Introduction

China’s economy has embraced growth prospects for as long as we can remember, but it now faces a myriad of systemic obstacles. From inherent problems tied to its aging population and lack of independent institutions, to today’s property and financial crisis, China is now at an important inflection point. In this article, we explore how the current economic challenges are linked to these systemic issues, what policies have been adopted to tackle the sluggish consumer demand faced since the reopening and why they failed to work. To conclude, we propose a set of potential solutions, as well as point out some areas of development in the coming months or years.

Economic Context

From the early 1980s, China has committed to opening and liberalizing its economy, progressively instating a state-led socialist market economy. With GDP growth reaching upper single digits from the 1980s to today, we have witnessed an unparalleled economic boom in the last 40 years. Harnessing its strong demographic growth by imposing the infamous “One child policy”, China effectively managed an “economic miracle”, multiplying by 30 its GDP per Capita between 1991 and 2022. Deng Xiaoping, China’s PM from 1978-1989, opened China to the influences of international markets. He did this through many channels, notably through the creation of Special Economic Zones (SEZ). The development of these SEZ were at first concentrated on the coast (facilitating trade), where foreign firms could implement a local branch and benefit from limited government oversight, reduced tariffs, and overall market-oriented policies. This contrasts the planned economy norm, present throughout the rest of China. With the goal of further enticing foreign investments, SEZ are now specializing e.g. Shenzhen as a tech hub or Shanghai a financial centre.

Described as a mixed economy due to the opposition of market liberalization forces with State planning, we can further observe this duality throughout China’s capital markets. Although some of them were relaxed in recent years, stringent capital and FX controls still remain in place for foreign investment in mainland China. Circumventing these controls meant the creation of an offshore market where firms could raise capital, listing on the Hong Kong exchange or even in the US. Parallelly, the traded currency on the offshore market is the CNH (vs. CNY for onshore market). This distinction comes once again from the restrictions imposed by China, with selling and buying limits as well as an approval requirement to trade CNY over a certain threshold. Indeed, China has had its currency pegged since 1997, although from 2005 onwards, it relied on a weighted basket of currencies rather than just the US dollar. Limited to a 2% variation against the fixed level, the peg is set to undervalue the currency, promoting exports. Investors prefer to trade with CNH, which floats freely and is subject to less regulations.

China’s banking sector is dominated by four state-owned commercial banks. This leads to generous access to credit for firms who are of strategic interest to the State. As opposed to Western firms, loans remain the primary source of funding for Chinese companies. This can be explained by an underdeveloped bond market and ease of access to credit from public banking institutions. State controlled financial sector also implies a lack of oversight and transparency, which usually leads to higher market inefficacy and potential bubbles.

A characteristic of China’s form of government is the strong autonomy of provinces, and their economic strength. Often overlooked, the ranking of EU countries and Chinese provinces by GDP gives the surprising result of only 4 EU countries in the top 20. What can be inferred from this is the importance of local governments in the economy (relevant when observing China’s debt problem). Indeed, local government debts exceed the State’s debt, with the most part contracted after 2008 through Local Government Financing Vehicles (LGFVs) for infrastructure projects. The most important source of revenue for provinces are land sales (a third of revenue), or more precisely “land usage rights”, as land in China belongs to the State. This heavy reliance on expanding the real estate market to finance provinces’ operations creates moral hazard problems. Skyrocketing land prices in recent years allowed provinces to maintain their public spending, but the recent crackdown on property developers brought this to a halt.

Another key characteristic of China is its property market. Accounting for more than a quarter of the GDP and storing 80% of total household wealth (against 30% for the US), this sector drives China’s economy. The importance of the real estate market in the economy can be explained by a myriad of factors, but here are the most relevant in our opinion. On the demand side, the rapid urbanization and relocation of workers from the countryside to cities due to the economic boom (double-digit GDP growth for most of the 1990s-2010s) led to a surge in demand for urban housing. From 1998 to 2021, China’s urban population more than doubled from 416 million to 914 million. With public policies addressed at easing access to housing through cheap mortgages, this further stimulated demand. Another key demand driver is the lack of any social security or pension program. For most citizens, buying an apartment replaced the western 401k retirement plan, as it is (or was) a safe asset that appreciated over time. On the supply side, this demand was met by the creation of large property development groups, who leveraged this demand (and their balance sheets) by selling unfinished housing units – the market was so expensive that a high number of people had to pay upfront before construction was completed against a small discount. The combined effect of hidden leverage from property developers and speculation led to a price bubble. At their peak in 2021, it took on average 50 years of median income to buy an apartment in Beijing, as opposed to 15 in London and 10 in New York.

This created the perfect conditions for a systemic property market crisis. As property developers sold unfinished apartments and used the cash generated to fund new developments, an uncontrollable spiral was created. Intervening to ensure long term stability of the sector and achieve lower prices, the State intervened in August 2020 by imposing the “Three Red lines Policy”, three debt ratios that Chinese property developers must satisfy to gain access to bank lending. Half of China’s top developers did not meet these requirements, and at the same time, the State influenced banks to reduce the volume of mortgage loans to households. This led to the failure of many property developers as they were forced to deleverage in order to meet cash requirements. This crisis had wider repercussions on the economy, notably on consumer confidence and foreign investments.

Another important factor to consider is the Chinese demographic situation as it has implications on the prospects of future economic growth and productivity of its labor force. For the first time in five decades, China’s population is decreasing and is rapidly aging. Historically, a key part of Chinese culture has been having many children, which was specifically visible in 1949 when fertility was encouraged due to high demand for manual labor. This led to a series of policies on fertility after unsustainable population growth: in 1980 the ‘one child policy’, in 2016 the ‘two child policy’ and recently, in 2021 the ‘three child policy’.

According to UN models, China’s population may fall below 800 million by 2100. This demographic shift is caused by the decrease in fertility rate in recent years, despite the introduction of the three-child policy in 2021, and the postponement of pregnancy. Namely, since 2000, the mean childbearing age has increased by three years.

Most importantly, China has a rapidly aging population due to increased life expectancy – 20% of its population is aged 60 and older and this trend is expected to continue. The UN estimates that by 2079, there will be more Chinese people outside working age population than inside (very high dependency ratio). This age demographic problem is exacerbated by a high degree of emigration (an estimated 310,000 people leaving the country per year in 2100). This demographic shift of population structure ‘aging before becoming rich’ may cause repercussions on China’s growth path, since the driver behind the country’s transition from an agrarian economy to an industrial society with increased living standards was indeed the large proportion of citizens of working age.

Furthermore, history suggests that once a country crosses the threshold of negative population growth, there is little that its government can do to reverse it. In fact, the Chinese government has recently attempted numerous pronatalist policies such as subsidies and tax deductions as well as increasing eldercare, but there has been no successful outcome yet. However, this ‘age structure effect’ can be argued as a double-edged sword for Chinese economic growth – decline in population size could increase per capita income, lower unemployment rates, and elevate consumption, thus boosting domestic economic activity.

How the Chinese Economy evolved since the Reopening

About 13 months ago, on January 8 in 2023, the Chinese economy finally reopened after almost 3 years of Zero-Covid policy, driving up the optimism among investors about the potential benefits it would have over global markets. For a more detailed analysis, please refer to our article on trading the Chinese reopening.

In 2023, the Chinese economy grew by 5.2%, exceeding the official target of 5%. However, this figure is unreliable as the growth was mainly supported by exports and investments through the previously mentioned LGFVs, while consumer spending remained resilient and failed to bounce back according to expectations. Even more, deflationary forces returned in the last quarter, with the CPI index touching a 14-year low at -0.8% YoY in January and producer prices falling 2.5% YoY. The underlying reason for these figures is of structural nature: supply-side expansion outweighs both domestic and external demand – capacity utilization in industry remains low, while consumer confidence is the lowest in the last 30 years.

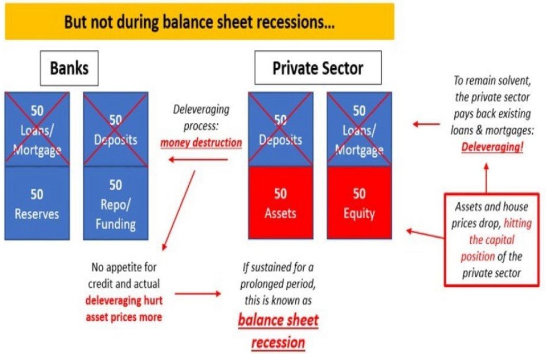

Household consumption started declining in the second half of the year in part because of a deteriorating job market. Unlike in the US, where most of the people had the option to continue working from home, the Chinese reopening presented a different perspective of the labor market. Indeed, tens of millions of workers returned from the countryside to search for jobs in developed cities, resulting in a depressing effect on wages. Looking at the employment components of PMI surveys, hiring continued to worsen in the services sector, which accounts for the majority of jobs in the economy, as many small businesses struggled to survive. Manufacturing hiring also deteriorated due to softening exports, while construction hiring slightly improved after the recent policy stimulus.

Source: Gavekal Dragonomics, Macrobond

Infrastructure and the industrial sector were the two areas that received a major proportion of investment through government funding, but also through bank finance. The gains in infrastructure and manufacturing investment have offset the decline in real-estate investment, but the net effect was disappointing: total fixed-assets investment growth in 2023 was 3%, compared to 5.5% in 2022. Interestingly, another massive investment undertaken was in the semiconductor industry, surpassing Taiwan at this chapter, while sales finally turned positive in YoY terms in November.

Current Difficulties encountered

Considering the innate specifics tied to China’s economy and the weak recovery since the reopening, we have identified four key obstacles and their implications in the near future:

1. Trade-off in policy choice

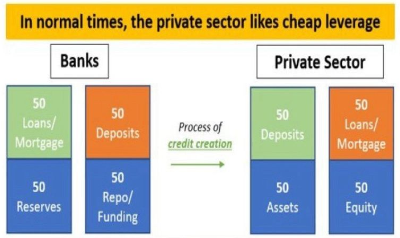

The choice of policy is the primary obstacle Chinese authorities are facing right now, as the monetary and fiscal policies that were adopted over the last few months were ineffective in relative terms and thus unable to stimulate the economy to the extent desired. When it comes to monetary interventions, People Bank of China has the primary responsibility of safeguarding the currency peg while keeping the system liquid enough to accommodate the central plan for lending volume of banks. Moreover, cutting different types of rates does not push up demand in the current Chinese environment, which is known as balance sheet recession. This can be summarized as a toxic economic loop where, after being afflicted by deleveraging and lower asset prices, households and corporates refuse to take in new credit and focus on just repaying their debt and shrinking balance sheets. More specifically, after Xi Jinping’s change of policy that imposed restrictions on bank lending to property developers (Three Red Lines policy), house prices started to drop hence hitting the capital position of highly leveraged Chinese households, as real estate is the top investment of Chinese citizens. Continued weakness in the housing market made developers and households prioritize staying solvent: pay back their loans or mortgages as fast as possible, therefore deleveraging in motion. Accordingly, the lack of new credit combined with actual deleveraging hit house and asset prices further in a vicious loop. The best way to solve this phenomenon would be through targeted fiscal stimulus, attempting to rescue troubled property developers and households. However, providing consistent stimulus programs would hurt the government’s balance sheet, as it has already acquired significant amounts of debt, especially at local governments level.

Source: The Macro Compass

2. China’s fiscal position and its implications

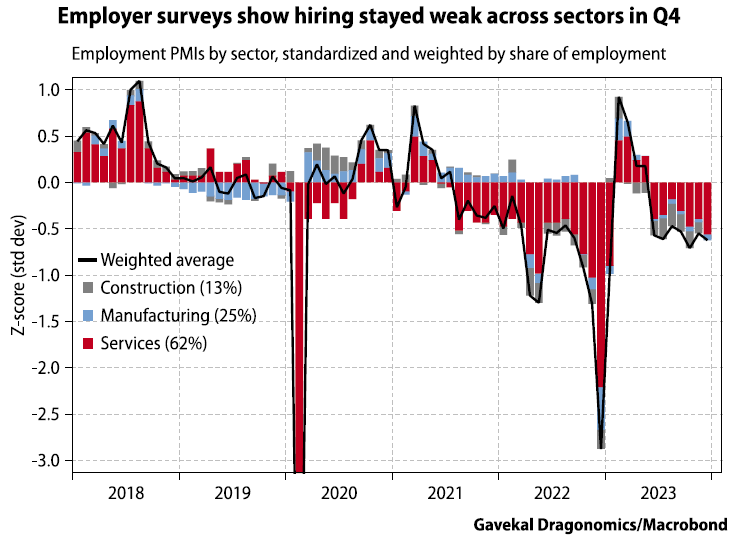

As for China’s fiscal position, tax revenue as percentage of GDP steadily declined over the last decade, reaching 14.4% in 2023, a similar level as in 1991. This is the result of continuous tax cut programs throughout the years, unmatched by a similar reduction in government expenditures. Much of the new deficit spending has been assigned to local governments, on a separate budget account, rather than the central government. This accounting gimmick has allowed the Ministry of Finance to continue reporting modest official deficits, usually under 3% of GDP, while still stepping up counter-cyclical spending on infrastructure and public works. These projects are increasingly financed by bonds issued in the name of local governments: since 2017, the outstanding amount of official local-government debt has exceeded that of central government debt. The amount of debt is still controlled by the central government, and projects must go through formal state-level procedures to receive this funding.

Source: Gavekal Dragonomics, Macrobond

From the onset of the pandemic until today, deficit spending to stimulate growth is the most obvious factor driving government debt steadily higher. But a factor that will become increasingly important in the coming years is the materialization of contingent liabilities, namely potential debts, that were not on the government balance sheet, becoming actual liabilities. The most widely discussed of these are the hidden debts of LGFVs. Although bond investors have long believed that these debts carry a de facto sovereign guarantee, the central government has consistently denied this, and they are not included in the official accounting of government liabilities. Then in 2023, Beijing allowed provincial governments to issue about 1.4 trillion worth of Renminbi in official bonds to refinance LGFV debts, in effect swapping off-balance-sheet debt for on-balance-sheet debt. While the sum so far is small, at least in the context of the national debt, the precedent is important. The central government has now shown that at least some LGFV debts are going to be treated as true government debt and moved on to the central government’s balance sheet. The process of turning these contingent liabilities into actual liabilities has therefore shifted from being a theoretical issue for the future to a practical issue for the present.

The other contingent liability that will start to materialize in the next few years is the aging population burden. China started to build an old-age pension system relatively late, leaving it relatively little time to accumulate assets before having to increase payouts to the retired. An obvious way to lessen the fiscal burden would be to raise China’s relatively low statutory retirement ages (55 for women, 60 for men), but the government has taken few concrete steps in this direction despite debating it for many years and the issue is now coming to a head.

3. Domestic assets value

The combined impact of the default of property developers, the uncertain environment created by arbitrary state decisions, and reduced demand for exports led the CSI 300 index to close 20% lower at the end of 2023. This is part of the more pronounced downward trend in the past 3 years, where the same index now records losses of more than 40% since the peak of early 2021. The lack of effective measures to support the equity market can be explained by the mission assigned to the PBOC. Indeed, its activity mostly focuses on maintaining a stable exchange rate and fixed income market, while stocks are seen as an inferior priority.

The consequences of the stock market meltdown are multiple. Financial investments saw a wipeout of their value: from wealth management products sold by now defaulted firms (e.g. Zhongzhi) to investments into the property market, this has impacted households’ spending power and savings, across all income ranges. Snowball derivatives, a popular financial instrument that provides a fixed return if the underlying stays in a specific range, suffered large losses in the past year as equity markets fell out of range. The stringent capital controls imposed by China make it difficult and prohibitively expensive to move money abroad, limiting foreign investment opportunities. The loss in value in investment has a double impact on the economy, through reduction in disposable income and cautious spending with increased savings. This fall in consumer confidence due to the drop in value of investments exacerbates the effect of the economic crisis and could lead to longer term implications.

4. US elections

Lastly, a recent cause of disorder for China are the incoming US elections. The former president Donald Trump pitched a potential 60% tariff on all Chinese imports in case he would be elected, which according to Bloomberg Economics, would shrink a $575 billion trade pipeline to almost nothing. The biggest impact would probably fall on textiles and electronics industries, which China currently dominates, but with thin profit margins that make it impossible for factories to absorb the tariff impact. At the same time, Joe Biden has broadened the scope of Trump’s tariffs imposed in his first mandate and implemented more anti-China policies, such as restricting its access to technology supply chains, that he is expected to roll over if re-elected. Even more, both administrations reportedly have in mind an additional set of investment and trade curbs on China, which alongside the other interventions mentioned, could create significant havoc for Chinese exports and would potentially shift its focus towards other trade partners.

Policy Interventions

Looking at policy intervention in China in the beginning of 2024 is significant as China did not have a good 2023, underperforming in almost every economic indicator. GDP was the only slightly higher than expected indicator, but given the demographic slowdown, real estate crisis, slumping stock market and decreasing consumption, this figure is distrusted. It is important to keep in mind that policy-making in China is a delicate process due to the restrictions imposed by the Chinese Communist Party (CCP) meant to improve or protect Chinese society, which come with undesired collateral effects on the economy. Overarchingly, policymakers in China in 2024 intend to use proactive fiscal policies, prudent monetary policies and to commit to the ‘nine-point plan’ which focuses on high-quality development, technological innovation in the industrial system, boosting domestic consumption and foreign direct investment (FDI), revitalizing agriculture to boost food security, and tackling the real estate crisis.

To prevent the market from underperforming for the fourth consecutive year and to avoid abnormal fluctuations in the market, the market regulator has been replaced (Wu Qing, who led traders mid 2000s crisis, as new chairman of CSRC), wider trading curbs have been established, increasing controls against illicit trading have been set and state buying of major bank stocks has increased. The stock market seems to be positively reacting to these recent interventions, as can be seen by a 1.14% increase in the SSE composite index in the past month, although other factors may play a part in this as well. The state vowed not only to ensure increased investments in ETFs, but also increased its spending to support listed companies through M&As and announced the restructuring of the CSRC. More specifically, the ‘state team’, as in a group of Chinese state funds, has bought the equivalent of $9.7 billion of onshore Chinese shares in the past month. Chinese FDI regulators will focus on easing investment restrictions in the telecommunications and other sectors and aim for greater transparency in an effort to increase FDI as this has been an area of challenge since slower than expected recovery post-COVID.

In addition, there has been an easing in the money market led by the injection of cash into the market along with a cut to the bank’s reserve requirement ratio. More specifically, in January the reserve requirement ratio was cut by 0.5%, the biggest cut since December 2021, which will allow around $111 billion equivalent to be released in the form of new loans. Furthermore, increasing amounts of housing projects are being listed eligible for funding. To tackle the issue of weak credit growth in the real estate sector, policymakers are urging risk-averse banks to step up lending – the People’s Bank of China (PBOC) added around 21 billion yen ($139 billion equivalent) to further support housing and infrastructure projects.

Policies other than monetary and fiscal are mainly aimed at fighting the population growth slowdown and adjusting to the aging population structure. For example, pronatalist policies include tax deductions, childcare leave and subsidies for couples who have one to three children. There have also been policies to decrease the cost of eldercare policies. However, there have been no material results yet. Additionally, the Chinese government has other specific initiatives for their 2024 policymaking such as setting spending limits on the gaming, anti-espionage, zero-covid, and private education policies.

Potential Developments

As previously mentioned, China is facing a now entrenched property and financial crisis. The retreat of foreign investors also exacerbated the fall in asset value. In an attempt to restore confidence into the real estate market, China announced a decrease in requirements for mortgages and rates for first-time homebuyers. Although relevant, these measures have yet to be effective in reviving the property sector. In our opinion, one way the Chinese government could stop the rot in the real estate market is the establishment of a FDIC-like insurance scheme for property deposits, that property developers would have to pay for in advance, based on their own risk. This would incentivize developers to finish the promised apartments and would boost investor sentiment. As for the equity market, a potential catalyst would likely have to come from the bottom-up – better corporate earnings, share buybacks, or the creation of new business models.

When regulations against lending to property developers were imposed, banks were instead advised to lend to other strategic fields of investments such as EVs, solar panels manufacturers, or green technologies. Today, China is dominating the entire EV supply chain, and it is the world’s biggest car exporter. If the divestment from the property sector becomes more rooted into the State’ political vision (which is today’s status quo), we could observe a shift in funding and access to credit, to the benefit of these industries. In addition, China has placed a lot of importance in developing nuclear energy in the past decade, and if successful, the US would lose its current comparative advantage in the energy sector. Its geopolitical influence would also be extended, as providing cheap energy to neighboring countries, such as India, would come at a cost. Although some industries face important growth prospects, some concerns still remain regarding the overall health of China’s economy.

Considering the limitations faced when trying to stimulate the economy using a traditional policy, be it either monetary or fiscal, China may find itself in a deflation spiral soon if the current issues in the economy persist. One of the few alternatives to exit this vicious cycle, agreed by common literature [6], is currency devaluation. The technical details of an FX intervention are out of the scope of this article, so for a more detailed analysis we recommend checking out this article. In short, a Renminbi devaluation should in theory stimulate the economy by giving a boost to export- and import-competing sectors. Moreover, since the Chinese yuan is pegged, it should inflate away some of the accumulated debt, induce private sector expectations of a higher future price level and create the desirable long-term inflation expectations that would rescue the economy from this state. However, there are some caveats regarding this method, and it should be implemented carefully. As China is not a developed economy, monetary shocks would transmit more rapidly than in developed countries such as the US, so a sudden devaluation could result in surging inflation growth. Accordingly, a suggested approach would be repegging the exchange rate at a level not far away from the current one and proceeding with small steps, until a market rate at which China reflated sufficiently to make its balance sheet look stable is achieved.

Lastly, based on the recent news regarding the potential tariffs imposed by the US on China, analyzed in a previous section, we believe that US elections will have an impact on the Chinese stock market. In our view, incoming tariffs announcements will come out at unexpected moments during the electoral campaign and will create more volatility for certain Chinese equities that would be the most affected by the tariffs. On the other side, on election day, all the uncertainties regarding the set of tariffs to be applied (the ones proposed by Trump or those proposed by Biden) will disappear and eventually become priced in. Consequently, the volatility on some Chinese stocks should be higher before elections than after elections. Potential candidates for this idea are companies with high export exposure to the US, relatively high capital expenditure and expensive relocation costs.

References

[1] Everything China is doing to rescue its battered Stock Market, Bloomberg

[2] China’s Real Estate collapse has just only just begun, Forward Guidance

[3] In Trump-Biden rematch, the only sure Loser is China, Bloomberg

[4] China’s well-to-do are under assault from every side, The Economist

[5] The Erosion of Fiscal Capacity, Gavekal Research

[6] Lars E.O. Svensson, “Escaping from a Liquidity Trap and Deflation: The Foolproof Way and Others”, American Economic Association

0 Comments