Introduction

This article discusses the impact of Trumponomics (Trump’s economic program) on the valuation of regional and international banks’ stock prices. It starts by providing an overview of the US banking system, and then moves towards explaining Trump’s expansionary fiscal program and its implied effect on the valuation of regional and international banks’ stocks. Finally, a fundamental analysis based on P/E, P/B, and spread (ROE-WACC) is made to provide empirical support to our hypothesis.

Trumponomics

After the election of Donald Trump as the US president in November 2016, financial markets in the United States have had to adjust to a period of uncertain fiscal policy. One of these important circumstances refers to the tax reform and expansionary fiscal programs that President Trump has been talking about since his appointment. In fact, Trump’s economic team announced on April 26th 2017 a radical slash on corporate taxes from 35% to 15%, and a “one-time” cut of the tax rate to induce companies to repatriate profits held abroad. The expectation of the biggest tax cut ever unveiled in US history has shown a particularly noteworthy positive impact on small cap companies of every major economic sector to date. However, Trump’s indolent policy implementation stance, along with a reluctant majority in Congress, has raised concerns on misleading pricing expectations in financial markets, as investors were vastly expecting a more feasible tax plan than the one revealed on Wednesday. Principally, when analysing the United States’ financial services industry, large attention has been driven to a potential overpricing of regional banks’ stocks. Hence, the scope of this article is to understand the effect of Trump’s fiscal policies on the future stock prices of regional and bulge bracket banks in the US, and also to comment on the larger picture of the US banking system.

US Banking Industry Overview

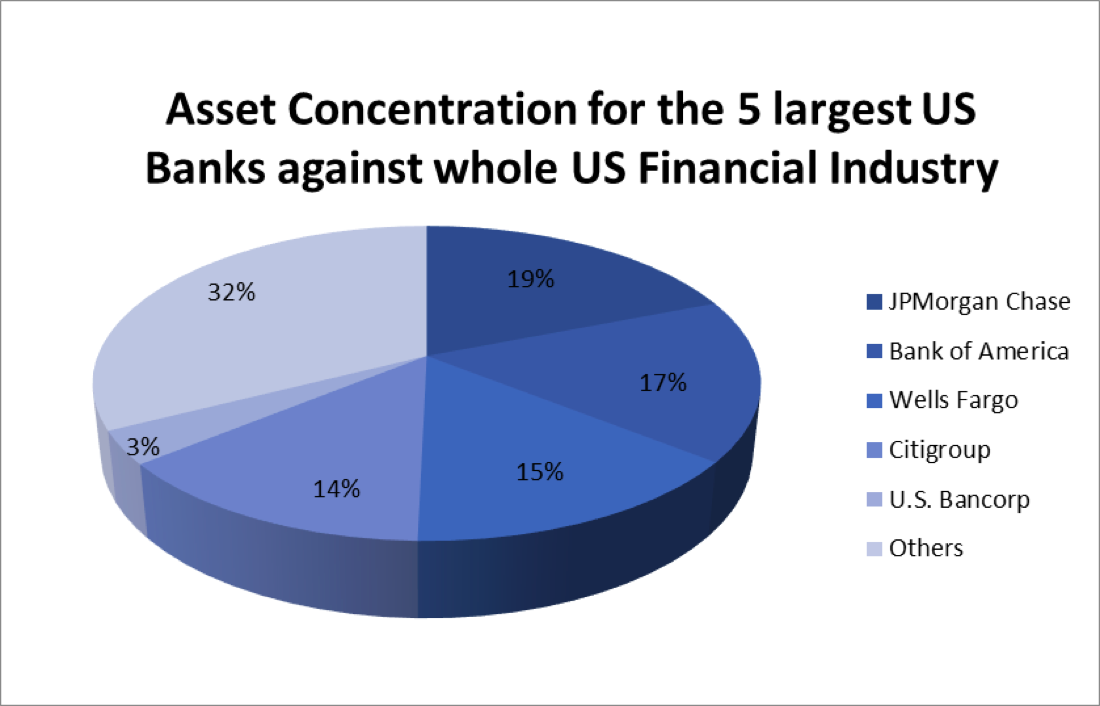

The financial services industry in the United States is broadly divided into two classes: regional banks, and international or mega banks. Regional banks are smaller financial institutions which focus on providing commercial banking services, and therefore have little to none investment banking operations. On the other hand, international or mega banks are those that have large operations outside US borders and whose total revenues rely heavily on trading and investment banking services. Over the last couple of years, the banking industry in the US has developed towards a centralization of market share, as the largest five US banks, JPMorgan Chase, Bank of America Merrill Lynch, Citigroup, Wells Fargo, and US Bancorp, control approximately 68% of the industry’s assets.

Chart 1: Asset concentration for the 5 largest US banks (source of chart data: Forbes)

Chart 1: Asset concentration for the 5 largest US banks (source of chart data: Forbes)

Diving into the profitability of regional vs. international banks, one can find various differences in revenue generating factors. When analysing the financial performance of regional banks, three main parameters are distinguished; 1) loan growth, both consumer and commercial, 2) net interest income and net interest margin (spread between deposit rate and loan rate), 3) credit performance. Taking an average of the five biggest US regional banks, US Bancorp, PNC Financial Services, Capital One Financial, BB&T, and SunTrust Banks, one finds that the patterns of profitability and credit performance are very similar among regional banks. The 12-month Average Total Revenue Growth is 5.8%, and the Non-Performing Assets are 1.08%, both can be regarded as strong indicators. Overall, average loan growth is worse, down from 52.3% of GDP 2Q 2016, to 52.2% of GDP 3Q 2016 (last data available), but with the recent interest rate hikes the effects on strength are uncertain. On the other hand international banks also produce revenues from trading activities and underwriting processes, besides just acting as depository and lending institutions.

Effects of Trump’s Policies on Stock Valuations

After 100 days in office, President Trump continues to be as abstract and vague as possible on his expansionary fiscal policy program. Actually, it seems that investors have started to believe that “there is no tax plan after all”. His announcement last week seemed to be identical to the campaign proposals: going from seven to three personal income tax brackets; raising the tax-free amount individuals can earn; eliminating inheritance tax and the “alternative minimum tax”; and a radically lower tax on business profits of 15 per cent, extended to cover non-incorporated business people. In reality, the only difference is the fact that the plan lacks the promised revenue-raising measures, hence further posing a threat to the United States’ massive deficit. All scenarios seem to point to an ineffective and unsustainable tax plan.

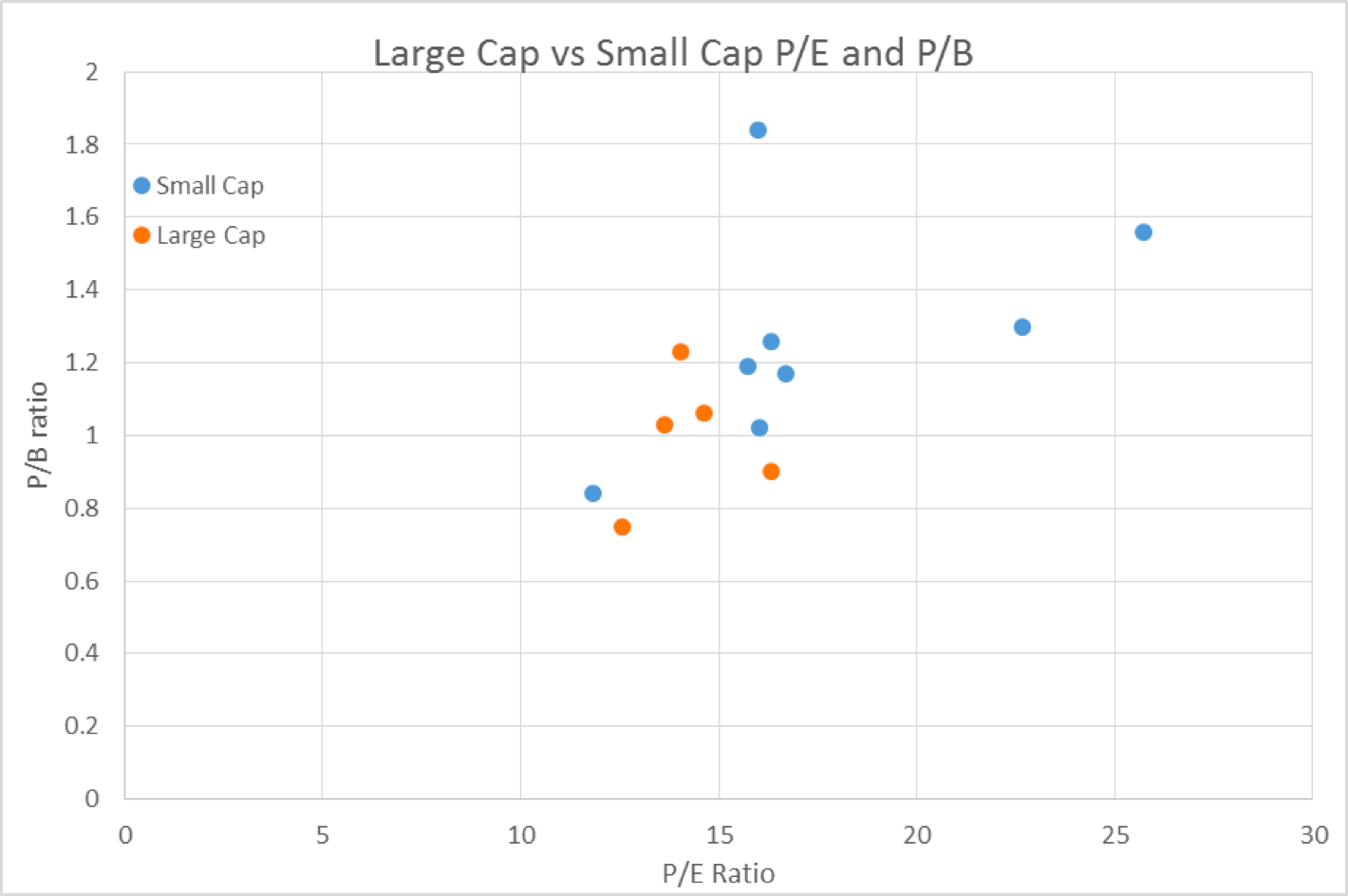

To compare the impact of Trump’s economic policies on the profitability of small cap regional banks to the profitability of large cap international banks, the Price to Book values were plotted against the Price to Earnings values for a sample of small and large caps. The sample comprised 8 small caps, and 5 large caps. As follows:

Chart 2: International vs regional US banks P/E and P/B (source of chart data: Tiingo.com)

Chart 2: International vs regional US banks P/E and P/B (source of chart data: Tiingo.com)

Interpreting these results, we can conclude that regional banks (small caps) have better P/E and P/B ratios than most bulge brackets (relatively higher prices). These results show the fact that expectations of a tax cut by Trump inserted an upward pressure in the stock prices of regional banks. As the tax reform seems less and less likely to pass, as evidenced by reactions to this Wednesday’s announcement, we would expect investors to reduce their bullish expectations in regional bank’s stock prices further. These reduced expectations come as a result of the sensitivity of revenue streams of regional banks to tax-cuts. However, if Trump manages to find a sound and effective strategy for implementing his tax-cut programs, then we should expect regional stock prices to go up. With regards to international banks stock prices, we can see that they are less sensitive to the tax-cut program, as investors did not raise their expectations on prices as much as for regional stocks, since their revenue streams are highly dependent international trading transactions and services.

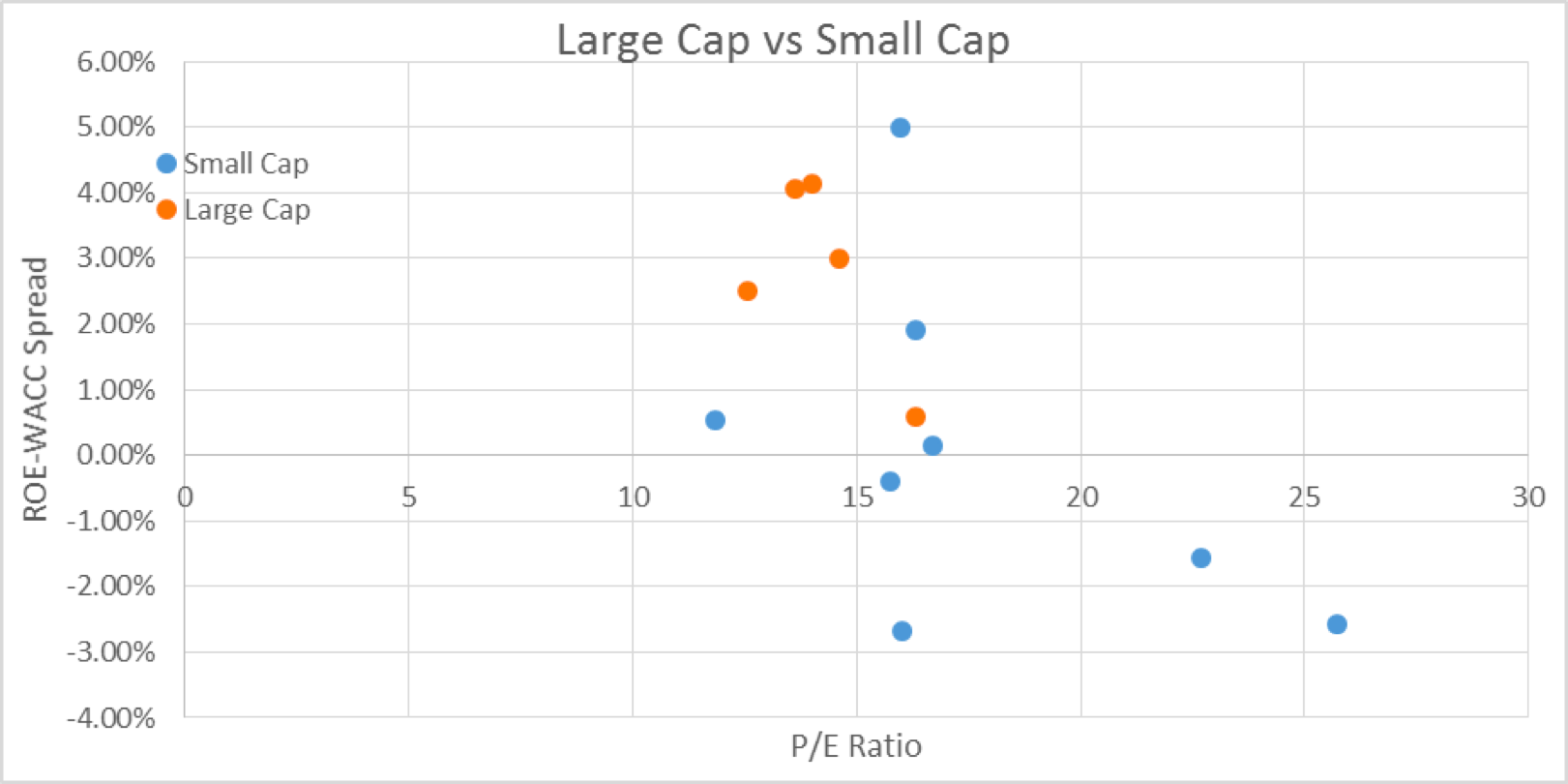

In addition, the ROE-WACC Spread was plotted against the P/E ratio for the same sample used above. As follows:

Chart 3: ROE-WACC vs P/E for regional vs international US banks (source of chart data: Tiingo.com)

Chart 3: ROE-WACC vs P/E for regional vs international US banks (source of chart data: Tiingo.com)

From this scatter plot, we can see that most of small caps have a negative spread (value added to investor), whilst those of big caps have a positive value. This further adds to our hypothesis that small caps are overvalued. A fundamental reason might be that large caps are more leveraged than small caps. Hence, in the calculation of ROE (Net profits/Equity) with small caps the denominator is a lot larger, relative to the profit, than with large caps. Therefore, and having in mind that interest expense on debt is tax-deductible, small caps would benefit disproportionately from tax cuts should they happen, and will potentially become the bigger losers in the current scenario where tax reform is stalled.

Finally, and re-stating our macroeconomic view of the impact of Trumponomics in the US financial industry, regional banks (small caps) are expected to fall off more than international banks (large caps) if Trump’s expansionary fiscal policies are not accepted by Congress. Fundamental reasons are related to the reduced leverage of small caps, and to the historically priced benefits of tax-cuts. Furthermore, the aforementioned concentration of the banking industry in the United States heavily favours bulge bracket banks, while forcing many small caps to shut down branches around the country. This adverse growth environment is yet another important reason why we expect regional financial organizations in the US to perform increasingly poorly in the future. A potential trading strategy deriving from our analysis could be to short the iShares U.S. Regional Banks ETF as Trump’s tax reforms become less probable to be accepted.

0 Comments