Introduction

Emerging Markets Debt is making a comeback in Google search bars. The term refers to sovereign bonds issued by less-developed countries. In fact, the words “debt” and “emerging” are closely linked: debt permits a country to raise fresh capital and with that to grow towards standards reflected in a developed economy, thus becoming an emerging economy. In this article, we will explain who the emerging markets are, how some low-income countries already started defaulting and the effects of the macroeconomic scenario on emerging markets. Finally, we will touch upon a bit of history regarding precedent bailouts and conclude with a trade idea based on our analysis.

Emerging Economies

An emerging economy is identified by a developing nation that is becoming more engaged with global markets as it grows and has some characteristics of a developed country but does not fully meet its standards. The major characteristics that an emerging country is heading to regard strong economic growth, high per capita income, liquid equity and debt markets, accessibility to foreign investors, and a dependable regulatory system.

One of the common features of emerging economies is a physical financial infrastructure, including banks, a stock exchange, and a unified currency. A key aspect is that over time, they adopt reforms and institutions like those of modern developed countries to promote economic growth. In addition, they tend to move away from activities focused on agricultural and resource extraction toward industrial and manufacturing activities. Their governments often pursue deliberate industrial and trade strategies to foster economic growth and industrialization. The most known ones include export-led growth and import substituting industrialization. The former strategy is used by economies that are considered emerging since it promotes more engagement and trade with the global economy. Finally, these countries also often pursue domestic programs such as investing in educational systems, building physical infrastructure, and enacting legal reforms to secure investors’ property rights.

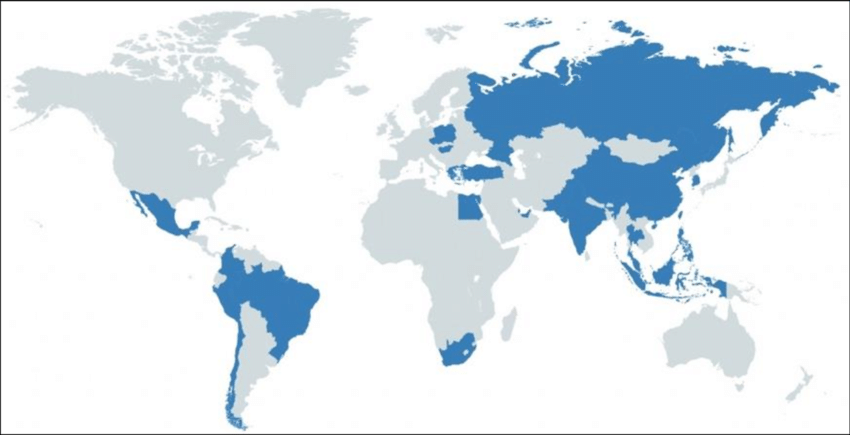

But who are the emerging markets? There isn’t a single answer. Emerging market economies are classified in different ways by different criteria such as levels of income, quality of financial systems, and growth rates, but the exact list of emerging market economies can vary. For example, the International Monetary Fund (IMF) classifies 23 countries as emerging markets while Morgan Stanley Capital International (MSCI) classifies 25 countries as emerging markets. There are some differences between the two lists. Standard and Poor’s (S&P) classifies 23 countries and FTSE Russell classifies 19 countries as emerging markets, while Dow Jones classifies 22 countries as emerging markets. At the discretion of any of these institutions, a country may be removed from the list by updating it to developed nation status or downgrading it to frontier nation. Likewise, developed nations can be downgraded to an emerging market, as is the case with Greece.

For the purpose of this article, we will refer to the MSCI Emerging Markets Index consists of the following 25 emerging markets country: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. It is worth mentioning one recent downgrade: Argentina. The South American country was cut from emerging market status by Morgan Stanley in June 2021. The downgrade to “standalone” status, which comes just three years after the index provider raised the country from frontier to emerging-market status, was prompted by Argentina’s continued capital controls.

Source: ResearchGate

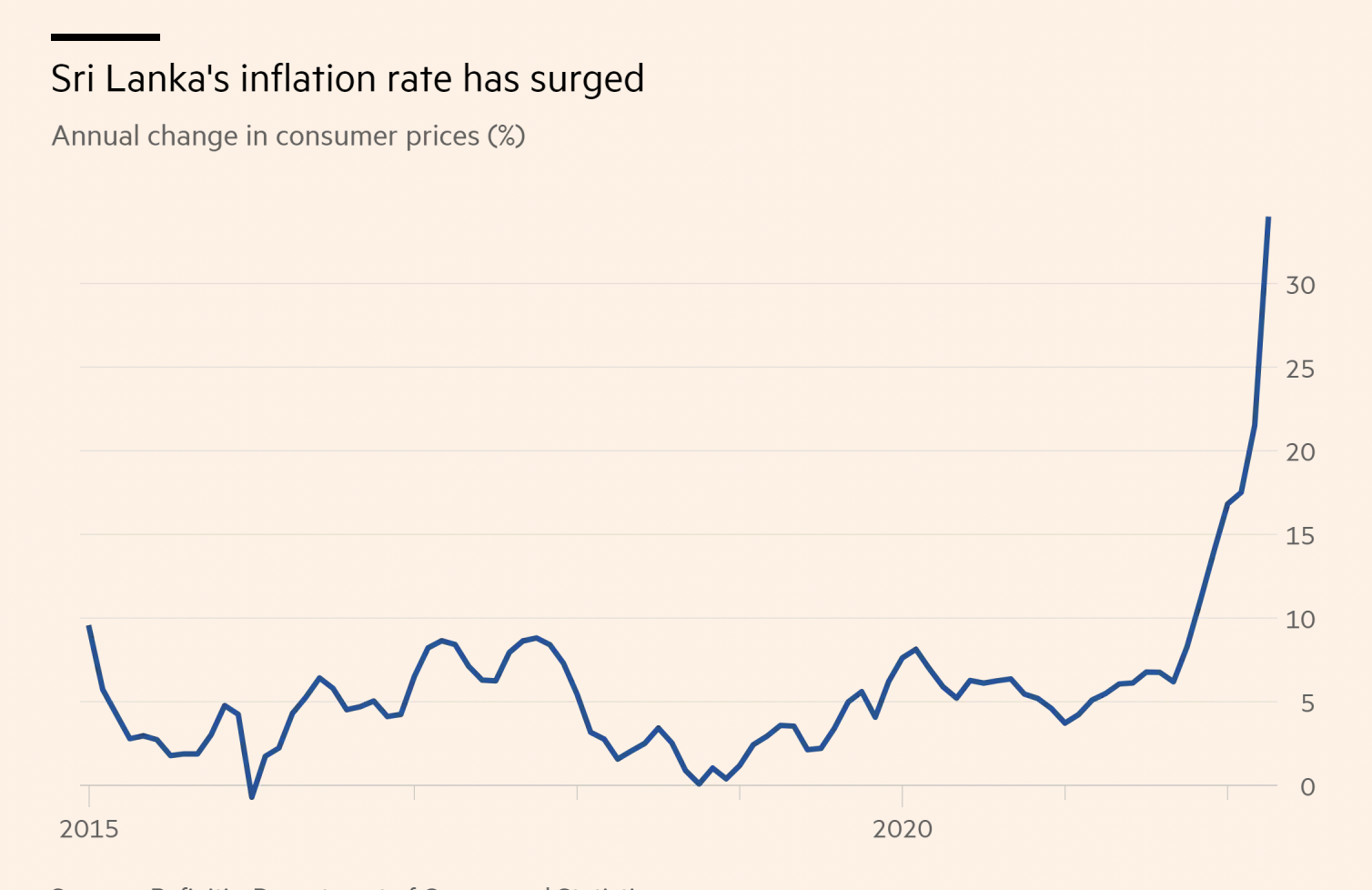

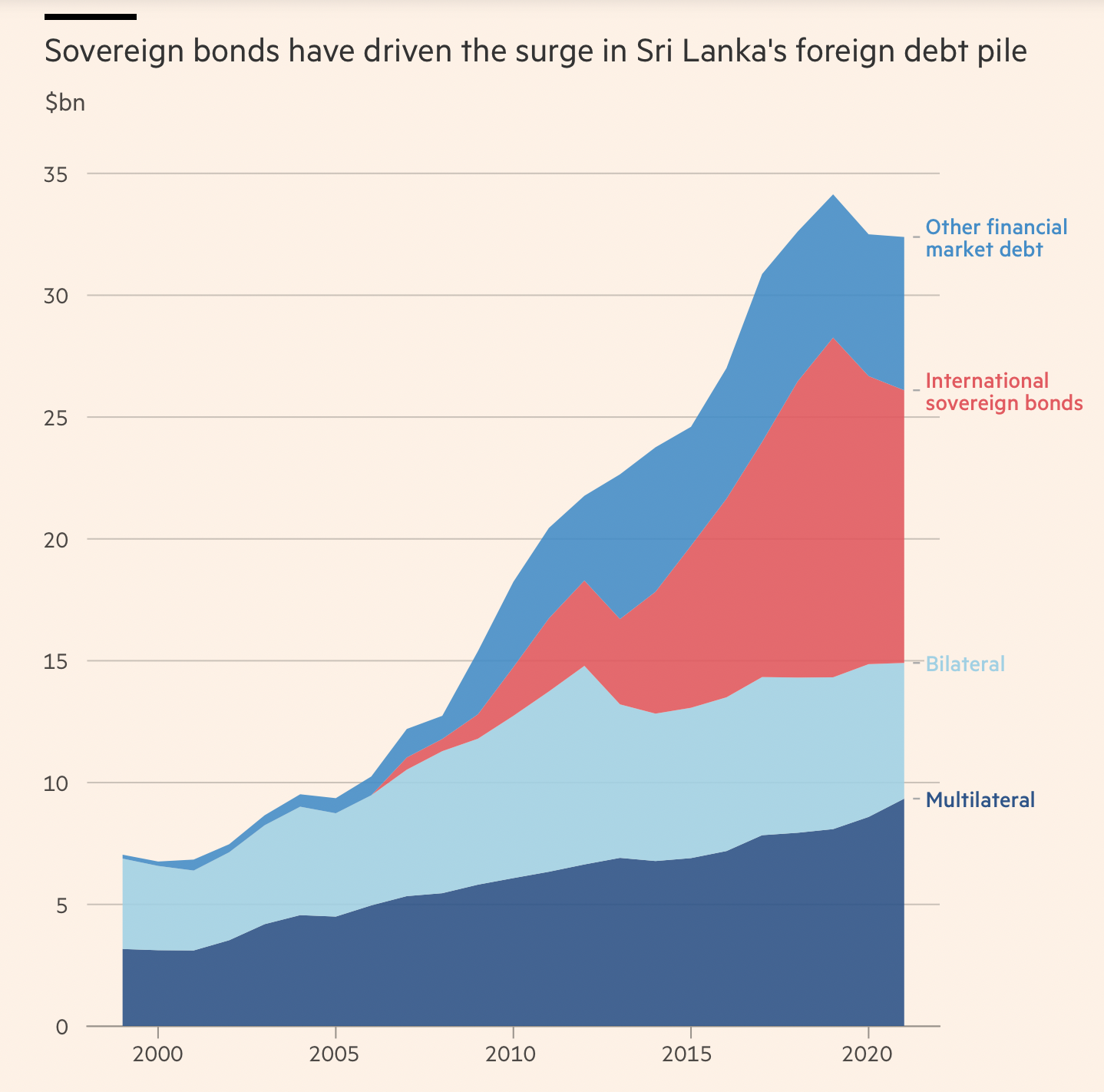

The Case of Sri Lanka

Before diving deep into the debt situation of emerging markets, it is worth to consider the situation of low-income countries. The Sri Lankan default provides a helpful case study in this regard. This spring, Sri Lanka became the first Asian-Pacific country to declare default when on April 12 its Central Bank confirmed that the country has missed the deadline for its foreign debt repayment. President Gotabaya Rajapaksa said that Sri Lanka would stop repaying its international debt to conserve foreign currency reserves for imports such as fuel, medicine, and food. This extreme action was taken due to the high inflation that the country is experiencing, which makes it impossible to buy foreign goods with local currency.

Source: Financial Times

Excessive debt with foreign creditors as well as hyperinflation (followed by a strong depreciation of the local currency) were the main triggers for the Sri Lankan default. Other low-income countries defaulting include Belize and Zambia. This case is very important to understand the emerging markets situation since it displays key risk factors that can push a country towards default.

The Emerging Markets Debt Situation

The US dollar strengthened to a 20-year high against a basket of foreign currencies this year, yielding more trouble for heavily indebted emerging nations around the world. The stronger dollar makes payments on loans owed in USD much more expensive. Adding to it, the FED is currently hiking rates with no sign that it will stop in the near term. If we look at the history of emerging markets from the Latin American debt crisis in the 1980s, the Mexican peso crisis in 1994, to the different Argentine defaults, to the Brazilian crisis in the early 2000, all those periods always coincided with periods of interest rate hikes in the US. Not only do emerging countries have larger shares of their debt in US currency, now they are having to pay even more for imports bought in USD as the currency strengthens. And this time around, global prices for fuel and food were already surging, due to currency fluctuations and significant supply shortages caused by the Russian invasion of Ukraine.

Sovereign bond yields have risen to levels that point to intensifying strains across more than one third of developing economies. Emerging market investors are used to volatility, but the asset class is now being buffeted by multiple crises at once. The debt crisis has prompted investors to pull $52bn from emerging market bonds this year. The number of emerging market borrowers that have debt trading at distressed levels has doubled over the last six months. The pandemic played its part in that development, as many emerging countries took on additional debt to subsidize idled workers and keep social services functioning exploiting the low-interest rates environment.

Source: Bloomberg

Source: Bloomberg

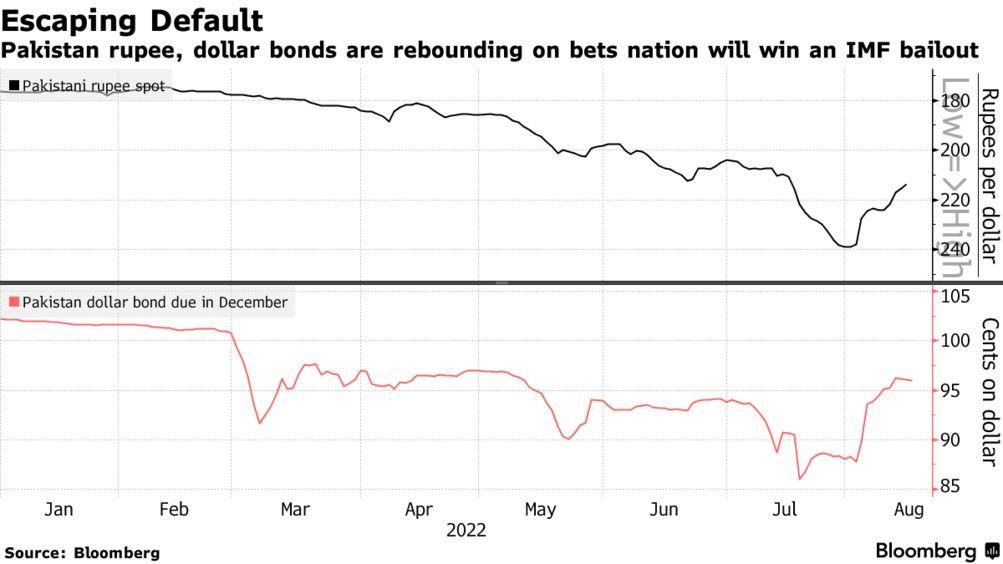

Looking at the screen above, it is evident how the debt crisis is not spreading equally among all emerging countries. Turkey is an outlier due to its loose monetary policy. The central bank announced on Thursday that it was lowering its benchmark one-week repo rate from 13% to 12% despite inflation that exceeded 80% in August. The lira is at record lows against the USD and there are no signs of pivot since ultra-low interest rates are the centerpiece of Erdogan’s unorthodox approach as he prepares for re-election next year. By contrast in Brazil, the hawkish central bank started hiking rates even before the Fed as it saw inflation diverging from its target. The country also benefits from the commodity boom which guarantees the economy a constant inflow of hard currency (mainly USD). Indonesia also benefits from the energy boom with inflation just around 2.6% and the central bank did not even start rising rates. The country at the most apparent risk for now is Pakistan. Following a current account deficit of $17.4bn, six times larger than the previous year, the IMF approved the seventh and eighth reviews of Pakistan’s bailout program, allowing for a release of over $1.1bn to the economy. The IMF agreed to extend the program by one year and increase the total funding by about $940mn at the current exchange rate.

Source: ![]()

![]()

![]() Bloomberg

Bloomberg

Overall, the rising rates environment combined with supply shortages and the strengthening of the dollar are spreading distress across emerging markets economies. This time however the debt crisis is not equally distributed. Several factors need to be considered and the most important that we have identified are monetary policy, fiscal policy, inflation, currency depreciation, current account deficit, percentage of debt denominated in dollar and exporting commodities.

Past Crises

As can be deduced from the very definition of emerging markets, oftentimes they are extremely focused on their economic development in an effort to catch up with more advanced peers, yet not rarely unstable from a political or economic perspective. Thus, it is not a rare occurrence that such players find themselves facing tremendous amounts of debt with foreign investors (necessary to retain speculators willing to provide capital to the risky stock or credit markets), which is often not only denominated in foreign currencies but also paired with unsustainable levels of inflation.

How did “developed countries” faced and solved these unprecedented crises in the past? A notable example, regarding Latin America’s countries in the 1980s and early 1990s can give us a fairly exhaustive list of the tools players such as the G7 members and the International Monetary Fund (IMF) used in these scenarios.

Indeed, as the oil shocks of the 1970s left South America’s LCDs with huge current account deficits, US government strongly encouraged corporate banking lending towards Latin America with a total outstanding debt that by 1982 reached a level of $327bn. During the 70s interest rates were kept near their “zero lower-bound” allowing countries such as Mexico and Argentina to sustain the increasing amount of debt. As the US priority became lowering inflation during the end of the decade, however, the burden quickly became unfeasible for South America’s economies, with Mexico being the first to default on its $80bn obligations in August 1982, followed suit by its peers. Commercial banks immediately cut off their lending, provoking a mass recession in the countries.

However, thanks to a cooperative action by the US government, the IMF and other financial institutions, several bridge loans and debt restructurings were granted to pay the interest (not the principal) in exchange for the adoption of structural reforms that would allow the increase of exports. Yet, the reforms were not realized as intended, causing a worsening of the financial condition that plateaued between 1989 and 1994, when the US government proposed a permanent reduction in loan principals and existing debt-servicing obligations, which led to $61bn being forgiven by private lenders.

China’s new role

Compared to the 1980s crises, other players have appeared in the distressed debt restructuring landscape: in particular, the G20 countries and China, are the most notable additions to the international scene. However, for the purpose of our thesis, we shall not consider the G20, as one of the members, Russia, makes it impossible for the organization to act in bailouts of emerging markets’ sovereign debt right now. What we are instead extremely keen on describing, is the role of the latest entry, China.

China’s role as a lender to EM countries has become increasingly relevant, with some estimating that the Asian superpower is holding 25% of all emerging markets debt, mostly in the form of commercial debt through the “Belt and Road Infrastructure program”. This program was established in 2013 and now counts around 149 members and an estimated amount of $838bn. Yet, many issues arise from Chinese participation in the lending business. First, China’s exposures are extraordinarily difficult to track as the country’s main lenders, the Export-Import Bank of China and China Development Bank, do not self-report their exposure, nor they allow for thorough disclosures from the borrowers’ side. Moreover, part of the debt is labeled as commercial when it is in fact owed to state-owned companies.

On top of this, most of the loans that China provides to these emerging countries (with a distinct preference for countries with strategic resources or strategic location in the Asian region), are exclusively bilateral, and the country refuses to enter into multilateral agreements such as the ones the IMF is usually conceding to EM countries.

Aside from the political conclusions one might take from the decisions taken by China to enter the EM lending business, it is important to highlight that such a complicated and bilateral involvement between Chinese institutions and several distressed countries might significantly worsen the situation of the latter. This will reinforce the difficulties countries especially in the EMEA and APAC region will face to service the current level of debt in a hawkish global environment with central banks fighting unprecedented levels of inflation. We believe that this Chinese exposure, which is peculiar in its nature, constitutes an additional burden for emerging markets, increasing the likelihood of descents in the bond market as well as the likelihood of possible defaults.

Trade Idea

Given the above analysis, how could we leverage our bearish view and set up a trading strategy? Analyzing market data, we can easily confirm that the market agrees with our view on the increased likelihood of potential defaults by some emerging markets: this is signaled by the CDX Emerging Market Index, the index tracking all the CDS contracts of emerging market countries. Despite trading slightly below the 3 months average, the index is already pricing in, if not overpricing, the default likelihood of the most distressed sovereign bonds:

Source: Bloomberg

This, despite validating our macro thesis, leaves little to no room for good investment opportunities in the CDX space. However, what we do think could be a viable tool to express our bearish view is the iShares JPMorgan USD Emerging Markets Bond ETF [EMB US: NASDAQ]. The underlying index, which tracks the dollar-denominated sovereign debt of emerging markets with more than $1bn outstanding and at least 2 years to maturity.

Despite the index trading at an historical low right now, we believe that it still has some room to decrease, as most central banks across the Emerging Markets landscape follow suit with the Fed moves despite having often moved in advance compared to the US counterpart. We believe the hiking cycle, although nearer the end for EM central banks than for Europe and the US, is still yet to end, thus calling for the opportunity to enter the trade. We propose a put spread with the ETF’s options with strikes of 79 and 78 (buying the 79 put and selling the 78 one), which would then present the following payoff:

Source: Bloomberg Options Valuation Function

Normally, we would suggest a higher spread or, if in liquidity constraint, a specular bear spread position with call options: yet, we remind the reader that such trades have to deal with a major illiquidity constraint on other strikes, maturities, or in general on the call options side, with the suggested trade being the easiest to apply.

0 Comments