Introduction

On March 29, 2022, UnitedHealth Group Inc. announced it would acquire LHC Group Inc. for $5.4bn. The deal is expected to close in the second half of 2022, pending shareholders’ approvals and regulatory approvals. This deal comes immediately after UnitedHealth’s $13bn acquisition of Change Healthcare which the US Department of Justice has recently filed a lawsuit against in an attempt to block the takeover. These daring moves epitomize UnitedHealth Group’s desire to get ahead of the profound and rapid undergoing changes in the healthcare industry, especially that of the growth of home-based healthcare. The recent years of turmoil in the industry, which climaxed with the Covid pandemic, have put pressure on companies to adapt and get ahead of the trends, and this is just what UnitedHealth Group hopes to do with the home-based healthcare market through its acquisition of LHC Group.

About UnitedHealth Group

Based in Minnesota, UnitedHealth Group is the largest healthcare company in the USA, and the world’s eighth largest by revenue. It is divided in two main branches: United Healthcare which accounts for 80% of revenues and Optum.

The first branch, United Healthcare, aims to offer a full range of health services, enabling affordable coverage and simplifying the health care experience. It does so through four businesses. UnitedHealthcare Employer & Individual is the first of these four businesses: it serves 26.4m Americans by offering health benefit plans for employers ranging from the public sector to small businesses. The second business, UnitedHealthcare Medicare & Retirement, aims to preserve the health and well-being of 13m seniors. The third business, UnitedHealthcare Community & State, provides diversified health care benefit products and services to 7.7m Americans in programs that care for the poor and the medically underserved. Lastly, UnitedHealthcare Global delivers medical and dental benefits to 7.8m people living, working, and traveling worldwide.

The acquisition will be made by UnitedHealth’s second branch: Optum. Optum oversees assisting partners and providers by delivering the accurate guidance and data they need to achieve better health services. Optum also serves customers through various businesses. Optum Health provides care directly through local medical groups and ambulatory care systems, including urgent and surgical care to 100m consumers. Optum Insight provides data and research to customers to help them reduce administrative costs and improve clinical performance. Lastly, Optum Rx offers a multitude of pharmacy care services.

About LHC Group

LHC Group is based in Louisiana and provides post-acute healthcare to patients through its home nursing agencies, hospices, and long-term acute care hospitals. Operating in two segments, home-based and facility-based services, it is one of the US’s largest providers of quality healthcare. Last September, the group announced that it had finalized its previous agreement to purchase the Heart of Hospice from EPI Group to expand its network of hospices in the US, bringing it to almost 150 locations. The company now has 30,000 employees and facilities in 37 states, which allows it to reach sixty percent of the US population aged 65 and older. LHC Group is recognized globally for its lead in the home-based healthcare industry: “LHC Group’s sophisticated care coordination capabilities and its warm, human touch is so important for home care” said Optum’s CEO.

Industry Overview: Home Healthcare

The Healthcare industry aims to provide services to treat patients with preventive and rehabilitative care. It is thus composed of establishments devoted to prevention, diagnosis, treatment, and rehabilitation of medical conditions, both from home and facilities.

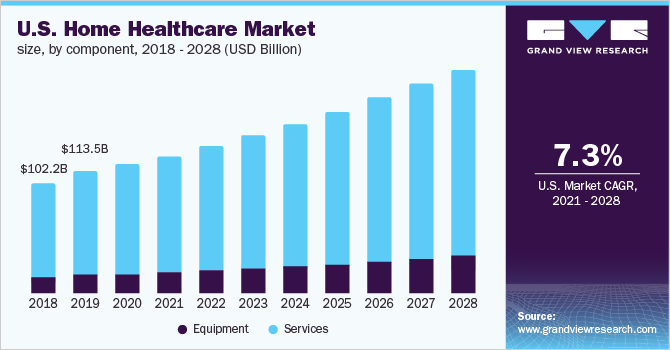

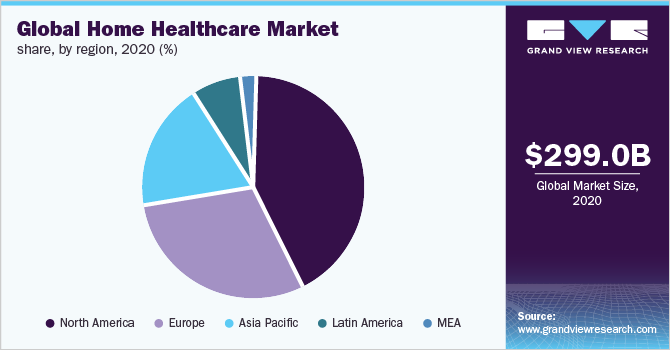

Health is omnipresent in our lives and its evolution has always been intimately tied to changes in culture and technology, amongst many others. Over the last years, a new trend has started to play an important role: the growth of home-based services. Reaching $229bn even before the pandemic, this market has since been growing at an ever-faster pace, especially in North America and Europe. In fact, as customers’ lifestyles change and the healthcare industry innovates, the US home healthcare market is expected to reach a 7.3% CAGR. Key factors of this growth include population aging around the world, hence rising healthcare expenditure by the population, and increased patient preference for value-based healthcare. Challenges in the development of such services are rapidly becoming an important subject in developed countries: what role should governments play? How strict must policies be? In Europe, governments have large control over the home-care sector: they are in fact involved in providing care and assessing individual care needs instead of providing the conditions for other organizations to provide home care. Nonetheless, in Europe and other developed countries, financial constraints may drive the focus more towards private companies. According to the World Health Organization, several country experts interviewed in a study mentioned the lack of regulation on the private sector as one of their main concerns. Hence, future governments will likely be concerned with regulating privately owned home-care providers and less involved in needs assessment and provision.

The ongoing pandemic has also played its role in reshaping the industry. For example, due to revised norms with regards to the Covid-19 pandemic, service providers expanded their portfolio by offering services such as at-home Covid-19 testing. The pandemic has transformed how Americans interact with their healthcare providers. Previously slow to catch on to the benefits of technology, clients, doctors, and regulators are embracing the benefits of delivering patient care virtually: in April 2020, telehealth services were being used by 46% of consumers, up from 19% the prior year. McKinsey’s recent report “From facility to home: How healthcare could shift by 2025” states that: “up to $265bn worth of care services (representing up to 25 percent of the total cost of care) for Medicare FFS and MA beneficiaries could shift from traditional facilities to the home by 2025”. Healthcare providers have thus been trying to adapt by offering new services and making strategic acquisitions. The home healthcare market is still relatively fragmented and comprised of independent providers. More than three quarters employ workforce of fewer than 50 workers. It is in this context that consolidation is taking place, as companies look to expand their services in areas such as hospice care and home health. For example, since the beginning of the pandemic, Charter Health Care Group has acquired Vitality Home Healthcare. Also, Chicago-based private equity firm the Vistria Group sold St. Croix Hospice to an affiliate of investment company HIG Capital.

Source: https://www.corporateknights.com/responsible-investing/divestment-study

Deal Structure

UnitedHealth Group, the largest US health insurer, announced on March 29th that it will buy LHC Group for $5.4bn in cash in an effort to expand its home health services. LHC is set to become part of UnitedHealth’s Optum Health arm. LHC Group which had $2.2bn in sales last year will be acquired by UnitedHealth for $170 per share. The offer price for each share represents an 8.1 percent premium over the previous day’s closing stock price (March 28th.)

UnitedHealth expects the LHC purchase to have no impact on its adjusted profit per share estimate in 2022 and to add modestly in 2023. Following the closing of the agreement LHC Group co-founders Keith and Ginger Myers will invest $10m in the health insurer’s stock.

UnitedHealth estimated the deal’s total worth to be at $6bn including debt. The transaction is expected to finalize in the second half of 2022 according to United Health. However, the deal must yet be approved by regulators and LHC Group shareholders.

Deal Rationale

The merger will bring together LHC’s healthcare services at home, primarily for elderly patients suffering from chronic illnesses and injuries, with UnitedHealth’s Optum unit which handles prescription benefits and provides healthcare data analytics. The deal will add one of the largest home-health companies in the US to a portfolio that already includes doctor groups, clinics and surgery centers as well as some home-based services.

In the US, demand for home healthcare has surged over clinic-based services, particularly during the COVID-19 pandemic, as patients and caregivers increasingly prefer to obtain crucial services from the comfort of their own homes. Due to an aging population and some families unwillingness to turn to nursing homes, in the wake of the Covid-19 outbreak, demand for home health has been rising. According to the Centers for Medicare and Medicaid Services, spending for home healthcare increased to $121.6bn last year and is expected to rise to $226.4bn by 2030.

Wyatt Decker, the CEO of Optum Health stated that the firm is seeing an increase in demand for home-based care from patients and their families. “This trend has really only just begun, of how much care can truly be delivered in the home,” he said in an interview. “We can give care in the home which is a lower-cost setting…than nursing homes or more advanced care facilities.” According to him the purchase will also “enhance the reach of Optum’s value-based capabilities along the full continuum of care including primary care, home and community care, virtual care, behavioral health and ambulatory surgery”.

The goal of UnitedHealthcare, the country’s largest health insurer, is to promote home health as a less expensive option to nursing homes and as a tool for reducing hospital stays. More care can now be offered at home because of technological advancements, providing even more flexibility. In order to reduce hospital stays further, health insurers have also started stressing more regular care for their clients, and home care would certainly help in this. The insurer aims to reduce hospital stays particularly among the Medicare population as this is a profitable growth engine for the business. Under the federal program, managed-care companies sell private Medicare Advantage plans, which are privately administered versions of government-funded Medicare coverage for persons 65 and older or with certain severe disabilities. An older population, increased penetration in comparison to fee-for-service plans (Medicare Advantage is predicted to reach 40% penetration by 2025), and a continued favorable regulatory climate are all contributing to making the Medicare population increasingly profitable.

UnitedHealth’s expansion has been fueled by acquisitions. Nevertheless, the deal comes a month after the US Justice Department sued to stop UnitedHealth’s $8bn acquisition of the billing and payment services provider Change Healthcare. The antitrust regulators stated that UnitedHealth was in danger of gaining too much influence over healthcare data and that it may utilize its new asset to help its insurance unit against competitors. UnitedHealth has responded, claiming that the Change Healthcare agreement will lower costs and improve client service and so has disputed the Justice Department’s assertions.

The deal also comes as a response to Humana Inc, UnitedHealthcare’s biggest rival in the Medicare business. Humana Inc. completed its acquisition of Kindred at Home last year spending nearly $5.7bn for the 60 percent stake of the company it didn’t already own. Humana claims to be the country’s largest home-health service. In the US, UnitedHealth and Humana are the two major suppliers of privately run Medicare Advantage programs. According to the Kaiser Family Foundation, they accounted for approximately 45 percent of the more than 26m people registered last year. This deal may also be seen as an attempt by UnitedHealth to compete with Humana on the Medicare Advantage market by expanding into stay-at-home care and so offering lower prices, a lesser risk of obtaining Covid and constant monitoring to attract customers.

Market Reaction

After the deal announcement, just before the opening bell, LHC shares were up 7.5 percent and trading just below the offer price of $168.70, while UnitedHealth shares were up modestly, just 0.1%. LHC Group shares were trading below 2020 levels where they registered an all-time high price of $214.61. However, LHC shares were increasing with respect to Q3 and Q4 2021, where they fell due to earnings below estimates. United Health shares on the other hand, are currently at their all-time high and have been increasing since 2018. This is partly due to the Medicare population which has been incessantly drawing profits to the insurance business.

Financial Advisors

SVB Leerink and Jefferies LLC served as financial advisors to LHC Group while United Health’s financial advisors have not been disclosed.

0 Comments