Prologis Inc [PLD:NYSE] – Mkt cap as of 09/11/19: $55.01bn

Liberty Property Trust [LPT:NYSE] – Mkt cap as of 09/11/19: $9.26bn

Introduction

The boom of e-commerce is rapidly pushing up demand for industrial real estate and thus driving warehouse giants to new pursuits. Accordingly, Prologis – the world’s leader in logistics real estate – has agreed to acquire Liberty Property Trust: a US leader in commercial real estate, managing over 100m ft2 of industrial and office properties in the States and the UK.

The deal, valuing Liberty at approximately $12.6bn, was announced on October 27 and is expected to close during the first quarter of 2020 in an all-stock transaction, including the assumption of debt.

About Prologis Inc.

Headquartered in San Francisco, Prologis Inc. is the dominant global industrial real estate company with $111bn (from $87bn in 2018) of assets under management and 1600 employees. In short, it owns, operates, and develops industrial property – a category mainly consisting of warehouses. Currently operating in 19 countries on 4 continents, its estate covers an area of 74m sq.m and a total of approximately 3800 buildings.

Now-known Prologis was found as AMB Property Corporation in 1983. A little before listing itself on the New York Stock Exchange, it was incorporated as Security Capital Industrial Trust (SCI), under which name it went through its first expansions outside of the US – Mexico and the Netherlands. After changing its name to Prologis in 1998, the company has mainly been focusing on industrial properties in targeted markets, forming different funds and extending its international presence to Japan, China, Singapore, and some European countries.

In terms of how Prologis operates, its activity is divided into two sections – capital deployment and strategic capital. The first one consists of property acquisition and development, while the second refers to strategic capital ventures Prologis has established through the years – 6 private and 2 public co-investment vehicles for investing in industrial real estate facilities. As much as $58bn of Prologis’s assets under management are part of its strategic capital division, but being minority investments the vast majority of those are not consolidated and account to just 10% of revenues.

The company’s massive expansion on both national and global scale has been supported by a series of relevant mergers and acquisitions through the years. Latest ones include the takeover of KTR Capital Partners for $5.9bn in 2015 and that of DCT Industrial Trust for $8.5bn in 2018. In July 2019, the S&P 5oo Member announced its intention to buy Industrial Property Trust Inc. (IPT) for approximately $4bn in a cash transaction, including debt, but the transaction is still pending and expected to close in Q4 of 2019 or Q1 of 2020.

In terms of financial performance, the company has declared approximately $2.8bn in total revenues and $1.6bn in earnings after tax for 2018. Total assets by the end of 2018 accounted for $38.4bn. Prologis ended 2018 with leverage of 25.0% on a market capitalization basis and debt-to-adjusted EBITDA of 4.2x.

Prologis’s buildings accommodate a wide variety of products – from food, transport, clothing, and appliances to commodities, auto, healthcare, etc. Among its top customers are companies like Amazon, DHL, XPO Logistics, FedEx, and Walmart.

About Liberty Trust

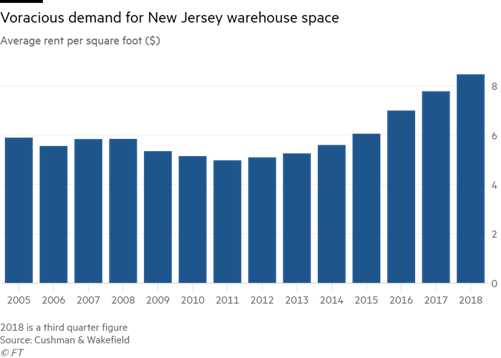

Liberty Property Trust is a US-based real estate investment trust company specialized in office buildings and industrial properties in the United States and the United Kingdom. Its activity concerns the ownership, acquisition, development, and management of logistics, warehouse, manufacturing, and R&D facilities in key markets. Its headquarters are in Malvern, Pennsylvania. The company started out as a warehouse business in southern New Jersey in 1970, went public in 1990, and gradually grew its industrial footprint to Florida, Pennsylvania, Texas, California, and other states.

By 2018, Liberty owns the third-largest industrial portfolio in the United States, accounting for about 80% of the company’s revenues. Liberty’s properties cover an area of 101m ft2 (~9.3m sq.m) while the company has more than 500 assets under management and more than a thousand tenant relationships.

The company has committed to sustainability in terms of design, operation, and development of its real estate properties. In accordance, it invested $4.1bn in high-performance green development in 2018 and declared to be 31% sustainable.

Regarding its financial performance, Liberty has reported total revenues of more than $700m and a net income of $492m by the end of 2018, of which $166m from continuing operations and $326m coming from a one time gain on disposal of assets. Its total assets were valued at approximately $6.9bn, of which, as of 31st December 2018, $5.7bn are of net Real Estate assets.

Industry analysis

The Logistics Real Estate is an example of Real Estate Property Industry that counts Prologis as the holder of the largest market share, which stands at about 30.55% and Annual Revenues of $3.2bn as of 2018. The company is followed by competitors such as Goodman, Caldwell Companies, Rexford Industrial and Duke Realty, where the remaining market share is more fragmented. Among the aforementioned competitors, Goodman is the only one which achieved $1.5bn in annual revenues as of 2018. Cushman & Wakefield is also an important competitor which still holds a lower number of warehouse facilities compared to Prologis even though Cushman brokers different types of Real Estate Property, especially non-residential Real Estate, going further beyond logistics.

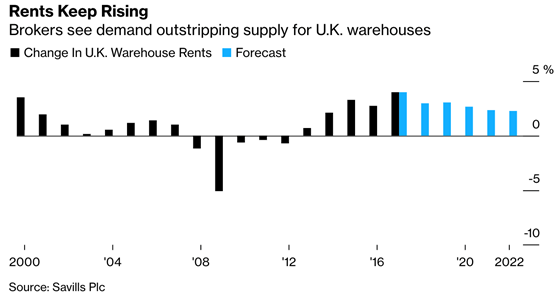

The overall logistics property market has been experiencing a surge in demand for space. According to the 2018 Prologis Logistics Rent Index, Global rent Growth stands at 6% annually with moderate variability across case-by-case countries. The U.S. and China, for example, experienced a 2018 increase. Europe remains below average but still records a good 5% increase in rent rates, nearly double the rate of 2017. It is interesting to add that Vacancies, hence empty available space in warehouses, virtually identified as the supply of the market, are at historic lows. This does not only function as a factor bidding up rent prices but also in terms of costs when constructing new warehouses. Indeed, leading clusters of warehouses in some of the biggest urban places in the world are seeing double-digit increases in construction costs for new facilities.

Source: Savills Plc

The first factor influencing the positive trend in rents and overall demand for warehouse space comes from a robust global economic growth. The industry tends to be quite sensitive to economic cycles as the total demand for space depends on overall private consumption and investments. The recent uncertainty and volatility in the global macroeconomic environment has been described as one of the main headwinds to consider in the disclosure notes of the financial statements of some of the previously mentioned incumbents in the industry.

Still, the prosperous economic trend that the world has been experiencing until now partially explains the surge in demand for warehouse space. E-Commerce has been acting as the key driver, allowing access to a virtually infinite variety of goods to anyone who has a simple Internet connection. This creates a surge in demand for goods and services ordered online, which has a domino effect on the surge of demand for storing space in warehouses.

Another interesting fact that must be stressed to explain the overall trend can be understood by analyzing how clusters of warehouses have changed in recent years. Concentrations around specific cities have been significantly increasing. These cities are usually coastal metropolis around the globe or smaller cities near them, they receive the highest levels of orders from Retail and eCommerce and, at the same time, due to the rapid increase in numbers of warehouses built to satisfy the surge in orders, they act as barriers to space supply, as scarcity of land has increased, and, with it, the cost of building new facilities.

The reason for this specific distribution of clusters is best described by one specific move that companies such as Amazon, Alibaba and Walmart, with its recent eCommerce strategy, are trying to implement: the possibility of delivering orders in just one day or even within the same day. The increase in popularity of “last-mile” deliveries, which creates tighter deadlines for eCommerce companies, has been financed with billions of dollars of investments and has functioned as another factor that explains the increase in volumes of orders and deliveries.

Europe remains the most interesting case to consider against the U.S. and China. The entire European market is expected to increase at a faster rate, shifting towards a position of growth leadership.

Source: Financial Times

Overall, Europe shows all the conditions for a rapid and profitable catch-up. It is benefiting from strong consumer sentiment, robust demand, strong market fundamentals and disciplined supply of storing space.

These trends are confirmed by the largest Private Equity firm, Blackstone, which, through its Real Estate specialized funds, is betting on smaller warehouses in big European cities. It goes without saying that as the stock of warehouses portfolio of Blackstone increased, so did the investing community’s interest in this industry, creating a sort of self-fulfilling cycle.

Lastly, the rise in demand for logistics real estate should be compared to what is happening in the bigger Real Estate industry and the Retail Real Estate market in order to better understand the significance of the described trends.

In general terms, the Logistics Real Estate returns, based on TH Real Estate estimations, are expected to outperform all the other property sectors at least until the end of 2022. In addition to this, the logistics events are just the opposite of what is happening, on the other hand, in the retail property market. Since 2017, which formally started the “Retail Apocalypse”, the market has been characterized by a series of retail bankruptcies and store closures as shoppers realize the benefits of eCommerce and try to cut costs related to brick-and-mortar structures by going online, further boosting the potential volume of future orders and the demand for warehouse space.

Outperformance from logistics real estate returns has occurred also when compared with returns from residential real estate as Central Banks around the world tried to increase interest rates before restarting cutting and reintroducing liquidity in the system. Recent macroeconomic trends may boost the housing market as consumer confidence is still resilient and strong and interest rates have reached record lows, making residential real estate a potential investment option next to logistics real estate.

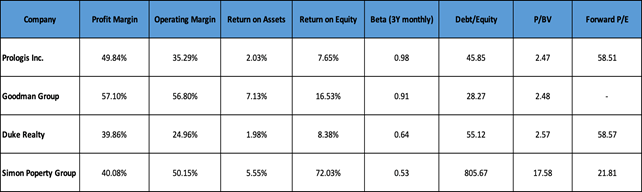

As briefly mentioned above, the business of selling warehouse space can be cyclical as it is linked to the entire macroeconomic trend, which means that earning can be quite volatile based on the conditions of the entire economy. In addition to this, it involves a high percentage of fixed costs relative to variable costs which further increases downside effects on earnings during depressed economic conditions and increases earnings on periods of economic growth. Overall volatility of earnings from assets is relatively high and implies a correlation to market movements of more than 1.0, namely from 1.10 to 1.30. This means that a potential economic downturn, whose probabilities have recently increased due to geopolitical tensions and a trade dispute between the U.S. and China, may negatively impact the positive increase in demand for logistics real estate property and returns in respective investments, especially if probabilities of a future downturn affect the expectations of Consumers. Still some of the companies, Prologis being one of them, actually show betas lower than 1.0 based on the last three years, implying lower exposure to market fluctuations and lower sensitivity to the general economic environment. This happens whenever the company has a well- established portfolio of warehouse facilities in some of the biggest cities in the world, as companies renting space may still stockpile inventory expecting a return to better economic conditions.

Deal Structure

On October 27th, the two companies announced the merger agreement according to which Prologis will acquire Liberty in an all-stock transaction that gives the target an Enterprise Value of $12.6bn.

Liberty shareholders will receive 0.675x of Prologis shares for each Liberty share they own, implying a 21.1% premium using Prologis closing price on the 25th ($90.86 per share) and Liberty undisturbed price ($50.6). The resulting ownership structure would see Liberty shareholders controlling about 13% of the shares of the combined company while Prologis shareholders are diluted to 87%.

Both boards of directors (trustees in Liberty’s case) have unanimously approved the transaction and the CEO of Liberty is set to join the board of the combined entity.

Deal Rationale

The rationale behind the deal is rather straightforward: as the demand for logistics real estate goes up the supply of those assets remains inelastic and slow to adapt, therefore controlling key areas near the cities would allow Prologis to build significant market power. Indeed, industrial and logistics real estate is a peculiar business because location means everything and securing key network nodes and developing them is the main driver of value. Liberty’s assets appear to be very complementary to Prologis’ and represent a perfect combination in terms of geographical coverage of the US territory doubling down on key markets with an 87% overlap, plus they open up the UK market where Prologis was weak.

Furthermore, as in every capital intensive business such as real estate, scale is a key comparative advantage allowing to make investments more effectively and cut costs. As reported by Prologis the transaction will produce immediate savings of $120m and a further annual estimated $60m in synergies coming mostly from incremental development value creation of properties.

In an effort to refocus its portfolio Prologis plans to dispose of approximately $3.5 billion of assets on a pro-rata share basis. This includes $2.8 billion of non-strategic logistics properties and $700 million of office properties. This will streamline the operating structure and focus on the most profitable segment.

As a measure of accretion in real estate instead of EPS is used the Core Funds From Operations per share (roughly EPS with D&A added back in) that starts from $3.03 per share in 2018 ($2.81 in 2017) and is projected to reach up to $3.21 in 2019. The transaction is expected to add between $0.10 and $0.14 Core FFO per share in the immediate future and upon stabilization of the acquired development assets, completion of the planned non-strategic asset sales and redeployment of the related proceeds, annual stabilized Core FFO per share is forecasted to increase by an additional $0.04 per share for a total of $0.14-$0.16.

Market reaction

As the deal was announced on the 28th of October, Prologis’ share price decreased by 5.5% during the entire trading day. The decrease in valuation reflects the dilutive effect of the transaction as Prologis is not planning on paying in cash but through 0.675 of its own shares for each share of Liberty. The share price increased in the following trading days which means investors came to think of the transaction as a way to effectively increase presence in the most important urban centres in the US and positively benefit from the surge in demand. Indeed, as construction costs for warehouse facilities have significantly increased in the last years, buying out already established portfolios may be the most efficient way to enlarge your presence. Shares of Prologis are up 53% YTD.

On the other hand, Liberty Property Trust saw a spike in the share price of nearly 17%, close to the 21% premium paid by Prologis on each share of the target. Liberty has seen its share price rise by 23.80% YTD, excluding the impact of the announcement.

In general, Real Estate Property companies focusing on Logistics Spaces have seen favourable valuation in the last years thanks to the overall good conditions of the sector. This fact can be seen in the share prices of Goodman, Rexford and Duke Realty. On the other hand, companies investing in Retail and Commercial Real Estate saw their shares’ valuation reduce significantly, reflecting the changing trends towards virtual commerce. The biggest Retail Real Estate owner, Simon Property Group saw its shares’ price decrease 33.63% from the peak of $227.04 per share reached in mid 2016, precisely around the beginning of the “Retail Apocalypse”.

Source: market data and company filings

The table shows some of the most relevant financial data from four of the main incumbents already mentioned. Generally speaking, they all show very good metrics of profit margins and operating margins, which are then reflected in Return on Equity measures (ROE). Going into more details, both Goodman and Simon Property group show off the charts return on equity. This can be explained through higher than average Returns on Assets, 7.13% and 5.55% respectively and, in the case of Simon Property Group, a very high ratio of Total Debt on Equity of 805.67%. In general, these companies show good efficiency in the generation of returns through the use of their assets and quite high levels of financial leverage (Duke and Prologis show ratios of 45.85% and 55.12% respectively). Betas stay below 1.0, as previously described. Stressing the corporate structure of these companies could also be relevant in understanding their trend against the market, as these are specifically Real Estate Investment Trusts (REITs), whose portfolio can be furtherly diversified, spanning through different property sectors.

Lastly, Market-to-Book Value average around 2.51, except for Simon Property, standing at 17.58. The ratios appear to be justified as their respective returns on equity satisfy and exceed the required costs of equities which are influenced by low betas. Forward P/Es, standing around 58.0, reflect good expectations of growth of earnings thanks to their specialization in logistics property, against, on the other hand, a lower 21.81 for Simon Property, which specializes in Retail real property.

Underwriters

BofA Securities and Morgan Stanley are acting as financial advisors and Wachtell, Lipton, Rosen & Katz is serving as legal advisor to Prologis. Goldman Sachs and Citigroup are acting as financial advisors and Morgan, Lewis and Bockius LLP is serving as legal advisor to Liberty.

0 Comments