Given the turbulence in the implied volatility observed in the aftermath of Apple’s Q1 results, we adopt a sophisticated quantitative model to better understand its dynamics.

What we have observed so far in the option market is a large decrease in the 1-month implied volatility, and a sustained level of 4-month implied. We pave our way into a calendar spread strategy – which consists in betting on the term structure of implied volatility – by estimating a Multifrequency Volatility model that exhibits multifractal properties.

We fit to the Apple historical time series of returns a Multifractal Markov-Switching model (Calvet and Fisher (2007)) to decompose the volatility process into multiple (uncorrelated) frequencies. We match each frequency component to the empirical ones by observing the prevailing level of persistence given by the inverse of the transition probability of the Poisson arrivals. This is followed by the computation of filtered probabilities for each state (there are 2^6=64 states) later summed up to get the probability of each frequency being in the high- or low-volatility state.

On a first stage, we run the MLE estimation on de-trended daily returns with 6 volatility frequencies, each allowed to switch between two values with equal conditional probability.

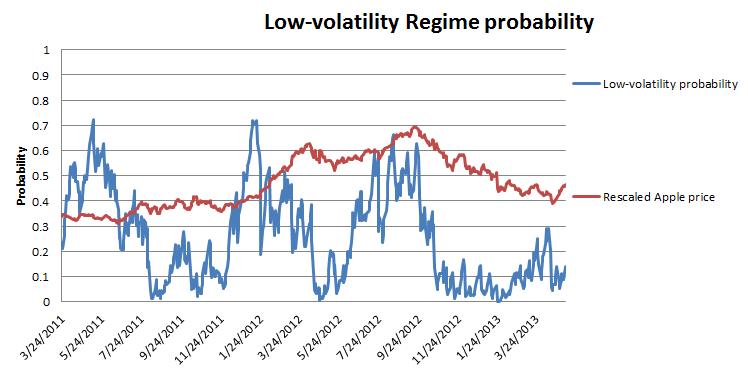

The chart below shows the probability of the 4th lowest-frequency (identified as the frequency with persistence of roughly one month) being in low-volatility state. The probability spiked following the results (which is consistent with the dynamics of post-Q1 implied volatility), but, unlike the market-implied volatility, the probability has reverted back to levels below 20%.

Source: BSIC

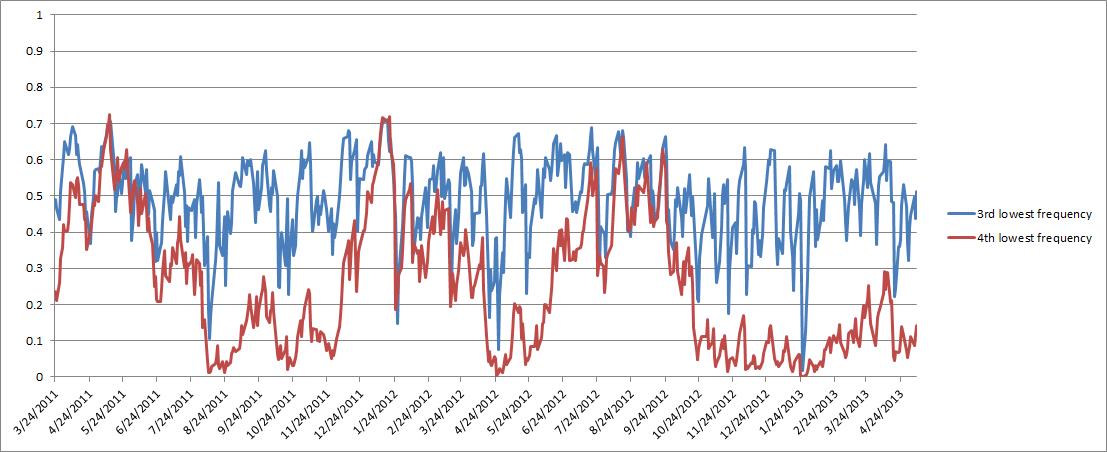

Taking into account weekly returns to capture even lower frequencies, we repeat the estimation of this time series, coming up with the following chart.

Although the market has now priced in much lower values for short-term implied volatility than for 4-months volatility, the rather persistent regimes of the multifractal volatility predict a sustained high-volatility regime for the month to come, but a more positive environment in the next 4 months.

By comparing the high- and low-frequency shock components, we appreciate the heterogeneous reaction to information news impacting the stock.

The above results in our trade idea to buy one-month implied volatility and sell 4-month implied via a volatility swap, or a more costly set of straddles. Given the current values of 1-month $20-ITM implied volatility (roughly 0.26) and 4-months of the same moneyness (of about 0.29), we pocket 3 points of implied volatility and carry on the position on expectations of a twist in the term structure.

Source: BSIC

Source: BSIC

1 Comment

Gabriele · 11 May 2013 at 18:35

Wonderful trade idea! Well done!