As we write this, the EUR/USD exchange rate has fallen to $1.3713 from about ~$1.4 when Draghi first gave his speech at the regular board meeting more than a week ago. The market seems to be pricing in possible monetary easing to be announced by the ECB in June at its regular meeting. A week ago, when our article “Draghi’s next move: Running out of choices?” was published, the 1-year EUR/USD forward was at $1.3763, whereas now, the same forward sits at $1.3713.

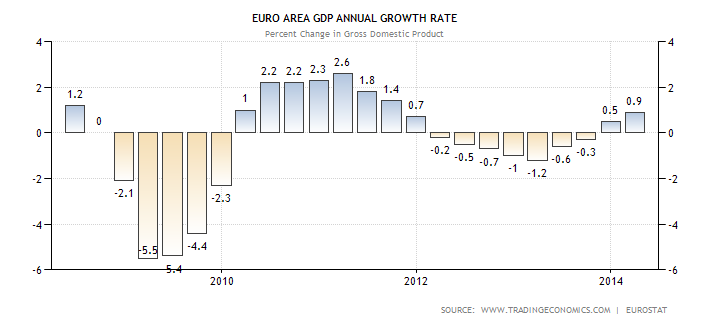

The latest annual GDP growth rate for the Eurozone, came out at 0.9%, disappointing the markets and adding to the momentum of expectations of new monetary easing in June.

Source: Trading Economics, Eurostat

With growth disappointing even the most hawkish board members of the Bundesbank, the bank has become more “tolerant”, and the markets widely expect it to support Draghi if the ECB finally chooses to go with QE. The Bundesbank, however, will only support a heavy private-asset purchasing program (QE) if the ECB staff’s projections for 2015 and 2016 inflation are lower than previously expected. Currently, the Bundesbank is willing to support moves such as negative deposit rates and long-term loans to banks at low interest rates. It believes that, with already low yields on governments bonds, a Quantitative Easing program would not do magic.

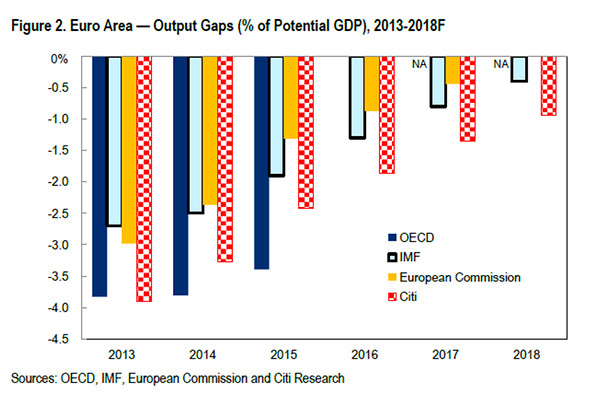

Output Gap Analysis

For any central bank to know what kind of monetary policy to follow, it must have a deep understanding of the output gap dynamics. Output gap is the difference between the current GDP and the potential GDP (the potential GDP being when unemployment equals the natural rate of unemployment, or, equivalently, when inflation is close to 0%). Different international institutions have different estimates of the output gap and the natural rate of unemployment for the Eurozone economies. However, these institutions consider the increase in unemployment in the Eurozone as structural and not cyclical, therefore estimating a lower potential GDP, and consequently, a smaller output gap.

Sources: OECD, IMF, European Commission and Citi Research

The OECD, the IMF, the European Commission and Citigroup all estimate output gap to be ranging from -3% to -4%, which would mean current output in the Eurozone is lower than potential output by 3% to 4%. However, a study done by the J.P.Morgan Research team, suggests these estimates are quite inaccurate. After accounting for productivity, labor market participation and demographics, they estimated the output gap to be at -6%. They suggest the increase in unemployment in the euro area to be half-cyclical and half-structural, even after taking into account structural changes in the labor markets and deflating bubbles in Spain and Ireland.

Why does the output gap matter for the ECB?

For the ECB, or any other central bank, to know what kind of interest-rate path to follow, it is necessary to know whether current output is below or above potential output. Output below its potential creates deflation, whereas output above its potential creates inflation. If there is a small output gap (which would mean the high level of current unemployment is structural) and the ECB goes with Quantitative Easing, we might have “bad” inflation, since prices would rise but unemployment would only fall marginally, creating the need for structural (supply-side) reforms. On the other hand, if the output gap is quite large, as the J.P.Morgan team predicts, and the ECB goes with Quantitative Easing and aggressive forward guidance, not only will prices rise, but unemployment will also fall drastically (one of JPMorgan study’s assumptions was that the increase in unemployment was half-structural and half-cyclical). With Draghi signaling that “the board is comfortable acting in June”, and the markets pricing in monetary easing, we believe that the ECB believes the output gap is large and that Quantitative Easing would indeed help the Eurozone, and will definitely go with it.

So how can we profit from this current situation?

Source: Bloomberg

Given our Macro Analysis, we would like to build a trade idea on our view. As mentioned before, we strongly believe that during next June meeting, Draghi will act to fight possible deflation and negative economic situation in the Eurozone. During these days, markets are pricing a supportive intervention from the ECB, possibly QE, another round of LTRO or a negative deposit rate. The most important effect of expectations can be easily seen in the level of interest rates among peripheral countries: the graph above shows the level of 10 years Government bond rate both in US and in Italy. It is possible to notice that, currently, the level for US is roughly 2.5% while for Italy just below 3%. This seems quite strange because US are worldwide considered as the risk free country by definition but their level of rates is not that distant to the Italian ones. This small spread is mainly due to the role of expectations: investors are considering likely the monetary easing action to come from the European Central Bank next month. Thus, they are buying more and more bonds from Italy, Portugal, Spain and Greece driving their prices up and their rates down.

With this situation, a smart move would be to build a carry trade. A carry trade consists in financing the position by borrowing money in a country with low interest rates and investing the money in another country (with different currency) that pays a higher interest rates. Assuming a not too long holding period (thus avoiding the risk of a possible default of the two countries involved in the trade) we could sell 10 years Government US notes (hence obtaining funds at a low rate) and buy 10 years Government Italian bonds, locking in a net positive interest rate of roughly 0.5%. Moreover, in our opinion, the next weeks will be characterized by a decrease in the Italian rate (due to the expected ECB move) and by a consequent increase in price. We therefore don’t need to keep the position until maturity but we can enjoy the foreseeable upside in the price of Italian bond by closing the position.

In the part before, with our carry trade, we went long on BTP and short on US notes. This also means that we took a position on currencies. Going long BTP/short US T-bonds is equal to go long on EUR/USD exchange rate. This is not the best bet in the current market situation. As pointed out in the first part of this article, Euro is depreciating against Dollar due to the different expected monetary actions that will be taken by Draghi and Yellen. Our view is that in the following weeks EUR/USD exchange rate will continue to decrease. To hedge our previous position, we could buy a cross currency swap. In practice, we are receiving Euro and paying Dollars, but given our view we would like to pay Euro and receive Dollars (to enjoy the upside of the Buck). For these reasons, in our swap we exchange the Euro we receive with Dollars, thus covering our long position in Euro.

Sources

http://blogs.wsj.com/brussels/2014/04/07/what-is-the-ecbs-estimate-of-the-euro-zone-output-gap/

http://online.wsj.com/news/articles/SB10001424052702303627504579559310643593806?mg=reno64-wsj

http://ftalphaville.ft.com/2014/02/04/1761122/why-the-eurozone-output-gap-could-be-a-chasm/

[edmc id=1734]Download as pdf[/edmc]

0 Comments