Introduction

The reopening of China’s economy in 2023 has been welcomed with optimism and anticipation as it offers a potential return to pre-pandemic growth. The Chinese government’s decision to reopen has led to an increase in the prices of many assets related to the country and has spurred speculation about how strong the recovery of the Chinese economy will be. Since the announcement, China has sent mixed signals, offering both encouraging and worrying signs of its future outlook. In this article, we will look at how the lockdowns have impacted the Chinese markets, the progress that has been made since the reopening, and the potential opportunities that might arise in the post-pandemic world.

Zero-Covid Policy

The Zero-Covid policy was a strategy to prevent the spread of COVID-19. It differs from other strategies because its goal was not only to slow down the spread of the disease but to eliminate it altogether. The goal was to resume normal economic activity after bringing new cases of COVID-19 down to zero.

The measures that were implemented in China differ by region, but the most common ones were lockdowns, contact tracing apps, mass testing, and quarantine facilities. Contact tracing apps were made mandatory for entering public spaces, and authorities used them to monitor people’s movements and to track the spread of the virus. According to annual budget reports from 20 of China’s 31 provinces, the country has spent at least $51.6bn fighting COVID-19. This figure is likely to keep growing as more provinces report their spending.

The slowing growth in China over 2022 is largely attributable to COVID-19 measures with growth slowing from 8% in 2021 to around 3% in 2022. Nonetheless, the Chinese economy managed to grow even within a very difficult business environment. Nomura’s models estimate the COVID-19 controls affected negatively 12.2% of Chinese GDP. This could be attributable to the cancellation of many business events, travel restrictions, and people being quarantined for long periods of time, among other things.

The Zero-Covid policy also negatively affected travel. In early December 2022, air traffic dropped to 20% of what was reported during the same period of 2019. That was especially worrying considering that according to a Fitch rating report, travel accounted for around 11% of Chinese GDP and 10% of employment in 2019.

The Reopening

On January 8 China finally reopened after three years of the Zero-Covid policy. How the reopening is going to play out is subject to a lot of debate. The rally in hard commodities signifies an expected surge in demand. China-linked equities have also rallied, but investors started pulling capital because of concerns regarding the strength of the reopening.

Chinese rebound is expected to be led by consumption instead of investment, as was the case during the 2 previous recoveries in 2010 and 2021. This will lead to higher domestic demand for commodities, higher demand for foreign goods and services, and stabilization of supply chains.

Goldman Sachs analysts believe that due to a faster-than-expected reopening, China will grow by 6.5% in 2023 on a Q4/Q4 basis. This growth will be driven through 3 main channels: increased domestic demand, international travel, and commodities demand. The increase in domestic demand will benefit China’s closest neighbors since the Association of Southeast Asian Nations (ASEAN) is the biggest trade partner of China. The currencies of the members of ASEAN saw a huge increase in value during the days following the reopening, but the combination of a strengthening dollar with inconclusive data coming in from China led to them going back down again.

Source: Bocconi Students Investment Club

International travel has already largely recovered in China, with the largest numbers of Chinese tourists going to Southeast Asia, once again contributing to the increase in the respective currencies’ value.

China’s Reopening effect on Latin America

The post-‘COVID zero’ reopening of the Chinese economy has substantially improved its growth outlook, as the International Monetary Fund’s most recent annual report on China, projects a 5.2% growth in the country’s GDP for 2023, followed by a consistent GDP deceleration, with 2028 projections of a 3.5% GDP expansion.

Source: International Monetary Fund

The report highlights the declining workforce and slower productivity growth as reasons for slower Chinese expansion following the pandemic. The previous structural change in its workforce (from agriculture to manufacturing) has already exhausted the earlier double-digit growth gains, as the country is currently moving more and more into the service industry. It’s also very likely to see China shifting its focus from investing abroad to stabilizing its domestic demand, by providing its citizens with some sort of financial compensation like unemployment benefits and health insurance. The IMF report also mentions that “rebalancing between the public and private sectors”, or in other words reforms of state-owned companies, currently underperforming their privately owned counterparts, would also result in a temporary production boost.

So, what does this mean for the rest of the world? According to projections, a 1% increase in China’s economy has a spillover effect of 0.3% on other nations. This impact may be further amplified in some parts of Latin America because of China’s trade’s importance to the countries in the region.

Source: Reuters

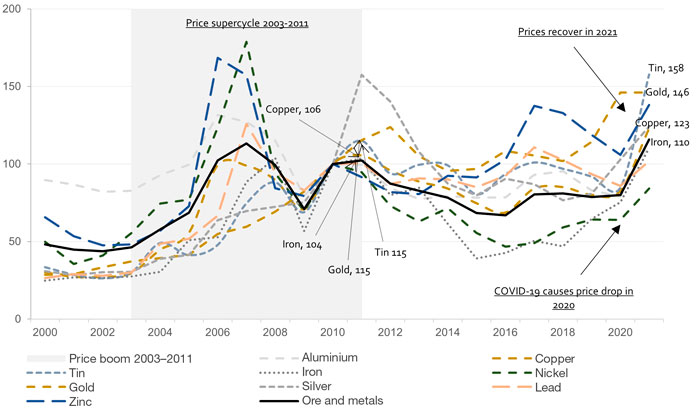

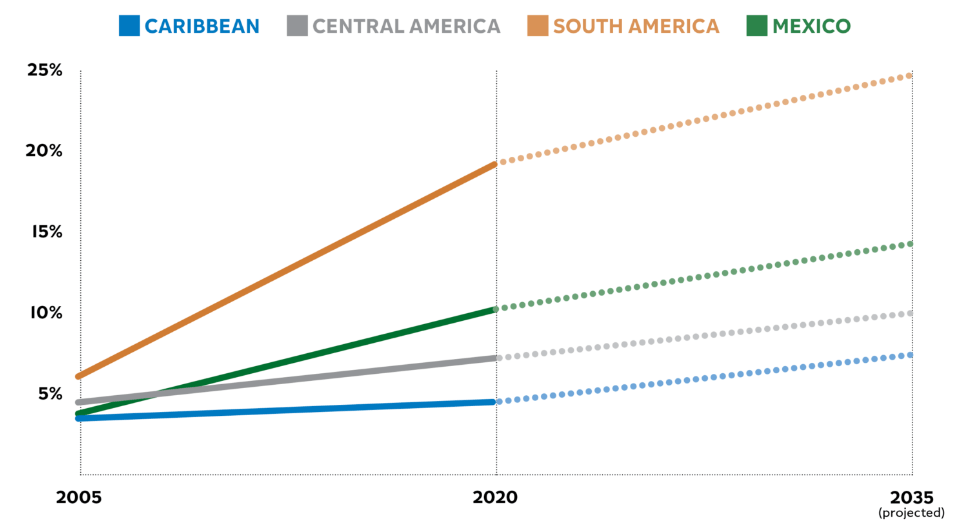

The decades since 2002 China’s industrialization triggered a commodity boom in Latin America, which was one of the main contributors to what was known as the 2000s Commodity Super Cycle. China started increasing its trade with Latin America while replacing the existing US supply chain. Trade between LATAM and China grew from $12bn in 2000, or 0.6% of Latin America’s GDP, to $445bn in 2021, or 8.5% of the region’s GDP. By 2021, China’s share of Latin American trade increased to 18% from only 5% back in 2005. This share rises to 24% if we exclude Mexico. Although China has become the primary trading partner for South America (Brazil, Chile, and Peru), the US still has a greater influence over Mexico and most of Central America.

Source: Economic Commission for Latin America and the Caribbean

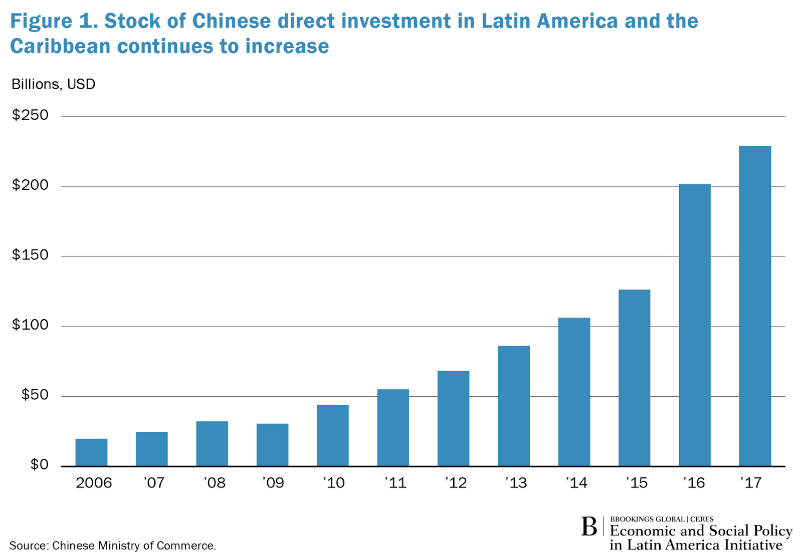

On top of that, between 2005 and 2020, Chinese “policy banks” like China Development Bank (CDB) and Export-Import Bank, started aggressively investing, and providing loans to LATAM, worth more than $138bn. This has caused a substantial boost in Latin America’s GDP, and an overall decrease in unemployment and poverty.

Source: The Economist, Brookings

Currently, China consumes more than 16% of the world’s oil, more than half of the copper, and more than 60% of the iron ore. Chile sends 67% of its copper exports to China, while Brazil sends 70% of its soybean exports there. On top of that 30% of all Brazilian exports, and 40% of all Chilean ones are absorbed by China.

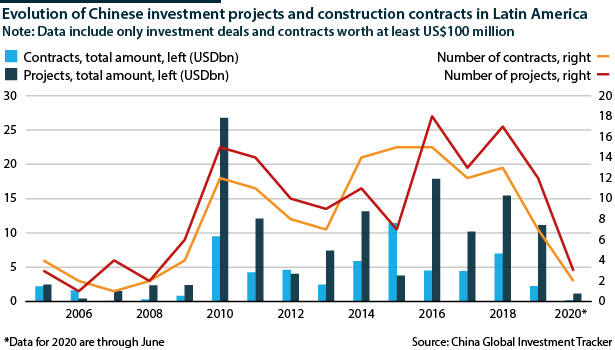

Even though China’s recent reopening seems like the perfect prerequisite for another Supercycle and a foreseeable LATAM economic prosperity, this may not be exactly the case. Current challenges in China like the domestic property slump, and repercussions of its trade conflict with the US point to a shift in China’s engagement with some parts of the region. Since 2020 China’s policy banks have adopted a more careful approach to lending, suspending all new loans to LATAM countries.

Source: Oxford Analytica, The Economist

The main reasons behind this decision would be the CDB’s focus on meeting development goals at home, and the continued losses incurred from the oil-for-loans deals with Venezuela after its current president Nicolás Maduro came to power in 2013. Shifting policies and administrations during the pandemic coupled with pushback from environmentalists are also causing a further stall in LATAM investments. Even if a surge in engagement with the region is observed as China reopens, it’s very unlikely to follow the same trajectory, as in the 2000s

Exports to and Imports from China, as a Percentage of Overall Trade

Source: Policy Center

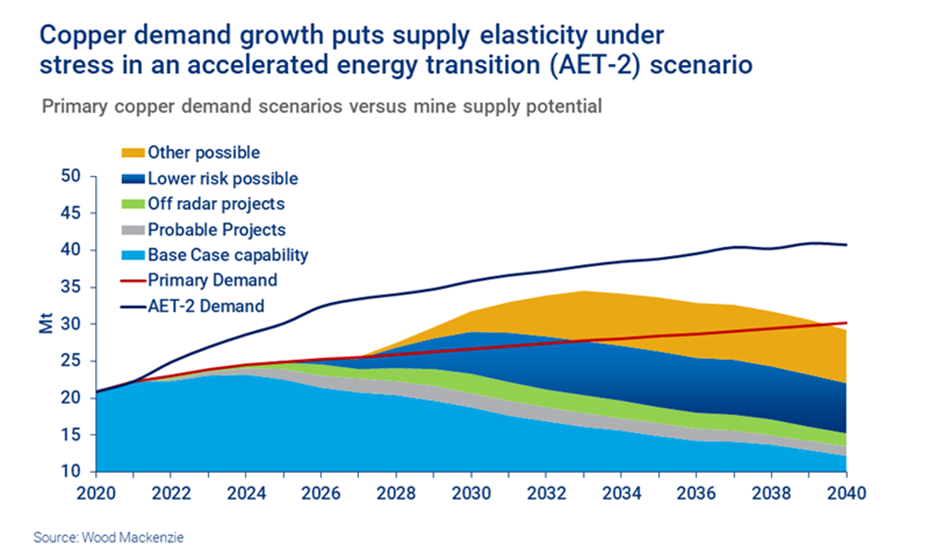

The country’s economic ‘rebalancing’ is expected to proceed towards higher-value services and the manufacturing of high-tech goods, with a particular focus on electric vehicles and renewable energy. This shift will be accompanied by changes in its import patterns and investment priorities. In relative terms, China’s imports of crude oil will fall, and those of critical metals and minerals like aluminum, lithium, and copper will rise. Between 2005 and 2009, 95% of all foreign direct investments (FDI) by China in LATAM went into raw materials, now this share has fallen to 46%, with focus shifting towards manufacturing and services, so it would be worth examining how this was reflected in recent trade development, and commodity prices.

During the last 8 years, Latin American exports of aluminum (used for solar panels) to China grew 28-fold. Over the same period, China increased its imports of Ecuadorian balsa wood (used for wind turbines) by 57%. Demand for batteries used in EVs has pushed lithium prices from a five-year average of $14,000 per tonne to $72,000 last year. Goldman Sachs projections point to a surge in demand for copper with expectations of prices reaching $11,000 in the next 12 months.

Another factor that should be taken into account is that China is becoming more strategic in its investments, with infrastructure, and electricity being key areas. Between 2017 and 2021 investments in the electricity sector represented 71% of Chinese M&As in LATAM, with major Chinese state-owned firms splurging $6bn collectively to buy Chilean and Peruvian electricity companies in 2021. Infrastructural investments seem to be accelerating as well. From a total of 192 regional infrastructure projects with Chinese involvement in the last 15 years, 57 were carried out in the last 2 years. According to The Economist, this may have to do with strategic projects linked to strengthening China’s food security, since a state-owned firm is currently building a port 50km north of Lima to increase China’s supply of food. The recent scandals with the telecom giant Huawei are another example of China trying to gain further influence over the tech market in LATAM. This event caused pushback from Trump’s administration, which tried to extend a loan to Ecuador to help it pay off billions of dollars worth of debt to China under the condition that it would exclude Chinese telecom firms from its 5G network.

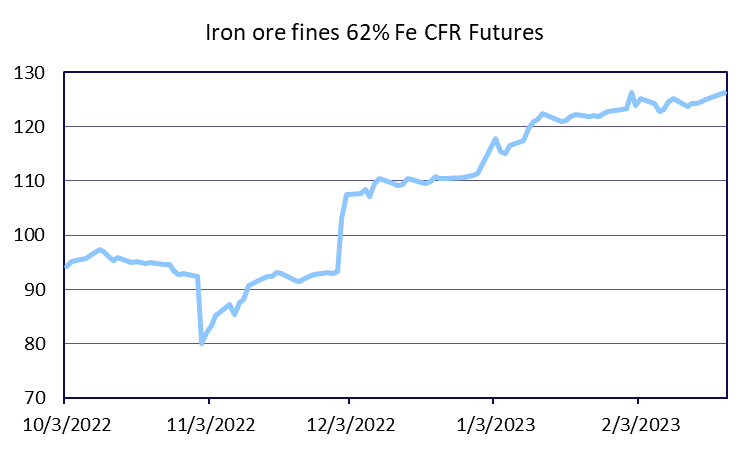

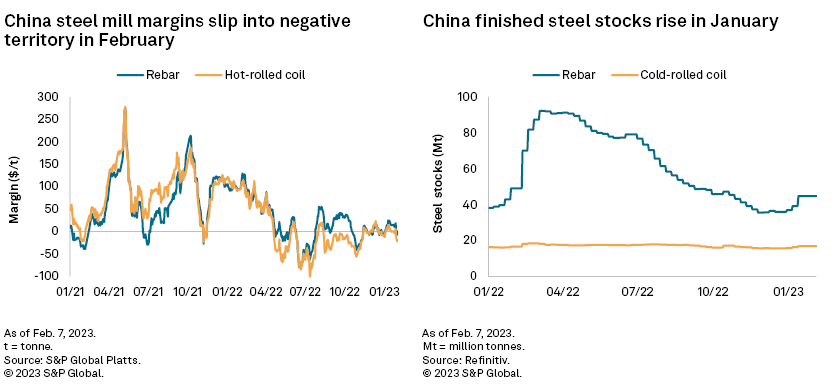

Iron Demand Side

Currently, Iron prices seem to be driven by positive sentiment with regard to the Chinese reopening. Concrete economic data has not yet shown the effects on iron demand coming from China, however. Wood Mackenzie is expecting that iron demand during 2023 will largely remain the same as in 2022. The positive sentiment is largely coming from expectations that the property sector is going to rebound because of increased stimulus after the next annual National People’s Congress on March 5th. And indeed, some metrics seem to be pointing in that direction, new home prices were up 0.1% MoM in January. That coupled with strong stimulus from the government such as allowing some cities to abolish the floor for mortgage rates for first home-buyers, is potentially signifying a recovery in the Chinese property market, which is one of the main drivers of steel demand and in turn iron demand.

Source: Bocconi Students Investment Club

That is not the complete picture, however. Private home surveys have indicated that home sales by floor area have fallen by 20% YoY. December data indicates that new residential space under construction fell by 39.8% YoY. This suggests that even though new home prices have increased, construction has been lagging, and thus demand for iron might not be as high as expected because developers have to deal with a large unfinished pre-sold housing stock. On top of this, iron imports have also been led by restocking activities before the Lunar New Year, but the boost in demand has yet to materialize. This has led to excess steel stocks, and consequently less steel production leads to less demand for iron ore.

Furthermore, the expectation that the property sector will be supported by government stimulus might be too optimistic. We must consider that China had to borrow a lot in order to keep the economy running in 2022. The combined public and private debt across all sectors of the economy reached $51.9 trillion, which is almost 3 times China’s GDP. Thus, the government might be more reluctant when it comes to borrowing in order to finance infrastructure investments, which has historically been its preferred way of boosting the economy.

Source: Bocconi Students Investment Club, The World Bank

This can be observed by looking at China’s fixed capital formation as a percentage of GDP. In the 90s and after the housing crisis of 2008, China managed to increase growth by funding investments through fiscal stimulus and lax monetary policy. This might not be possible given the current deficit. Additional borrowing also has a demographic problem. Because of China’s one-child policy, young workers are becoming scarcer. The economy is expected to soon have 3 retirees for every worker. This will lead to further borrowing in order to fund those retirement plans. Having that in mind, it is unlikely that Beijing is going to expand the deficit much further.

Source: Refinitiv, S&P Global

Iron Supply Side

The price has also been supported by constraints on the supply side. In January there were weather-related disruptions to Brazil’s exports, which pushed up the price of iron even further. These disruptions however can be explained by seasonal factors and the expected 2023 iron exports from Brazil remain unchanged at 310-320 Mt. Despite a small slump in February, Australian exports of iron ore remain strong and are expected to keep growing as the relationship between Australia and China improves. Ukraine’s exports are expected to decline even further in 2023. India’s iron exports to China plunged in 2022 because of high tariffs and overall low demand.

Trade Idea

Based on our macro analysis we believe that critical metals and minerals, especially copper, would experience surges in prices soon. China’s changing focus towards higher-value services and the manufacturing of high-tech goods would see increasing demand for commodities crucial for the construction of infrastructure, renewables, and energy power plants, as well as batteries for EVs.

Source: United States Geological Survey

Around 50% of all copper is currently produced in LATAM. As China is moving towards manufacturing and the service industry, this share would only grow larger, while the demand for copper would just keep increasing. At the beginning of February, Copper futures fell sharply and as of this date are trading at $3.95 per pound, or $8,805.8 per ton, which is still $2200 cheaper than Goldman Sachs’ expectations of $11,000 by the end of the year. This recent downturn was mainly caused by speculations as at the start of January concerns about possible demand erasure from central banks clashed against supply restrictions. This coupled with the lower-than-expected Chinese industrial demand following the new year celebrations pushed prices down. Despite this, China’s current copper reserves are at a 15-year low, and production halts in major South and Central American regions compounded concerns about low inventories in the US and Europe, as well as adding to views that copper markets could be heading into a deficit. Current projections point exactly to this as well.

Source: Wood Mackenzie

Also, copper mining is very crucial for the ever-growing demand for EVs and “Carbon” goals, as roughly 84% of cobalt (a key element for the production of EV batteries) comes as a “side benefit” of copper and nickel mining.

Source: Edison Lithium Corp

Currently because of mining deferments in Peru (the second largest copper producer) caused by political unrest, ore processing operations in Panama have been recently halted due to government tax and royalty payments issues from Canada’s First Quantum Minerals. In our view, all of this presents the perfect storm to invest in copper futures.

To hedge our long copper position we are going to go short iron, since iron and copper experience a strong positive correlation of 0.87, and we believe iron prices will underperform copper, as demand for copper is increasing at a faster rate. Additionally, iron demand fell by only 1% in 2022, so the reopening should not really boost its demand substantially. Currently, the markets are expecting increased fiscal stimulus to boost the property market and the steel sector, boosting iron prices. This however might be an overly optimistic view given the current deficit, which we expect the government is going to try to contain. We expect copper to outperform iron mainly because iron depends too much on additional government stimulus, regardless of the strength of the recovery. That is why we should go short iron.

Specifically, we recommend going long March HG Copper futures and short March SCI Iron Ore futures since those are the most liquid futures. Currently, the carry of the short side of the trade is -1.94%, and the carry of the long side of the trade is 1.59%. This means that the overall carry of the trade stands at -0.35%. Since the cost of carry is relatively small, we can roll the trade if needed, although it would be preferable to take profit soon after the National People’s Congress on March 5th when we expect the two prices to converge.

It is worth mentioning that a reopening does not always mean more growth and mobility. This was the case with South Korea and Taiwan’s reopening. It was caused by surging COVID-19 cases after the relaxation of pandemic measures, which prompted people to practice social distancing even without official lockdowns. We cannot overlook a similar thing occurring in China. In that situation however, we will win on the short side of the trade as iron demand drops and storages are full, and we expect to lose less on the copper side of the trade.

Sources

- Caribbean, Economic Commission for Latin America and the. Developments in the prices of natural resources for export in Latin America and the Caribbean. 29 Apr. 2022, https://www.cepal.org/en/insights/developments-prices-natural-resources-export-latin-america-and-caribbean.

- Chinese Influence in Latin America Will Increase. https://dailybrief.oxan.com/Analysis/DB256518/Chinese-influence-in-Latin-America-will-increase. Accessed 26 Feb. 2023.

- Ezrati, Milton. “China’s Overwhelming Debt Burden Points To Still Deeper Problems.” Forbes, https:// www.forbes.com/sites/miltonezrati/2023/01/16/chinas-overwhelming-debt-burden-points-to-still-deeper-problems/. Accessed 26 Feb. 2023.

- Iron Ore CBS February 2023 – Prices Ease as China Optimism Fades. https://www.spglobal.com/ market intelligence/en/news-insights/research/iron-ore-cbs-february-2023-prices-ease-as-china-optimism-fades. Accessed 26 Feb. 2023.

- Mak, Robyn, et al. “Breakingviews – China’s Growth Path Will Be Felt around the World.” Reuters, 14 Oct. 2022. www.reuters.com, https://www.reuters.com/breakingviews/chinas-growth-path-will-be-felt-around-world-2022-10-14/.

- Breakingviews – China’s Growth Path Will Be Felt around the World.” Reuters, 14 Oct. 2022. www.reuters.com, https://www.reuters.com/breakingviews/chinas-growth-path-will-be-felt-around-world-2022-10-14/.

- Srinivasan, Krishna, et al. Asia’s Easing Economic Headwinds Make Way for Stronger Recovery. 20 Feb. 2023, https://www.imf.org/en/Blogs/Articles/2023/02/20/asias-easing-economic-headwinds-make-way-for stronger-recovery#:~:text=Global%20financial%20conditions%20have%20eased,from%203.8%20percent%20in%20202

- “The Impacts of China’s Economic Reopening on Latin America.” Policy Center, https:// www.policycenter.ma /publications/impacts-chinas-economic-reopening-latin-america. Accessed 26 Feb. 2023.

- “What Does China’s Reopening Mean for Latin America?” The Economist. The Economist, https://www. economist.com/the-americas/2023/01/18/what-does-chinas-reopening-mean-for-latin-america. Accessed 26 Feb. 2023.

- What Role for China’s Policy Banks in Latin America and the Caribbean? | Global Development Policy Center. https://www.bu.edu/gdp/2022/03/28/what-role-for-chinas-policy-banks-in-latin-america-and-the-caribbean/#:~:text=There%20are%20several%20probable%20reasons,of%20continued%20losses%20in%20Venezuela. Accessed 26 Feb. 2023.

0 Comments