Introduction

The term eCommerce has been around for years, now. Definitions of it have been imprecise and, most of the time, people tend to associate it to companies like Amazon and Alibaba and not without a reason since their business is commerce through the internet. Virtual Commerce, however, is more complex than a simple association to some champions in a precise industry. It is a trend, an industry, a strategy and a force that has disrupted retailing as we know it in multiple sectors. As a business force, it has implied a wave of failures but also a wave of successful examples of adaptation to the changes occurring.

This article tries to better understand what eCommerce is, how it is growing across the world and what factors and consumer benefits caused its exponential increase in popularity. It then focuses on concrete examples of tangible impact of eCommerce in the retailing industry, in order to better understand whether it is the only root to the wave of failures that occurred or if some other problem may have contributed to it. Lastly, it digs into possible positive spillovers of the trend and investment opportunities exploited by Blackstone.

Industry Overview and Business Models

In general terms, eCommerce defines a new potential strategy for incumbent retailers. The advent of the internet and globalization have inevitably increased competition in the industry, but it has also opened the door to expansion. Thinking of opening new brick-and-mortar branches around the world has become a costly solution if compared to the virtual commerce strategy. The last years saw significant growth rates in Virtual Commerce adoption around the world. International markets such as Asia-Pacific, Latin America saw CAGR in revenues generated through online retailing of 17% between 2012 and 2016 and kept on growing at the same pace if not faster until the present days. The United States, on the other hand, have experienced slower growth during the same period, as it had been a first adopter of the technology.

Emerging markets have been experiencing surges in the demand for global products, which makes them show higher growth rates than the developed world. In addition to this, countries such as Brazil, Indonesia, Thailand and China, with a relatively young population show an average of 76% of consumers who are willing to order from international websites.

Another possible factor in the rise of international demand for consumer goods and possible boost for eCommerce is the increasing trend of international shipping with flexible, low-cost and low-risk options, making it easier for retailers to reach markets beyond their frontiers without investing in fixed capital.

On top of these consumer behaviour changes, it is important to consider technological factors. In the recent past, for example, we saw the development of safer and faster payment methods which are executed completely through portable devices. In these terms, Brazil still ranks as the top country with the highest volume of retail sales processed through mobile devices (40%, based on online site traffic), followed by China and India.

Focusing on the United States and based on U.S. Census Bureau data, eCommerce spending doubled relative to total retail sales between 2007 and 2017, reaching 10%. This is determined not only by the increasing popularity of online megastores such as Amazon but also by classic brick-and-mortar competitors that have launched online initiatives. This aspect stresses how the entire traditional business model of retailers is being challenged into thinking about new solutions.

Advantages of a new Business Model

Based on a recent Stanford paper (Assessing the Gains from E-Commerce, P. Dolfen, L. Einav, P.J. Klenow, B. Kopack, J.D. Levin, L. Levin, W. Best) these variety and convenience gains from eCommerce can be mathematically quantified.

Researchers started from the universe of all credit and debit card transactions cleared through the Visa System in the United States between January 2007 and December 2017, and additional purchasing data from the U.S. Census and International Revenue Service, counting an average of 380 million cards and 35.9 billion transactions. They divided the transactions into physically swiped transactions or “Card Present”, meaning that the transaction occurred in person and the alternative “Card Not Present”. Both of the categories contain transactions linked to online spending.

The results of the research stress how online spending, specifically through Visa Channels, has increased on average in all of the main US industries, including retail. According to the numbers obtained, Online spending as a share of total US consumption went from approximately 5% in 2007, to 8% in 2017.

As stated above, the upward trend is the result of two main factors: convenience and variety surpluses allowed by Virtual Commerce.

The possibility of avoiding trips to offline stores, spending time and financial resources with parking, transacting and going back home with the purchased items is by far the main advantage of eCommerce against the traditional business model of offline retailing, but not only, as the process has involved many industries, from Non-store retailing, to electronics and Air Transportation. The convenience advantage seems to increase with the distance from the nearest offline retailing store. The relation between the share of physical purchases against physical distance from stores is studied by the researchers through a linear regression that yields a beta coefficient of -0.013 and a standard error of less than 0.0001. The result is statistically significant and implies that moving a consumer from 10 to 20 miles away from the nearest brick-and-mortar store, increases the share of purchases made online by 0.9 percentage points.

In terms of variety surplus, the possibility of having access to a wider variety of merchants through online channels is another tangible advantage explaining the rise of eCommerce. In fact, 88% of online spending was recorded by merchants that were not visited offline, giving a first clue of how online accessibility increases competition for the producer but increases gains for the consumer. In general, the estimation of the consumer variety gains model of the paper shows how consumers are better off when a set of variables increases.

Specifically, the surplus increases if the quality of products available offline and/or online increases (respectively qb and qo) and if shopping efficiency offline and/or online increases (Ab and Ao).

In our specific case, we see how eCommerce drastically improves shopping efficiency, as demonstrated with convenience gains and product quality thanks to wider access to different competing products.It is reasonable to think at this point how the classical business model of retail stores has been completely disrupted by the two aforementioned factors.

Retail Apocalypse and Survival

As stated at the beginning of the article, eCommerce is a new strategy that has changed the retailing industry and that must be exploited by incumbent players if survival is to be achieved in an increasingly competitive environment. A good example of the successful implementation of the strategy in the past was Walmart.

The company went from a traditional supermarket chain to the third-largest online retailer in the world, surpassing even Apple. The company has been acquiring and establishing strategic partnerships since 2016 in order to implement and widen an eCommerce strategy and to exploit the possibility of attracting the younger proportion of the population which could not attract through the traditional brick-and-mortar model. Flipkart, for example, was one of the biggest acquisitions of Walmart, opening the doors to the online retailing sector of India. Strategic partnerships included Google, in order to exploit Google Express and Google Home. The online network established, allied with the already existing channel of more than 4,700 physical stores, has allowed Walmart to establish itself as an omnichannel model that grows every year with massive investments in M&A and technology. The company has invested in a total website redesign and improvements for its mobile app, taking some similar algorithms from Amazon. The modern website, in fact, can display products based on trends in the user’s local area and gives the Free Delivery option for orders of $35 or higher.

The success of Walmart, however, has not been shared by the entire retail industry. Forever 21, which has recently filed for bankruptcy protection, is an example of a company that could not adapt to the new trends affecting retailing.

As a privately-owned fashion retailer that became popular among budget-conscious teenage girls, it expanded at a rapid pace but recently lost ground to H&M and Primark as it fell out of favour in terms of fashion offerings. As a consequence, the compressing profit margins could not allow the company to adequately invest in online sales and get rid of the fixed costs coming from its extraordinary large stores.

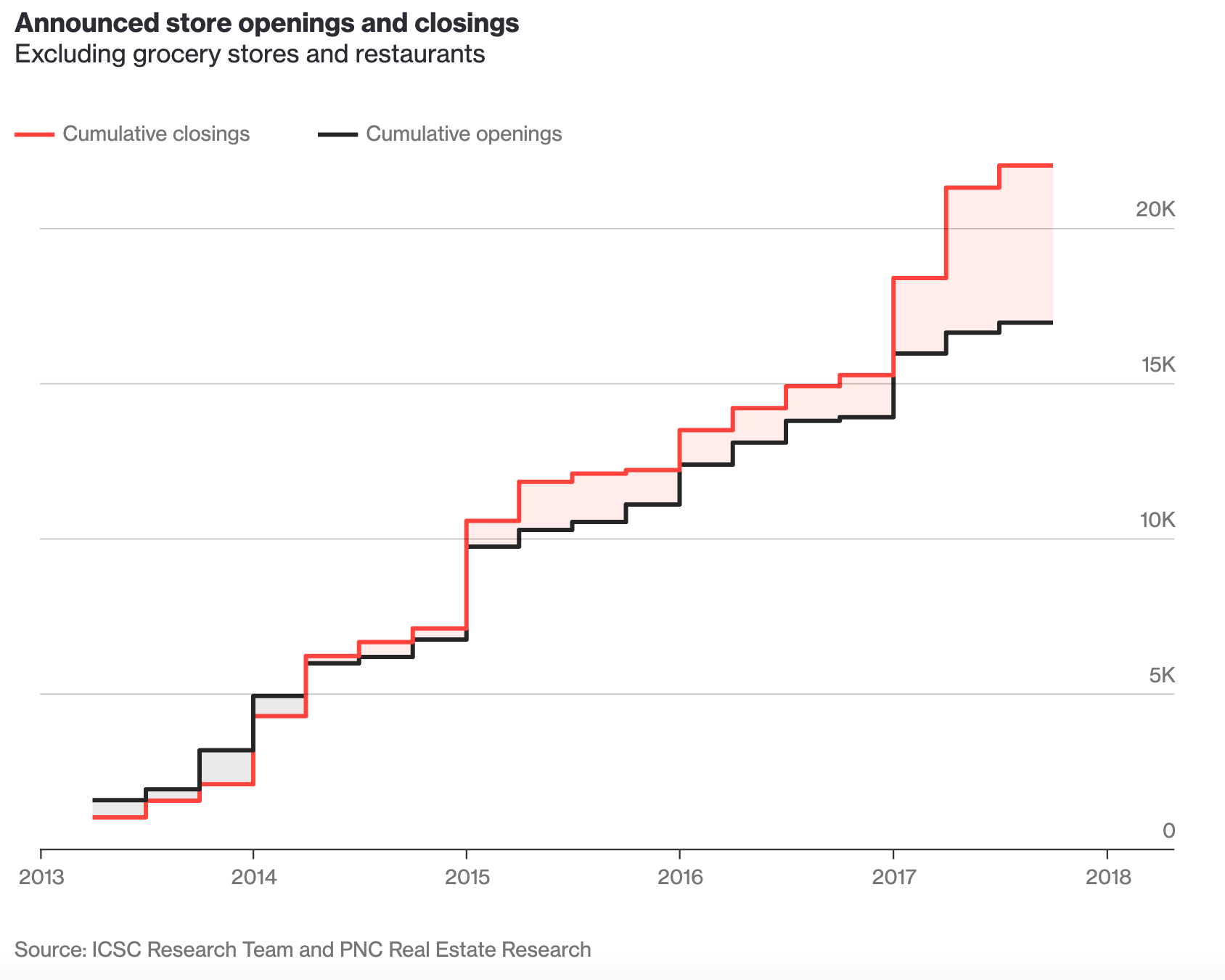

As a matter of fact, the example of Forever 21 is just one single piece of a puzzle that has been given the name of “Retail Apocalypse”. The term was first used in 2017 and refers to the wave of announcements of plans to discontinue or scale back the retail presence from some of the major retail companies. Between 2017 and 2018, 9 major players filed for bankruptcy, including the once-popular Sears Holdings, American Eagle, Urban Outfitters, while others saw their stocks hit record lows. It is particularly interesting to note that the recent years have been, especially in the US, years of economic growth, low levels of unemployment, strong consumer confidence and low interest rates, which would imply a retailing boom in terms of store openings, but instead, we see that closures have actually surpassed openings for some years, now.

Source: ICSC Research Team and PNC Real Estate Research

This is basically the Forever 21 story repeated in different cases of retail bankruptcies, with some exceptions. Many of these troubled companies have a rooted problem that has been amplified, most of the time, by compressing profit margins due to a loss in market share from online commerce. The problem is leverage, which is accentuated by the fact that many retail stores had been targets of LBOs. This aspect and the continuous gains of eCommerce have created negative environment for their credit rating, casting out refinancing proposals to banks and bondholders even when the company was stable in profitability. Toys R Us Inc., for example, had stable financial results combined with a high leverage ratio and a small decline in quarterly sales. That gradually increased pressure from the debtholders of the company, causing it to file for bankruptcy in 2017.

Making things worse is the fact that much of this overall industry debt is due in 2019 and 2020 with respectively $6bn and $3bn of bonds maturing, rising to an annual average of $5bn until 2025. Credit ratings have significantly deteriorated, boosting the amount of high-yield debt for retail companies. According to data from Fitch and Moody’s, the industry’s leveraged loans are up 15% to $152bn, adding uncertainty to the overall situation.

Sources: Fitch Ratings, Moody’s

Positive spillovers and Investment Opportunities

The eCommerce wave has functioned as a disruptive force for the entire retailing business but it has also been exploited by some as a good investment opportunity. Blackstone has given clues about how it really understands the trend and the spillovers generated recently.

The last two weeks saw some major deals that the private equity firm sealed that prove the last point.

On September the 16th Blackstone concluded an all-cash takeover of Canadian real estate investment trust Dream Global, giving a valuation of $4.7bn. Besides the 200+ office spaces it owns across Europe, the trust allows Blackstone to own the warehouses in more than 100 European cities, mainly in Germany and the Netherlands.This was one of the main additions to a larger portfolio of logistics property.

June of 2019 saw another strategic move by Blackstone as the firm bought Singapore-based GLP’s portfolio of US warehouses for a price of $18.7bn. On September the 30th it announced it closed another deal of the same kind: a group of industrial warehouses from Colony Capital at a price of $5.9bn, including debt. Colony’s portfolio includes 60m square feet of warehouse space in Dallas, Atlanta, Florida, New Jersey and California.

The result of these three large and rapid deals has led to the creation of a significant portfolio of industrial real estate. $8bn in value are concentrated in Europe, but the reasons are quite clear. Blackstone is betting on a continuous positive trend of eCommerce led by the growth of Amazon which is followed, as explained above, by other traditional retail companies like Walmart. Warehouses are a basic tool for the virtual commerce business model. In particular, this “last mile” properties in Europe will be held by a special purpose vehicle called Mileway and will be used by Amazon and delivery companies such as Deliveroo.

According to Blackstone, eCommerce is expected to keep on positively growing especially in Europe where average penetration rates of virtual retail stay at 8.8% for now. Europe is expected to reach penetration rates similar to the US and East Asia in the not-so-distant future and the idea can be supported by the fact that growing demand for virtual commerce has boosted demand for warehouses and their valuations.

Conclusion

Virtual Commerce has proven to be an unstoppable force since the benefits it creates are higher relative to the low costs incurred when using Internet to make purchases and orders. It disrupted the classical business model of traditional retail companies, forcing them to adapt. Some managed to change and are ready to face the challenge, others, usually the smaller ones, did not. However, it cannot be considered as the only force at the base of the “Retail Apocalypse” as existing and pressuring leverage conditions excluded the possibility for financial flexibility for many retail companies. All those companies that were not free to implement adaptation strategies in terms of Online sales saw their margins collapse and their credit grading decline, causing a vicious spiral when dealing with debtholders.

Still, this is what usually happens every time an innovative force enters an industry: it amplifies existing problems and those that rapidly understand the change are those that survive and may thrive during the adjustment period.

0 Comments