This article is part of our series that discusses the impact of low and negative interest rates on several asset classes. Here we will focus on the implications of NIRP on fixed income products.

Introduction

Today’s low or negative interest rates have already been experienced other times in history, for example in the US during the 40’s, or in Japan during the 90’s. However, the combination of low/negative interest rates and a flat yield curve is rarer in history. When the FED set interest rates at 0% during the financial crisis at the beginning of 2008, long term rates were still close to 2.5%. Or, when Japan first faced its so-called liquidity trap at the end of the 90’s and set its short-term interest rates essentially at 0% in 1999, long term rates were still close to 2%. Instead, recently in Europe, US, and Japan we have seen low/negative interest rates and a flat yield curve (even though it has recently steepened, particularly in the US), which implies markets expect such interest rates to remain low for a long time. In this article we will look at the implications of NIRP on fixed income products focusing on 1) their use in asset allocation for diversification purposes, 2) the search for yield behavior that NIRP has stimulated.

Fixed income as a hedge

Fixed income products, in particular sovereign bonds with nominal interest rates of countries such as the US, have often been used in portfolios to diversify the risk of equities. An example is the traditional 60/40 portfolio. As the following table shows, since 1972: 1) equities have generated most of their returns in environments characterized by positive growth; 2) bonds instead provided most of their performance during periods of negative growth, while their performance was on average negative when growth was rising.

| Average real return | US equities | 10 Year US Treasuries |

| Rising growth | 7.20% | 1.67% |

| Falling growth | -1.89% | 8.53% |

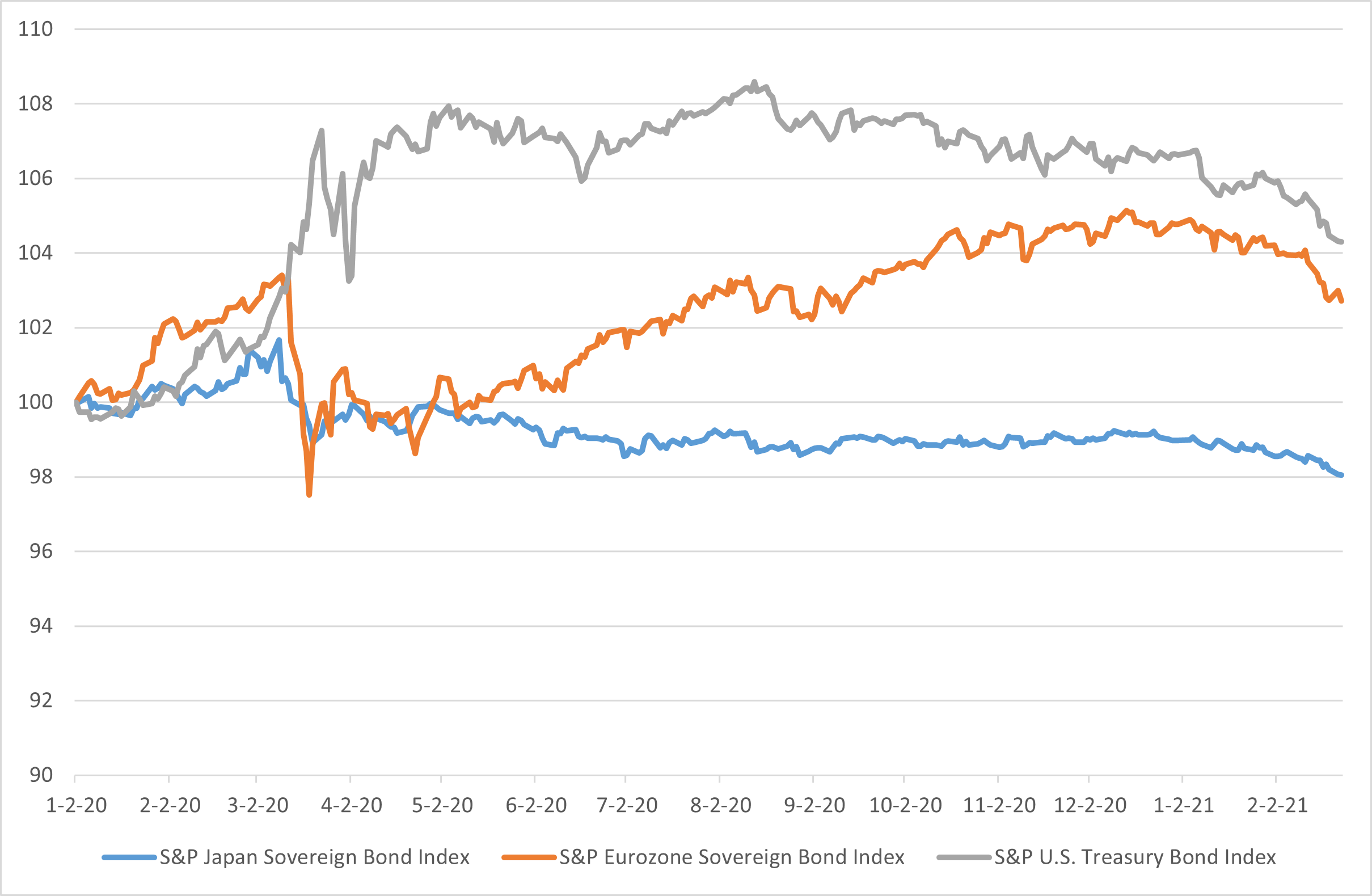

This dynamic is attributable to the monetary policy framework that has been in place during this period: until the Great Financial Crisis, monetary policy relied on interest rates to control the financial cycle and thus stimulate or slow-down the economy. In environments characterized by rising growth, central banks tended to increase interest rates (and thus bonds did not perform well), in those with negative growth, they lowered interest rates in order to stimulate the economy (and bonds gained). However, after the GFC, most of the developed countries reached levels of interest rates that were either 0 or negative. Central banks then turned to policies such as Quantitative Easing, or Forward Guidance, that were meant to reduce long term interest rates in order to stimulate the economy. This implied that, from a diversification standpoint, bonds could still play an important role in a portfolio. But, in the current environment, bonds probably will not be as useful as in the past. With long and short-term rates so low, the potential for upside is quite limited. The recent Covid-19 crisis highlighted this point. Below we report the performance of the sovereign bonds’ indexes in Europe, Japan and the US. We can notice that bonds of the countries with negative interest rates (Europe and Japan) did not provide much of a diversification during the March downturn, because nominal yields were already very low.

Inflation on the horizon

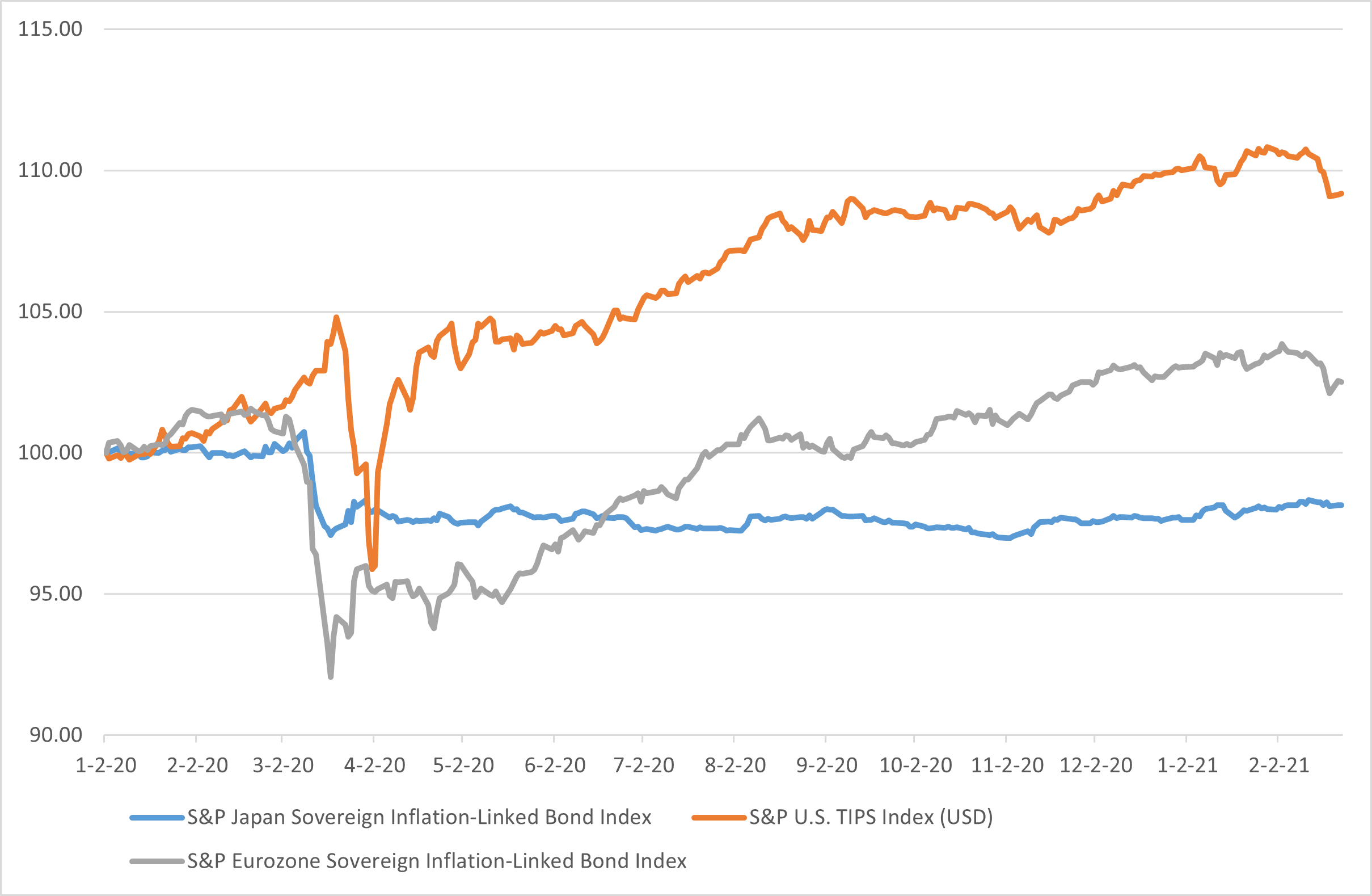

In addition, the pandemic has accelerated a shift towards a new paradigm where monetary policy is very intertwined with fiscal policy. This shift has been made necessary by the ever-increasing debt levels of developed economies. Under this new monetary policy paradigm, when central banks are faced with a crisis, they will respond more quickly than in the past by injecting liquidity in the economy and coordinating with governments, which will carry out huge fiscal stimulus, just like it happened during the recent Covid-19 crisis. If they are successful in stimulating the economy, a general reflation in asset prices will likely take place, as the one observed in the past year. However, if they are unsuccessful, their liquidity will likely end up in store-holds of wealth and may end up increasing inflation, causing a stagflation. In the first scenario, equities will likely perform very well, but in the latter one, they will likely have negative real returns. Inflation-linked bonds and gold would be a very useful hedge against the equity component of a portfolio, in particular for this type scenario. The advantages of inflation-linked bonds have become apparent this year; in fact, in the main advanced economies, particularly the US, they outperformed their respective nominal bonds.

The key reason why inflation-linked bonds can be useful is that real yields are composed of nominal yields minus breakeven inflation. With nominal yields relatively stable, real rates are highly dependent on breakeven inflation, which in turn is strictly correlated to the expected rate of inflation. Consequently, IL bonds can balance the scenarios that we listed above. However, this relationship between real rates and breakeven inflation, implies that if governments do not swiftly react to a recession, deflation will lead to higher real yields, which may further slow-down the economy. Consequently, in a deflationary recession IL bonds do not provide much protection. This is exactly why their performance in Japan was lackluster.

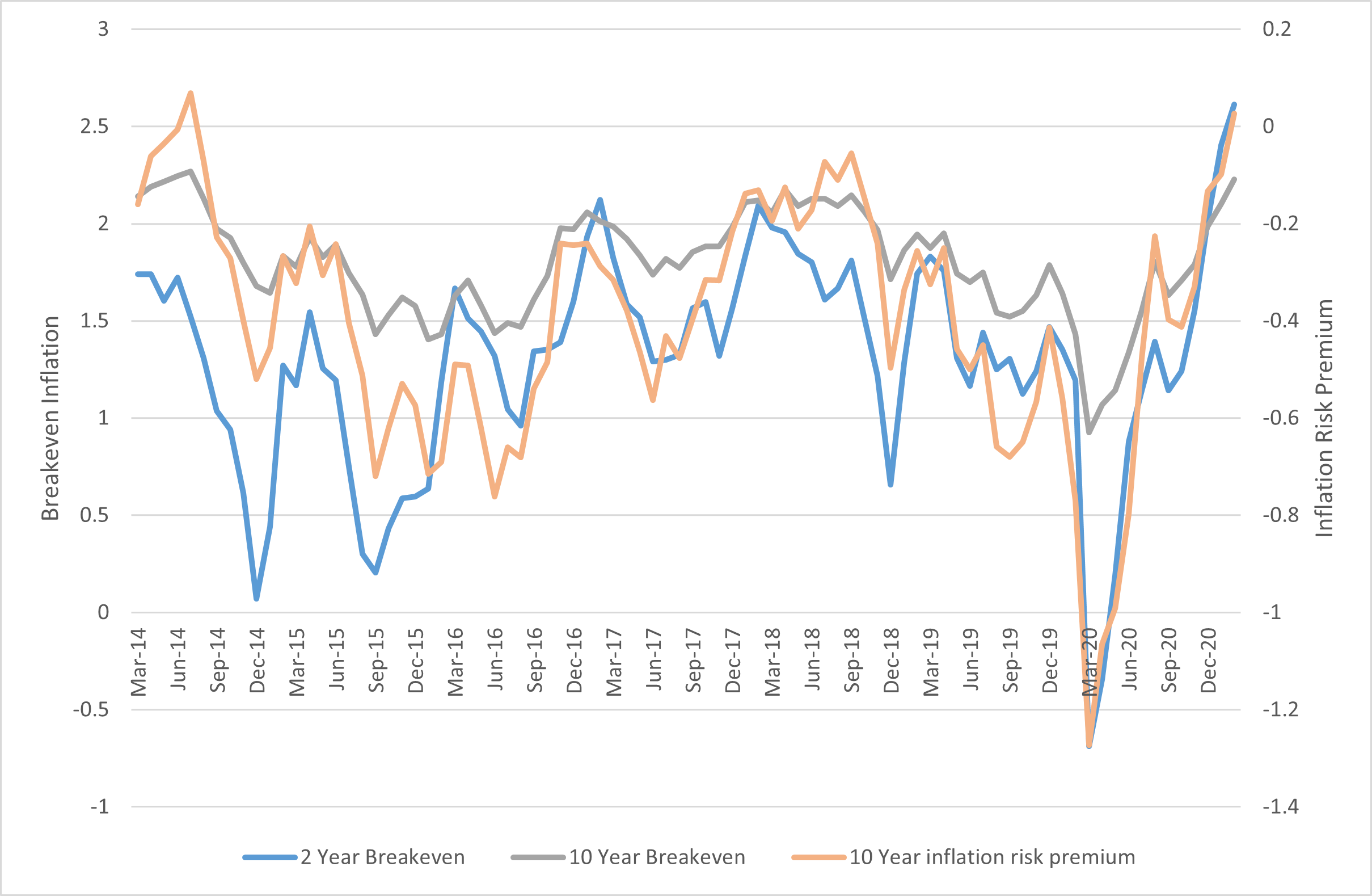

Furthermore, historical evidence suggests that especially in an environment characterized by high levels of debt, as today’s one, policy makers will seek to keep nominal yields low, while aiming at increasing inflation to reduce the real values of such debts. In such instances, real yields have often gone deeply negative while nominal ones were fixed; consequently, IL bonds could have still provided protection. In this respect, we can notice that inflation expectations have been recently rising in the US due to the acceleration in the economic recovery and the approval of stimulus packages by the new administration. This has led to a marked increase in breakeven inflation across the entire yield curve, in particular for short term breakeven inflation (2 and 5 years). In addition to this, the inflation risk premium has strongly increased, turning slightly positive after many years; this signals that investors are now requiring a premium to hold nominal bonds. Continuing easy monetary policy will likely provide further tailwinds to inflation expectations.

How is fixed income doing?

Even though traditional fixed income classes still play an important role for institutional investors such as insurance companies or pension funds, the extremely low interest rate environment has induced investors to search for higher-yielding opportunities. We will firstly review the prospects of traditional credit products and subsequently take a closer look at the other asset classes across the fixed income universe and examine those that have turned into attractive opportunities amid the low-yield environment.

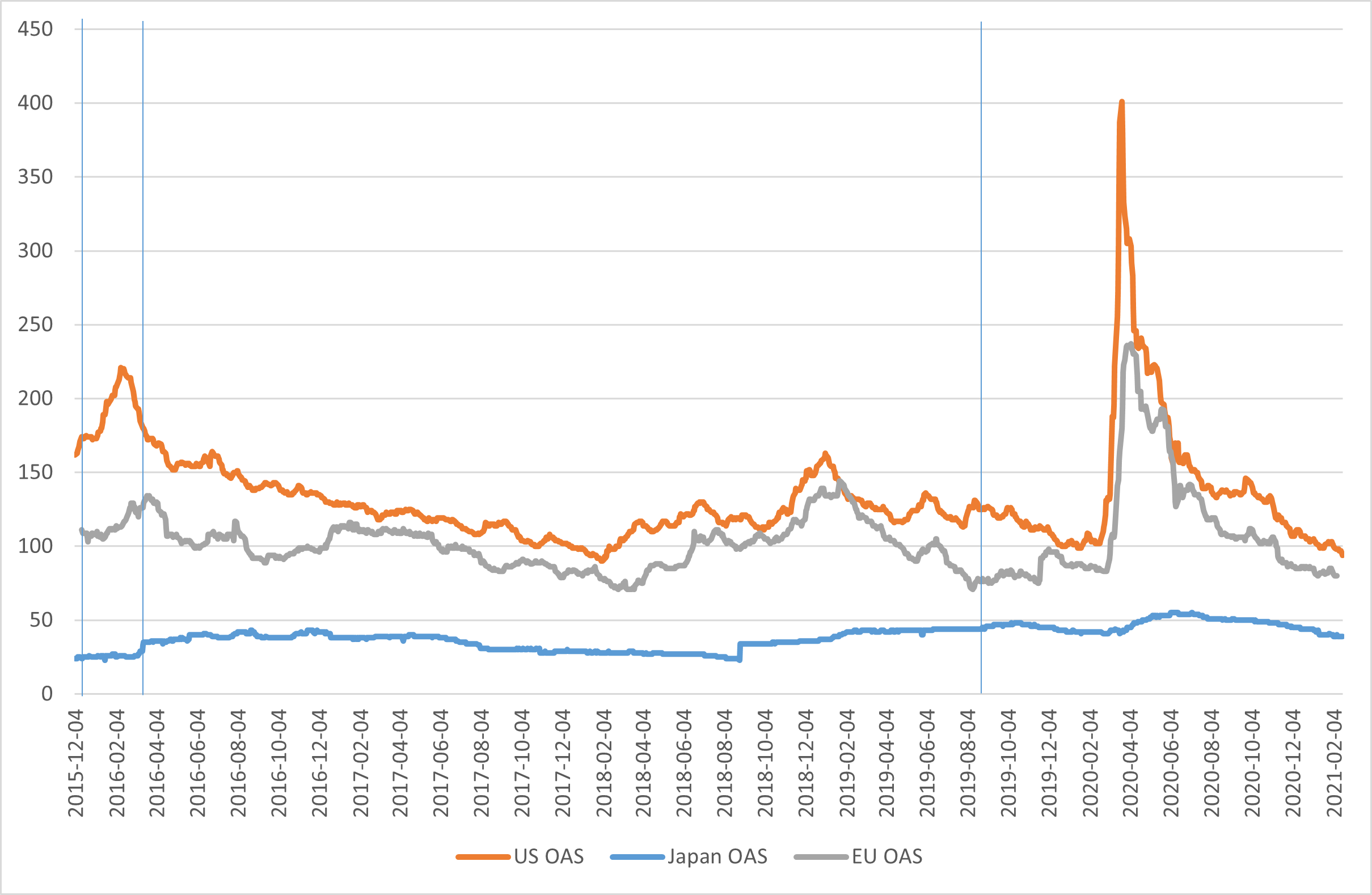

Looking at investment grade bonds in the US, we can notice that low interest rates have not led to a marked reduction in their option adjusted spreads, in fact they have been even lower than today both in the mid 90’s and before the Great Financial Crisis. Similarly, negative interest rates in both Europe and Japan have not significantly reduced OAS of investment grade companies. In particular, focusing on Europe, we notice that reductions of interest rates in negative territory (highlighted in the figure below by the blue lines) did not have a clear impact on OAS, neither in the short or in the long run. When looking at high yield products, we similarly notice that low/negative interest rates are not associated with fundamental reductions in OAS. We consequently conclude that NIRP impacted traditional credit products mainly through short term interest rates and through the flattening of the slope of the yield curve.

Looking for opportunities in an ultra-low yield environment

Even though the economic recovery from the Covid-19 crisis is expected to continue throughout 2021, the improvements are likely going to be gradual. Central banks in most parts of the world are expected to keep interest rates low, even if inflation expectations increase. Therefore, a considerable jump in yield in developed markets does not seem likely in the near future. Investors looking for more attractive yields need to consider fixed income classes that might lie outside of their traditional portfolios.

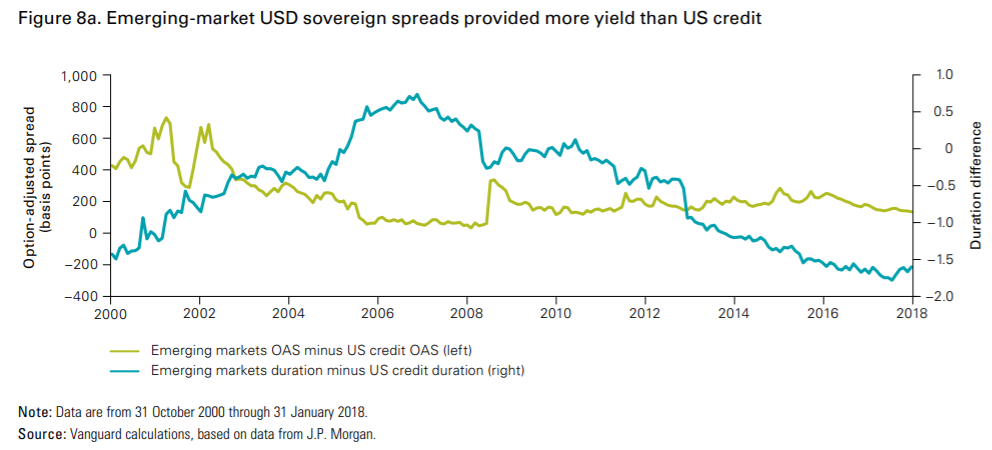

One such opportunity is emerging markets (EM) debt. Many of the EM countries exhibit strong economic fundamentals and a satisfying level of creditworthiness. According to the IMF, global GDP growth of emerging markets and developing economies reached 3.7% in 2019, compared to only 1.7% for advanced economies and this difference is expected to widen even further. As of 2020, gross government debt as a percentage of GDP stood at 61% for EM, whereas for advanced economies the figure was more than double, reaching 124%. Moreover, most countries entered the pandemic with steady inflation, stabilized exchange rates and independent central banks, which allowed them to implement appropriate monetary policies as a response to the crisis. All these considerations suggest that the yield advantage of the EM debt is only partially justified by the increased default risk. In fact, a substantial part of the premium reflects either a reduced liquidity or a negative perception bias caused by the unfamiliarity and complexity of these markets. And the difference in yield is alluring; over the past twenty years EM hard currency sovereign bonds not only yielded more than the US credit (as measured by the difference in their option-adjusted spreads), but also exhibited lower duration risk on average.

Obviously, the EM universe is quite diverse and different countries demonstrate different risk profiles. Investors need to be mindful to risks and indicators of creditworthiness, such as debt service costs, multilateral and bilateral financing lines, and a dependence on tourism receipts and remittances. Yet, positive prospects for a risk-on environment and expectations of a prolonged weakness of the US dollar should be supportive of the EM debt in general.

Let us now be more specific and examine one of the promising emerging market countries in more detail; in particular, we will focus on China. Its Central Government Bonds (CGBs) have seen increased foreign inflows over the past years. Even though foreign holdings still represent only 9% of the total CGB market, inflows from abroad almost tripled since 2017. China is currently the third largest sovereign bond market in the world, although in relative terms the picture looks different: CGBs outstanding represent less than 20% of China’s GDP. The country’s current Moody’s rating is A1, which is better than that of many southern and eastern European countries.

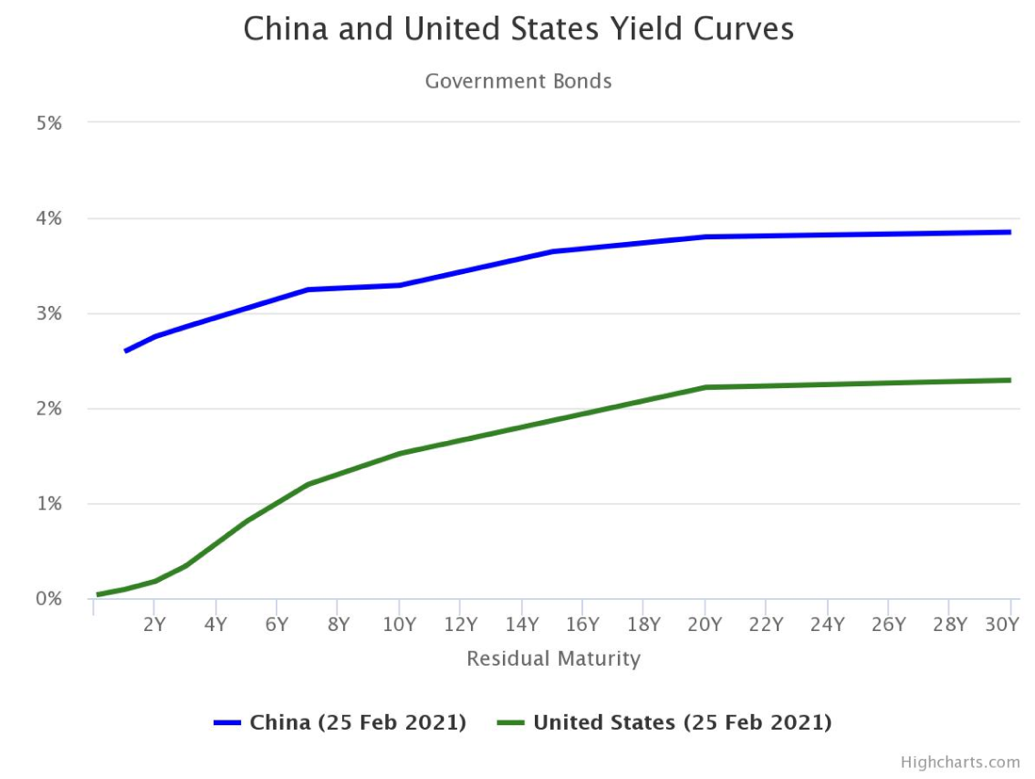

Clearly, one of the most compelling features of Chinese debt is the level of yield. It was also supported by the fact that, in contrast to developed markets, China has maintained a largely neutral policy during C-19, cutting the interest rate only moderately. The yield of 10-Year government bonds issued in renminbi currently stands at 3.3%, which implies a 175bp spread over 10-Year US Treasuries. Interestingly, the spread is even higher for short term maturities, peaking at 255bp for 2-year bonds.

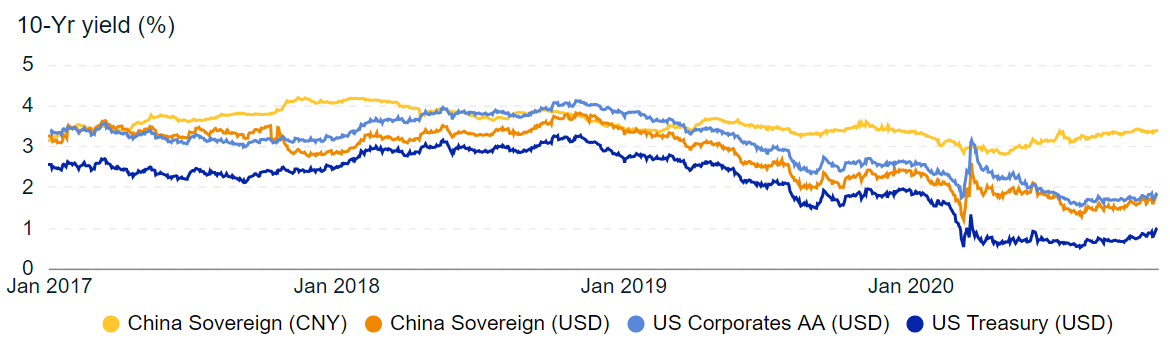

It is also worth noting that since 2019, CGBs has consistently earned higher yields than US Corporates AA bonds (except for the brief period in March 2020 after the outbreak of Covid-19 crisis). Another upside is that whereas the credit rating of the two is almost comparable, sovereign debt generally enjoys an increased layer of security because of the governments’ ability to set fiscal policies to steer the economy in the desired direction. Moreover, when under significant pressure governments are eligible to receive funding lines from IMF or World Bank. In contrast, corporates do not benefit from such a support structure.

Source: MSCI

When considering RMB-denominated bonds, investors might wonder about the exchange risk. However, the historical volatility of USD/CNY exchange pair has historically been considerably lower than volatilities of other major currencies with respect to the USD. Moreover, the outlook for renminbi is positive as capital inflows to emerging markets are expected to pick up in 2021, as risk appetite increases. China’s fundamentals are generally strong: the balance of payments is healthy; manufacturing has already shown an impressive post-pandemic recovery and exports are on the rise. All of this is likely to support the Chinese currency and boost foreign investors’ bond returns.

Source: MSCI

Another area of opportunity worth tapping into in the low/negative interest rate environment is private credit. Private credit (or non-bank lending) denotes privately originated investments that are not traded on public markets. They usually comprise higher yielding and illiquid securities with a wide range of risk profiles: ranging from senior secured debt to distressed securities. According to the BIS, the private credit market grew from slightly more than $300 billion in 2010 to nearly $800 billion in 2018. Arguably the most attractive feature of private credit is its ability to offer a yield pickup over traditional publicly traded fixed income. A large part of this excess return is due to the illiquidity premium. Thus, private credit instruments are especially suitable for investors ready to commit long-term capital. However, the magnitude of the risk premium is also linked to the transaction size and complexity of the deal.

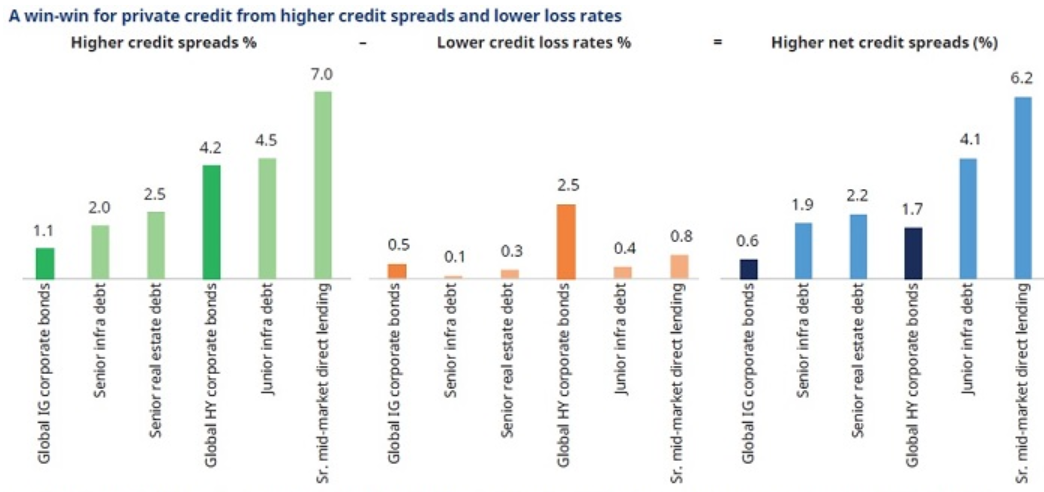

The spreads in private credit indeed look attractive: while public investment grade credit offered credit spreads around the 1.1% level, senior infrastructure and real estate private debt was earning 2 – 2.5%. Senior debt has the highest repayment priority and typically also includes collateral and financial covenants, making it comparable to investment grade credit in the public space. A similar yield advantage is offered by junior debt in comparison with high yield bonds. This benefit is even more pronounced when we consider net credit spreads (which also take into account credit loss rates). Many private credit sectors have historically displayed low default rates; infrastructure for instance is a robust sector exhibiting more stable cash flows and lower risk profile than corporate bonds. Moreover, infrastructure and real estate debt are both backed by real assets, which substantially increases recovery rates in the event of default. Thus, while the average net IG spread stood at 0.6%, for senior real estate and infrastructure debt it hit the 2% mark.

Sources: Bank of America Merrill Lynch, Callan Associates, Cass Business School, CBRE, De Montfort University, Moody’s, Preqin, Cambridge Associates, and Schroders. November 2020

Private credit is still an area where investors can identify a number of dislocations that were created during the crisis. In more liquid and frequently traded public markets, such opportunities vanish much faster. Obviously, a disciplined approach selecting deals with lower leverage levels and tighter covenants and structural protections is advisable in order to navigate the risks associated with the lingering effects of the pandemic. But all in all, private credit remains an enticing source of higher yields without excessive exposure to risk.

Bibliography

Roberts, Daren, Scot Donaldson, Vytas Maciulis, and Jonathan Lemco. 2019. “Emerging-Market Bonds: A Fixed Income Asset with Equity-like Returns (and Risks).” Vanguard Research.

0 Comments