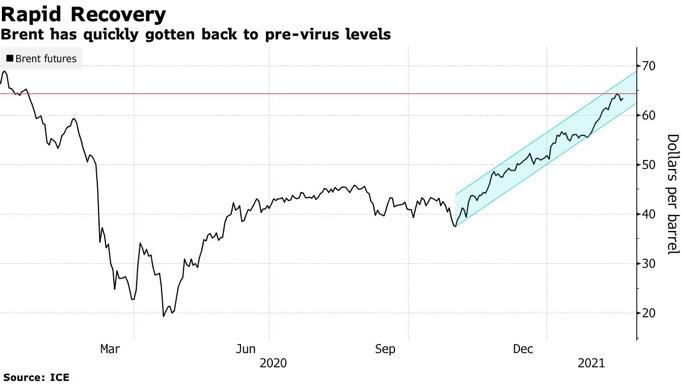

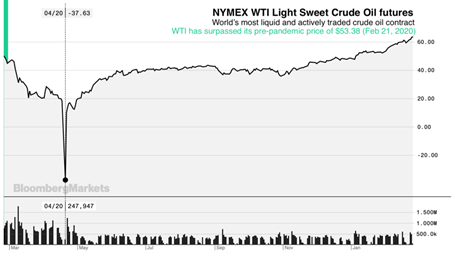

The oil market has been one of the most interesting to follow since the outbreak of the SARS-CoV-2 pandemic. Due to the severe reduction in travel and factory activity, demand plummeted, dragging down the price of oil. Disagreements between Saudi Arabia and Russia on oil supply caused a supply shock to coincide with a demand shock, a rare event in history. On April 20, 2020, American crude WTI reached the historic low of negative $37.63/barrel.

The prices of the two global benchmarks, Brent crude and WTI, have since recovered, reaching pre-pandemic levels and trending upward, but a heated debate is currently underway on the outlook for oil in the year the world will start to recover from one of the largest exogenous shocks of all time. In this article, we aim to provide our contribution to the debate, expressing a view on oil’s future, after briefly discussing the cyclicality of oil prices.

Source: Bloomberg, ICE

Source: Bloomberg

If the reader is interested in an overview of the main features of oil and its market, alongside the determinants of its price, they might be interested in a previous article by BSIC’s Corporate Finance division addressing these topics.

The cyclicality of oil prices

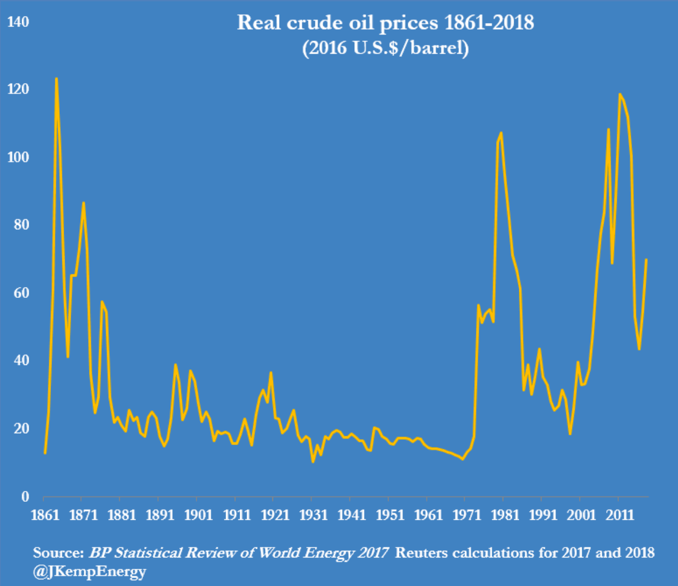

An interesting and important feature of oil prices is that they exhibit cyclical behavior. As the graph below shows, much like world GDP, the oil price undergoes a series of boom-bust cycles. In the larger context of commodities, on which we have written an introduction that can be found here, it is common to use the word supercycles, indicating prolonged length and magnitude of oil cycles compared to other asset cycles. A supercycle is an extended period of abnormal demand increases that drive prices above long-run trends, as suppliers struggle to match it.

Source: BP Statistical Review of World Energy 2017, Reuters, JKempEnergy

But why is the oil market cyclical? The answer lies in the capital-intensive process of oil production. The cycle can be thought of as beginning with excess oil supply, which results in low prices. This disincentivises investment but stimulates demand. As a result of cheap oil, demand grows, reducing excess supply and depleting inventories. Slowly but surely the price rises until at a certain level, companies involved in oil production (including those that deal with exploration, extraction and transport) begin to make enough revenue to finance investments and launch new projects. In this stage new companies are formed; investors ride the bullish wave and large amounts of leverage build up. As soon as the price curve reaches a maximum, demand starts falling, and soon enough supply outstrips orders, causing the price to collapse, financing to be curbed and the supercycle to end.

Analysts debate whether we are in the expansive phase of a supercycle; strong growth expectations for China rekindle memories of the last supercycle, which was tied to the country’s impressive growth starting in the early 2000s. Other causes include the Iraq war, a weakening US dollar and an increase in investors’ demand for commodities. That was the fourth great commodity supercycle since the 1900. The first one was sparked by the industrialization of the US economy at the beginning of the 19th century, the second by global rearmament in the 1930s and ‘40s, and the third by the reconstruction and economic growth of Europe and Japan after the Second World War.

Whether or not we are currently witnessing an oil supercycle is hard to assess. Our view is that, should this be the case, the current cycle will not be as long as previous ones since environmental regulation will act faster than the time span generally associated with commodity supercycles. Without giving a definitive answer to whether or not we are at the inception of a new commodity supercycle, we will now present our view for 2021.

The BSIC 2021 oil outlook

We are moderately bullish on oil for 2021, with a price target between $70/barrel and $75/barrel. Here are the main factors that undergirds our position.

- A strong outlook for global GDP growth in 2021, especially for China.

There is consensus amongst analysts and economists that global GDP growth will be below trend in 2021, but still strong enough to stabilize economies worldwide and undergird a year of recovery. J.P. Morgan forecasts world GDP growth in 2021 to reach 5.8%, while the IMF sees it at around 5.5%. We believe that an international rebound is currently underway, albeit subdued, especially in areas still facing lockdown and strict social distancing measures, limiting economic life. In Q2, these measures are supposed to be gradually discontinued, allowing for business activity to jump back and leading the way to a prudent return to normalcy.

The oil price is driven mostly by supply and demand, more so than other assets. The growth outlook we forecast is thus the main reason why we see global demand for oil to rise in 2021, pushing its price up. Notably, we believe that the main driver of the increase in oil demand will be China, whose 2021 GDP growth forecast of 9.2% (J.P. Morgan) exceeds that of any other country. This is particularly remarkable, as China was almost single-handedly the driver of the last commodity supercycle, as described above. The outlook on the country’s growth is particularly bullish, and we believe that the resulting increase in production and consumption will exert a strong influence in oil dynamics. In particular, we notice that gross domestic savings – which has always been notably high in China – has been declining consistently since 2010, reaching a level of 44.34% in 2019, down from a peak of 51.09%. We believe that this downward trend will eminently support consumption growth in 2021, as the largest population in the world is freed from lockdowns and restrictions.

2. Easy monetary and fiscal policy.

Fed Chair Jerome Powell has made it very clear that, even in a scenario where inflation reaches target, markets should not expect a rate hike any time soon. The chairman also stated that strong growth is his base-case scenario for 2021, during his semi-annual testimony to Congress on Feb 24. We believe that this low interest rate environment is the perfect backdrop for a tighter commodities market for two main reasons. Firstly, low interest rates are the basic underpinning of investment financing; companies and governments are in a better position to finance ambitious projects when rates are low, and they are planning to do so in 2021. This supports our outlook for oil insomuch as operations, in particular infrastructural ones, are still powered by petroleum energy. Secondly, low interest rates lead yield-hungry investors to shift to equities and other assets like commodities, where they see gains. The oil market is currently in severe backwardation, meaning the price of oil decreases as we move along the futures term structure. This implies that by simply rolling futures investors can collect positive roll yield that is much more attractive than what they can earn from government bonds and, surprisingly, most corporate bonds. Clearly, this is not the only market where investors will hunt for yield. Emerging markets are another notable source of yield, as government bonds promise much higher returns than in developed markets, and we do expect investors to take advantage of such an opportunity as well.

Moreover, fiscal policy will be a strong institutional factor pushing oil prices up in our view. With the US Congress discussing a $1.9 trillion stimulus bill and democrats having a majority in both the House and the Senate, we see a clear prospect of strong fiscal stimulus in the world’s largest economy. Fiscal and monetary policy have been crucial in preventing default rates from skyrocketing since the outbreak of the pandemic. The very low yields maintained by risky corporate credit throughout the past year have been ascribed to easy monetary conditions, government support, and more relaxed requirements to obtain financing. We believe that fiscal policy will remain supportive in 2021, as low rates make debt more sustainable and governments deficits less of a preoccupation in the short term.

3. OPEC supply will remain highly inelastic

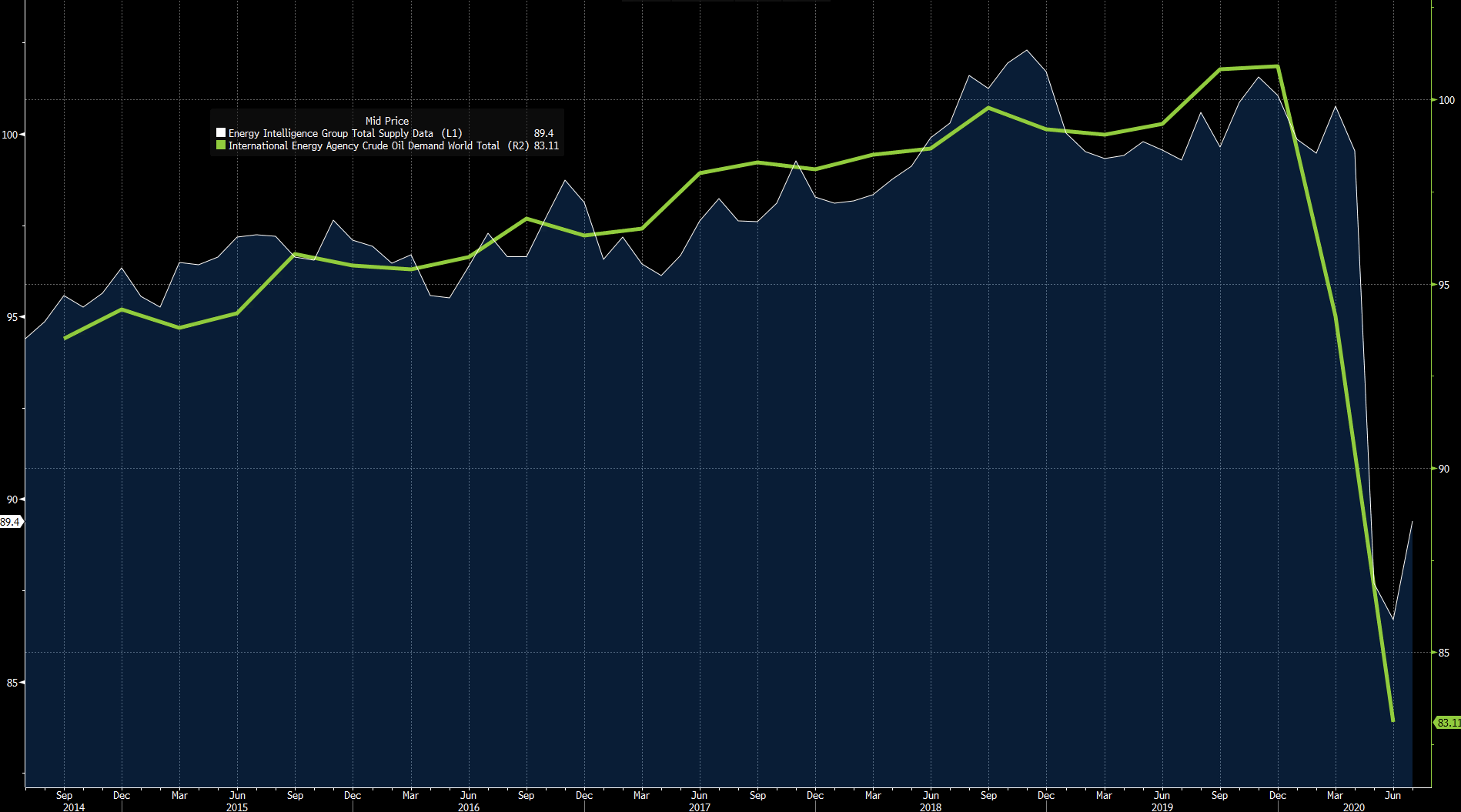

As rosy as our economic outlook is, we don’t think that pre-pandemic oil demand will be reached before 2022. Although both Brent crude and WTI prices have already reached pre-Covid levels, 2021 will most likely not be the year we see oil demand peak. In particular, great uncertainty remains around air travel.

Source: Bloomberg

That might be seen as a counterargument to the price increase we are forecasting, but only until supply dynamics come into the picture.

OPEC had planned a 300,000 bpd increase in production for January, but cut that down to 180,000 bpd, effectively supplying 25.5 million bpd in the first month of the year. Moreover, on January 5, Saudi Arabia announced that it would unilaterally cut 1 million bpd of production in the until March at least. All of this happens after OPEC+ cut crude oil production by a record 9.7 million bpd in 2020, to try to ease the drastic fall in oil prices that followed the outbreak of the pandemic. This leads us to believe that OPEC supply in 2021 will be highly inelastic, as the cartel will look to safeguard the main revenue sources of its constituent nations and more than offset the below trend demand for black gold.

4. The path to net-zero.

Several developments have led us to join the growing consensus that net-zero targets and ESG principles will have the effect, at least in the short-to-medium run, of supporting a rise in oil price. An increasingly large number of analysts forecast that the fight against climate change could have the unintended consequence of limiting oil supply through regulation, while boosting demand not just for petroleum products but also a whole host of other commodities like lithium and other metals needed to build renewable energy infrastructure.

A notable example of this is President Biden’s ban of fracking on US federal land. Hydraulic fracking has been a supply-enhancing innovation in the past decades. In fact, it has enabled the US to increase its oil production so much that in 2015 Congress ended the 40-year ban on exports, opening American oil to international markets and preventing a glut from forming in the domestic crude market. Thanks to fracking, the US is now a major oil exporter, but opposition to the extraction technique has intensified as greenhouse emissions, one of the drawbacks of fracking, have drastically increased, leading to serious environmental concern. Mr. Biden has thus taken action, upon taking office, to follow through on his campaign promises. He started by halting works on the Canadian heavy oil Keystone XL Pipeline, which had been in the making for a decade and was designed to transport 830,000bpd of Canadian crude to Texas. Since then, he has indefinitely suspended new leases of federal land for oil and gas development. This suspension does not target existing operations, whose permits remain valid, nor has the President banned fracking through an executive order, as some feared he would, but the direction of the new administration’s climate action is very clear, and our view is that it will result in lower oil supply in 2021.

Secondly, some of the world’s largest oil producers have recently started taking the climate emergency seriously and have announced production cuts for the upcoming decade. Royal Dutch Shell has stated that its production has already peaked and will decline by 1-2% per year, with the goal of reducing the production of traditional fuels by 55% in a decade. British Petroleum has similarly announced that its oil and gas output will shrink by 40% and its portfolio will rotate toward renewables, bioenergy, hydrogen and carbon capture technology.

On balance, our view is that major oil production investments that need 5 to 10 years to come into fruition will struggle to find support and financing, since we expect regulation to make them unprofitable sooner than previously forecasted.

5. Inflation hedge and rotation into commodities.

One final argument in support of our view is related to portfolio construction. Firstly, we expect significant rotation from equities into energy (not just ESG) in the upcoming months. From 2010 to 2015, the energy sector made up 10.6% of investors’ portfolios, it is currently down to 3.1%. This sharp decline is easily explained: as we saw above, the past 5 to 10 years have seen a slump in the performance of energy funds and indices, which explains why active allocations have plunged from 7% to 1.5%, making up the largest chunk of the rotation away from energy. We expect this process to revert soon, with hedge funds closing short positions in cyclical segments of the equity market and seeing potential for a rise in oil price. Many hedge funds have made large profits out of the enhanced volatility of oil in 2020, both betting against it in months of March and April and anticipating its comeback in the following quarters. But that is only part of the story. Retail investors have proven to represent an increasingly influential group in the determination of market sentiment, and it needs to be seen whether they will jump on board or content themselves with ESG-focused products.

A second factor that we expect to play out in favor of our view is the potential rise in inflation that more and more investors and strategists are predicting for 2021. Commodities have historically been used as a hedge against inflation, and this time will be no different. Our view is that it is unlikely that inflation will overshoot the 2% target, given that it has failed to reach it in the years before the pandemic, but fears of inflationary pressures are likely to push investors towards commodities. Whether or not inflation will become a serious issue in 2021, investors will be navigating a reflationary environment, and commodities will serve as a haven.

A trade idea

Based on our outlook, we aim to express a general bullishness on oil in line with economic recoveries worldwide and our expectations of a rotation into commodities in the search for yield and protection from inflation, as well as a more specific view on China’s outsize growth and OPEC’s supply inelasticity.

Persistent heavy backwardation in the WTI futures curve presents an attractive opportunity (9% positive carry at the time of writing.) To take advantage of this, we recommend monthly near-the-money call exposure to Invesco DB Oil ETF (DBO), since DBO is designed to maximize roll returns by selecting the futures contract with the highest roll yield at each roll date. This trade is designed to benefit from upside moves in WTI and backwardation while offering the flexibility to easily and efficiently discontinue the strategy if for any reason the outlook for WTI or its term structure becomes unattractive. The strategy has unlimited upside and tightly limited downside, with the use of short-dated options to minimize exposure to option price risk in case of the strategy’s discontinuation. Example implementation: long March call, strike $12; $5 per contract, breakeven at $12.05 (current price $10.71).

We forecast increased demand from China (the world’s largest oil importer), fueling its economic growth mainly from OPEC sources which have remained staunchly inelastic on the supply side after taking 7m barrels a day out of production; this makes us bullish on OPEC oil. OPEC oil is very hard for us to trade directly, so the next best thing is OPEC’s benchmark: Brent crude. We concur with Goldman’s third quarter price target of $75 a barrel and the IEA’s assessment that demand will recover slowly early this year but pick up steam in the second half.

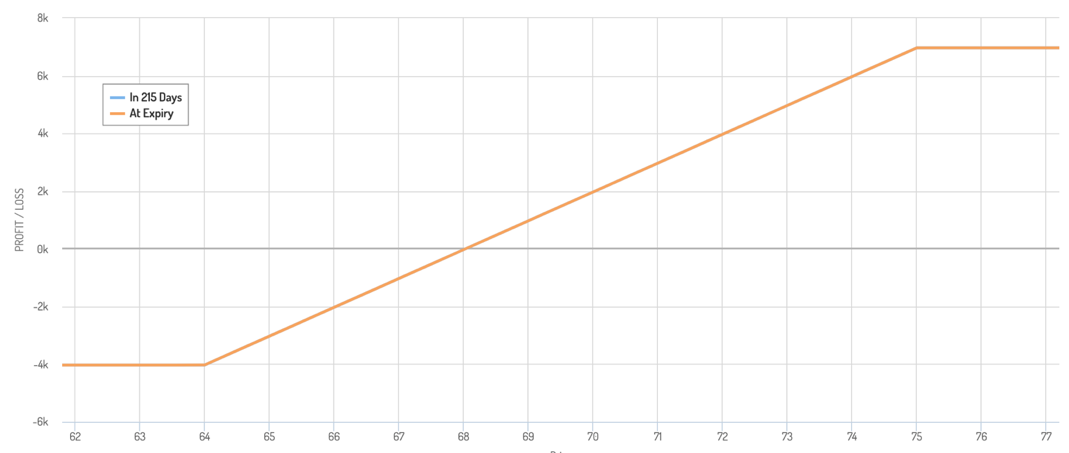

To express our view on interval and timing while reducing our upfront costs we’ll rely on a bull call spread, going long at-the-money-forward calls and short $75 strike calls on the September futures contract. This means that at best we stand to make the difference between the strikes minus the net premium paid, while at worst we stand to lose the net premium paid (this is a debit spread.) Each contract corresponds to 1000 barrels, therefore:

Long Sep $64C, Short Sep $75C spread per contract profit: Max = $6970 (F ≥ $75), Min = -$4030 (F ≤ $64), breakeven at F 68$

0 Comments