Abstract

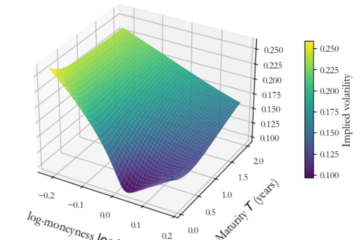

This research presents a Time Series Momentum (TSMOM) trading strategy implemented on highly liquid exchange-traded funds (SPY and GLD), enhanced with a novel macro-instrumented regime switching framework for state-dependent de-risking. Our approach addresses the well-documented momentum crash problem—sudden reversals that can wipe out months of accumulated gains during macroeconomic regime shifts—through two complementary gate mechanisms: an Oil Volatility Index (OVX) gate capturing commodity market uncertainty, and a Dynamic Nelson-Siegel State Gate derived from yield curve dynamics and macroeconomic fundamentals. Our implementation prioritizes accessibility and realism: the two-ETF universe requires no futures expertise, prime brokerage relationships, or complex infrastructure, making the strategy replicable by individual investors and small funds. By combining regime-awareness with transparent logic, this approach offers a pragmatic middle path, sophisticated enough to mitigate crashes, yet simple enough to understand, implement, and trust.

0 Comments