On November 5th, the world’s highest-valued fintech company, Ant Group, had plans to list its shares on the Hong Kong and Shanghai Stock Exchanges in the largest IPO in history, aiming to raise a total of $37bn and to surpass Saudi Aramco’s record of $29bn from December last year. However, following a sudden intervention by the Chinese government and a new regulatory environment that requires Ant to make some changes to its business model, the deal has been halted. Professionals involved in the deal state that Ant will have to respond to Chinese regulators’ requests and file a new IPO prospectus in Hong Kong – a process that is expected to take another six months at least.

About Ant Group

Ant Group, an affiliate company of Alibaba Group, is China’s largest mobile payment application and a leading financial technology open platform worldwide. Headquartered in Hangzhou, it employs more than 16,000 people, and enjoys over 700m monthly active users of its Alipay app, which supports transactions in 18 currencies and is used by more than 300k merchants worldwide to sell their products to consumers.

Ant’s business model consists of generating revenues from digital payment services by charging merchants transaction fees based on a percentage of volume. The company was founded under the name ‘Alipay’ in 2004 by Jack Ma, five years after he established Alibaba, as an online payment tool (very similar to Apple Pay and PayPal) that aimed to address the forming concerns of Chinese buyers and sellers regarding online transactions in the then-newly established Chinese e-commerce market. For many years, Alipay had been bringing substantial added value to Alibaba in facilitating e-commerce, but it had not been capturing as much value for itself with free peer-to-peer payments and discounted fees on payments executed for Alibaba. To gain value, control of customer funds was needed, since Alipay had to cover the costs arising each time a user uploaded money to the system (a 0.1% fee levied by the bank of the user). Therefore, retaining the funds for as long as possible was essential for the company to be able to cover the costs. Later, Alipay turned to other services and built its financial services strategy around access to data and access to customer funds. In 2014, Alipay restructured as Ant Financial, raised private capital, secured a license to operate a new banking business and advertised its money market fund Yu’ebao.

During the years, the firm has grown from a payment tool to a well-known one-stop-shop where users can buy on credit, buy insurances through established groups and invest in mutual funds. Alipay and digital wallet partners jointly serve approximately 1.3bn users globally. In 2020, it changed its name from Ant Financial to Ant Group to show that it is not only a financial services company but a technology business.

Source: antgroup.com

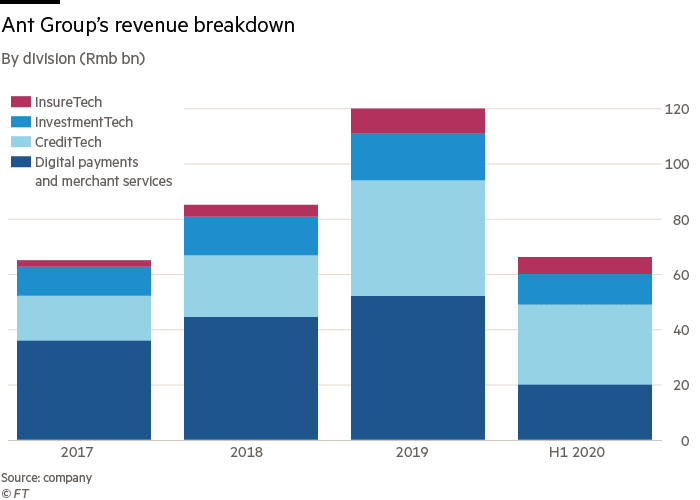

The Digital Finance Technology Services division consists of three subdivisions – CreditTech for consumer credits (subsidiaries: Huabei, which operated as a virtual credit card, and Jiebei, a short-term consumer loan provider), InvestmentTech for investment services, Ant’s wealth management business (with subsidiary Yu’ebao, the first investment product for that many consumers and largest money market fund product globally), and InsureTech for innovative low-cost insurance products. You can find a breakdown of Ant’s revenues by division below.

Source: FT

Ant’s global presence consists of digital wallet partnerships and expands from China, Japan, and South Korea to Australia, the US, Canada, and some European countries such as Italy, Norway, Iceland, and the UK. Its international strategy, though, focuses on the fast-growing region of South-East Asia. The group is building an Asian headquarter in Singapore and holds local fintech investments in Thailand, Indonesia, and Burma. Many of these partner companies are backed by their local governments so they represent a powerful set of partners to the Chinese behemoth. Ant won a digital banking license in Hong Kong in 2019 and it is expected to get one for Singapore later this year to be able to lend money to businesses more easily.

In terms of financial performance, Ant Group has been developing well for a relatively young and fast-growing company. It reported $3bn (¥21.2bn) in net profit for the first half of 2020 on $10.5bn (¥72.5bn) of revenue (up 38% YoY), which implies a net profit margin of almost 30%, indicating good profitability. Ant’s key revenue drivers are its technology service fees and its online payment service, Alipay. Between 2017 and 2018, Alipay was Ant’s main source of revenue, but from 2019 onwards, the bulk of revenue (63% of Ant’s revenues for the first six months of 2020) is being generated by its digital finance technology platform. The platform charges fees from partner commercial banks, insurers, mutual fund managers and other partners that pay for access to a large customer base via Alipay and for risk management technology.

The worldwide pandemic has not affected Ant negatively, at least so far. A challenge ahead of Ant, though, lies in the tight regulations by the Chinese government that represent an obstacle to both domestic and international growth. The possible introduction of a central digital currency in China would threaten Alipay’s and Tencent’s WeChat Pay’s dominant positions.

Industry Analysis

The business of Ant Group mainly includes digital payment, digital financial technology platform, and innovative business and others. In 2019, these three main segments accounted for 43.03%, 56.20% and 0.77% of generated revenues respectively.

Digital Payments

Ant Group is the largest digital payment service provider in China. During the 12-month period ending June 30, 2020, the total payment transaction scale in Mainland China processed by the company reached ¥118tn. The Digital Payments segment has a global transaction value of $3,859bn in 2019. China is currently the biggest market in the world in Digital Payments, with transaction value reaching US$1,596bn in 2019.

The mobile payment industry chain is composed of regulatory authorities, terminal equipment providers, mobile operators, financial institutions, third-party payment platforms, merchants, and users. There are three main business operation models for the mobile payment industry in China: mobile operators, financial institutions and third-party payment platforms. The business model of mobile operators completely removes the banks’ intervention from the equation and uses the telephone bill account as the payment account. The service provided by financial institutions represents the primary set up as the largest payments groups either were originally or developed over time to be also financial institutions. The third-party payment institution-led model consists in some third-party platforms providing transaction services by signing contracts with different banks. Banks provide funds and then third-party institutions guarantee the smooth completion of transactions, basically acting as a middleman that provides the platform too costly to develop for smaller financial institutions. This creates high demand for the platform’s promotion capability, research and development capacity, and fund operation abilities.

The three cases of most frequent mobile payment tools usage are catering consumption, small or convenience store consumption, and e-commerce platform shopping, accounting for 69.5%, 69.0%, and 65.3% respectively. 78.4% of users prefer to use QR code payment methods. New payment methods such as non-inductive payment, NFC payment, and face payment are emerging, accounting for 32.9%, 26.3%, and 25.8% respectively.

There exists a de facto duopoly in the digital payment market. Alipay and Tenpay (Wechat pay) take more than 90% of the market, with Alipay taking up 54.93% and Tencent financial technology 38.98%. Alipay attracts customers mainly by differentiating consumption situations, and further promoting its online fintech products to improve customer loyalty, while Tenpay takes advantage of its social attributes to convert users and increase transaction scale.

The new coronavirus pandemic has had greater impact on China’s consumer market in the first half of the year, and the growth rate of mobile payment transactions has declined significantly. In the long run, the pandemic is expected to accelerate the “onlineization” of consumer services and strengthen users’ mobile payment habits. It is expected that the number of mobile payment users will increase to 790m in 2020.

Aside from being the leading mobile payment player, Ant group is also a leading fintech platform, including three major platforms of Micro Loan Technology, Wealth Management Technology, and Insurance Technology. In the 12-month period ending June 30, 2020, there were 729m users who had used one or more digital financial services on the company’s platform.

Consumer Credit

Ant Group is China’s largest online consumer credit and credit technology service provider for small and micro operators. China’s consumer credit market mainly includes credit cards, installments and other unsecured credit products. The market size is expected to grow from ¥1.3bn in 2019 to ¥24tn in 2025, with an average CAGR of 11.4%. Online consumer credit refers to credit in which the entire loan process is completed online or through mobile terminals. The scale of online consumer credit in China reached ¥6tn in 2019 and is expected to reach ¥19tn in 2025. The CAGR from 2019 to 2025 will reach 20.4%. This mainly benefits from the wider application of data technology.

In 2019, the credit balance of small and micro operators with a single transaction value of less than ¥500,000 is ¥600m, and is expected to reach ¥2.6bn in 2025, with an average CAGR of 27.2%. In 2019, the contribution rate of China’s small and micro enterprises to GDP reached 60%, but the credit balance of small and micro operators only accounted for 32% of the total corporate loan balance. China’s small and micro operators, especially those with a lack of credit history, are still underserved by financial institutions.

According to the three dimensions of scenario, capital, and risk management, China’s consumer finance market can be divided into three categories: banking, e-commerce, and licensed consumer finance companies. Regarding the banking segment, due to the strong financing ability and low cost of banks, the consumer finance market has long focused on bank consumer credit products, mainly including bank cards and consumer loans. The e-commerce segment mainly relies on the e-commerce platform to provide installment shopping and small consumer loan services for long-tail users. Currently, the two main products are Ant Huabei from Ant group and Jingdong Baitiao from Jingdong finance. Consumer finance companies started quite late in China. Most of them are located in Eastern and Northern China, and most consumer finance companies are relatively small.

Wealth Management

For wealth management services, the scale of Chinese personal investable assets is expected to grow from ¥160tn in 2019 to ¥287tn in 2025, with an average CAGR of 10.3% during the period. In 2019, the scale of personal investable assets sold through online channels in China reached ¥21tn, and because of the widespread application of digital technology and users’ pursuit of a better investment experience, it is expected to reach ¥69tn in 2025, and the CAGR will reach 21.6%. In terms of the demand side, with the in-depth development of digital technology and the continuous transformation of user investment styles, the scale of online wealth management products has developed rapidly. In 2019, there were a total of 877m Internet users, which is expected to grow to 1.1bn in 2025. On the supply side, the number of funds is increasing year by year, and the degree of product standardization is high.

Insurance

Including life insurance, health insurance and property insurance, China’s insurance premiums are expected to grow from ¥4.3tn in 2019 to ¥8.6tn in 2025, with a CAGR of 12.4% during the period. In 2019, the scale of China’s online premiums reached ¥300bbn. Driven by digital technology, it is expected to reach ¥1.9tn in 2025, with a CAGR of 38.1%.

IPO Structure

Ant Group was set to list on the Shanghai stock exchange’s STAR market and on the Stock Exchange of Hong Kong. It is the first time that the book building for such a big IPO has been conducted outside Wall Street. The decision to list the company on national exchanges might come from geopolitical pressure due to the pandemic and ongoing tensions between Washington and Beijing. However, it reveals a strategic choice; there has been unprecedented retail appeal for Ant’s shares. The IPO attracted a record $3tn orders from individual investors, more than UK’s GDP. This retail frenzy is supported by a substantial amount of margin lending by financial institutions.

The dual listing is set to raise about $34.5bn, surpassing Saudi Aramco’s as the biggest-ever IPO. The fintech company has equally split its offering, issuing 1.67bn shares each in Shanghai (A-shares) and Hong Kong (H-shares). The offering price is around $10.30 a share which means that the company would be worth more than $310bn, a market value significantly higher than many global banks.

The Hong Kong order book has closed a day earlier than scheduled, getting $168bn of orders that is 389 times the shares on offer. On the other leg of the IPO about 5.16m retail accounts raised $2.85tn of bids, which means 872 times the number of shares reserved for the Shanghai Market (where participants are required to have a minimum ¥500,000 in their accounts). The excess demand can be linked to the decision by Alibaba to subscribe 730m of Shanghai shares via its subsidiary Zhejiang Tmall in order to maintain its stake in the group.

The enthusiasm towards Ant’s listing has triggered the over-allotment mechanism. The so- called greenshoe option has allowed the group to issue a further 15% of shares, raising another $5.7bn.

The shares were expected to start trading on November 5. On November 3rd, Jack Ma and other executives have been called in for a supervisory meeting with Chinese regulators after which the biggest-ever IPO has been suspended. The reason is that Beijing is becoming concerned about the potential financial instability that could result from fintech giant Ant Group rapid growth. However, regulators have been vague about what led them to suspend the IPO. What we know is that Ant Group will face increased scrutiny and will be subjected to restrictions similar to those of Chinese banks.

IPO Rationale

Ant’s dual IPO is the world’s hottest listing in a while. However, the western world can only look from afar as the listing follows the trend in which more and more Chinese companies list closer to home or even delist from U.S. exchanges altogether, signaling a general retreat from US financial markets.

Even before the IPO announcement, Ant had to rethink its U.S. expansion plans as trade war tensions spilled over into deal making. In early 2018, the U.S. blocked Ant’s attempt to buy U.S. money transfer company MoneyGram in a $1.2bn deal, citing national security concerns.

Nonetheless, Ant’s international strategy looks very focused on geographies such as South East Asia, where it has established partnerships with nine digital payment startups.

Ant said the capital raised from the dual offerings will be used in mainly three ways: first, to drive user engagement and expand user base through both the diversification of the services available through the Alipay service and the solidification of its relationships with partner financial institutions through digital finance technology service. Second, to enhance its research and development capabilities mainly in product and technology innovation, aiming at the development of its blockchain technologies such as AntChain. Finally, Ant intends to use the final part of its net proceeds to expand cross- border payment and merchant services; this will be made possible by broadening the coverage of its international payment connections to connect more consumers (including customers of Alibaba’s e-commerce business and users of e-wallet partners) and by investing in technology and service enhancement, such as technology infrastructure of Ant’s international payment connections.

Market Reaction

Ant Group has tried to distance itself from Alibaba founder Jack Ma in the past, insisting that it is an independent company. Yet, on August 25th, Alibaba shares in New York jumped 3.6% on the back of Ant Group’s IPO news.

On the announcement date, the news didn’t have a remarkable effect on the share prices of Ant’s biggest rivals such China UnionPay and Tencent. On the other hand, on October 27th morning, the day after Ant Group set the price for its shares making it the biggest listing of all time, Tencent share price rose by 3.5%.

Recently, Ant’s IPO was abruptly halted because of last minute changes in the financial technology regulatory environment. On the same day, the shares of Alibaba, which owns about one-third of Ant and relies on its technology to power its payments platforms, fell 8% in Hong Kong and 9% in early trading in New York.

Ant has vowed to return cash committed to its IPO by retail investors in Shanghai and Hong Kong — many of whom bought with high levels of leverage, but this event could have irreparably shaken their faith in investing in China’s markets.

Recent Events

On November 3rd, two days before trading was due to start, Shanghai and Hong Kong stock exchanges postponed Ant’s listing. A few days before Mr. Ma, who also founded Alibaba, had been called in for “supervisory interviews” by the Shanghai Stock Exchange, few imagined this would lead to Ant’s IPO suspension.

The Chinese Government said it suspended the $37bn listing of Ant Group to better maintain the stability of the capital markets and to protect investors’ interests. Moreover, the order to stop Ant’s IPO is likely to have come from the very top of the Chinese government, potentially from President Xi Jinping himself. The suspension might be linked to Jack Ma’s recent public criticism of Chinese regulators and calling their policies outdated. This decision comes after the publication of new draft regulations on China’s booming micro-lending sector, which was responsible for nearly 40% of its sales in the six months to June.

It is difficult to determine how long Ant’s IPO will be suspended for and this also throws into doubt what will happen to $300m in fees for Wall Street investment banks and others working on the deal.

Underwriters

Citigroup, J.P. Morgan, Morgan Stanley and CICC are Sponsors and Book runners of the Ant’s Hong Kong share sale while CICC and China Securities are Joint Sponsors and Underwriters of the Shanghai leg of the IPO.

Meanwhile, Credit Suisse and CCB International are Joint Global Coordinators and Joint Book runners. Finally, Deutsche Bank and Goldman Sachs are Joint Lead Managers.

0 Comments