Introduction

The BIS triennial survey held every 3 years indicated most recently in 2019 that the USD was on 88% of all transaction. This makes it the world most used currency and the main reserve currency of centralbanks and transaction. However, another currency has recently made great gains in terms of adoption. The Chinese yuan. In this article we will investigate what defines a dominate world currency, the requirements to becoming one, the role of commodity markets and lastly how China has been able to make their jump in adoption and if it will eventually be able to overtake the USD.

The International Role of US Dollar

A global currency is a currency which is widely accepted for trade, invoicing and issuance of debt across the world. In the world there are 151 currencies, but the U.S. dollar is clearly the leader. Not only it is a currency of the world’s largest economy, but also it is the main reserve, invoicing and FX currency.

However, considering the economic growth of China during the last 30 years and looking at its Made in China 2025 plan, we are going to examine how strong is the dollar’s position world, what characteristics global currencies have and whether Renminbi has any chances of becoming such currency in the foreseeable future.

- History of US dollar as world currency

The history of the dominance and the status of the U.S. dollar dates back to the Bretton Woods arrangements, addressing global financial imbalances after the World War II. Until then, the dominant international currency was pound sterling, used for global trade and invoicing. However, the replacement by the U.S. dollar was long foreseeable due to long-term fundamentals. The U.S. economy overtook the British one back in the 1870s and due to disruption of trade channels cause by the World War I, it overtook the UK in terms of trade volume in 1915. Since then, during the interwar period, the world has experienced a form of an international currency duopoly. The U.S. still had to resolve some of its domestic issues regarding its financial markets, such as the lack of a central bank until the year 1913, which has resulted in numerous banking crises prior to that. However, it was clear that the dominance of the sterling is mainly due to the inertia effect of pricing international contracts and the dollar is gaining momentum. Finally it was able to seal its status with the Bretton Woods arrangement, establishing the U.S. dollar as the world reserve currency.

- Main functions of an international currency

Currently, the U.S. dollar’s position comes from how it’s used as the backbone of the financial system, both domestically and outside of the U.S. As described by Paul Krugman in his 1984 paper, an international currency has got six main functions:

As we can see, the private demand comes from the fact that the dollar is easily exchangeable or used as a vehicle currency due to lower transaction cost. In fact it was one side of the transaction in 88% of all FX transactions (and 91% in swaps) in 2019, according to the Bank of International Settlements 2019 report.

It also comes from the fact that it allows for diversification and investment in U.S. assets and is the most commonly used currency in global payments. We can further observe, that these factors are not independent. It is considered to be a safe-haven currency if it can be easily exchanged for other currencies or goods worldwide and since a large share of the global trade is invoiced in dollars then investors seek safe-haven in the same currency and so we enter a self-reinforcing mechanism.

Looking from the official perspective, it is the most widely used reserve currency in the world. As of Q4 2019, the dollar makes up around 60% of all known foreign reserves, followed by the Euro with around 20%.

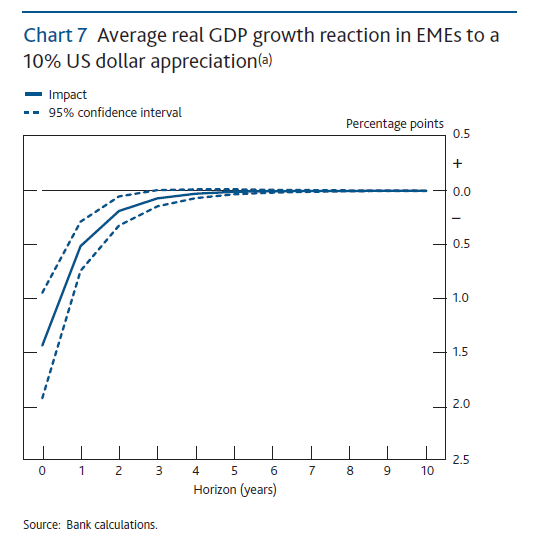

It is also the most used funding currency, according to BIS 2018 report, the total stock of US dollar-denominated debt of non-banks outside the United States stands at $11.4 trillion, of which non-banks from EMs account for $3.7 trillion. In fact, these functions of U.S. dollar imply a reverse external trade channel behavior. As the U.S. dollar appreciates against another local currency, then it would make other country’s products relatively more attractive for the U.S. consumers, leading to increased exports and growth. However, since trade invoicing occurs in the dominant currency and the foreign entities also very often need to repay their debts in U.S. dollars, appreciation of the USD against a local currency in many cases actually leads to lowering of the output and growth.

Source: Bank of England Quarterly Bulletin, The global role of the US dollar and its consequences

3.How to become a world currency

The main explanatory factors contributing to a currency becoming dominant within the world or some region are:

- Low and stable inflation

- Open and deep financial markets

- Country’s share of world GDP and trade volume

- Balance of payments

Which once again are self-reinforcing and interdependent. As we could see, the Bretton Woods arrangement reflected the long run economic changes which took place in the beginning of the 20th century. In terms of relative size of GDP and use in financial systems, the dollar is rivaled only by the Euro, however the difference is significant. Low and stable inflation reinforces the demand for the currency. When looking at the first and third factor, we can see that e.g. the Yen was fitting the criteria, but due to restrictive capital controls and lack of open and deep financial markets it was not able acquire a significant role and as it began to open up then came the period of the 1990s.

Which leads us to the role of openness and depth of the financial markets. Both the U.S. dollar and the pound sterling were able to establish their position due to large financial centers located in New York and London, once again unrivaled by e.g. Frankfurt. This is closely tied to the 4th point – Balance of payments. The U.S. has been running a current account deficit for the last 40 years, therefore, as argued in some papers, it was a provider of USD liquidity to the rest of the world. At the same time other countries have been purchasing U.S. denominated assets, which has allowed the U.S. rates to remain relatively low and due to the fact that it is a dominant trade currency it did not experience the depreciative consequences of running a current account deficit.

US Dollar Dominance In The Global Oil Market

When the US President Richard Nixon ended the convertibility of the USD to gold he had effectively marked the death of the Bretton Woods system. Following this decision, foreign policy and economic policy advisors tried to come up with a solution to block a potential decline in the global demand for USD. One of the possible ways to cement the global demand for USDs could be a dollar dominated global oil market. Such an action could increase global demand for USD and USD assets not only because oil trades in dollars but also because the receivers of these Petrodollars would recycle these Petrodollars in ways that could support the dollar like considerable purchases of US Treasuries.

In 1972, Henry Kissinger led a delegation and negotiated with Saudi Arabian Royal Family to come up with an agreement to make Saudi Oil priced exclusively in USD. The final agreement was: USA would support Saudi Arabia militarily, in exchange for Saudi Arabia pricing its oil exclusively in USD. This was the first agreement to provide military assistance in exchange for USD pricing of oil but all OPEC countries had made agreements by 1975. Therefore, we can say that the Petrodollar system was established in 1975.

By the establishment of the global Petrodollar system several factors contributed to the support of global USD demand:

- Oil importing countries and companies have started to stock up USD to fund their oil purchases.

- As oil was priced dominantly in USD, many oil exporting countries started to peg their currencies with USD. This can have an effect on global demand for dollars as the central banks of these countries have to store strong dollar reserves to defend their pegs in case of strong FX movements.

- Petrodollar collectors (Oil exporting countries) have started to “recycle Petrodollars”. This meant that they have started to become consistent buyers of US Treasuries, stocks and bonds in US and foreign markets via their sovereign wealth funds such as Abu Dhabi Investment Authority and Kuwait Investment Authority. These actions make oil exporting countries go on to make USD transactions further from just selling oil and receiving USD.

All of these factors contribute to the support of Petrodollars to global demand for USD. So it is clear that the Petrodollar system is one of the main reasons why USD dominates 88% of all global FX transactions. To evaluate if Chinese Yuan (CNY) can become a petrocurrency we have to look if CNY can replace USD as a petrocurrency and if China can promise what USA is providing to oil exporting countries.

- One of the main pillars of the global oil market is the oil futures market, many transactions such as hedging activities of refineries, oil producers, airlines happen in the oil futures market. The two main oil futures markets that contribute to the majority of global oil future transactions are the West Texas Intermediaries Crude Oil which trades at NYMEX and the Brent Crude Oil which trades at Intercontinental Exhange (ICE). Both futures contracts are denominated in USD. If Petroyuans were to become a real thing, we believe that we need to see an emergence of a yuan denominated oil futures market. China has been moving towards such a target as they launched a Yuan denominated oil future at the Shanghai International Energy Exhange Market in March 2018. Even if the volume of these futures is considerable its not a globally used oil future yet as most players in the yuan denominated oil future market are domestic. Widespread usage of this future is required to create a Yuan dominance in global FX.

- China has to develop its military presence and capabilities so that it can offer the military assistance that US is currently offering to many OPEC countries. Without such a move convincing nations such as Saudi Arabia, UAE to price oil in Yuans could be problematic. In this point we believe that there are also geopolitical factors to consider such as the Arab-Iranian relations and China-Iran relations. Therefore, it is clear that a transition from “Petrodollars” to “Petroyuans” will have political aspects in addition to the economic questions that need to be answered

The Emergence of the Chinese Yuan

After discussing what makes a reserve currency a reserve currency and taking a closer look at the oil market we will now examine the development of China and the Chinese yuan. In 2004 it was the 29th most used currency being part of 0.1% of all transactions. In 2019 when the BIS conducted their 3 year survey it placed 8th and being part of 4.3% of all transactions

The main currencies have not changed their standing in their ranking but EUR, JPY and GBP have lost significant market share, particularly to the yuan. We will examine how that has come to be. Firstly, in the last 20 years China has shown a growth story few countries can speak off.

China’s percentage of world GDP has dramatically increased since the 2000s. In 2000 it was at 3.65% while in 2017 it was at 15.54%. The graphic only goes until 2017 but more recent estimates at the end of 2019 put it at 20% of world GDP. This is quiet significant but how did it manage to get there?The growth was fueled by an immense amount of government spending. Their government spending has also consistently increased giving rise to a almost exponential curve of government spending growth. If we compare that to the US, the difference of % share of government spending from China has been 5% higher than that of the US (in 2019) with 21% of GDP vs 26% of GDP. Additionally fiscal and financial reforms that led to market liberalization added to Chinas growth. Particularly in the last couple of years. Some strong motivation came from Chinas “Made in China 2025” Plan. The plan outlines Chinas aim of moving from a cheap producing country to producing high quality and higher value goods such as semiconductors etc. It also wants to archive independence from other countries in their supply chain.

Particularly the last point has had quiet a strong influence on trade. Chinas exports have grown immensely since 2000, again showing signs of an exponential growth. This stabilized around 2015-2016. From this time China has managed to climb from having 4% share of world trade to 11.5% in 2016. More recently it has been put at around 13% before the Coronavirus. Again we can see a slowdown around 2015-16. This has been due to the growing trade tensions between the US and China which eventually led to a full out trade war. It is on par with US share of world trade. So how come the Chinese yuan isn’t used for more denomination? How has the yuan fared in becoming a more used and even reserve currency?

A strong benefit of becoming a world reserve currency is a positive feedback loop as shown in the Figure below. This is exactly what happened in 2015 and 2016. In 2015 the IMF named the yuan a official currency for reserves of central banks.In 2016 it then proceeded to adding it to the SDR basket. The SDR is a unit of account used by the IMF which represents a claim on the currency of a member country. It was created in 1969 to supplement the access to low supply reserve currencies such as Gold or USD. It was given to countries and cannot be held by private parties. Before the financial crisis and the economic fallout that followed in 2009 there were 21.4 billion XDR (currency code for SDR), afterwards and after the eurozone debt crisis in 2014 there were 204 billion XDR. The value of SDR is based on the world major currencies and weighted according to their prominence in international trade and foreign reserves. Every 5 years its content and weight are reviewed. In 2016 there was the latest review and the yuan was added to the basket. The weights are as follows: U.S. dollar 41.73%, euro 30.93%, renminbi (Chinese yuan) 10.92%, Japanese yen 8.33%, British pound 8.09%.

The addition to the SDR greatly increased the usage and liquidity of the yuan. But there are other positive effects of being named a reserve currency. More demand, if met by increasing money supply, decreases interest rates in yuan denominated bonds allowing for further economic expansion and thus creating another positive feedback loop of growth and further adoption of the yuan. However, there remains doubt about the viability of the yuan as a world dominating currency. • With the figure on the right with the NEER we see that in more economic uncertain environments the yuan is prey to more speculation and quiet unstable. Particularly in 2018 we saw that it appreciated quiet a bit. The CEFTS index, the index against which the yuan is measured, was adjusted in 2017 to reduce the weighting of the USD. This reduction decreased the dependence of China on the US and the USD, but at the same time it increased the volatility as a relatively stable currency was weighted less. The CEFTS is quiet similar to the NEER in the way that it is a trade weighted index of the partner currencies. The NEER is the nominal effective exchange rate which is the “Weighted average of bilateral exchange rates.” It is mostly trade weighted. An increase in the index indicates an appreciation of the currency compared to other trading partner currencies.

From the figure we see that the yuan has been extremely volatile to the USD in the 2017-2019 time period. It is not only the volatility in the currency makes the yuan yet unsuitable to be come a world currency but also the transparency of monetary policy in China vs the US. For example, it is estimated that the Chinese central bank has 5$ trillion in hidden reserves. These could be in yuan or any other currency. Also the way monetary policy is conducted is not only often unpredictable but not as straightforward as investors would like. When conducting monetary policy China has historically a lot more levers to pull than the US (theoretically both have the same monetary tools), making their policy quiet unpredictable. The Chinese central bank mainly acts on the reserve ratios, overnight funding ratios, SHIBOR, lending rates, and conducts open market operations (OMOs) as monetary policy. The US mainly works with the repos and reverse repos to manage interest rate policy and since 2008 starting conducting OMOs, but more importantly their decisions by the federal open market committee (FOMC) are often predicted and priced in by the market. In addition, Chinas policy aims are often confusing. Within the past 20 years they changed their monetary policy objective from inflation targeting to anti-inflation targeting.

Nonetheless China is pushing hard for more adoption of the yuan having in mind the fundamentals that make a world currency. In 2015 China opened the “Renminbi trading hub” in Canada as well as similar hubs in Singapore and London. These hubs are designed to provide access to yuan funding in these areas and thus higher adoption in structured products. It also worked to create a Renminbi trading center in the US with high profile names such as Michael Bloomberg, former Treasury Secretary Hank Paulson and Tim Geithner. The aim is to provide cheaper access to the yuan for US financial institutions and trading firms, allowing US financial institutions to offer yuan denominated hedges, structured products and other derivatives. In 2016 China granted the United States a quota of 250 billion yuan, the equivalent of $38 billion, under China’s Renminbi Qualified Foreign Institutional Investor program. It appointed one Chinese and one U.S. bank to conduct RMB Clearing Services in the US. While these efforts a in itself nothing that would concern a US policy maker, all taken together it can once again be seen as Chinas long-term approach to expanding its influence world wide through higher adoption of the yuan.

Conclusion

In conclusion we can say that there are still some key features that China needs to manage if it should really overtake the USD as the world main currency. Central banks around the world choose to keep a higher amount of yuan in foreign exchange reserves. Furthermore, the PBOC allows free trade of the yuan and relaxes its peg to the U.S. dollar as well as become more straightforward about its future intentions with the yuan. Particularly Chinese monetary policies need to be perceived as stable and more predictable. This also means China’s financial markets need to turn more transparent. It adoption in the world commodity market, particularly oil, needs to occur and more stability of the economy from its fundamentals is necessary. Only once the yuan acquires the U.S. dollar’s reputation of stability, which is backed by the enormity and liquidity of that of the U.S. Treasury does the Chinese yuan in the long run (e.g. 2046) have a change to maybe overtake the USD.

0 Comments